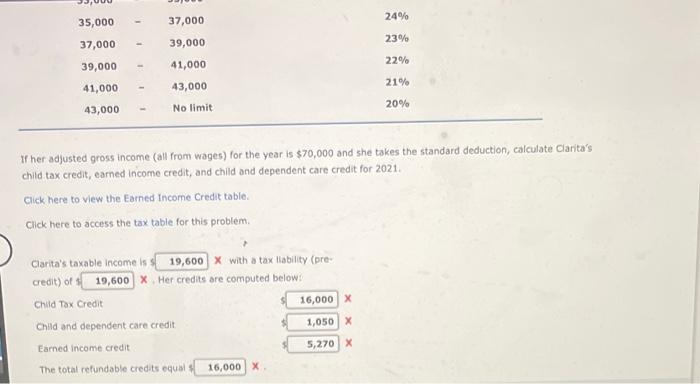

Child Care Deduction Income Limit For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more Depending on their income taxpayers could

You are eligible to claim this credit if you or your spouse in the case of a joint return pay someone to care for one or more qualifying persons in order for you to The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents

Child Care Deduction Income Limit

Child Care Deduction Income Limit

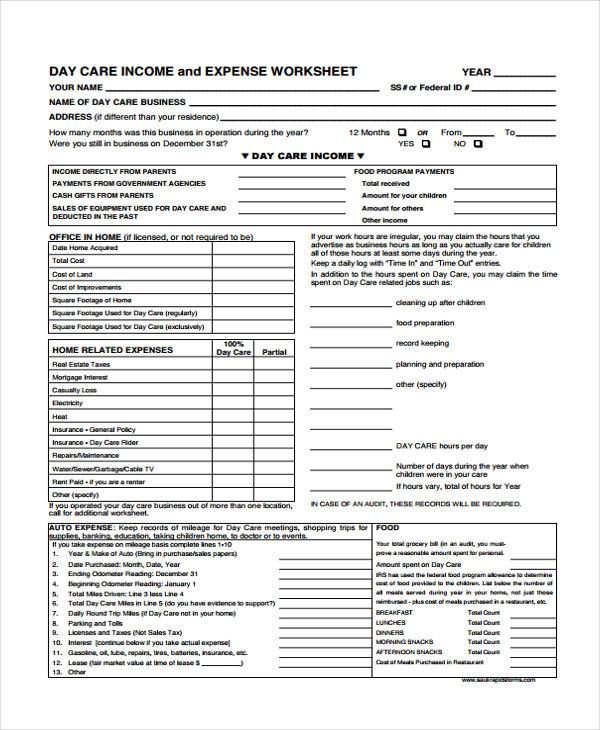

https://www.latestrebate.com/wp-content/uploads/2023/02/5-best-photos-of-child-care-provider-tax-form-daycare-provider-tax-db-1243x2048.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

