Cashback Rebate Before Tax Or After Tax Web 15 oct 2021 nbsp 0183 32 And since a discount isn t taxable there s no need to keep track of all your cash back rewards to prepare your tax return However there may be times when you need to reduce the amount of a deduction to reflect the discount that a cash back reward

Web 23 ao 251 t 2023 nbsp 0183 32 MoneyGeek s Takeaways The cash back you earn by spending money on your credit card is not taxable If you earn cash back without needing to spend any Web 10 ao 251 t 2007 nbsp 0183 32 I m trying to figure out what the final numbers should be now that there s a sizeable 3000 cashback incentive Is the 3000 incentive subtracted off before sales

Cashback Rebate Before Tax Or After Tax

Cashback Rebate Before Tax Or After Tax

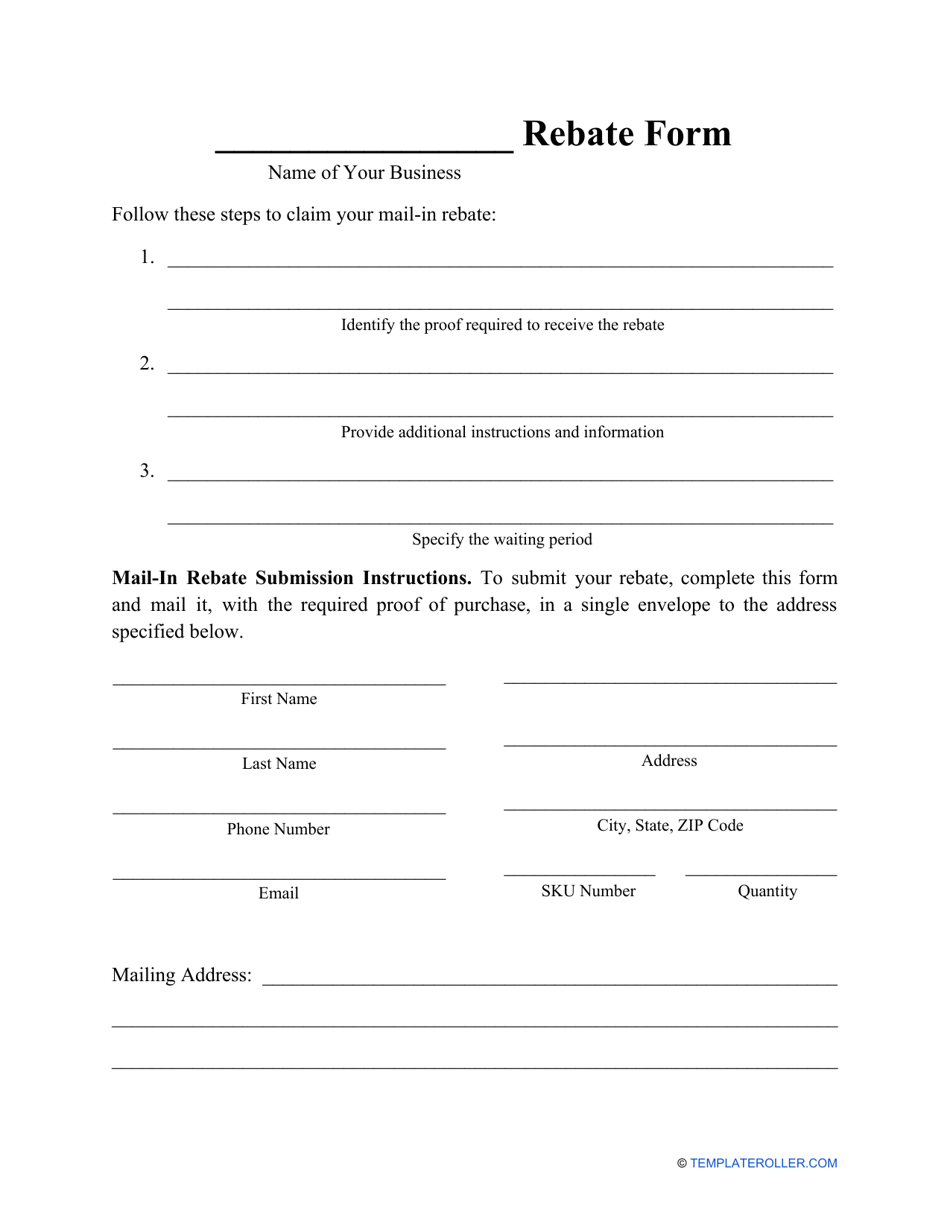

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

My Preferred Cashback Programs Ebates And Mr Rebates Ms Financial

http://www.msfinancialliteracy.com/wp-content/uploads/2016/12/ebates-rebates.jpg

Web 16 juil 2020 nbsp 0183 32 1 Answer Sorted by 7 Generally you will get cash back for the entire amount so 1 06 in your case The credit card issuer usually doesn t event know the Web Does the cashback percentage count before tax or after Say your order is 94 and tax is 6 Is cashback based on an order worth 94 or 100 1 comment Laumarinp 3 yr

