Centrelink Tax Rebate Web Taxable Centrelink payments If you get a taxable Centrelink payment you may need to lodge a tax return at the end of the tax year You ll get a Centrelink payment summary if

Web The rebate covers 50 of out of pocket expenses for approved child care up to a maximum amount per child per year You do not need to make a separate claim to receive Child Web 7 sept 2023 nbsp 0183 32 In Queensland eligible vulnerable households who receive the 372 Queensland Electricity Rebate will automatically receive a 700 Cost of Living Rebate

Centrelink Tax Rebate

Centrelink Tax Rebate

https://www.servicesaustralia.gov.au/sites/default/files/2019/01/update-manage-tax-deductions-step-1.png

Centrelink Form Su580 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/532/652/532652168/large.png

Centrelink Tax Rebate

https://blinkypreschool.com.au/bill/wp-content/uploads/sites/4/2018/05/banner-centrelink.jpg

Web 20 avr 2022 nbsp 0183 32 what Centrelink payments are taxable deducting tax from your payment Taxable Centrelink payments If you get a taxable Centrelink payment you may need to Web 9 mai 2023 nbsp 0183 32 Energy Relief Payments The following note was posted on Centrelink s website on May 9 2023 You don t need to contact us You ll automatically get the rebate from July if you currently get a state based

Web This applies if you got FTB fortnightly or choose to get all of your FTB at the end of the financial year We will pay the last FTB payments for 2022 23 between 4 and 17 July Web rebate income and the worksheet to work it out see Rebate income 2023 If you are eligible for this offset we will calculate the amount of the offset for you Use our

