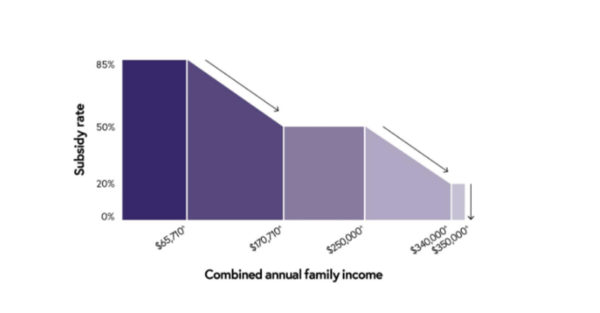

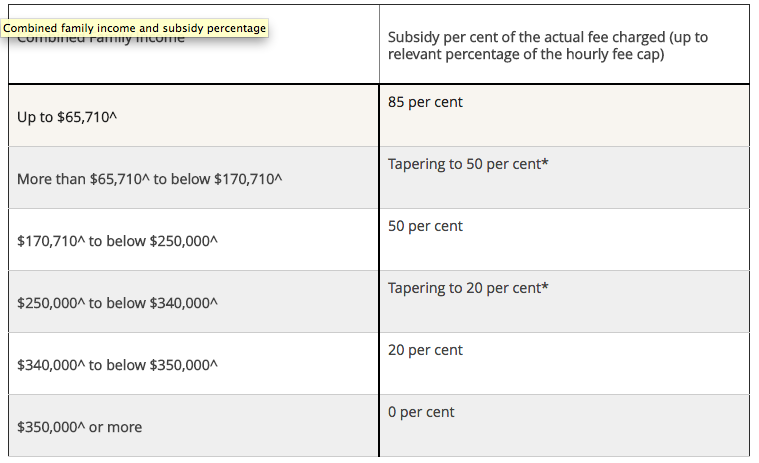

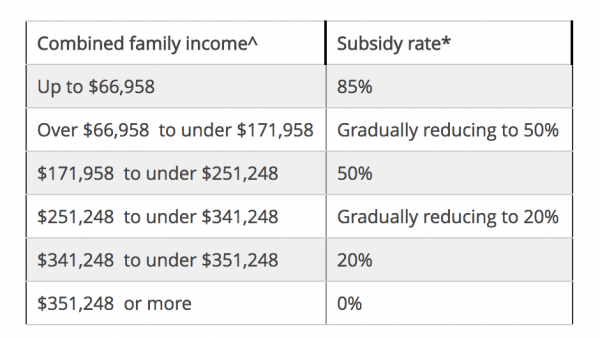

Child Care Rebate Amount Web 30 juin 2021 nbsp 0183 32 Families earning more than 190 015 and under 354 305 will have a subsidy cap of 10 655 per year per child Families earning under 190 015 will not have their