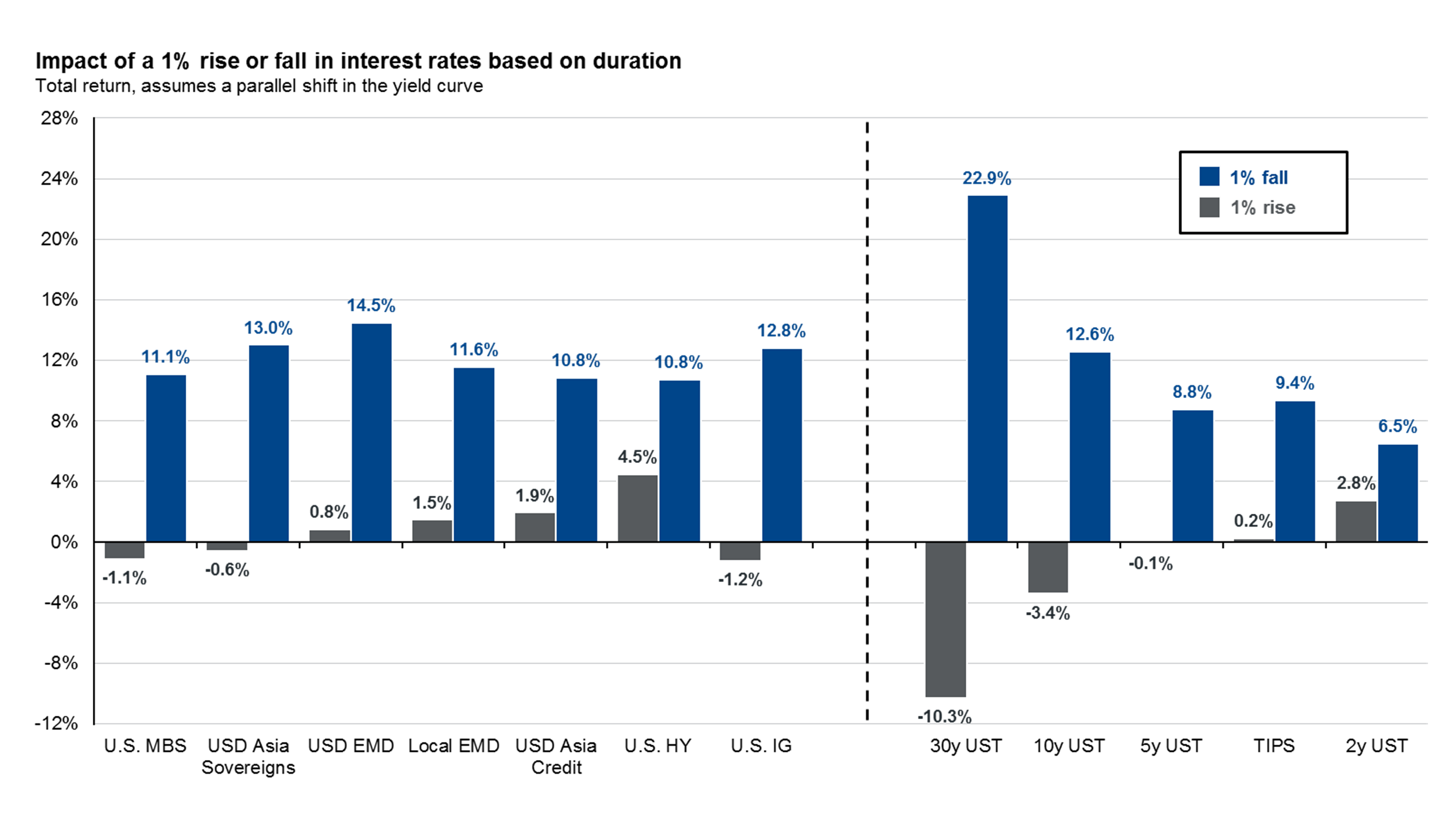

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

https://www.hdfcsales.com/blog/wp-content/uploads/2021/06/tax-deduction-on-fixed-deposit.jpg

So the maximum credit for 2020 was 1 050 for one qualifying person 35 of 3 000 and 2 100 for two or more people 35 of 6 000 How To Claim the Child For tax years 2022 and 2023 there is a limit of 3 000 for one qualifying person or 6 000 for two or more qualifying persons The credit is not refundable Your credit amount is

If you paid for babysitting day care or even a summer camp you might be eligible to receive up to 8 000 in credits during this year s tax season depending on Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in

Download Child Care Deduction Income Limit

More picture related to Child Care Deduction Income Limit

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Standard Deduction 2020 Self Employed Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/standard-deduction-budget-announcements-budget-2018-gives.jpg

Solved Problem 7 11 Child And Dependent Care Credit LO 7 2 Chegg

https://media.cheggcdn.com/study/a9b/a9b1294d-bb58-4b88-bcec-5d7c9459a85e/image

If you have 1 dependent with qualifying care costs of 3 000 and your AGI is over 43 000 your tax credit would be worth 600 because that s 20 the percentage For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the

Key Takeaways IRS Form 2441 is completed by the taxpayer to report child and dependent care expenses paid for the year This form must be filed if you re Part of Tax Free Childcare You can get up to 500 every 3 months up to 2 000 a year for each of your children to help with the costs of childcare This goes up to

Printable Kentucky General Bill Of Sale Archives Template DIY

https://i0.wp.com/templatediy.com/wp-content/uploads/2022/08/Child-Care-Receipt-Word.jpg?fit=1414%2C2000&ssl=1

Child Care Experience Deduction Care Tax Credit Carbon Tax Credit

https://thumbs.dreamstime.com/z/child-care-experience-deduction-tax-credit-carbon-concept-tiny-people-income-subsidies-abstract-vector-illustration-set-220123146.jpg

https://www.irs.gov/newsroom/understanding-the...

