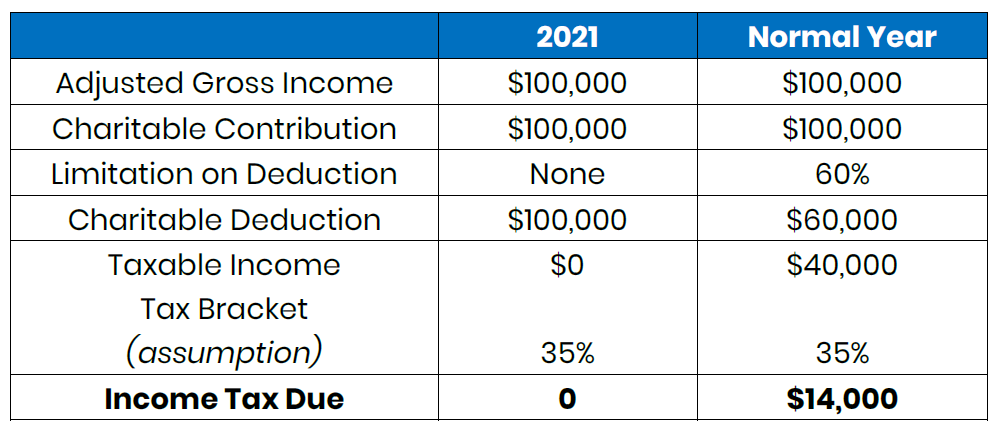

Charity Tax Deduction Limit In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the taxpayer s adjusted gross income AGI Qualified contributions are not subject to

Limits apply to charitable contribution deductions based on IRS limits For 2022 and later limits are 60 of the taxpayer s adjusted gross income AGI although some exceptions apply Article The result is your charitable contribution deduction to charity X can t exceed 300 1 000 donation 700 state tax credit The reduction applies even if you can t claim the state tax credit for that year

Charity Tax Deduction Limit

Charity Tax Deduction Limit

https://i.ytimg.com/vi/ibZx8jmqBCk/maxresdefault.jpg

How Does Donating A Car Affect Taxes

https://www.donateforcharity.com/wp-content/uploads/2013/10/irs-car-donation-tax-deduction-e1381639923844.jpg

2021 Giving Tax Incentives Judi s House

https://judishouse.org/wp-content/uploads/2021/11/Charitable-Giving-Incentives-2021-Table.png