Web 27 avr 2021 nbsp 0183 32 Income Tax on Cashback Last updated on April 27th 2021 Cashback is a reward for a customer on the purchase of goods or services The calculation is a Web 19 juil 2021 nbsp 0183 32 We recently refinanced the loan with another Bank who was offering a better rate as well as a Cashback incentive The fine print on the Bank page in relation to the

Download Cashback Rebate Before Tax Or After Tax

More picture related to Cashback Rebate Before Tax Or After Tax

Weighted Average Cost Of Capital Clearing The Confusion For User Part 2

https://media.licdn.com/dms/image/D5612AQH6ZLafWxYCig/article-cover_image-shrink_720_1280/0/1682236152523?e=2147483647&v=beta&t=k9lnQPjpseS75OwllioOs9TMGoQbUW5p6YgQvQM83B4

How To Calculate Before And After Tax Cash Flows When Real Estate Investing

http://usercontent1.hubimg.com/6871046_f496.jpg

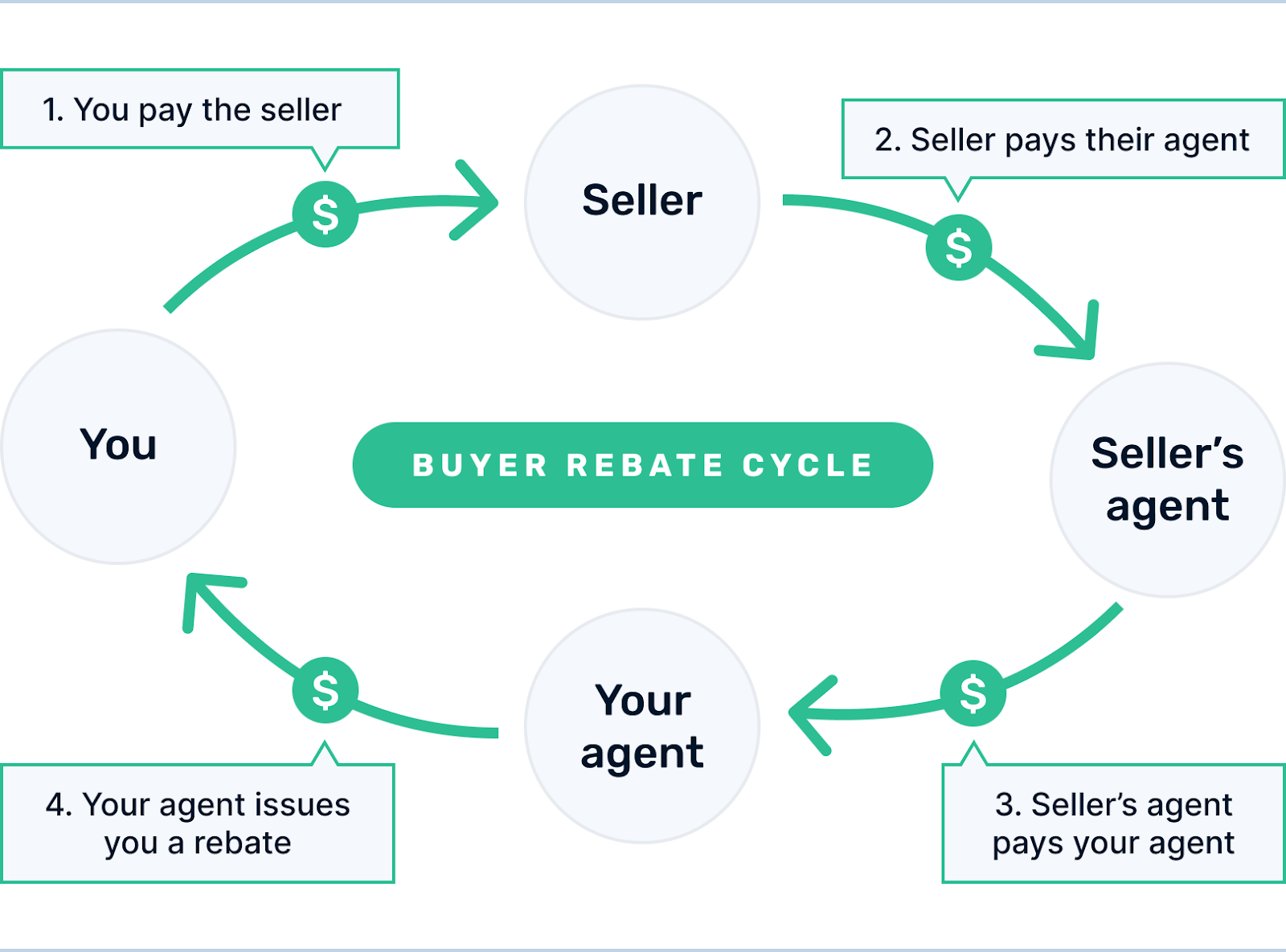

Home Buyer Rebates Get Cash Back When You Buy

https://cosmic-s3.imgix.net/463c8790-7c97-11eb-abfb-1b324c629d39-RebateCycle2.png?auto=format&w=430px&q=20

Web 13 juin 2020 nbsp 0183 32 Contents What is a cashback Different types of cashbacks Tax treatment of cashbacks FAQ s What is a cashback A cashback is an amount returned on the Web 7 juil 2022 nbsp 0183 32 Should discount be applied before or after tax Discounts are applied before taxes so any discount that you ve created will be applied before the Sales Tax you ve

