Charitable Deduction Limits Learn how to deduct donations of cash and property to qualified charitable organizations from your taxable income Find out the IRS limits for different types of

Learn how to deduct charitable contributions of money or property made to qualified organizations and the limitations that apply depending on the type of organization and Learn how to deduct charitable contributions on your tax return if you itemize and what limits apply based on your Adjusted Gross Income Find

Charitable Deduction Limits

Charitable Deduction Limits

https://www.hrpro.com/wp-content/uploads/2022/05/HSA-Limits-Chart-600.png

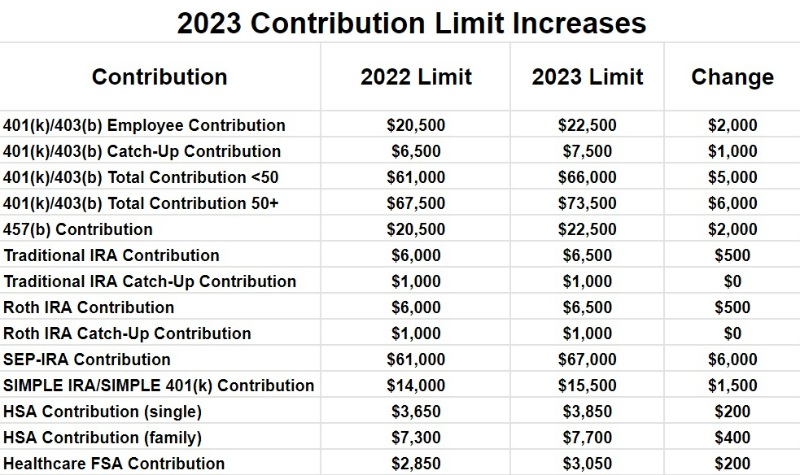

401k Maximum Contribution 2023 PELAJARAN

https://theneighborhoodfinanceguy.com/wp-content/uploads/2022/09/2023-retirement-contributions-limits-img.jpg

Annual Retirement Plan Contribution Limits For 2023 Social K

https://socialk.com/wp-content/uploads/image-12.png

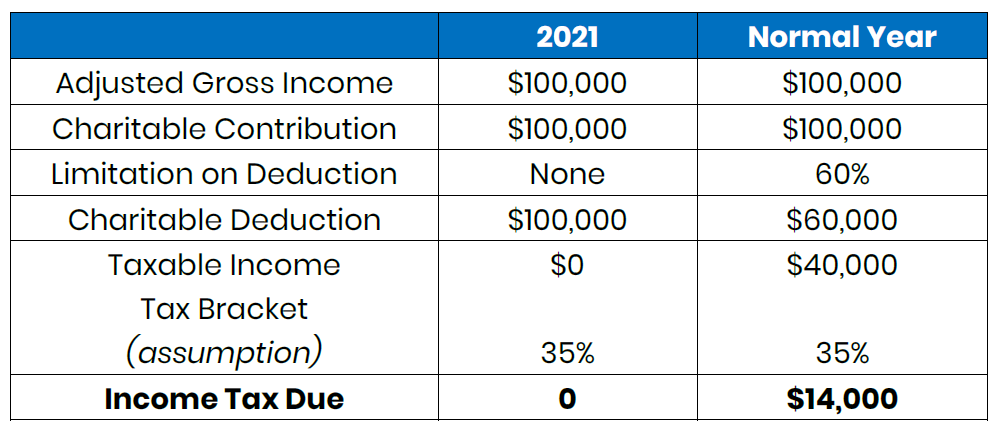

Learn how to claim a deduction for charitable contributions to qualified organizations and the rules and limits that apply Find out what records to keep how to report The law now permits C corporations to apply an increased limit Increased Corporate Limit of 25 of taxable income for charitable contributions of cash they make

What qualifies as a charitable donation How can I maximize my deductions for charitable giving What about other ways to maximize my charitable deduction The IRS has incentivized charitable giving for people 70 1 2 and older With a qualified charitable distribution QCD you can transfer up to 100 000 to charity tax

