Charity Tax Concession Status Fbt Rebate Web Fringe benefits tax rebates Fringe benefits tax FBT is a tax paid on any benefits that an employer provides to their employees outside of their salary or their superannuation

Web Fringe benefits tax FBT is a tax paid on benefits that an employer provides to their employees in addition to their salary such as the use of a work car or phone Charity Web Charities use this form to apply for ATO endorsement to access one or more of the following charity tax concessions income tax exemption goods and services tax GST charity

Charity Tax Concession Status Fbt Rebate

Charity Tax Concession Status Fbt Rebate

https://fiverr-res.cloudinary.com/images/t_main1,q_auto,f_auto,q_auto,f_auto/gigs/309468463/original/d4d21d724c515edf80205adae0594576ab477ec9/guide-you-complete-australian-tax-assignments-gst-payg-fbt-cgt-offset-rebates.jpg

Osgoode Family Ball Tournament We Do It For Charity We Do It For Fun

http://www.familyballtournament.com/wp-content/uploads/2013/05/FBT-Logo.png

BBC Concession Sale Discount Off Deduction Rebate

https://pic1.zhimg.com/v2-90d5159ed0d359ae7031499aeaa1c714_b.jpg

Web 12 nov 2020 nbsp 0183 32 The main Commonwealth tax concessions available to ACNC registered charities are income tax exemption Goods and Services Tax GST concessions Web Those that qualify for an FBT rebate are registered charities other than public benevolent institutions or health promotion charities that are an institution not established under a

Web Only available to charities that are registered HPCs PBIs public and not for profit hospitals and public ambulance services This is capped at 30 000 per employee for PBIs and Web The rebate is currently equivalent to 47 percent of gross FBT payable and is subject to a capping threshold of 30 000 per employee FBT Exemption Charities designated as

Download Charity Tax Concession Status Fbt Rebate

More picture related to Charity Tax Concession Status Fbt Rebate

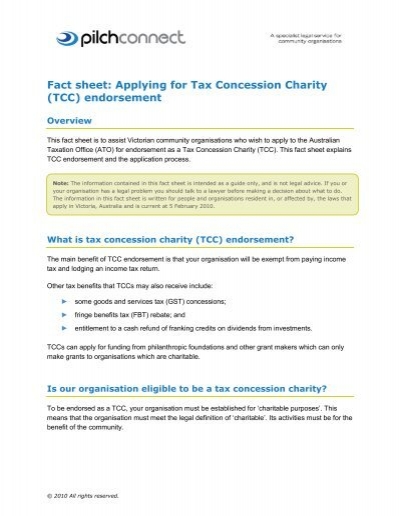

Fact Sheet Applying For Tax Concession Charity TCC Pilch

https://www.yumpu.com/en/image/facebook/25348160.jpg

Tax Relief On Charitable Donations Johnston Smillie

https://www.jsca.co.uk/wp-content/uploads/2018/04/charity-692x480.jpg

Elanco Rebate Status Understanding The Benefits Elanco

https://www.elancorebates.net/wp-content/uploads/2023/04/Elanco-Rebate-Status.png

Web Rebate for charitable institutions and rebatable employers An FBT rebate essentially a tax discount is available to organisations that are charities registered with the ACNC Web endorsement to access one or more charity tax concessions Charity tax concessions are n income tax exemption n goods and services tax GST charity concessions

Web Tax concessions are available for a range of not for profit organisations including charities public benevolent institutions and other types of incorporated associations Web 19 mai 2021 nbsp 0183 32 If you re accessing or you ve been endorsed for the FBT rebate basically it applies to all of your employees but remember it s not an exemption it s merely a

Goodyear Rebate Status Check Your Tire Rebate Goodyear Tires

https://i0.wp.com/www.goodyearrebates.net/wp-content/uploads/2023/03/Goodyear-Rebate-Status.png?ssl=1

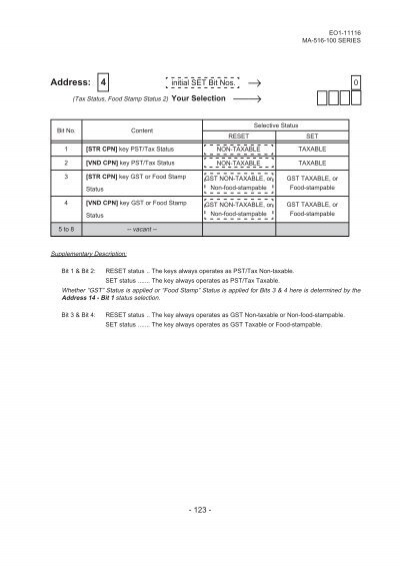

1 Key PST Tax Statu

https://www.yumpu.com/en/image/facebook/5902635/127.jpg

https://www.acnc.gov.au/tools/factsheets/charity-tax-concessions

Web Fringe benefits tax rebates Fringe benefits tax FBT is a tax paid on any benefits that an employer provides to their employees outside of their salary or their superannuation

https://www.acnc.gov.au/tools/topic-guides/fringe-benefits-tax-fbt

Web Fringe benefits tax FBT is a tax paid on benefits that an employer provides to their employees in addition to their salary such as the use of a work car or phone Charity

FBT exempt Electric Cars Part 1 One Accountancy

Goodyear Rebate Status Check Your Tire Rebate Goodyear Tires

Pensioner Rebates Tweed Shire Council

Government Urged To Use Superannuation Tax Concession Changes To Expand

Worked Examples Not for profit Employers Completing Your FBT Return

2023 FBT Return Calculation Details Taxable Employers Australian

2023 FBT Return Calculation Details Taxable Employers Australian

Discount Exemption Rebate Concession Reduction Deduction

How To Give To Charities Tax Efficiently Facebook Live August 11 2021

Discount Exemption Rebate Concession Reduction Deduction

Charity Tax Concession Status Fbt Rebate - Web The rebate is currently equivalent to 47 percent of gross FBT payable and is subject to a capping threshold of 30 000 per employee FBT Exemption Charities designated as