Chevy Volt Tax Rebate Form Web 19 ao 251 t 2022 nbsp 0183 32 The U S Department of Energy s website currently lists 21 vehicles that are eligible for the full 7 500 tax credit with models like the Chevy Bolt EV Bolt EUV

Web The maximum credit is 7 500 It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find Web 1 avr 2020 nbsp 0183 32 Typically the federal incentive for the electric vehicle tax credit is a flat 7500 credit however this amount comes with a stipulation the tax credit is only worth 7500

Chevy Volt Tax Rebate Form

Chevy Volt Tax Rebate Form

https://i0.wp.com/struggleville.net/wp-content/uploads/2018/08/MenardsRebate4468.jpg?w=1400&ssl=1

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

https://www.buyvia.com/i/2016/02/mobil-1-rebate-form.png

P G And E Ev Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PG-Rebate-Form-2021.jpg

Web 15 avr 2023 nbsp 0183 32 A 7 500 tax credit for purchasers of new electric vehicles is changing again after the U S unveiled new guidelines that will impact the list of car models that qualify Scott Olson Getty Images Web 1 nov 2022 nbsp 0183 32 GM plans to launch 30 new EVs by 2030 and within two years from now anticipates having at least six under the MSRP threshold depending on their

Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Web Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to

Download Chevy Volt Tax Rebate Form

More picture related to Chevy Volt Tax Rebate Form

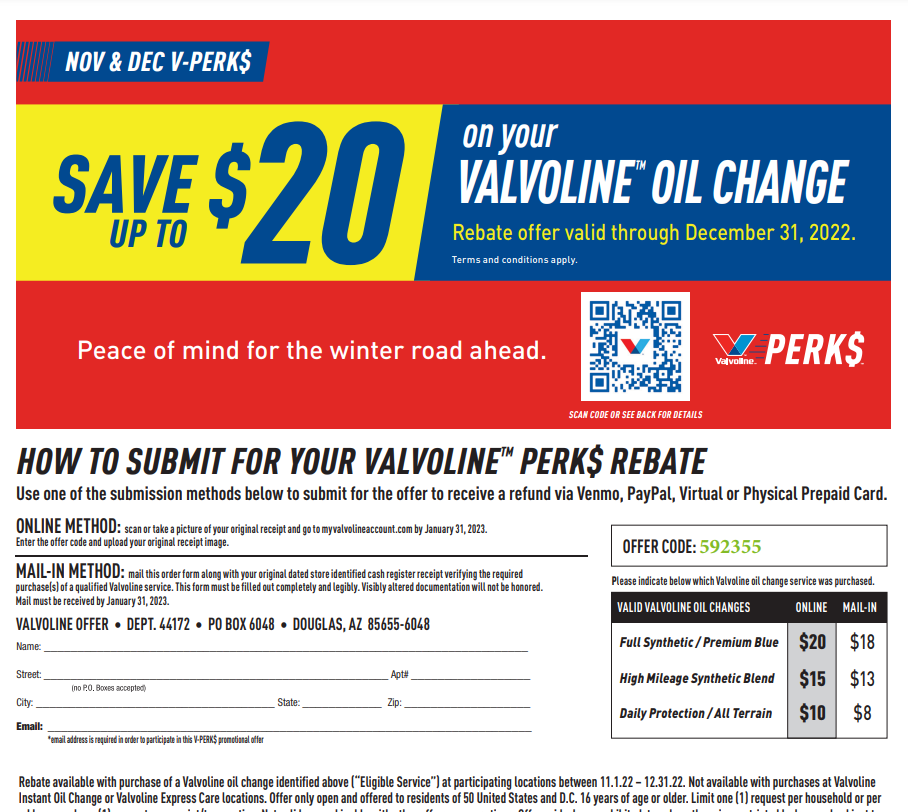

Valvoline Rebate Forms Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/01/Valvoline-Rebate-Form-2023.png

Top Mass Save Rebate Form Templates Free To Download In PDF Format

https://i0.wp.com/www.masssaverebate.net/wp-content/uploads/2022/10/top-mass-save-rebate-form-templates-free-to-download-in-pdf-format-101.png?fit=530%2C749&ssl=1

Kingston Progressive ELECTRIC CAR REBATE

http://4.bp.blogspot.com/-Ep6EPcH-zQg/T0FrFNxtuVI/AAAAAAAAFdQ/ULIsViapXnA/s1600/chevy-volt-electric-car_3.jpg

Web 21 juin 2011 nbsp 0183 32 If you purchased an eligible EV in 2022 the tax credit can be claimed on IRS Form 8936 when you do your taxes in 2023 Your tax person should know how to fill it out and if you re using Web 1 janv 2023 nbsp 0183 32 Federal Tax Credit Up To 4 000 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a

Web 4 janv 2023 nbsp 0183 32 Buyers of the Chevrolet Bolt EV and EUV are once again eligible for the full 7 500 EV tax credit amount starting this month but prices just rose 900 Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