Download Centrelink Tax Rebate

More picture related to Centrelink Tax Rebate

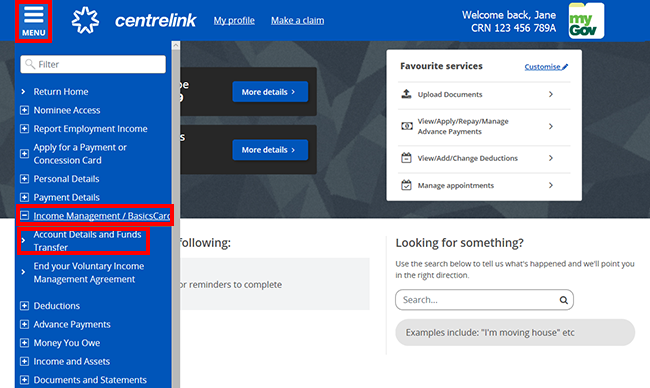

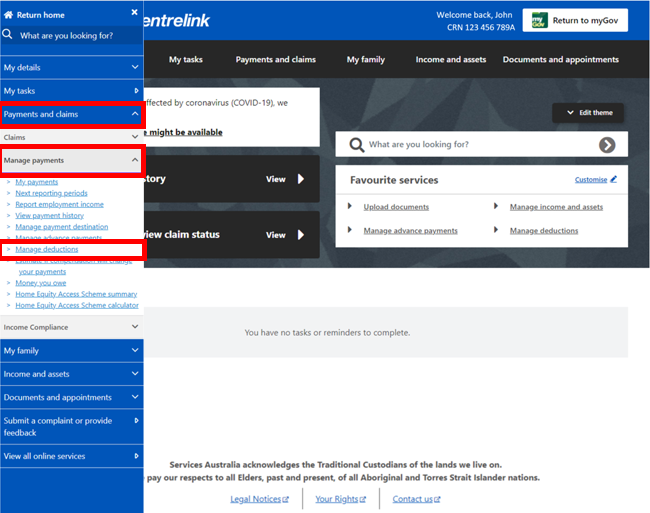

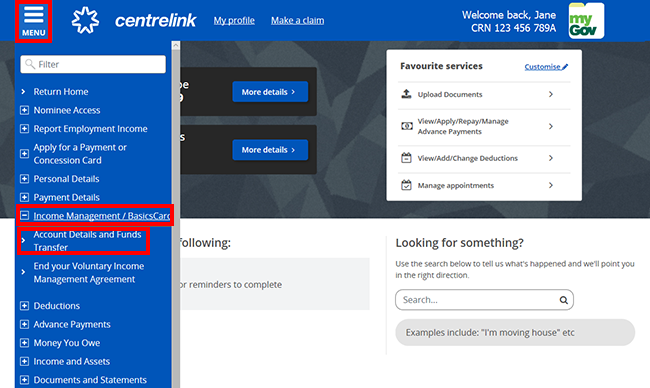

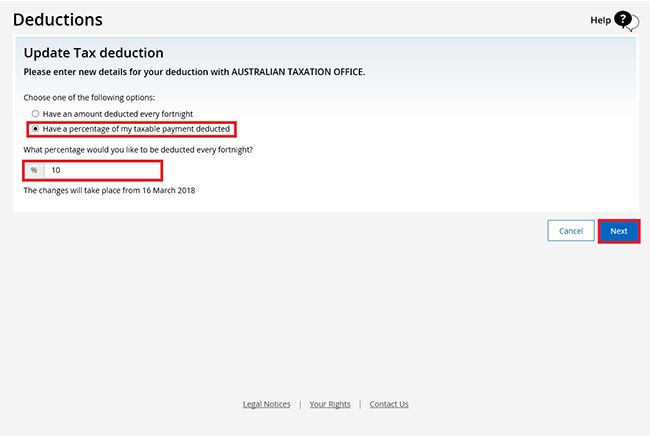

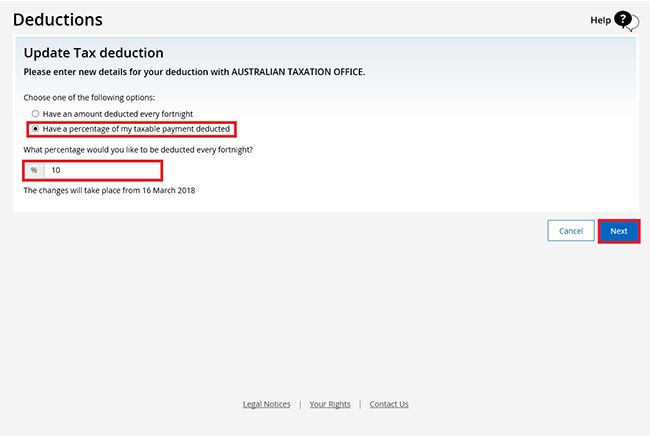

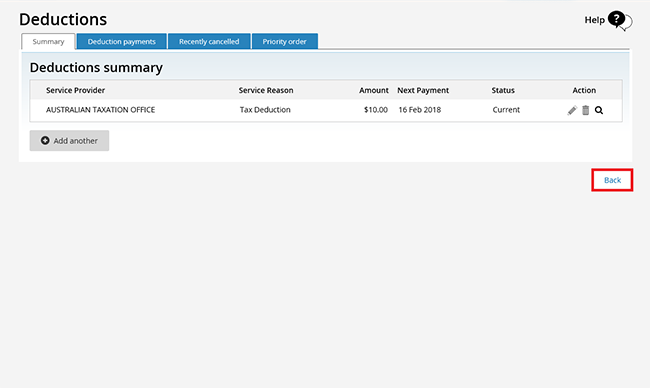

Centrelink Online Account Help Managing Your Tax Deductions

https://www.servicesaustralia.gov.au/sites/default/files/2022-05/update-manage-tax-deduction-online-step1b-040522.png

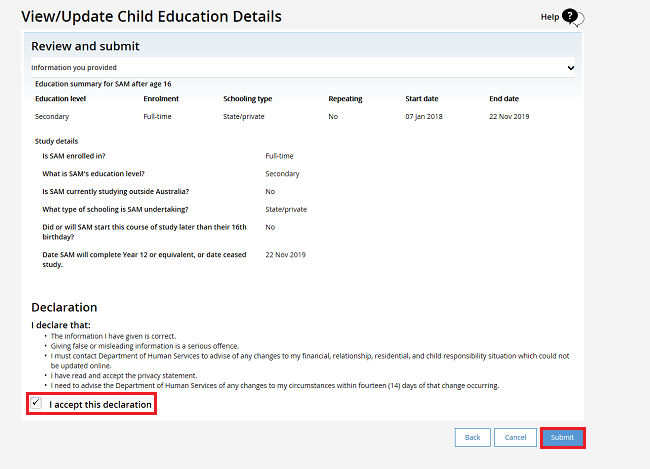

Centrelink Online Account Help Update Your Child s Education Details

https://www.servicesaustralia.gov.au/sites/default/files/2019/03/update-your-childs-eduction-details-family-tax-benefit-step4c.png

Centrelink Payment Rates 2023 Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2023/06/Guide-to-govt-payments-1jul2023-to-19Sept2023.jpg

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can Web Centrelink payment details for the 2022 23 tax year are available Read about how to get your Centrelink payment summary Find out all of these what payments are on your

