Charitable Tax Credit 2022 Verkko In return for your payment you receive or expect to receive a state tax credit of 70 of your 1 000 contribution The amount of your charitable contribution to charity X is reduced by 700 70 of 1 000 The result is your charitable contribution deduction to charity X can t exceed 300 1 000 donation 700 state tax credit

Verkko 10 huhtik 2022 nbsp 0183 32 Charitable giving during the holiday season this year takes on a new happier meaning when it comes to tax deductions Typically most people aren t able to get a tax break when they donate Verkko 27 marrask 2023 nbsp 0183 32 Charitable giving tax deduction limits are set by the IRS as a percentage of your income Cash contributions in 2023 and 2024 can make up 60 of your AGI The limit for appreciated assets in 2023 and 2024 including stock is 30 of your AGI Contributions must be made to a qualified organization

Charitable Tax Credit 2022

Charitable Tax Credit 2022

https://childrenscareaz.org/wp-content/uploads/2020/08/CCA-Infographics.jpg

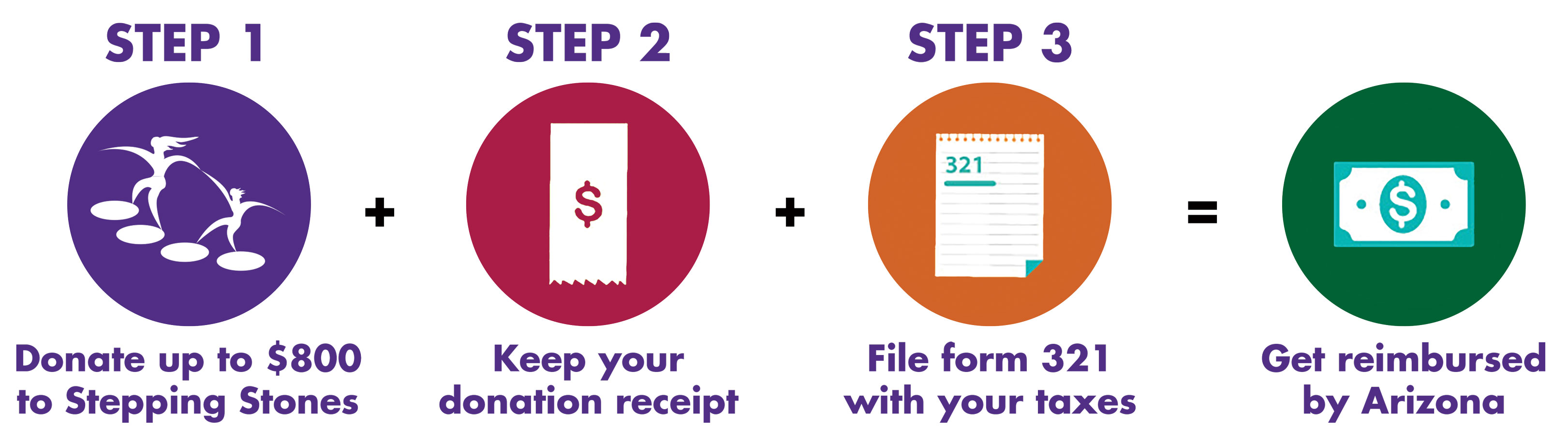

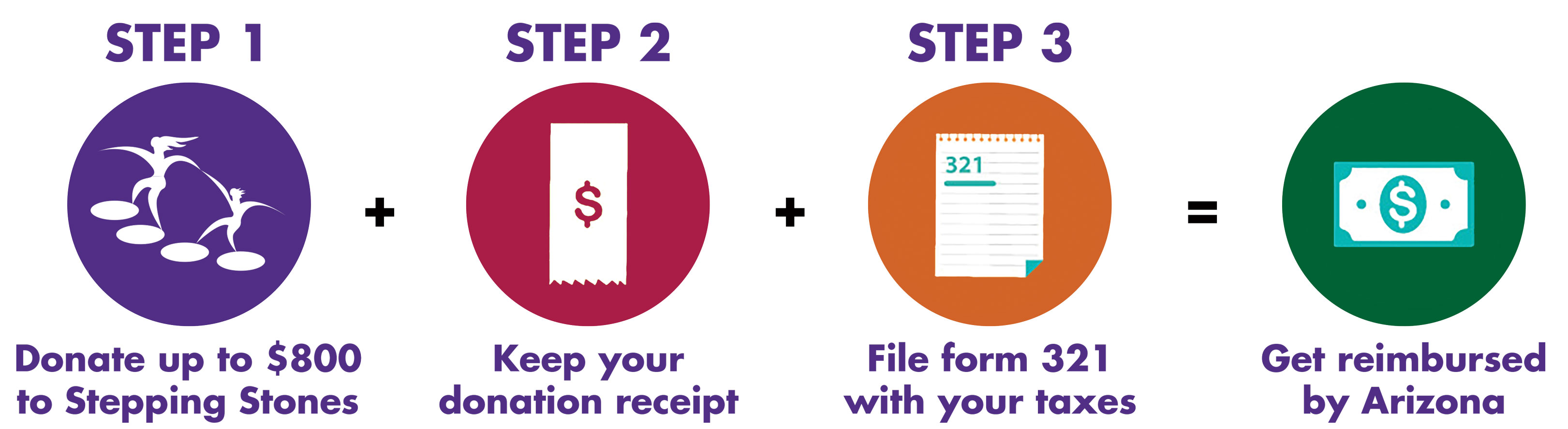

Keep Your State Taxes Local With A Charitable Tax Credit Stepping

https://steppingstonesaz.org/wp-content/uploads/2018/09/Tax-Credit-4-Steps-Transparent-CMYK.jpg

What You Need To Know About The Arizona Charitable Tax Credit

https://financemagazine.co/wp-content/uploads/2021/10/IMG_8467-1217_PMNW.jpg