Web Any sales tax will not be included in the cash back you receive after validating your receipt Any cashback sent after your receipt is successfully validated will reflect the price of the Web 1 Cashback you purchase the product and you send in the receipt to company they will issue the cash in a check or sometimes a coupon 2 discount is give immediately upon

Is Gross Before Taxes Or After TaxProAdvice

https://www.taxproadvice.com/wp-content/uploads/is-gross-income-before-or-after-taxes-quora.png

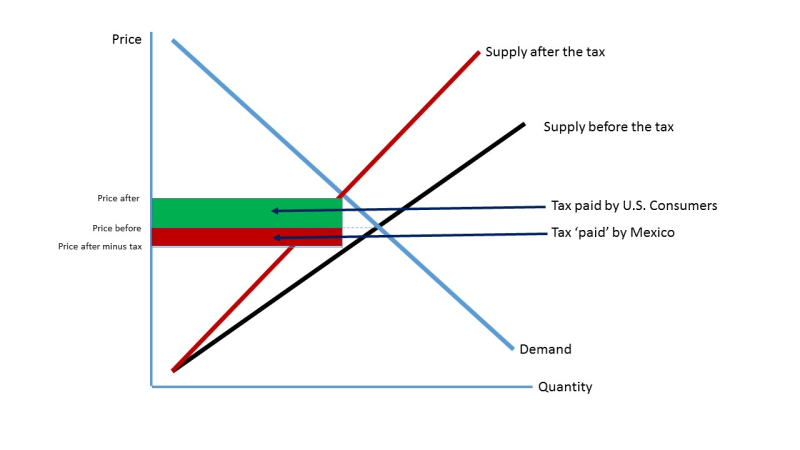

Political Calculations Who Will Pay The Import Tariff On Mexican Goods

https://3.bp.blogspot.com/-nYR90I3ZijU/WI5zxzTo4dI/AAAAAAAAOgI/EF5OvNaR8S0X0LuZKMACoYrmfIwc4DQFwCLcB/s1600/Tim-Haab-supply-demand-curve-before-after-tax.jpg

https://turbotax.intuit.com/tax-tips/irs-tax-return/video-are-cash...

Web 15 oct 2021 nbsp 0183 32 And since a discount isn t taxable there s no need to keep track of all your cash back rewards to prepare your tax return However there may be times when you need to reduce the amount of a deduction to reflect the discount that a cash back reward

https://www.moneygeek.com/credit-cards/cash-back/advice/is-cash-back...

