Cares Individual Rebates Web Avoid Economic Impact Payment Scams read more here Starting in March 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act provided Economic

Some individuals received checks in the mail while others received direct deposits in their bank accounts On May 18 the Treasury Department said that future payments may be issued in the form of prepaid Visa debit cards rather than checks The Act Web 20 mars 2020 nbsp 0183 32 The Coronavirus Aid Relief and Economic Security CARES Act S 3548 as introduced on March 19 2020 proposes direct payments of up to 1 200 per person

Cares Individual Rebates

Cares Individual Rebates

https://media.licdn.com/dms/image/C5612AQGunmSszpGqUA/article-cover_image-shrink_720_1280/0/1585773011217?e=2147483647&v=beta&t=_mcoVbNh0yuFiDBW25nHfJKegK-USlH1TbNV9Slifys

CARES Act For Individuals Rebates Retirement Account Changes And More

https://www.mnadvisors.com/images/default-source/default-album/caresactforindividualsf1702025-f7cb-4032-b4f1-efdf3492a29f.jpg?sfvrsn=e278f5ad_3

Cares Act Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-recovery-rebates-distributions-rmd-waivers-student-loan.png

Web 30 mars 2020 nbsp 0183 32 The CARES Act includes a one time payment to tax filers in order to help households cover necessary expenses during the coronavirus outbreak We estimate Web The CARES Act provides that payments from the Fund may only be used to cover costs that Are necessary expenditures incurred due to the public health emergency with

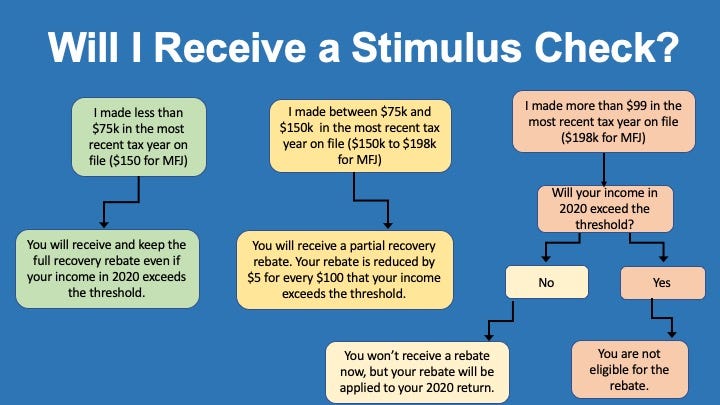

Web 1 avr 2020 nbsp 0183 32 For filers exceeding the income thresholds above recovery rebates decrease by 5 for every 100 of adjusted gross income 99 000 maximum for single or Web The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act was enacted in March 2020 and created a refundable tax credit for individuals The

Download Cares Individual Rebates

More picture related to Cares Individual Rebates

Top CARES Act Rebate CPA Firm For San Jose Restaurants Get ERTC Fast

https://i.pinimg.com/736x/7e/7c/a1/7e7ca1aca925ce12c1ad284eb5cfd024.jpg

Best CARES Act Tax Credit Program 2022 Get Maximum Rebates With ERTC

https://i.ytimg.com/vi/CmMnjevi0RU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIARABGGUgZShUMA8=&rs=AOn4CLC20LeCqVVaYFn4TS6Z-53vbiG19g

Check Status Of Recovery Rebate Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2022/11/what-you-need-to-know-about-recovery-rebates-under-the-cares-act-1.png

Web Under the CARES Act an eligible individual is allowed an income tax credit for 2020 equal to the sum of 1 1 200 2 400 for eligible individuals filing a joint return plus 2 500 Web 20 d 233 c 2022 nbsp 0183 32 People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax

Web 5 sept 2023 nbsp 0183 32 The CARES Act authorized direct payments of 1 200 per adult plus 500 per child for individuals making up to 75 000 heads of households making up to 112 500 Web 30 mars 2020 nbsp 0183 32 for individuals 2 400 for joint taxpayers Additionally taxpayers with children will receive a flat 500 for each child The rebates would not be counted as

Recovery Rebate Income Limits Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-q-a-about-recovery-rebates-student-loans-health-care-4.png

CARES Act Your Recovery Rebate Questions Answered By Mike Kinealy

https://miro.medium.com/max/1400/1*kPHUGswzT8aycBqES02Vsg.jpeg

https://home.treasury.gov/policy-issues/coronavirus/assistance-for...

Web Avoid Economic Impact Payment Scams read more here Starting in March 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act provided Economic

https://en.wikipedia.org/wiki/CARES_Act

Some individuals received checks in the mail while others received direct deposits in their bank accounts On May 18 the Treasury Department said that future payments may be issued in the form of prepaid Visa debit cards rather than checks The Act

Calam o Get Fast ERTC Refund Take This Free CARES Act Rebate

Recovery Rebate Income Limits Recovery Rebate

Claim CARES Act Tax Credits With PPP Loans In 2022 Guaranteed Maximum

How The CARES Act Can Help Sell IAQ Get Rebates To Your Customers

What Cars Have The Biggest Rebates 2020

Free CARES Act Tax Credit Assessment Best ERC Rebate Eligibility Test

Free CARES Act Tax Credit Assessment Best ERC Rebate Eligibility Test

Rep Andy Barr CARES Act Rebate Checks YouTube

How Did The CARES Act Recovery Rebate Work

The CARES Act Recovery Rebates Fee Only Financial Advisor Deer Park

Cares Individual Rebates - Web 30 mars 2020 nbsp 0183 32 The CARES Act includes a one time payment to tax filers in order to help households cover necessary expenses during the coronavirus outbreak We estimate