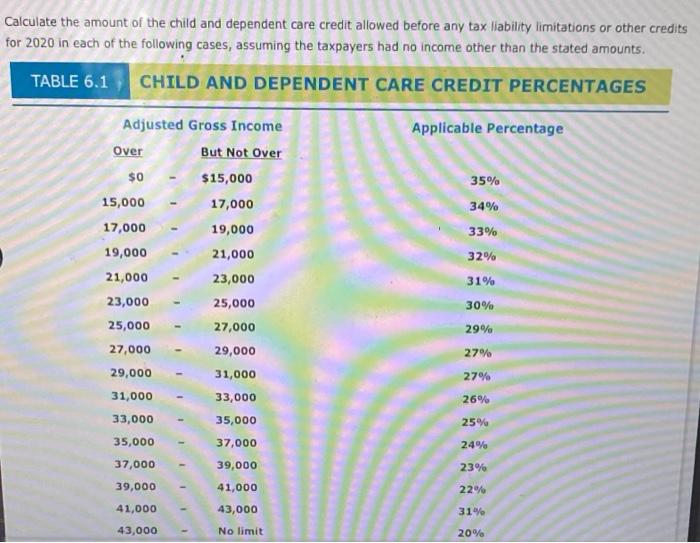

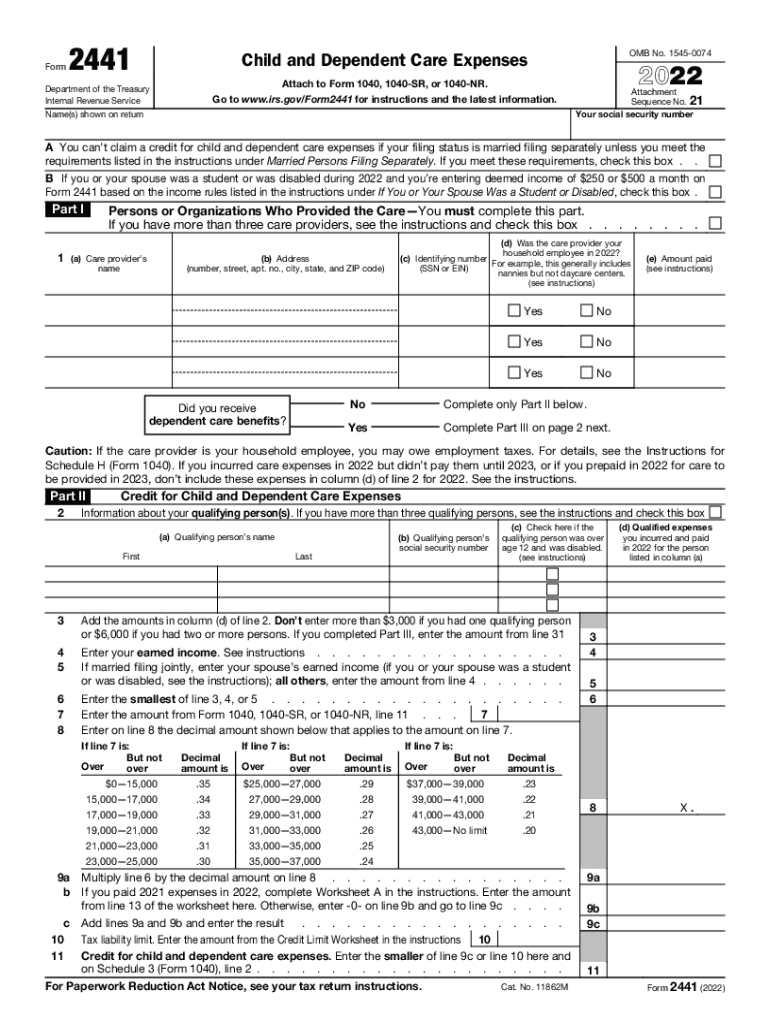

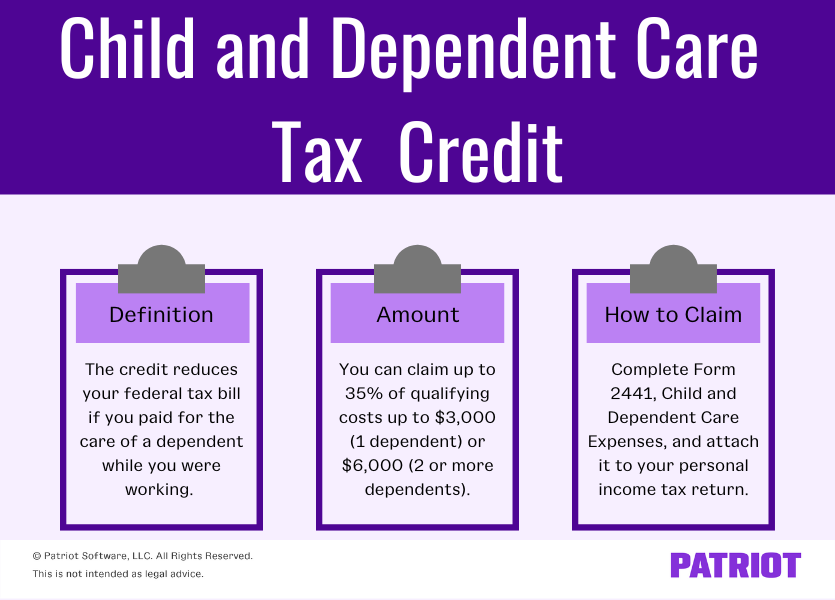

Child And Dependent Care Credit Refundable Or Nonrefundable 2022 Verkko For 2022 the credit for child and dependent care expenses is nonrefundable and you may claim the credit on qualifying employment related expenses of up to 3 000 if you had one qualifying person or

Verkko IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child Verkko 21 huhtik 2022 nbsp 0183 32 Under the nonrefundable CDCC the maximum benefit for households with two or more qualifying dependents is about 1 500 per year and households with

Child And Dependent Care Credit Refundable Or Nonrefundable 2022

Child And Dependent Care Credit Refundable Or Nonrefundable 2022

https://www.karladennis.com/wp-content/uploads/2022/10/KDA-blog-cdc-scaled.jpg

Child And Dependent Care Credit 2022 2022 JWG

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

Child And Dependent Care Credit How To Claim And More Tips GoodRx

https://images.ctfassets.net/4f3rgqwzdznj/3Yd0zLkbKdF8R1h2j9mNhb/26f117a9be5e89b2fcc10da0e1aa6581/smiling_preschool_teacher_and_toddler-1295820320.jpg

Verkko For 2022 the credit for child and dependent care expenses is nonrefundable and you may claim the credit on qualifying employment related expenses of up to 3 000 if you Verkko The federal Child and Dependent Care Credit CDCC subsidizes child care costs for working families Before 2021 the CDCC was nonrefundable so only families with

Verkko For 2021 the Child and Dependent Care Credit is fully refundable so not only would you reduce your tax to 0 you would be eligible for a 300 refund Refundable tax Verkko 28 maalisk 2023 nbsp 0183 32 The 2021 enhancements to the credit for child and dependent care expenses have expired For tax year 2022 the credit for child and dependent care

Download Child And Dependent Care Credit Refundable Or Nonrefundable 2022

More picture related to Child And Dependent Care Credit Refundable Or Nonrefundable 2022