Web Sign into myGov If you don t have this set up you ll need to use either your Centrelink online account through myGov Express Plus Centrelink mobile app Some payments Web koelbirdssuck 2 yr ago Centrelink payments are classed as income so it is wise to have deductions taken out for taxation purposes It is a good idea plus it s also a good idea to

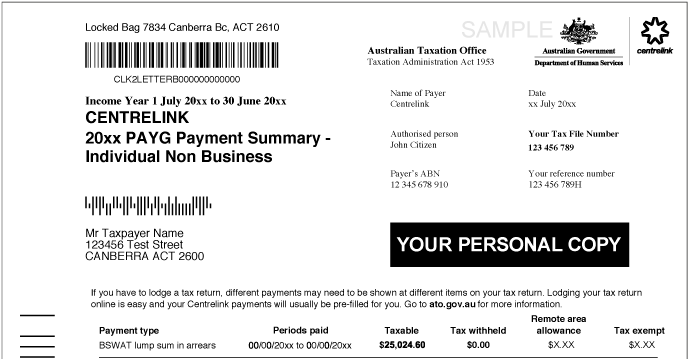

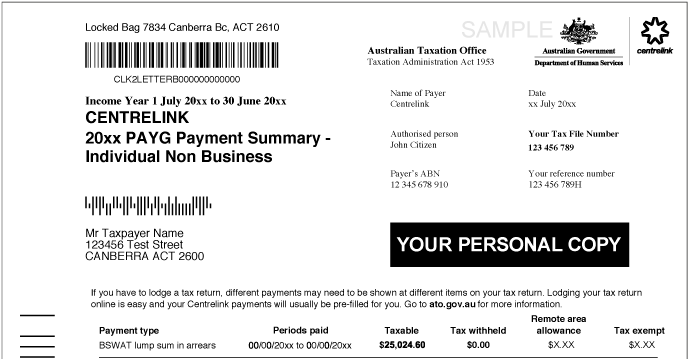

Do You Get Tax Back From Centrelink Tax Walls

https://www.ato.gov.au/uploadedImages/Content/MEI/Images/Centrelink PAYG payment summary.png

