Charity Tax Deduction 2022 Your deduction may be further limited to 50 30 or 20 of your AGI depending on the type of property you give and the type of organization you give it to Starting with tax year 2022 your deduction for cash

Cash donations for 2022 and later are generally limited to 60 of the taxpayer s adjusted gross income AGI To deduct a charitable contribution taxpayers The IRS has incentivized charitable giving for people 70 1 2 and older With a qualified charitable distribution QCD you can transfer up to 100 000 to charity tax free The money would have

Charity Tax Deduction 2022

Charity Tax Deduction 2022

https://images.squarespace-cdn.com/content/v1/5a60cb144c0dbf811647fce8/80259db2-916f-487a-833e-88aead19febd/2022-standard-deduction+copy.jpg

IRS Reminds Of Special 2020 Tax Deduction For Donating To Charity

https://www.penbaypilot.com/sites/default/files/2020/11/field/image/N2011P42018H.jpg

Donation Value Guide 2019 Spreadsheet Unique Goodwill Donation

https://i.pinimg.com/originals/80/a7/71/80a771ab9f2ef0ac717c9a3e35380ffa.jpg

The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they don t Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes The amount of

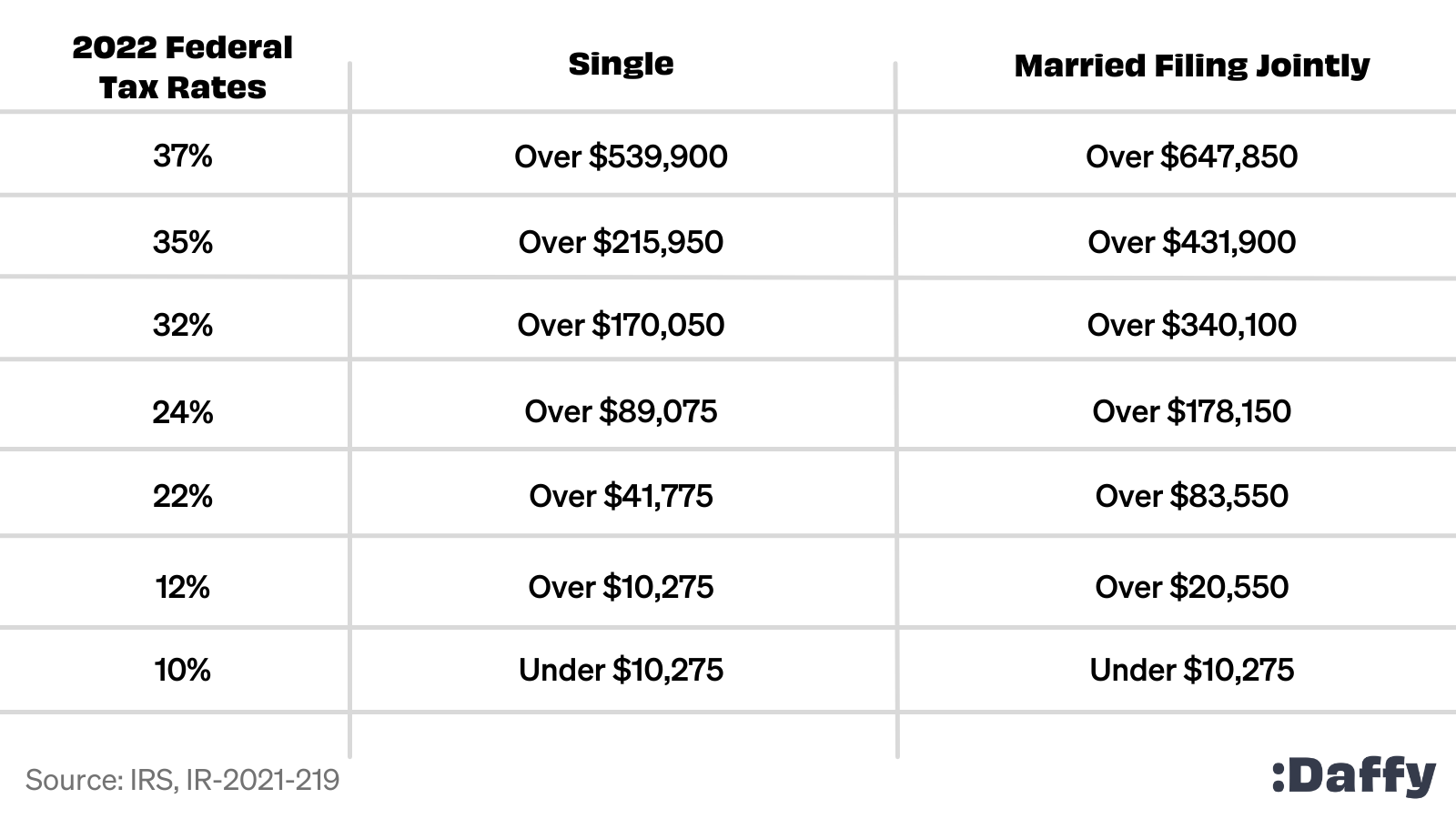

Tax year 2022 deduction limits are 30 of adjusted gross income AGI for contributions of noncash assets if the assets were held for more than one year 60 of AGI for contributions of cash To help you navigate the latest IRS tax updates from 2023 to 2024 we ve put together a guide including the updated tax brackets charitable deduction limits how much of a charitable donation is tax

Download Charity Tax Deduction 2022

More picture related to Charity Tax Deduction 2022

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

https://cdn1.npcdn.net/image/16272778521a6ef50158b79f67207a9ee7fe2b2eb3.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Gifts to charity can still reduce your taxable income and increase your tax refund but some of the rules for deducting charitable donations are changing for 2022 This year donors can fully deduct contributions equal to up to 100 percent of their adjusted gross income or AGI Under the Tax Cuts and Jobs Act that took effect in 2018 the cap was set

