Cares Act Tax Rebates Web 2 avr 2021 nbsp 0183 32 WASHINGTON The Internal Revenue Service today issued guidance for employers claiming the Employee Retention Credit under the Coronavirus Aid Relief

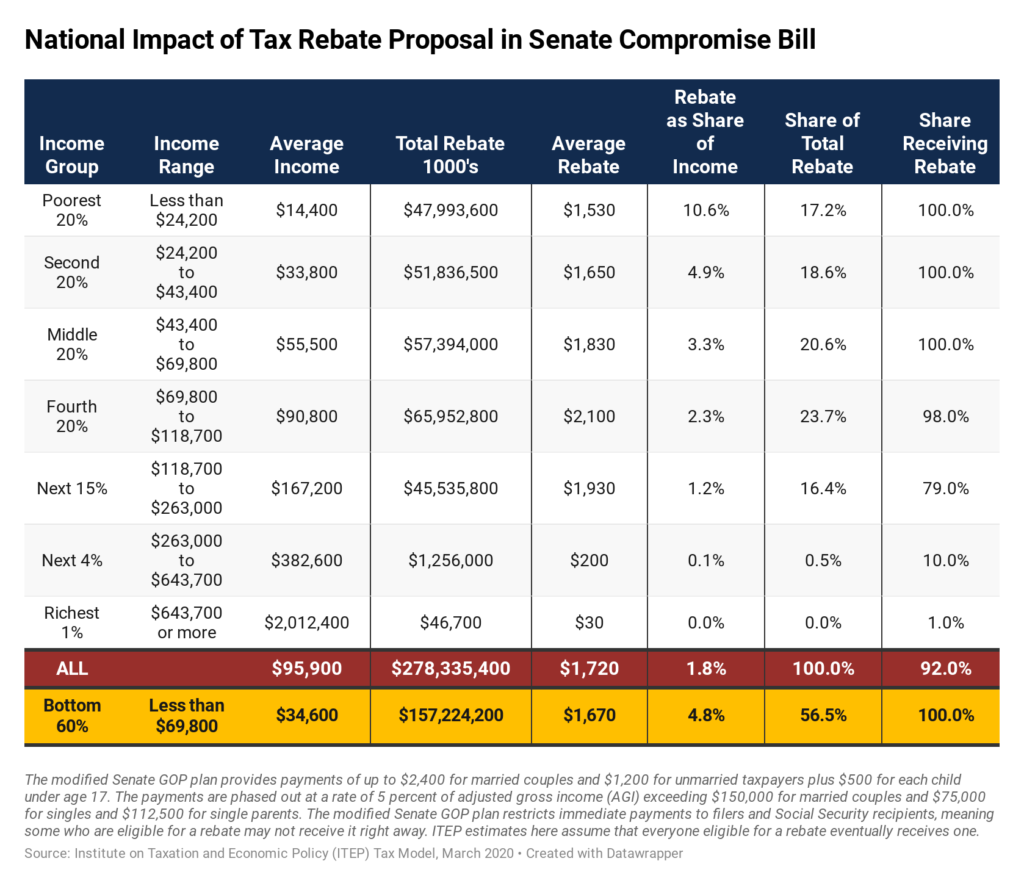

Web 17 avr 2020 nbsp 0183 32 The 2020 recovery rebates equal 1 200 per eligible individual 2 400 for married taxpayers filing a joint tax return and 500 per eligible child These amounts In response to the COVID 19 pandemic dramatic global reduction in economic activity occurred as a result of the social distancing measures meant to curb the virus These measures included working from home widespread cancellation of events cancellation of classes or moving in person to online classes reduction of travel and the closure of businesses In March it was predicted that without government intervention most airlines around the world

Cares Act Tax Rebates

Cares Act Tax Rebates

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/the-cares-act-recovery-rebates-fee-only-financial-advisor-deer-park-2.png?resize=1024%2C884&ssl=1

Cares Act Fraud Tracker CARS HJW

https://i2.wp.com/suquamish.nsn.us/wp-content/uploads/2020/04/CARES-Act-Cash-Rebate-One-Pager.png

Best CARES Act Tax Credit Program 2022 Get Maximum Rebates With ERTC

https://i.ytimg.com/vi/CmMnjevi0RU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIARABGGUgZShUMA8=&rs=AOn4CLC20LeCqVVaYFn4TS6Z-53vbiG19g

Web 24 juil 2023 nbsp 0183 32 Under the Coronavirus Aid Relief and Economic Security CARES Act up to 1 200 rebates are provided for individuals 2 400 for joint filers with an additional Web 28 avr 2020 nbsp 0183 32 Tax relief for individuals and businesses in the CARES Act includes a one time rebate to taxpayers modification of the tax treatment of certain retirement fund