For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more Depending on their income taxpayers could

https://www.irs.gov/newsroom/child-and-dependent-care-credit-faqs

You are eligible to claim this credit if you or your spouse in the case of a joint return pay someone to care for one or more qualifying persons in order for you to

Income Tax Deductions For The FY 2019 20 ComparePolicy

Printable Kentucky General Bill Of Sale Archives Template DIY

Global Fixed Income Yields And Risks

Real Estate Agent Tax Deductions Worksheet 2022

Aca Percentage Of Income 2022 INCOMUNTA

What To Do If Your Employer Won t Pay You Legally Care HomePay

What To Do If Your Employer Won t Pay You Legally Care HomePay

Residential Aged Care Fee Income Assessment Form Printable Printable

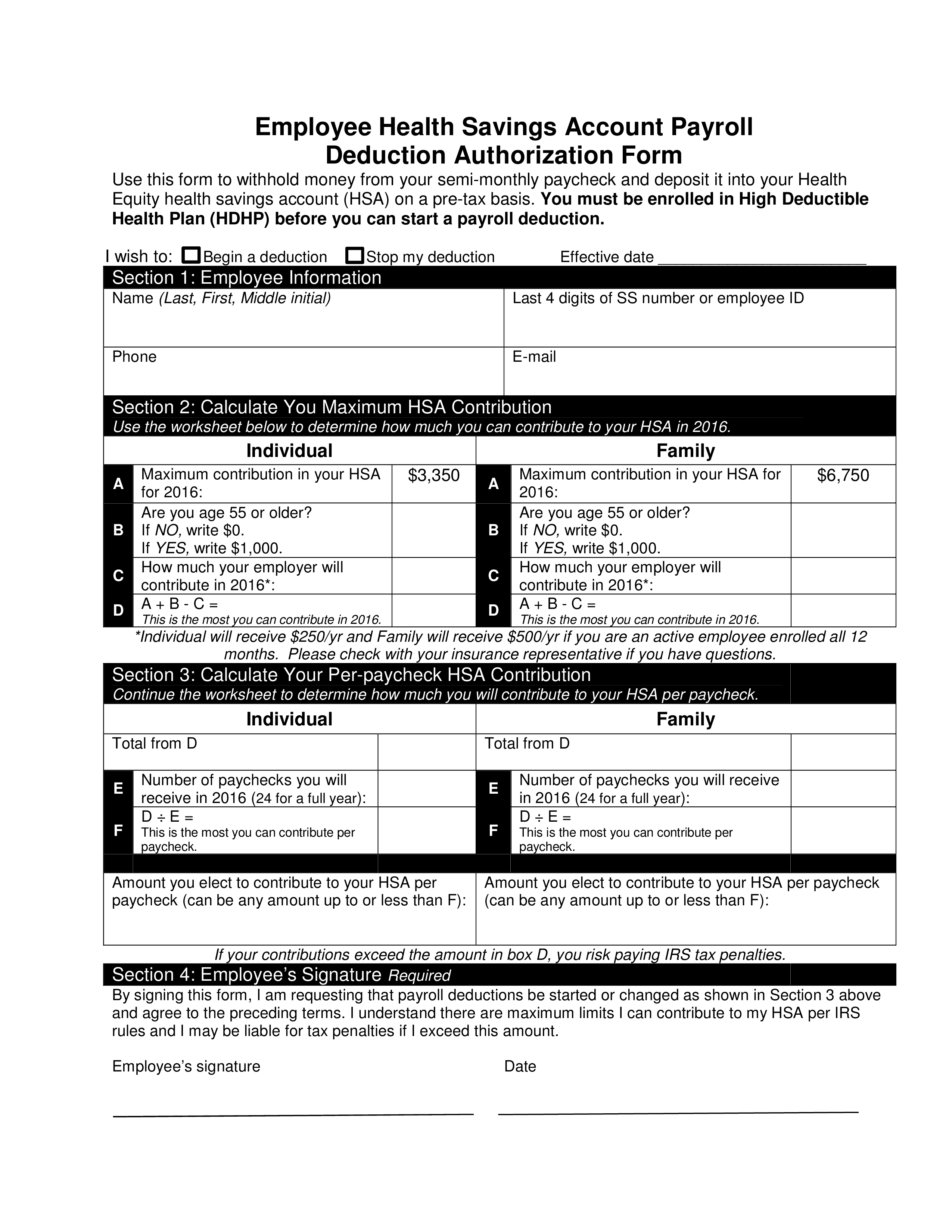

Employee Health Payroll Deduction Form Templates At

Money Saving And Passive Income Concept Free Stock Photo Public

Child Care Deduction Income Limit - To be eligible for the child care tax credit you must meet certain income requirements The credit is designed to help lower income families so the income limit