Charity Tax Deduction Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes

The charitable contributions deduction allows taxpayers to deduct donations of cash and property given to qualified charitable organizations There are Internal Revenue Service IRS limits Taxpayers who itemize can generally claim a deduction for charitable contributions to qualifying organizations The deduction is typically limited to 20 to 60 of their adjusted gross income and varies depending on the type of

Charity Tax Deduction

Charity Tax Deduction

https://www.wendroffcpa.com/wp-content/uploads/charity-contribution.jpg

IRS Reminds Of Special 2020 Tax Deduction For Donating To Charity

https://www.penbaypilot.com/sites/default/files/2020/11/field/image/N2011P42018H.jpg

Here s How To Get This Year s Special Charitable Tax Deduction

https://kubrick.htvapps.com/htv-prod-media.s3.amazonaws.com/images/donations-1609343326.jpg?crop=1.00xw:1.00xh;0,0&resize=900:*

The purpose of charitable tax deductions are to reduce your taxable income and your tax bill and in this case improving the world while you re at it 1 How much do I need to give to charity to make a difference on my taxes Nearly nine in 10 taxpayers now take the standard deduction and could potentially qualify to claim a limited deduction for cash contributions These individuals including married individuals filing separate returns can claim a deduction of up to 300 for cash contributions made to qualifying charities during 2021

Charitable contributions can lower your taxable income as well as your tax bill To get the full benefit however your donations to charity and other itemized tax deductions must exceed the A gift to a qualified charitable organization may entitle you to a charitable contribution deduction against your income tax if you itemize deductions You must itemize in order to take a charitable deduction

Download Charity Tax Deduction

More picture related to Charity Tax Deduction

Donate Car For Tax Deduction Tax Deductions Donate Car Deduction

https://i.pinimg.com/originals/55/a8/37/55a837f4c7cc8edfbd3e1f6dac982bdf.gif

How To Maximize Your Charity Tax Deductible Donation WealthFit

https://images.prismic.io/wealthfit-staging/412c54c56299372c10093120ad811293a9e703bd_02-maximize-charitable-deductions.jpg?auto=compress,format&w=1772

DONATE CAR TO CHARITY CHARITY TAX DEDUCTION

https://2.bp.blogspot.com/-B08-ormewfc/XEIKXmWDF3I/AAAAAAAAGuo/gkiBWAgKoa87h-SytOw85wgRwtZuhsmxQCLcBGAs/s1600/Car+onlinecardonation+005.jpeg

With a qualified charitable distribution QCD you can transfer up to 100 000 to charity tax free The money would have to go directly from your IRA to an eligible charitable organization Charitable contribution deductions for cash contributions to public charities and operating foundations are limited to up to 60 of a taxpayer s adjusted gross income AGI Key Takeaways The

[desc-10] [desc-11]

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Everything You Need To Know About Your Tax Deductible Donation Learn

https://www.globalgiving.org/learn/wp-content/uploads/2019/07/Full-Tax-Deductions-669x1024.png

https://www.nerdwallet.com/article/taxes/tax...

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes

https://www.investopedia.com/terms/c/charitable-contributions...

The charitable contributions deduction allows taxpayers to deduct donations of cash and property given to qualified charitable organizations There are Internal Revenue Service IRS limits

How To Apply For A Donated Car

Tax Deduction Letter Sign Templates Jotform

The Year End Tax Deduction Charity Matters

Donate A Vehicle To Charity Tax Deduction 2012 2013 YouTube

Bunching Up Charitable Donations Could Help Tax Savings

Irs Donation Value Guide Fill Online Printable Fillable Blank

Irs Donation Value Guide Fill Online Printable Fillable Blank

Donate Car To Charity YouTube

If I Donate My Car To Charity How Much Tax Deduction Can I Take YouTube

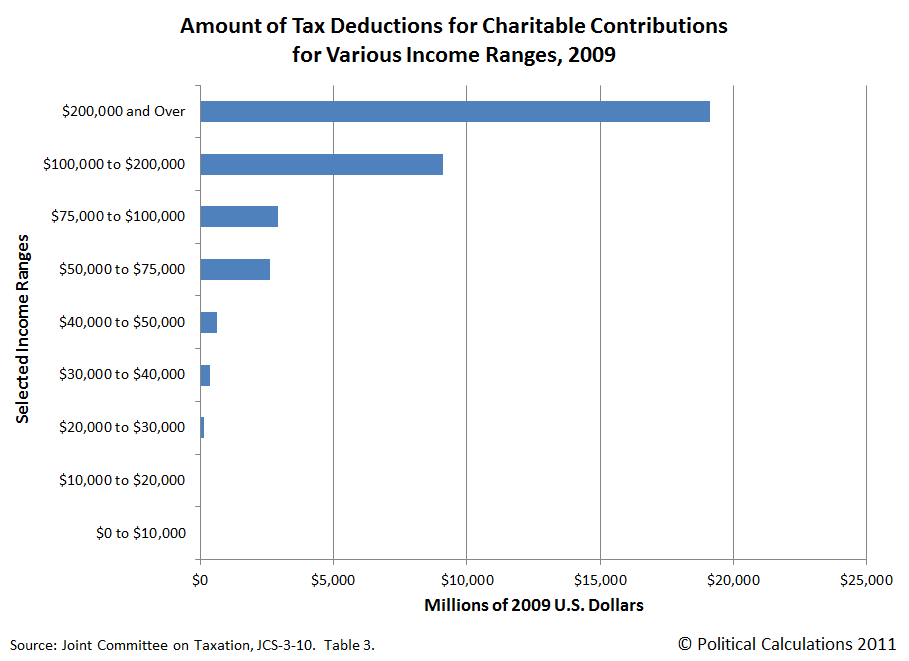

Political Calculations Tax Deductions For Charity By Income Level

Charity Tax Deduction - [desc-12]