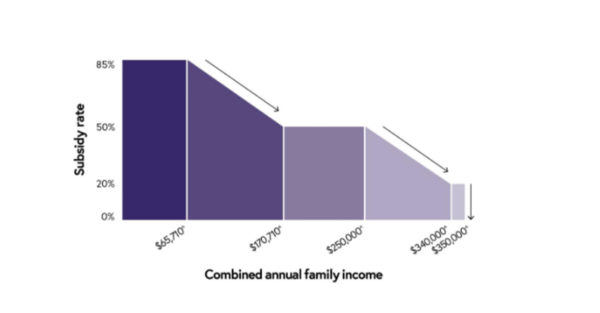

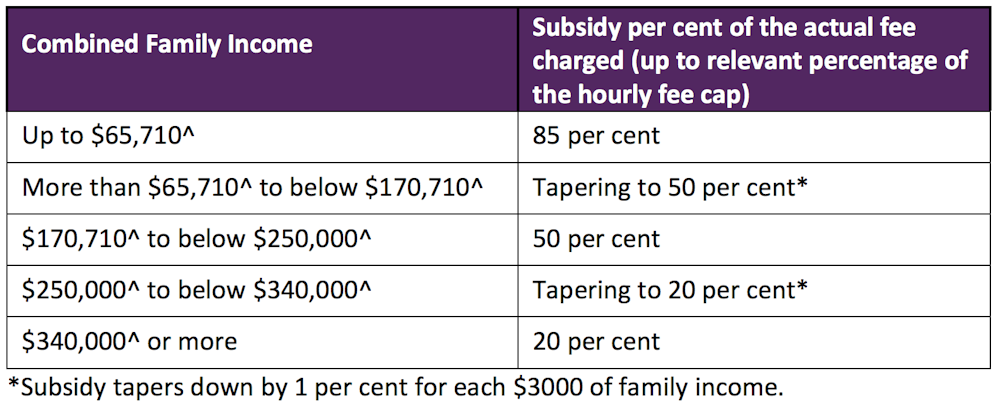

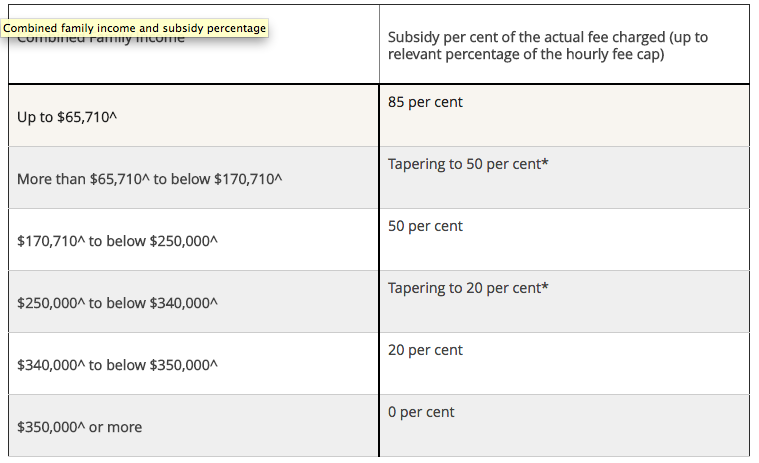

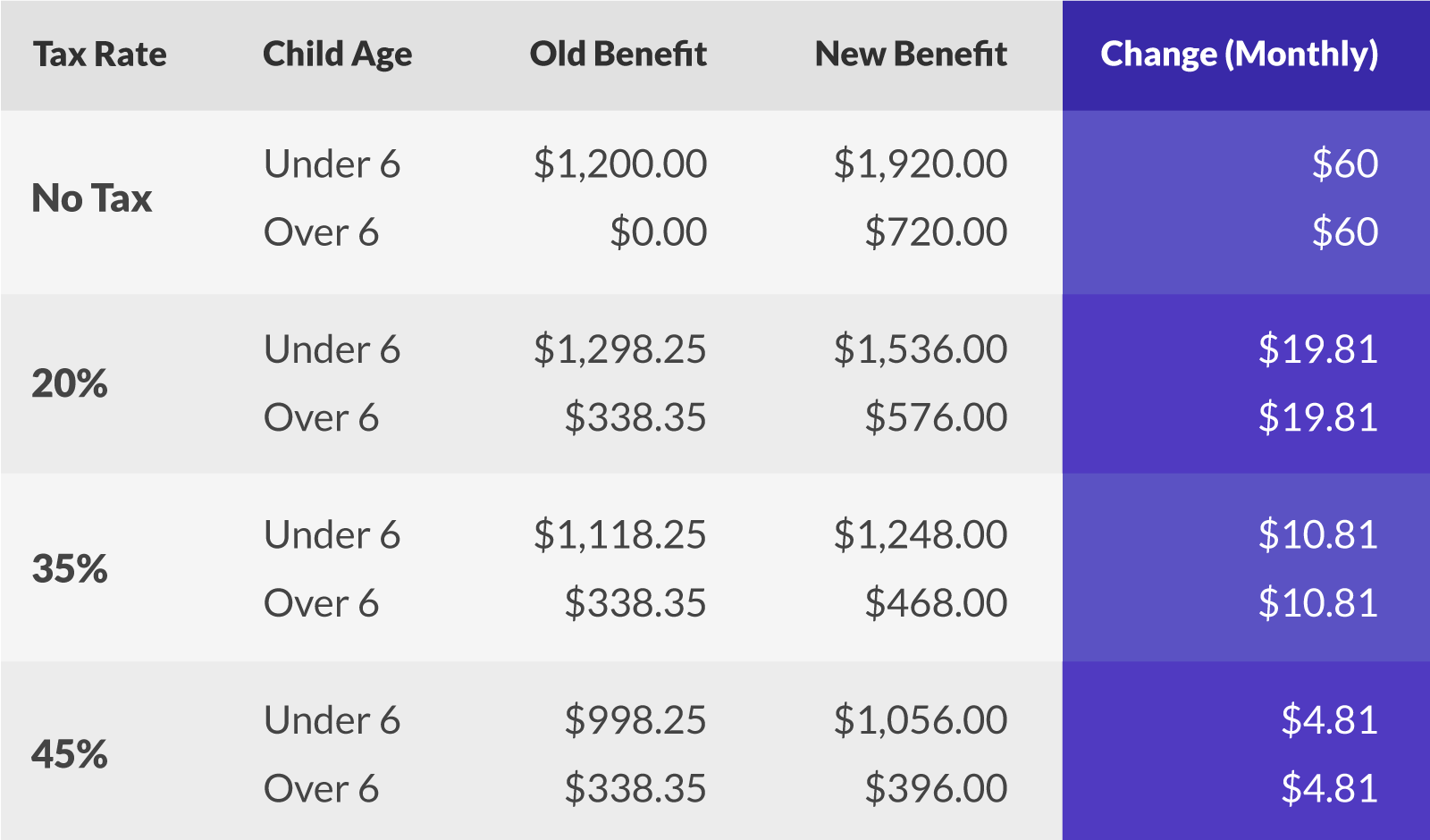

Web From 10 July 2023 Child Care Subsidy increased which means most families using child care now get more subsidy The maximum amount of CCS increased from 85 to 90 Web If you are using approved child care for the purposes of Child Care Benefit CCB for work training or study related reasons the Government will provide you with 50 per cent of