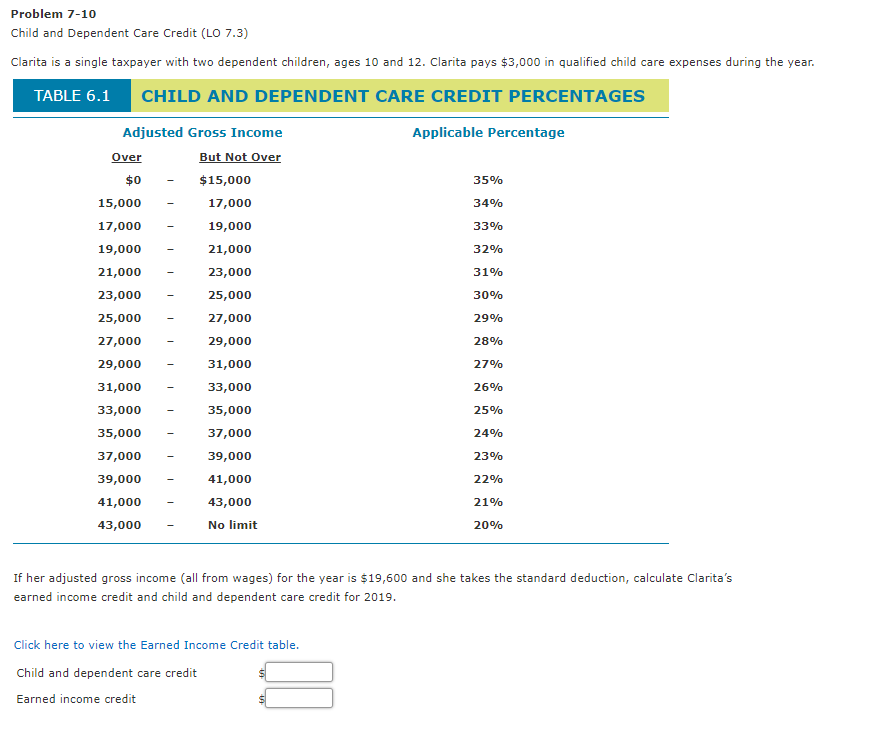

Solved Calculate The Amount Of The Child And Dependent Care Chegg

https://media.cheggcdn.com/study/c1e/c1e6c6b2-2420-432b-bc09-0a6b45cd2a4c/image

What Is The Child And Dependent Care Credit 2020 2021 Children

https://i.pinimg.com/originals/b1/9e/75/b19e756bb18d95670b5d74f26463ff6c.jpg

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

https://mfiworks.com/wp-content/uploads/2021/05/the-child-tax-credit-and-the-dependent-care-credit.jpg

Verkko 18 lokak 2023 nbsp 0183 32 Topic No 602 Child and Dependent Care Credit You may be able to claim the child and dependent care credit if you paid expenses for the care of a Verkko A nonrefundable credit is a dollar for dollar reduction of the tax liability A nonrefundable credit can only reduce the tax liability to zero The credit discussed in

Verkko 8 huhtik 2022 nbsp 0183 32 The previous year s tax return filed in 2022 will include the Child and Dependent Care Credit which covers half or 50 of qualified childcare expenses Verkko 9 marrask 2023 nbsp 0183 32 It depends on your situation The CDCC is nonrefundable so it can make a difference if you anticipate a tax bill However if you foresee a refund the

CHILD DEPENDENT CARE CREDIT FAQS National Tax Office

https://www.nationaltaxoffice.com/wp-content/uploads/2021/09/Child-and-dependent-kids-stading-with-bookbag.png

Child And Dependent Care Credit 2022 2024 Form Fill Out And Sign

https://www.signnow.com/preview/624/654/624654191/large.png

https://www.irs.gov/publications/p503

Verkko For 2022 the credit for child and dependent care expenses is nonrefundable and you may claim the credit on qualifying employment related expenses of up to 3 000 if you had one qualifying person or

https://www.irs.gov/.../understanding-the-child-and-dependent-care-credit

Verkko IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child

Child And Dependent Care Credit LO 7 3 Calculate Chegg

CHILD DEPENDENT CARE CREDIT FAQS National Tax Office

Easy Steps Claim Child And Dependent Care Credit Hanfincal

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

Child And Dependent Care Credit Reduce Your Tax Liability

New Refundable Child Care Tax Credit REFUNDABLE TAX CREDIT

New Refundable Child Care Tax Credit REFUNDABLE TAX CREDIT

2022 Education Tax Credits Are You Eligible

Reminder Child Dependent Care Credit Has Increased For 2021 Only

Solved Problem 7 10 Child And Dependent Care Credit LO 7 3 Chegg

Child And Dependent Care Credit Refundable Or Nonrefundable 2022 - Verkko 24 tammik 2022 nbsp 0183 32 Taxpayers with dependents who don t qualify for the child tax credit may be able to claim the credit for other dependents This is a non refundable