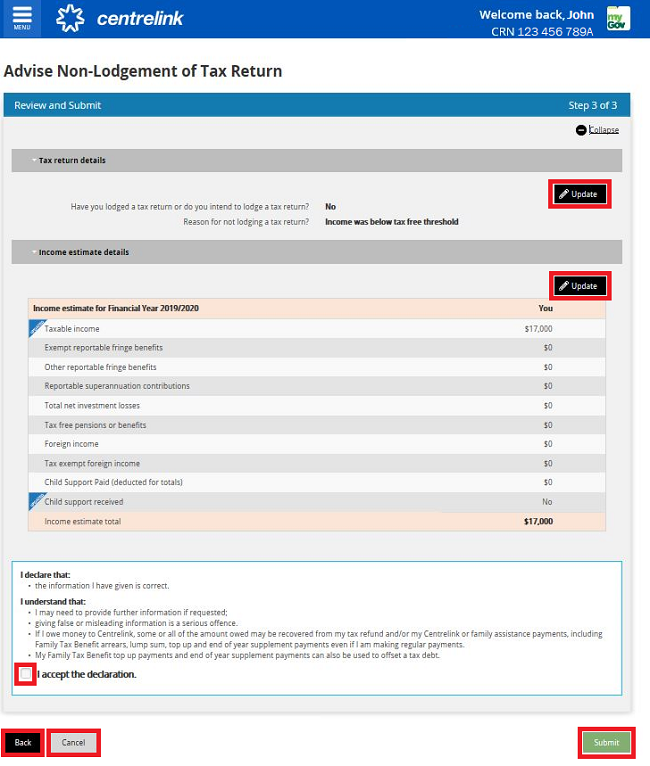

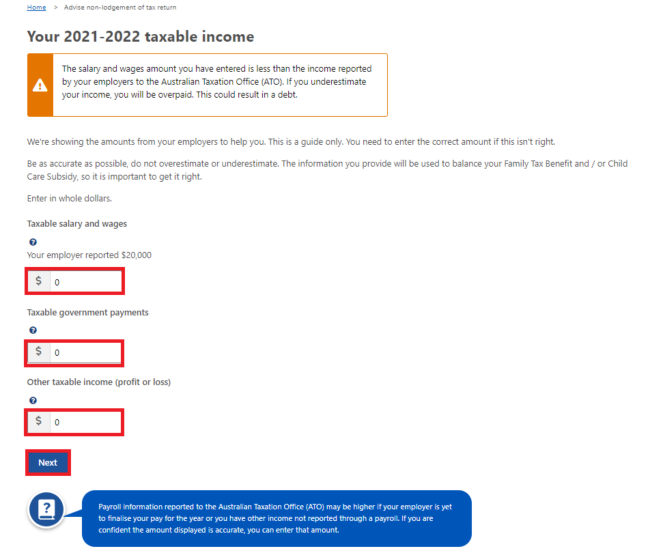

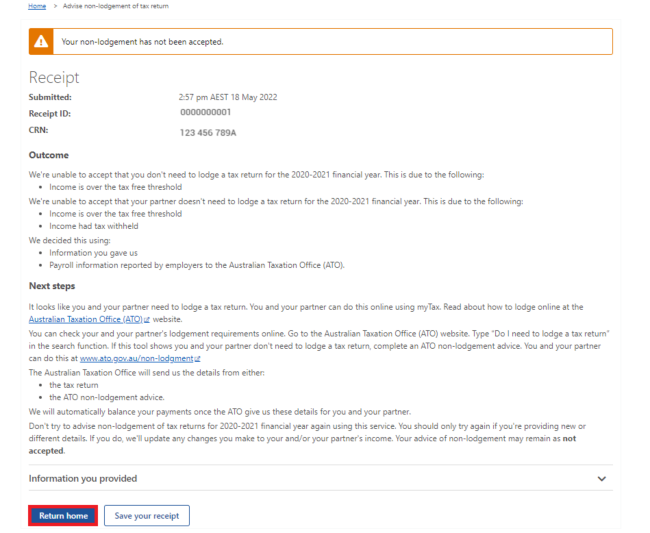

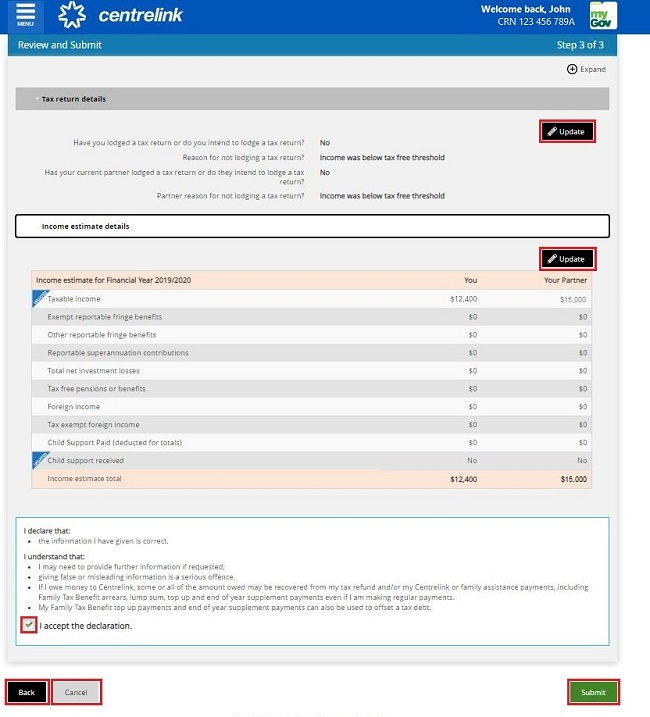

Centrelink Online Account Help Advise Non lodgement Of Tax Return

https://www.servicesaustralia.gov.au/sites/default/files/2022-07/coa-advise-non-lodgement-step4d-010722.png

https://www.servicesaustralia.gov.au/taxable-centrelink-payments?...

Web Taxable Centrelink payments If you get a taxable Centrelink payment you may need to lodge a tax return at the end of the tax year You ll get a Centrelink payment summary if

https://www.centrelink.gov.au/onlineclaim/help/paymentChoices_help.htm

Web The rebate covers 50 of out of pocket expenses for approved child care up to a maximum amount per child per year You do not need to make a separate claim to receive Child