Verkko Can I Deduct My Charitable Contributions Page Last Reviewed or Updated 01 Dec 2023 Your charitable contributions may be deductible if you itemize Find forms and check if the group you contributed to qualifies as Verkko 28 lokak 2022 nbsp 0183 32 Here s how it works You give 10 000 on Jan 1 and another 10 000 on Dec 31 This strategy allows you to claim the 20 000 gift as an itemized deduction on your tax return for the year in

Verkko Federal and provincial donation tax credits add up By donating to your favourite charity you may receive as much as 49 of the amount you donated back at tax time That could mean a 494 tax credit on a total of 1000 donated in a single year in some provinces Verkko 19 jouluk 2022 nbsp 0183 32 As for things like linens they tend to retain very little value after they ve been used Otherwise you may be able to deduct the below values Twin bed 36 to 104 Full or larger bed 52 to 176 Bedspread or blanket 3 to 25 Coffee table 15 to 100 Desk 26 to 145

Download Charitable Tax Credit 2022

More picture related to Charitable Tax Credit 2022

Giving Tax Credit Where Credit Is Due

https://www.chevyhardcore.com/image/2023/12/giving-tax-credit-where-credit-is-due-2023-12-29_09-27-16_080592.jpg

Estimate Your Tax Credit Deduction Alliantgroup

https://www.alliantgroup.com/wp-content/uploads/2022/05/web-photo_aglogo-04-scaled-1.jpg