Child Care Rebate Amount

Child Care Rebate Amount

https://www.carrebate.net/wp-content/uploads/2022/08/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

Five Things You Need To Know About The New Child Care Subsidy

https://cdn.babyology.com.au/wp-content/uploads/2017/11/childcarerebate-600x313.jpg

Child Care Rebate Changes 2017 What It Means For You

https://cdn.newsapi.com.au/image/v1/73041173e883cd0c59dd34bafe03170f

Web 3 juin 2009 nbsp 0183 32 The Child Care Tax Rebate CCTR will provide 4 4 billion over four years to assist working families with their out of pocket child care costs The Child Care Benefit Web you get or will be eligible for CCS your family s combined income is under 354 305 you have more than one child aged five or younger in childcare Alongside the standard

Web 10 juil 2023 nbsp 0183 32 Assistance to help you with the cost of child care To get Child Care Subsidy CCS you must care for a child 13 or younger who s not attending secondary school Web 10 juil 2023 nbsp 0183 32 Families earning up to 80 000 can get an increased maximum CCS amount from 85 to 90 If you earn over 80 000 you may get a subsidy starting from 90

Download Child Care Rebate Amount

More picture related to Child Care Rebate Amount

Child Care Rebate Changes 2017 What It Means For You

https://cdn.newsapi.com.au/image/v1/30e248ff2877200e614bc2ca3adf011b

PolicyCheck The Government s New Child Care Plan

https://images.theconversation.com/files/162589/original/image-20170327-3308-9oycmo.png?ixlib=rb-1.1.0&q=45&auto=format&w=1000&fit=clip

Child Care And Early Childhood Learning Future Options PC News And

https://www.pc.gov.au/news-media/pc-news/previous-editions/pc-news-august-2014/child-care-and-early-childhood-learning-future-options?a=139880

Web If a family earns more than 189 390 per year and less than 353 680 then the total amount of CCS they can receive in 2020 21 is 10 560 per child the annual cap Families earning less than 189 390 per year do Web You can claim this subsidy using your Centrelink online account through myGov We ll prefill any information you ve already given us into your Child Care Subsidy claim If you need to stop your claim you can save your

Web 10 juil 2023 nbsp 0183 32 This Child Care Subsidy Calculator CCS Calculator is developed for Australian parents to estimate their possible Child Care Subsidy payment amount from Web The overpayment is 2 750 for FTB and Child Care Subsidy We ll use the 1 300 we withheld to reduce the amount of Child Care Subsidy owed They ll still have to pay

New Childcare Rebates And What They Mean For You Ellaslist Ellaslist

https://www.ellaslist.com.au/ckeditor_assets/pictures/1682/content_family_income_subsidy_childcare.png

Family Tax Child Care Rebate 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/facsia-annual-report-2005-2006.gif

https://www.education.gov.au/early-childhood/announcements/child-care...

Web 30 juin 2021 nbsp 0183 32 Families earning more than 190 015 and under 354 305 will have a subsidy cap of 10 655 per year per child Families earning under 190 015 will not have their

https://www.servicesaustralia.gov.au/your-income-can-affect-child-care...

Web From 10 July 2023 Child Care Subsidy increased which means most families using child care now get more subsidy The maximum amount of CCS increased from 85 to 90

2022 Forms For Family And Children Fillable Printable PDF Forms

New Childcare Rebates And What They Mean For You Ellaslist Ellaslist

How To Keep Receiving Childcare Rebates Under The Government s New System

Child Care Rebate Application Form Free Download

The New Child Care Subsidy Is Means tested And So It Bloody Should Be

Child Care Expenses Tax Credit Colorado Free Download

Child Care Expenses Tax Credit Colorado Free Download

Ask Your Centrelink Family Assistance Questions Wearing Your Pyjamas

Child Care Rebate Form 3 Free Templates In PDF Word Excel Download

Child Care Expenses Tax Credit Colorado Free Download

Child Care Rebate Amount - Web 5 juin 2016 nbsp 0183 32 Messenger Labor has pitched a A 3 billion childcare policy to families promising to lift the annual cap on the childcare rebate from 7500 to 10 000 The