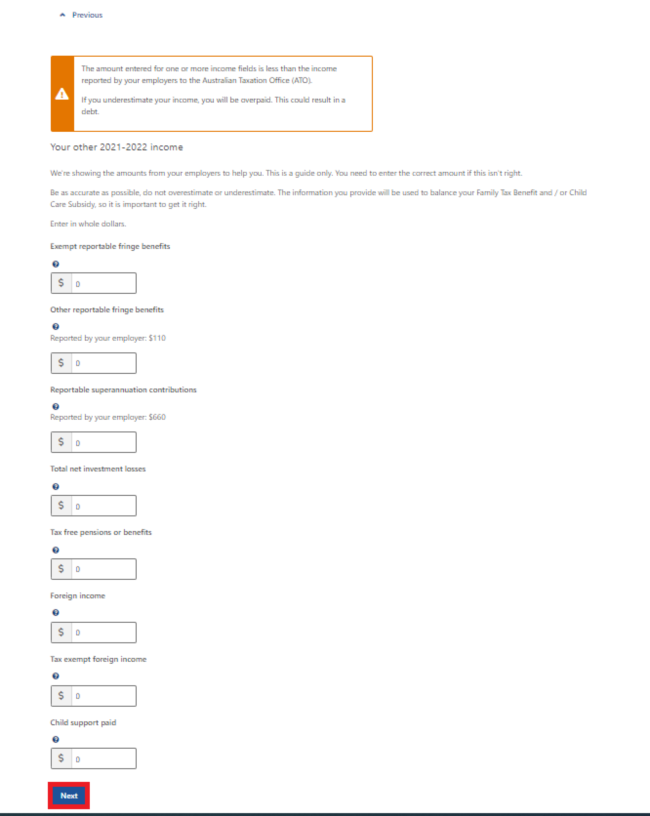

Centrelink Online Account Help Advise Non lodgement Of Tax Return

Do You Get Tax Back From Centrelink Tax Walls

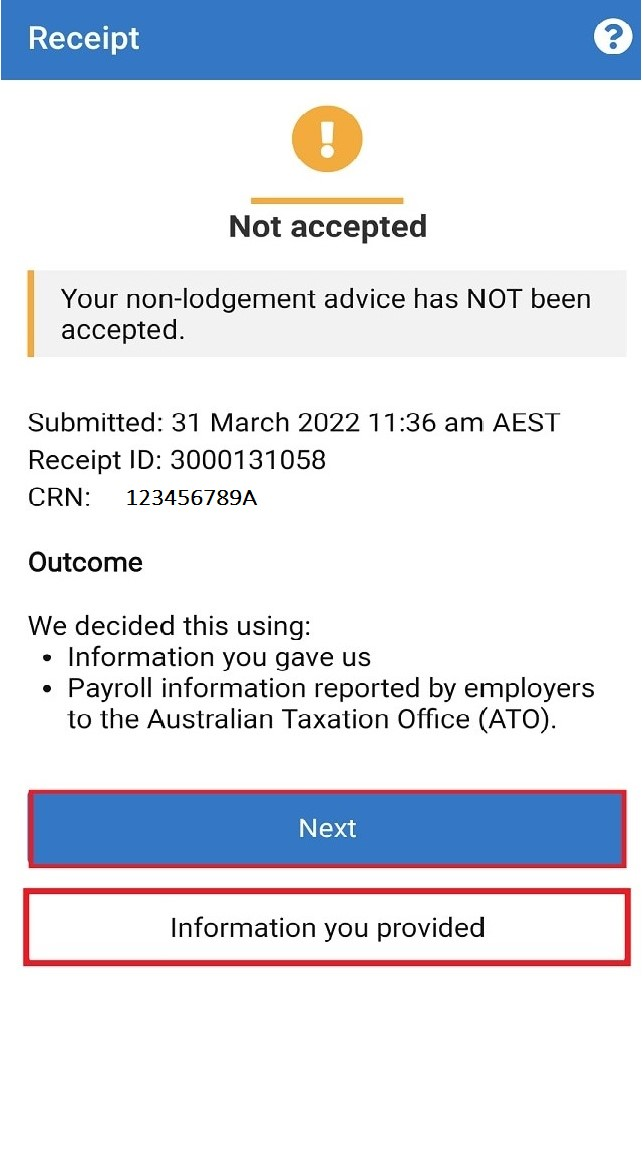

Express Plus Centrelink Mobile App Help Advise Non lodgement Of Tax

Centrelink Online Account Help Advise Non lodgement Of Tax Return

Centrelink Online Account Help Advise Non lodgement Of Tax Return

Centrelink Online Account Help Managing Your Tax Deductions

Centrelink Online Account Help Managing Your Tax Deductions

Centrelink Online Account Help Managing Your Tax Deductions

Centrelink Online Account Help Advise Non lodgement Of Tax Return

Centrelink Online Account Help Advise Non lodgement Of Tax Return

Centrelink Tax Rebate - Web This applies if you got FTB fortnightly or choose to get all of your FTB at the end of the financial year We will pay the last FTB payments for 2022 23 between 4 and 17 July