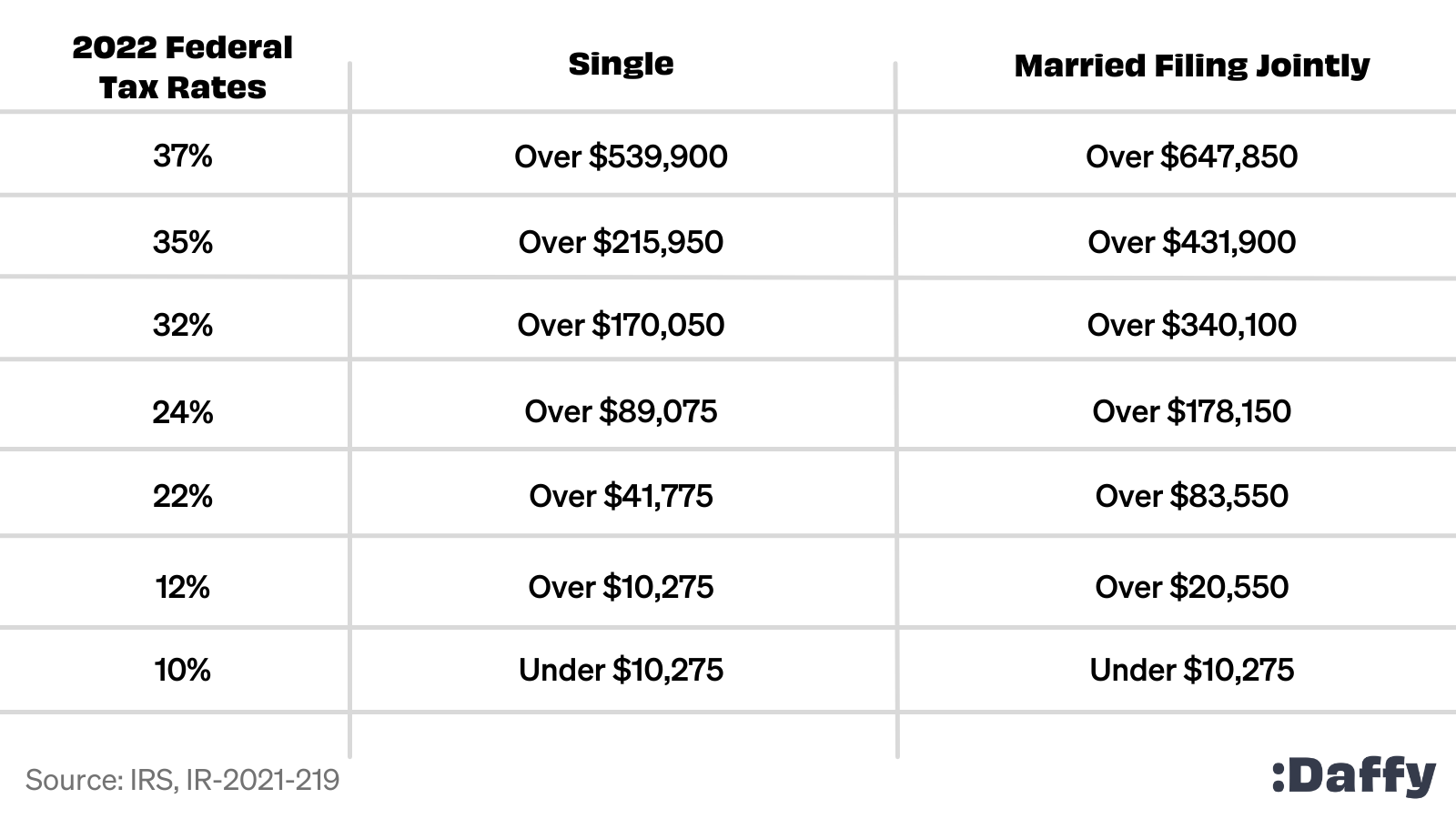

The Complete 2022 Charitable Tax Deductions Guide

https://daffy.ghost.io/content/images/2022/05/Daffy-donor-advised-funds-2022-federal-tax-rates.png

Verkko 15 marrask 2023 nbsp 0183 32 You must fill out one or more of Form 8283 Noncash Charitable Contributions and attach them to your return if your deduction for each noncash contribution s more than 500 If you claim a deduction of more than 500 but not more than 5 000 per item or a group of similar items you must fill out Form 8283 Section A Verkko Discover the impact a charitable donation can have on your taxes This calculator determines how much you could save based on your donation and place of residence Enter the donation amount in the box below and press the Calculate button

Verkko Dec 15 2022 at 1 29 p m Most Americans plan to make at least a small donation to charity this year Getty Images Despite the uncertain economy most Americans 93 plan to make at least Verkko For a quick estimate of your charitable tax credit for the current tax year try out the Charitable donation tax credit calculator For more information about claiming your charitable donations see the General Income Tax and Benefits Guide