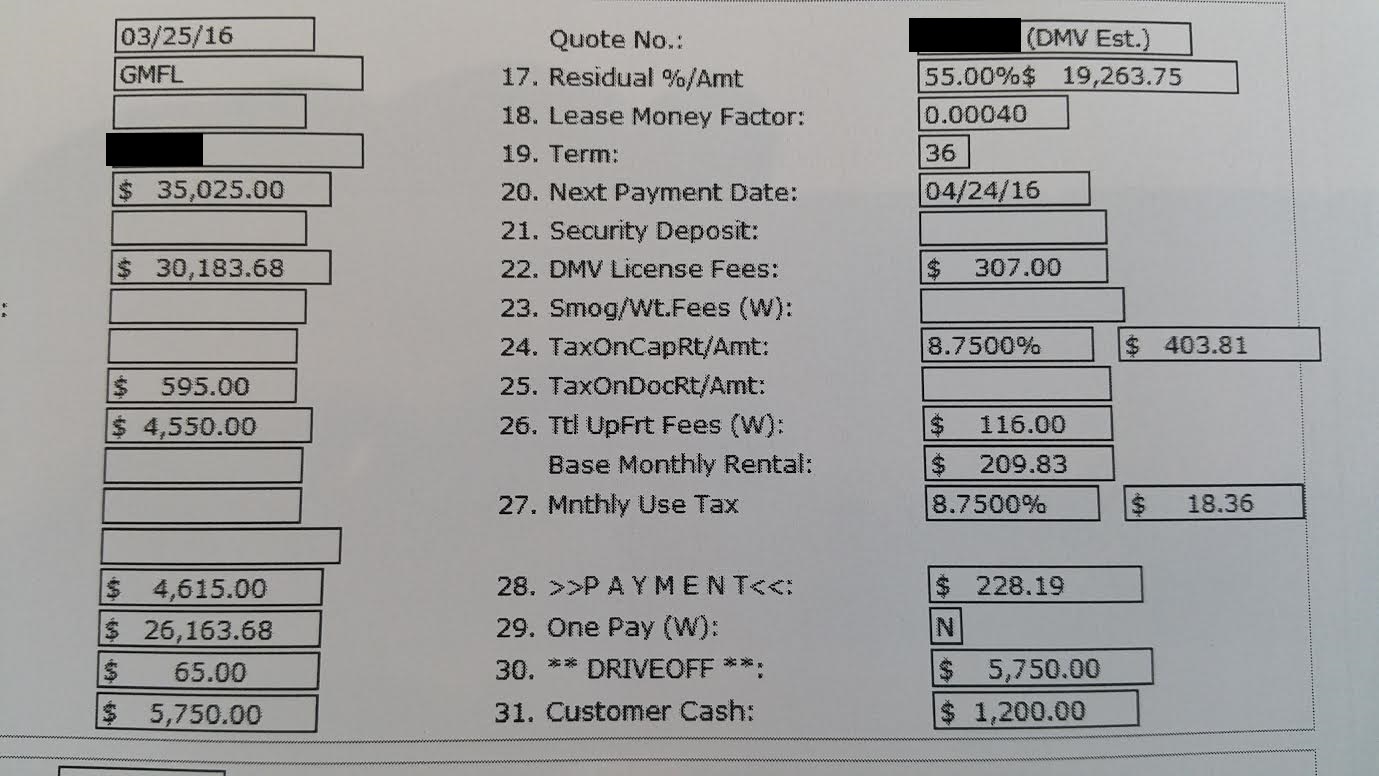

2016 2017 Volt Getting Dealership To Rebate Federal Tax Credit Ask

https://forum.leasehackr.com/uploads/default/original/1X/bcdf05c1da05f16b80c4235015af077d9a1cb171.jpg

https://gmauthority.com/blog/2022/08/gm-vehicles-would-be-eligible-for...

Web 19 ao 251 t 2022 nbsp 0183 32 The U S Department of Energy s website currently lists 21 vehicles that are eligible for the full 7 500 tax credit with models like the Chevy Bolt EV Bolt EUV

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web The maximum credit is 7 500 It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find

2023 Tax Credit Form Did You Get One When You Purchased Your Bolt

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

PA Property Tax Rebate Forms Printable Rebate Form

Carbon Tax Rebate 2022 Printable Rebate Form

Ouc Energy Rebates Fill Online Printable Fillable Blank PdfFiller

Tax Application Fill Online Printable Fillable Blank PdfFiller

Tax Application Fill Online Printable Fillable Blank PdfFiller

Printable Old Style Rebate Form Printable Forms Free Online

Pin On Tigri

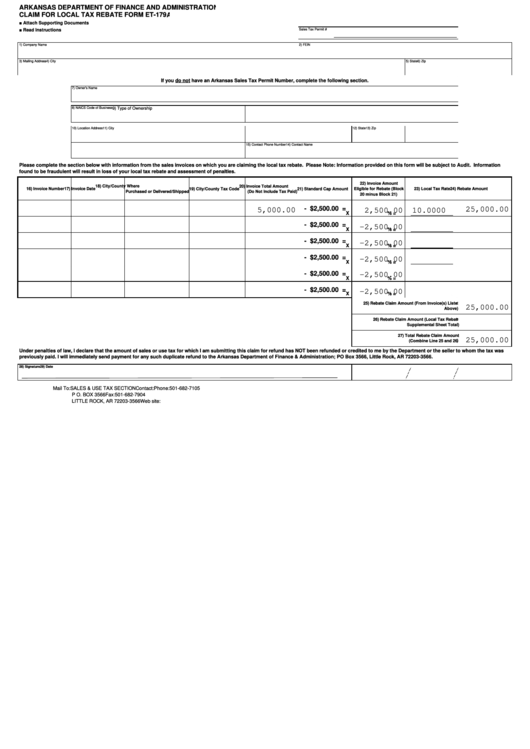

Fillable Form Et 179a Claim For Local Tax Rebate Printable Pdf Download

Chevy Volt Tax Rebate Form - Web 15 avr 2023 nbsp 0183 32 A 7 500 tax credit for purchasers of new electric vehicles is changing again after the U S unveiled new guidelines that will impact the list of car models that qualify Scott Olson Getty Images