Check For Tax Credits A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their tax return Some tax credits such as the Earned Income Tax Credit

You can use credits and deductions to help lower your tax bill or increase your refund Credits can reduce the amount of tax due Deductions can reduce the amount of This service is the easiest and quickest way to report changes that affect your tax credits view a list of your future payments view a list of your 3 previous payments You ll need

Check For Tax Credits

Check For Tax Credits

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

HMRC Issue Tax Credits Claim Reminder Adapt Accountancy

https://752460.smushcdn.com/1591278/wp-content/uploads/2021/07/renew-tax-credits-1084x1446.jpg?lossy=0&strip=1&webp=1

Curious About Tax Breaks For Homeowners No One Knows Them Better Than

https://i.pinimg.com/originals/4c/9c/70/4c9c7048997bbeb1f91747edd3b1b1c5.jpg

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and A tax credit is a benefit that lowers your taxes owed by the amount of the credit Tax credits can be nonrefundable refundable or partially refundable

Prepare accurate tax returns for people who claim certain tax credits such as the Earned Income Tax Credit EITC Helps low to moderate income workers and families get a tax break Child Tax Credit Credit for Other File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit

Download Check For Tax Credits

More picture related to Check For Tax Credits

HMRC Reveals Details Of R D Credits Anti fraud Campaign Tax Tips G T

https://galleyandtindle.co.uk/wp-content/uploads/2022/07/RD-Tax-Credits.jpg

What Is The Difference Between A Tax Credit And Tax Deduction

https://static.twentyoverten.com/5d5413591d304774fba39eb3/WZASn6oAJLl/Tax-Credits-vs-Deductions.jpg

The Value Of Investment Tax Credits For Your Business

https://torontoaccountant.ca/wp-content/uploads/2014/11/Tax-credits.jpg

Check if you can get Working Tax Credits This advice applies to England See advice for Northern Ireland Scotland Wales Universal Credit has replaced tax credits for most A tax credit is an amount of money that you can subtract dollar for dollar from the income taxes you owe Find out if tax credits can save you money

The child tax credit is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit can reduce your tax bill on a dollar HMRC routinely check tax credit awards to make sure they are correct This page explains the process

Tax Credits Are Hidden Benefit For Homeowners

https://www.tennessean.com/gcdn/-mm-/c35235dca3494476ea713db1a4eea54b43cda490/c=0-1242-4148-3585/local/-/media/2016/02/08/Nashville/Nashville/635905382793361586-DeniseCreswell.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

The Complete List Of Tax Credits MAJORITY

https://www.datocms-assets.com/20859/1587974477-screen-shot-2020-04-27-at-10-00-47.png?fit=crop&auto=format%2Ccompress&lossless=true&fm=png&w=900

https://www.irs.gov/newsroom/tax-credits-and...

A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their tax return Some tax credits such as the Earned Income Tax Credit

https://www.irs.gov/credits-and-deductions

You can use credits and deductions to help lower your tax bill or increase your refund Credits can reduce the amount of tax due Deductions can reduce the amount of

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

Tax Credits Are Hidden Benefit For Homeowners

How To Use 2020 Income Tax Refund Check From IRS To Spend And Save

3 Reasons You Shouldn t Receive A Tax Refund Next Year GOBankingRates

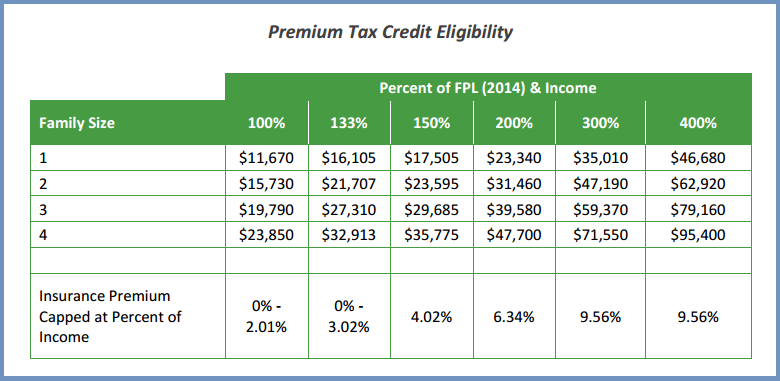

FAQs Health Insurance Premium Tax Credits

Student Tax Credits And Deductions Loans Canada

Student Tax Credits And Deductions Loans Canada

UPDATE IRS Issues Guidance On Tax Credits Under FFCRA

Tax Reduction Company Inc

R D Tax Credits Pixelmate

Check For Tax Credits - A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and