Download Charitable Deduction Limits

More picture related to Charitable Deduction Limits

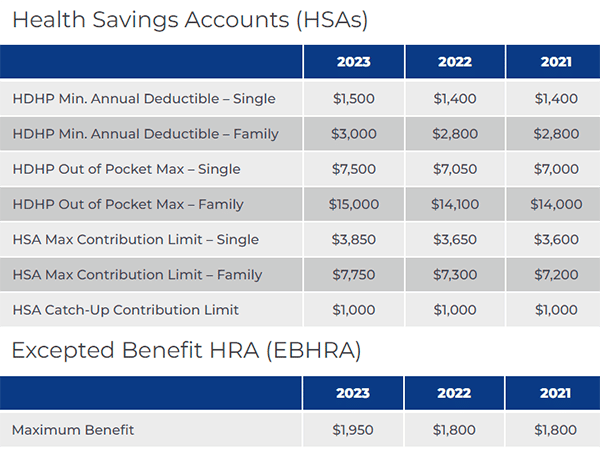

IRS Announces 2023 HSA Contribution Limits

https://blog.threadhcm.com/hs-fs/hubfs/HSA Contribution Limits Table.png?width=1024&name=HSA Contribution Limits Table.png

Tabela Atualizado Irs 2023 Hsa Limit IMAGESEE

https://i2.wp.com/medcombenefits.com/images/uploads/blog/2023_HSA_Limits_Table.jpg

2023 Dcfsa Limits 2023 Calendar

https://www.wexinc.com/wp-content/uploads/2022/05/ContributionLimitsChart_Blog_SupplementalGraphic_2023-1-1024x768.jpg

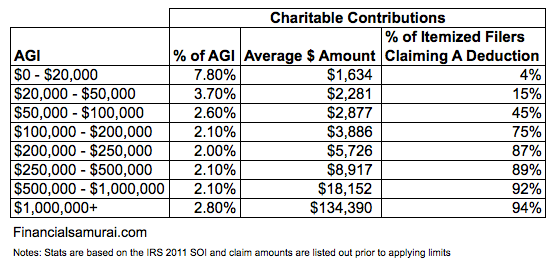

What Is the Charitable Donations Deduction Limit For taxpayers who itemize their deductions the limit for cash donations is 60 of adjusted gross income Charitable contributions are generally tax deductible if you itemize The amount you can deduct may range from 20 to 60 of your adjusted gross income

Deductions for contributions of long term capital gain property such as appreciated securities held for more than one year are limited to 30 of AGI Deductions for all The amount of charitable contributions an individual can deduct in any one tax year is limited depending on the types of organizations to which the contributions were made

Tax Deductions For 2023 Ontario Image To U

https://www.wiztax.com/wp-content/uploads/2022/10/2.png

CharitablePlanning

http://www.charitableplanning.com/system/images/10022/original/Capture2.PNG?1505498424

https://www.investopedia.com/terms/c/charitable...

Learn how to deduct donations of cash and property to qualified charitable organizations from your taxable income Find out the IRS limits for different types of

https://www.irs.gov/charities-non-profits/...

Learn how to deduct charitable contributions of money or property made to qualified organizations and the limitations that apply depending on the type of organization and

Important Year End Tax Moves To Save Money And Grow Wealth Financial

Tax Deductions For 2023 Ontario Image To U

Income Limitations On Charitable Giving Deductions

25 Days Of Giving Quick Rule of Thumb On Charitable Deduction Limits

Maximize Your Tax Deduction For Charitable Contributions

Coloradans To Vote On Deduction Limits That Would Undermine Charitable

Coloradans To Vote On Deduction Limits That Would Undermine Charitable

Navigating Charitable Donations Deduction Limits What You Need To Know

Recommendations For Charitable Planning

2021 Giving Tax Incentives Judi s House

Charitable Deduction Limits - Learn how to maximize your charitable contributions and tax deductions with the latest IRS updates Find out the tax brackets standard deductions charitable