Cares Recovery Rebate Web 17 avr 2020 nbsp 0183 32 Updated April 17 2020 The Coronavirus Aid Relief and Economic Security Act CARES Act P L 116 136 which was signed into law by President Trump on March

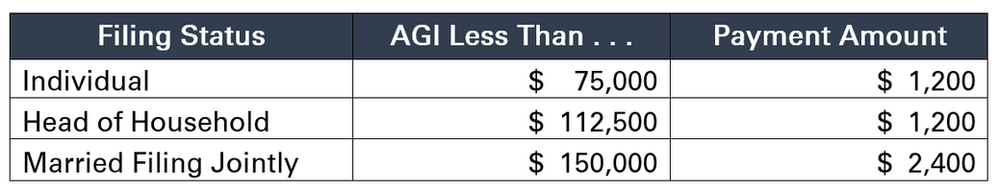

Web 26 mars 2020 nbsp 0183 32 Who is eligible for a recovery rebate All U S residents or citizens with adjusted gross income under 75 000 112 500 for head of household and 150 000 Web The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act was enacted in March 2020 and created a refundable tax credit for individuals The

Cares Recovery Rebate

Cares Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/the-cares-act-recovery-rebates-fee-only-financial-advisor-deer-park-2.png?resize=1024%2C884&ssl=1

Check Status Of Recovery Rebate Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2022/11/what-you-need-to-know-about-recovery-rebates-under-the-cares-act-1.png

CARES Act Recovery Rebate Payments And Deceased Recipients

https://mossadamsproduction.blob.core.windows.net/cmsstorage/mossadams/media/images/insights/2020/06/20-pc-0610_smsi.jpg

Web 30 mars 2020 nbsp 0183 32 Recovery Rebate for individual taxpayers The bill would provide a 1 200 refundable tax credit for individuals 2 400 for joint taxpayers Additionally taxpayers Web 27 mars 2020 nbsp 0183 32 The recovery rebate is reduced by 5 for every 100 of adjusted gross income AGI above 75 000 for individuals 112 500 for heads of households and

Web 30 mars 2020 nbsp 0183 32 CARES Act Recovery Rebate Highlights All U S residents or citizens are eligible to receive a payment of 1 200 or 2 400 per married couple plus 500 per Web Core provisions under the CARES Act 2020 recovery rebate amounts and timing 2020 recovery rebate amounts are 1 200 2 400 in the case of a joint return for eligible

Download Cares Recovery Rebate

More picture related to Cares Recovery Rebate

Recovery Rebates Threshold Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/consolidated-appropriations-act-provides-relief-to-individuals-and.png?fit=593%2C454&ssl=1

The CARES Act Recovery Rebates Fee Only Financial Advisor Deer Park

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/the-cares-act-recovery-rebates-fee-only-financial-advisor-deer-park-1.png?w=858&ssl=1

Recovery Rebate Credit H And R Block Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/recovery-rebate-credit-h-r-block-in-2021-hr-block-rebates-3.jpg

Web 7 avr 2020 nbsp 0183 32 Regular UI benefits are funded by state taxes But the CARES Act establishes among other provisions federal funding for three major UI programs Pandemic Web The rebate amount is reduced by 5 for each 100 of the taxpayer s AGI exceeding the following threshold 75 000 if filing status was single or married filing separately 112 500 for head of household 150 000 if

Web 2 avr 2023 nbsp 0183 32 The Recovery Rebate is available for federal income tax returns up to 2021 A qualified tax dependent could receive up to 1 400 married couples with two Web 1 avr 2020 nbsp 0183 32 The recovery rebate is an automatic tax free payment to help with financial situations with the amount available being dependant on the filing status of the

CARES Act 2020 Recovery Rebates

https://dmlo.com/wp-content/uploads/2020/04/Canva-Row-of-Dollar-Bills-e1585754215189.jpg

Stimulus Checks From The Government Explained Vox Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/stimulus-checks-from-the-government-explained-vox.png?resize=1024%2C739&ssl=1

https://crsreports.congress.gov/product/pdf/IN/IN11282

Web 17 avr 2020 nbsp 0183 32 Updated April 17 2020 The Coronavirus Aid Relief and Economic Security Act CARES Act P L 116 136 which was signed into law by President Trump on March

https://www.finance.senate.gov/chairmans-news/cares-act-recovery...

Web 26 mars 2020 nbsp 0183 32 Who is eligible for a recovery rebate All U S residents or citizens with adjusted gross income under 75 000 112 500 for head of household and 150 000

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

CARES Act 2020 Recovery Rebates

Recovery Rebates For Individuals Recovery Rebate

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

CARES Act For Individuals Rebates Retirement Account Changes And More

TAX RELIEF PROVIDED BY THE CARES ACT Individual Recovery Rebates

TAX RELIEF PROVIDED BY THE CARES ACT Individual Recovery Rebates

What Does The Recovery Rebate Form Look Like Bears Printable Rebate Form

Recovery Rebates For Individuals Under The CARES Act Bruning

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

Cares Recovery Rebate - Web 30 mars 2020 nbsp 0183 32 Recovery Rebate for individual taxpayers The bill would provide a 1 200 refundable tax credit for individuals 2 400 for joint taxpayers Additionally taxpayers