Web 1 juil 2020 nbsp 0183 32 The CARES Act among other things provides quot recovery rebates quot to individuals expands and enhances unemployment benefits extends loans and loan guarantees to eligible businesses offers funding Web 30 mars 2020 nbsp 0183 32 The CARES Act includes a one time payment to tax filers in order to help households cover necessary expenses during the coronavirus outbreak We estimate

Download Cares Act Tax Rebates

More picture related to Cares Act Tax Rebates

Taxes On New Car Rebates Tennessee 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/tax-rebates-in-the-federal-cares-act-itep.png

Claim CARES Act Tax Credits With PPP Loans In 2022 Guaranteed Maximum

https://i.ytimg.com/vi/ONrUFegdgRI/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgUShEMA8=&rs=AOn4CLCJ1pHzQ4bjFTR80ZQJcVdPe9Ofow

Top CARES Act Rebate CPA Firm For San Jose Restaurants Get ERTC Fast

https://i.pinimg.com/736x/7e/7c/a1/7e7ca1aca925ce12c1ad284eb5cfd024.jpg

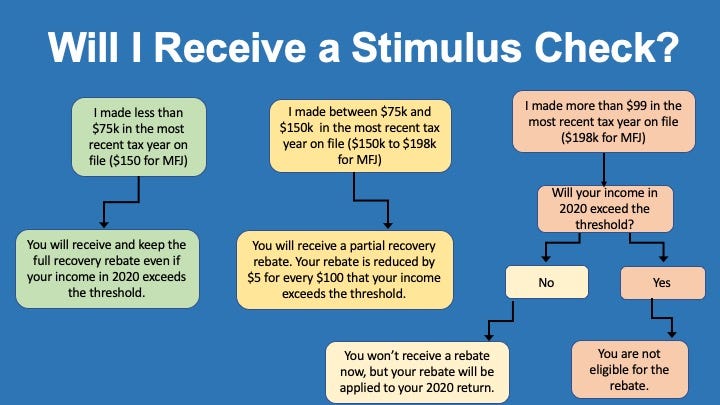

Web 30 mars 2020 nbsp 0183 32 The rebate phases out at 75 000 for singles 112 500 for heads of household and 150 000 for joint taxpayers at 5 percent per dollar of qualified income Web 5 janv 2021 nbsp 0183 32 For more on tax provisions in the CARES Act see CRS Report R46279 The Coronavirus Aid Relief and Economic Security CARES Act Tax Relief for Individuals

Web 29 mars 2020 nbsp 0183 32 The rebate starts to phase out at adjusted gross income of 75 000 for singles 112 500 for heads of household and 150 000 for taxpayers filing joint returns Web 2 avr 2020 nbsp 0183 32 Congress s latest coronavirus relief package the Coronavirus Aid Relief and Economic Security CARES Act is the largest economic relief bill in U S history and

Check Status Of Recovery Rebate Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2022/11/what-you-need-to-know-about-recovery-rebates-under-the-cares-act-1.png

CARES Act Your Recovery Rebate Questions Answered By Mike Kinealy

https://miro.medium.com/max/1400/1*kPHUGswzT8aycBqES02Vsg.jpeg

https://www.irs.gov/newsroom/irs-provides-guidance-for-employers...

Web 2 avr 2021 nbsp 0183 32 WASHINGTON The Internal Revenue Service today issued guidance for employers claiming the Employee Retention Credit under the Coronavirus Aid Relief

https://crsreports.congress.gov/product/pdf/IN/IN11282

Web 17 avr 2020 nbsp 0183 32 The 2020 recovery rebates equal 1 200 per eligible individual 2 400 for married taxpayers filing a joint tax return and 500 per eligible child These amounts

Free CARES Act Tax Credit Assessment Best ERC Rebate Eligibility Test

Check Status Of Recovery Rebate Recovery Rebate

Calam o Get CARES Act Tax Credits Fast 2022 ERC Rebate Audit Proof

Calam o Top ERTC Expert Scott Duncan Guarantees Maximum CARES Act Tax

Calam o Get Fast ERTC Refund Take This Free CARES Act Rebate

Calam O CARES Act ERTC Deadline Fast Tax Rebate Application Free

Calam O CARES Act ERTC Deadline Fast Tax Rebate Application Free

Recovery Rebate Income Limits Recovery Rebate

The CARES Act Paycheck Protection Program What You Need To Know

How Did The CARES Act Recovery Rebate Work

Cares Act Tax Rebates - Web CARES Act Recovery Rebates The CARES Act proposes recovery rebates of up to 1 200 for an individual taxpayer and 2 400 for joint filers A taxpayer with children will