Web 23 ao 251 t 2023 nbsp 0183 32 MoneyGeek s Takeaways The cash back you earn by spending money on your credit card is not taxable If you earn cash back without needing to spend any

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes NIAT Definition Calculation Example

Is Gross Before Taxes Or After TaxProAdvice

Media Release Focus On Long Term Strategic Priorities Drives Strong

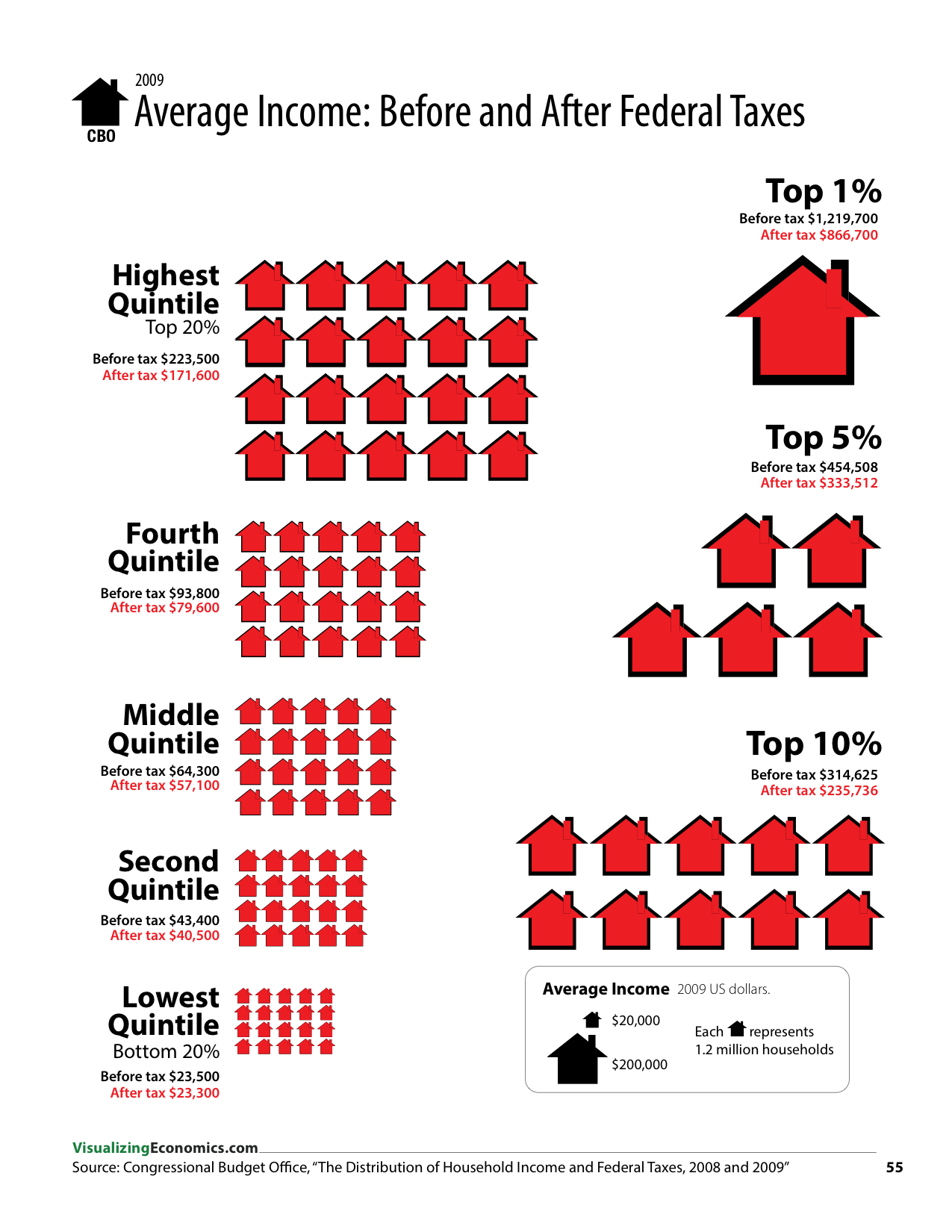

How Much Do Federal Taxes Redistribute Income Visualizing Economics

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

Does 145kr Goes Before Taxes Or After Picture From Internet R

Does 145kr Goes Before Taxes Or After Picture From Internet R

Bing Cashback Returns As Bing Rebates After A Decade On Ice WinBuzzer

Handy Tip Calculator By Xuejun Li

Should You Report Income Before Or After Taxes Yuri Shwedoff

Cashback Rebate Before Tax Or After Tax - Web 16 juil 2020 nbsp 0183 32 1 Answer Sorted by 7 Generally you will get cash back for the entire amount so 1 06 in your case The credit card issuer usually doesn t event know the