For 2022 the standard deduction is 12 950 for single filers or 25 900 for married couples filing together And if you take the standard deduction in 2022 you can t Giving to charity can be life affirming and as a bonus it can help with your tax bill If donating to a charity is part of your tax plan here are a couple of tips so you

The IRS Encourages Taxpayers To Consider Charitable Contributions

https://www.irs.gov/pub/image/acl-charitable-contributions-870.jpg

.png)

50 Unmissable Benefits Of Filing Jointly Ultimate Guide 2024

https://www.schwabcharitable.org/sites/g/files/eyrktu821/files/case-study-comparison(jsakamoto%40reflectur.com).png

https://www.irs.gov › publications

Your deduction may be further limited to 50 30 or 20 of your AGI depending on the type of property you give and the type of organization you give it to Starting with tax year 2022 your deduction for cash

https://www.investopedia.com › terms › charitable...

Cash donations for 2022 and later are generally limited to 60 of the taxpayer s adjusted gross income AGI To deduct a charitable contribution taxpayers

Donating Artwork To Charity Tax Deduction Ins And Outs Of Donating To

The IRS Encourages Taxpayers To Consider Charitable Contributions

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

2022 And 2023 Tax Thresholds HKP Seattle

The Complete 2022 Charitable Tax Deductions Guide

2021 2022 PCT Annual Report Palliative Care Tasmania

2021 2022 PCT Annual Report Palliative Care Tasmania

Charity Tax Deduction Andrews Tax Accounting

Make Sure You Claim Your Charitable Tax Deductions On Form 1040 Or

The Government Shutdown Won t Hurt Your Tax Deduction

Charity Tax Deduction 2022 - To help you navigate the latest IRS tax updates from 2023 to 2024 we ve put together a guide including the updated tax brackets charitable deduction limits how much of a charitable donation is tax