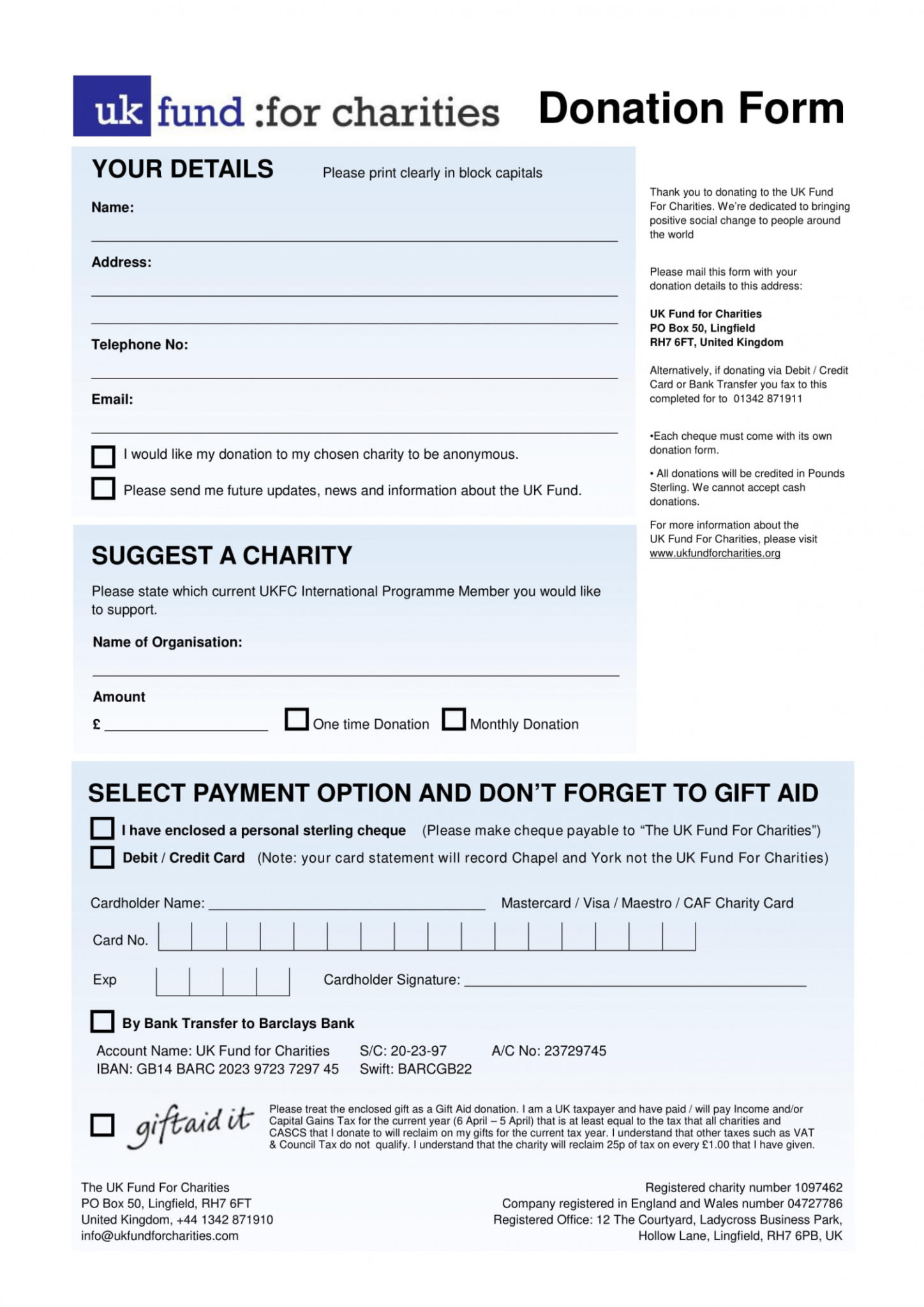

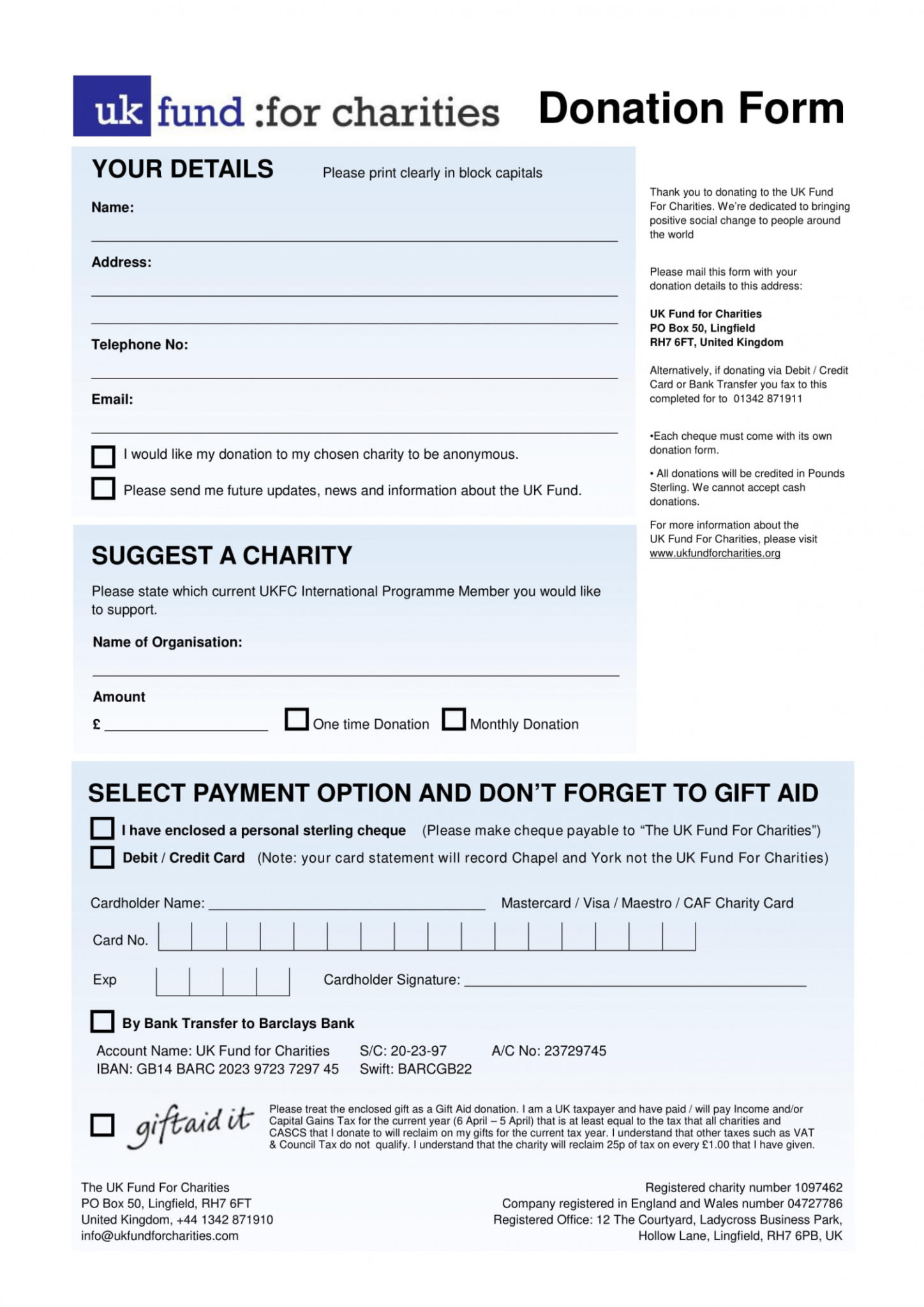

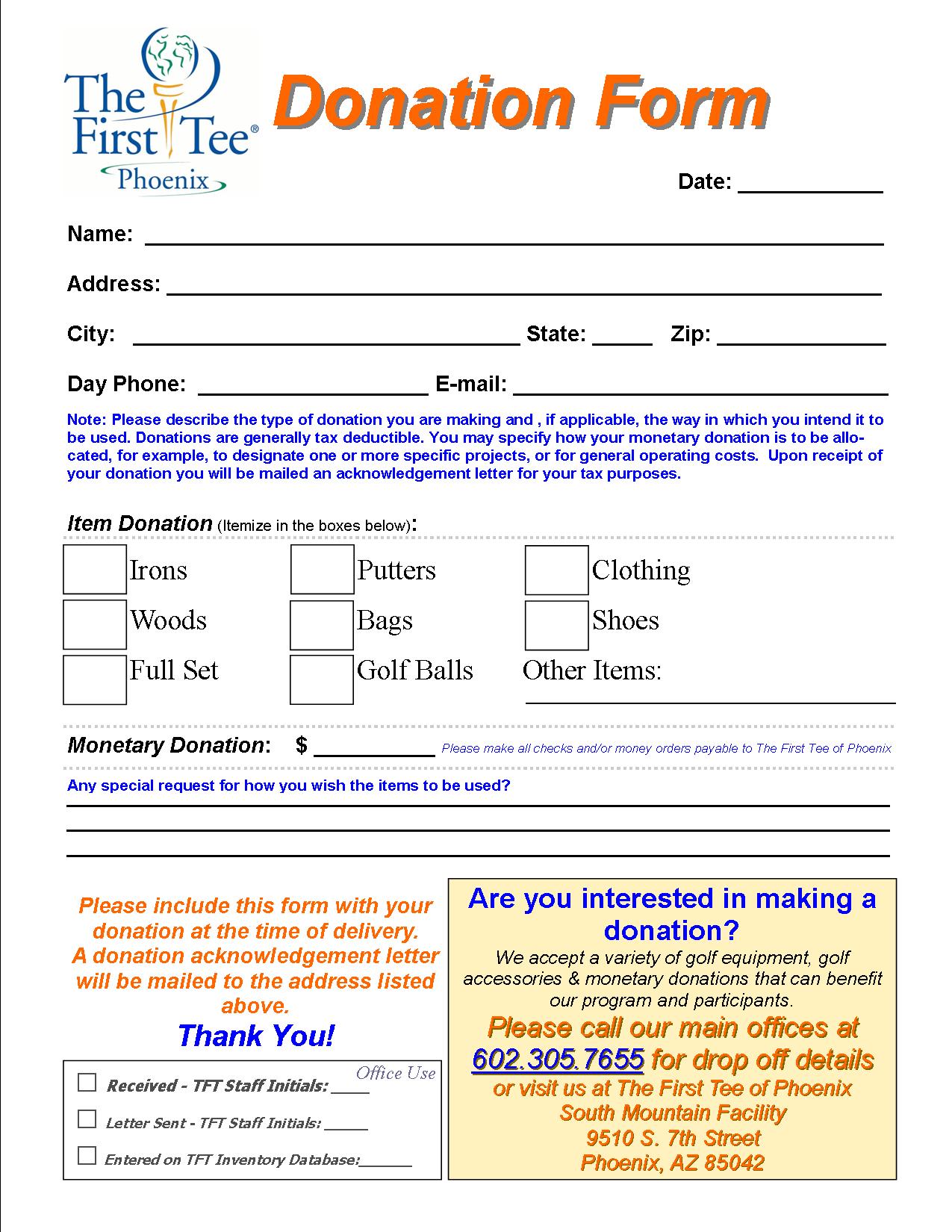

Printable Free 5 Charity Donation Forms In Pdf Ms Word Charitable

https://minasinternational.org/wp-content/uploads/2020/06/printable-free-5-charity-donation-forms-in-pdf-ms-word-charitable-donation-agreement-template-excel-1448x2048.jpg

Tax Credit Universal Credit Impact Of Announced Changes House Of

https://commonslibrary.parliament.uk/wp-content/uploads/2015/11/IDS.jpg

https://www.irs.gov/publications/p526

Verkko In return for your payment you receive or expect to receive a state tax credit of 70 of your 1 000 contribution The amount of your charitable contribution to charity X is reduced by 700 70 of 1 000 The result is your charitable contribution deduction to charity X can t exceed 300 1 000 donation 700 state tax credit

https://www.usatoday.com/story/money/taxes/2022/04/10/tax-deduction...

Verkko 10 huhtik 2022 nbsp 0183 32 Charitable giving during the holiday season this year takes on a new happier meaning when it comes to tax deductions Typically most people aren t able to get a tax break when they donate

2022 Education Tax Credits Are You Eligible

Printable Free 5 Charity Donation Forms In Pdf Ms Word Charitable

Donation Letter For Taxes Template In PDF Word Set Of 10 Donation

Charity Donation Card Template

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

Charitable Tax Credit In 2017 Things To Know Transparent Hands

Charitable Tax Credit In 2017 Things To Know Transparent Hands

Sign Up Beta Charitable Trust

Credit Insurance Concept On Craiyon

Guide To Claiming Charitable Donation Reciept CanadaHelps Donate To

Charitable Tax Credit 2022 - Verkko 28 lokak 2022 nbsp 0183 32 Here s how it works You give 10 000 on Jan 1 and another 10 000 on Dec 31 This strategy allows you to claim the 20 000 gift as an itemized deduction on your tax return for the year in