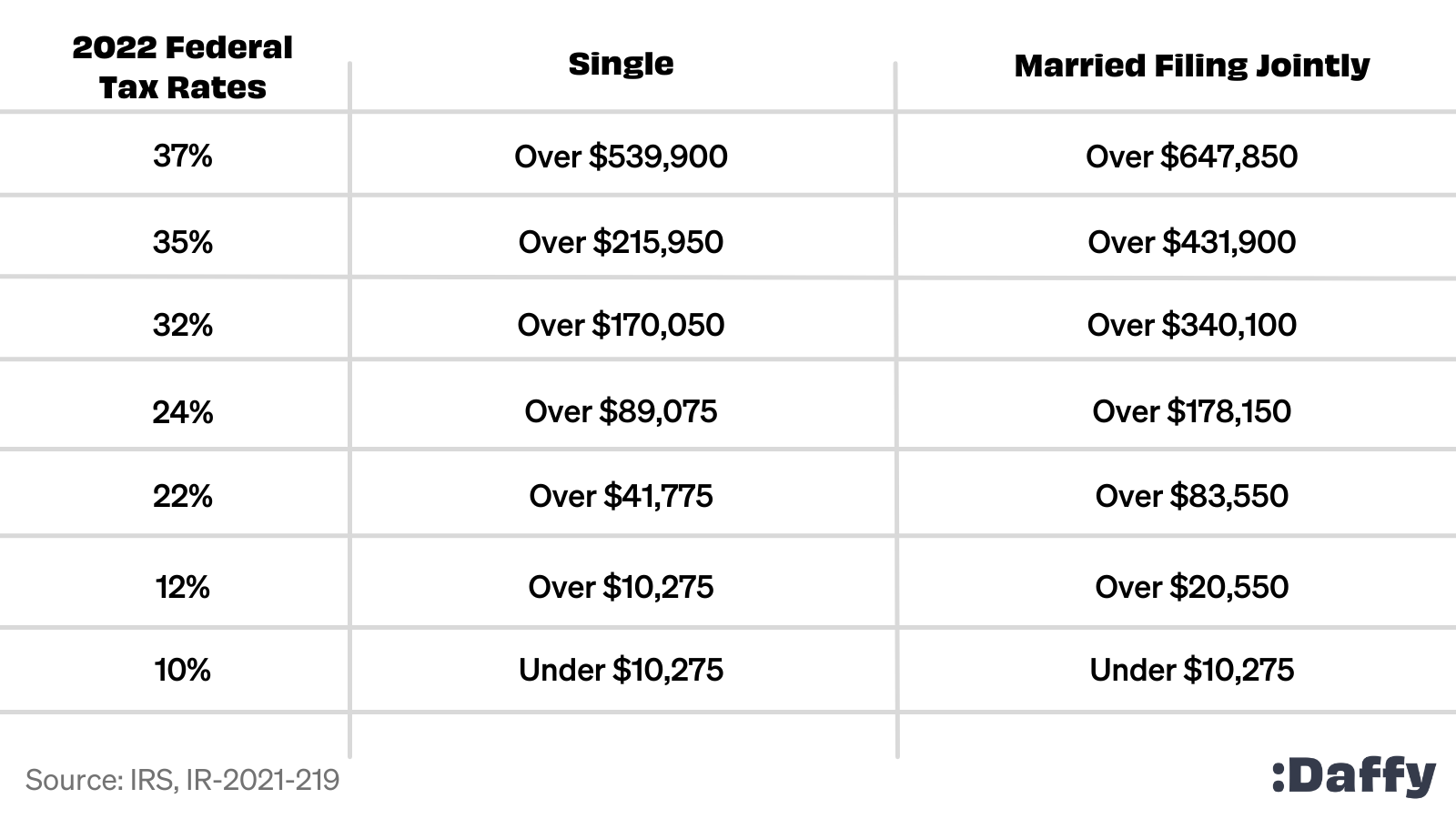

The 2023 and 2024 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the AGI limit of 60 for cash donations for qualified Charitable contributions are generally tax deductible if you itemize The amount you can deduct may range from 20 to 60 of your adjusted gross income

The amount of charitable contributions you can deduct generally can t be more than 60 of your Adjusted Gross Income AGI but in some cases 20 30 or 50 limits may apply Table 1 of IRS Publication 526 Charitable Contributions has examples of what you can and cannot deduct Charitable donations must be made to tax exempt 501 c 3 organizations to qualify as a deduction A legitimate charitable organization should be happy to provide proof of its tax exempt

Download Charity Tax Deduction Limit

More picture related to Charity Tax Deduction Limit

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1080xN.5462529921_cvyy.jpg

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

https://cdn1.npcdn.net/image/16272778521a6ef50158b79f67207a9ee7fe2b2eb3.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

April 2 2024 at 8 35 a m Getty Images Accuracy is important when estimating the value of noncash contributions Key Takeaways To get the charitable deduction you usually have to itemize Are charitable contributions tax deductible Here s what you need to know when filing your 2024 tax return

[desc-10] [desc-11]

Can You Get A Tax Deduction For Giving A Gift Hatley Law Group APC

https://hatleylawgroup.com/wp-content/uploads/joanna-kosinska-LbMy35NyCNg-unsplash-scaled.jpg

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

https://www.hdfcsales.com/blog/wp-content/uploads/2021/06/tax-deduction-on-fixed-deposit.jpg

https://www.irs.gov/charities-non-profits/...

In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the taxpayer s adjusted gross income AGI Qualified contributions are not subject to

https://www.investopedia.com/terms/c/charitable...

Limits apply to charitable contribution deductions based on IRS limits For 2022 and later limits are 60 of the taxpayer s adjusted gross income AGI although some exceptions apply Article

Section 80C Deductions List To Save Income Tax FinCalC Blog

Can You Get A Tax Deduction For Giving A Gift Hatley Law Group APC

What Will My Tax Deduction Savings Look Like The Motley Fool

The Complete 2022 Charitable Tax Deductions Guide

Charity Tax Breaks Extended Through 2014 Only

What Are Pre tax Deductions Before Tax Deduction Guide

What Are Pre tax Deductions Before Tax Deduction Guide

Charitable Tax Deduction Peculiarities

Maximising Tax Benefits Your Guide To Claiming A Rental Property

DONATE CAR TO CHARITY CHARITY TAX DEDUCTION

Charity Tax Deduction Limit - The amount of charitable contributions you can deduct generally can t be more than 60 of your Adjusted Gross Income AGI but in some cases 20 30 or 50 limits may apply Table 1 of IRS Publication 526 Charitable Contributions has examples of what you can and cannot deduct