Child Care Rebate And Tax Return Web 13 janv 2022 nbsp 0183 32 For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from

Web Tax credits work out your childcare costs You can calculate your childcare costs to report to HM Revenue and Customs HMRC If you already claim tax credits and your childcare Web 13 f 233 vr 2022 nbsp 0183 32 What does that mean In brief for the 2021 tax year you could get up to 4 000 back for one child and 8 000 back for care of two or more In prior years the

Child Care Rebate And Tax Return

Child Care Rebate And Tax Return

http://www.formsbirds.com/formimg/child-care-rebate-form/3306/child-care-expenses-tax-credit-colorado-l2.png

Child Care Rebate Income Tax Return 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/your-us-expat-tax-return-and-the-child-care-credit-when-abroad.png

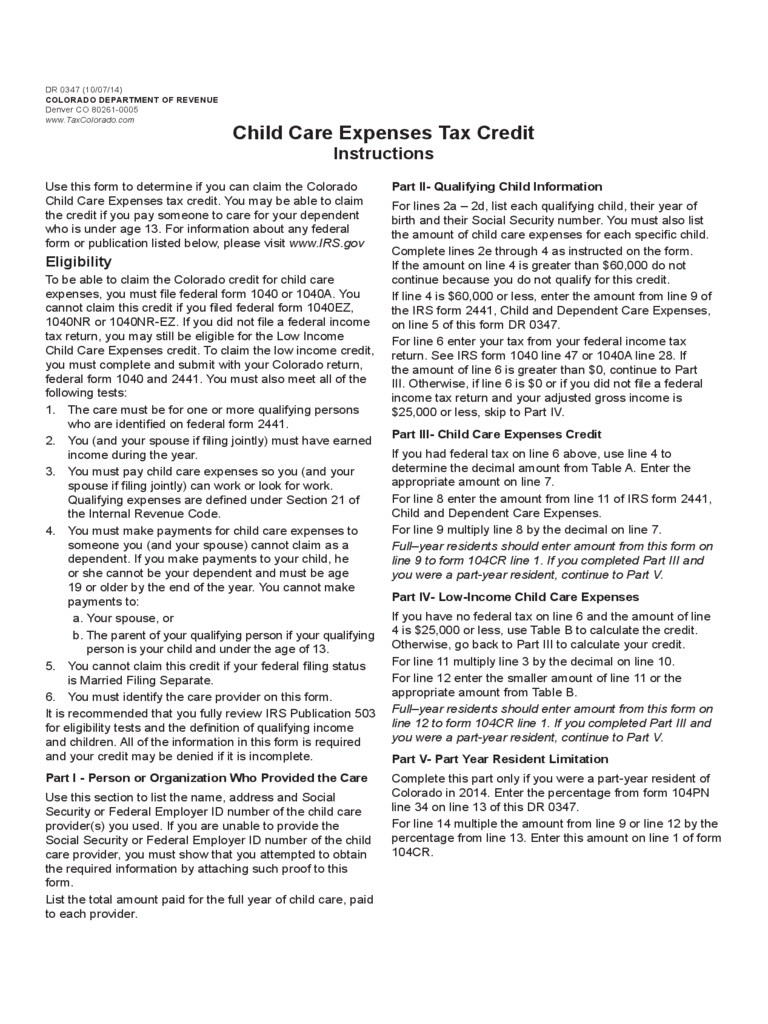

Child Care Expenses Tax Credit Colorado Free Download

http://www.formsbirds.com/formimg/child-care-rebate-form/3306/child-care-expenses-tax-credit-colorado-l3.png

Web 2 mars 2022 nbsp 0183 32 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit Web If you got Family Tax Benefit or Child Care Subsidy and you or your partner are not required to lodge a tax return you need to tell us When we balance your Child Care

Web 29 mai 2023 nbsp 0183 32 Important The enhanced Child Tax Credit 2021 rates of 3 000 to 3 600 per qualified child depending on the age of the child ren do not apply to 2022 Returns Web 5 d 233 c 2022 nbsp 0183 32 So a 1 000 tax credit will shave 1 000 off your tax bill regardless of your tax bracket When calculating the credit you can receive on your day care expenses the

Download Child Care Rebate And Tax Return

More picture related to Child Care Rebate And Tax Return

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-tax-credit-payment-dates-2022-drift-hestia-bloger.jpg

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-care-expenses-tax-credit-colorado-d1.png

New Child Care Rebate Calculator 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/if-only-singaporeans-stopped-to-think-higher-subsidies-for-child.jpg

Web 11 f 233 vr 2022 nbsp 0183 32 In other words families with two kids who spent at least 16 000 on day care in 2021 can get 8 000 back from the IRS through the expanded tax credit Prior to the Web 28 janv 2022 nbsp 0183 32 Child and Dependent Care Credit For parents that incur expenses to have their child looked after so that they can go to work look for work or study may be able

Web 24 f 233 vr 2022 nbsp 0183 32 For your 2021 tax return the cap on the expenses eligible for the credit is 8 000 for one child up from 3 000 or 16 000 up from 6 000 for two or more Web child care expenses less the child care benefit CCB to which you are entitled How does the 30 child care tax rebate work with CCB You can claim both the rebate and

Childcare Tax Rebate Google Docs

https://lh3.googleusercontent.com/docs/AOD9vFr_UKhK8qduqUufb1KgrPjWuQgA9bQz6e_fB4Id6GSAU9bertsDMt_QDKuWXxNyOwyWifG2KNWPFPPizPhVuqSffuQxD5RfFL3awCjHxPMH=w1200-h630-p

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

https://www.cnbc.com/2022/01/13/how-to-take-advantage-of-the-expanded...

Web 13 janv 2022 nbsp 0183 32 For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from

https://www.gov.uk/childcare-costs-for-tax-credits

Web Tax credits work out your childcare costs You can calculate your childcare costs to report to HM Revenue and Customs HMRC If you already claim tax credits and your childcare

Child Care Rebate

Childcare Tax Rebate Google Docs

Family Tax Child Care Rebate 2023 Carrebate

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Pin On Tax Tips Forms

Daycare Business Income And Expense Sheet To File Your Daycare Business

Daycare Business Income And Expense Sheet To File Your Daycare Business

Child Care Receipt For Tax Purposes

15 Tax Receipt Templates DOC PDF Excel

Promise The Children 2016 Child Care For All Promise The Children

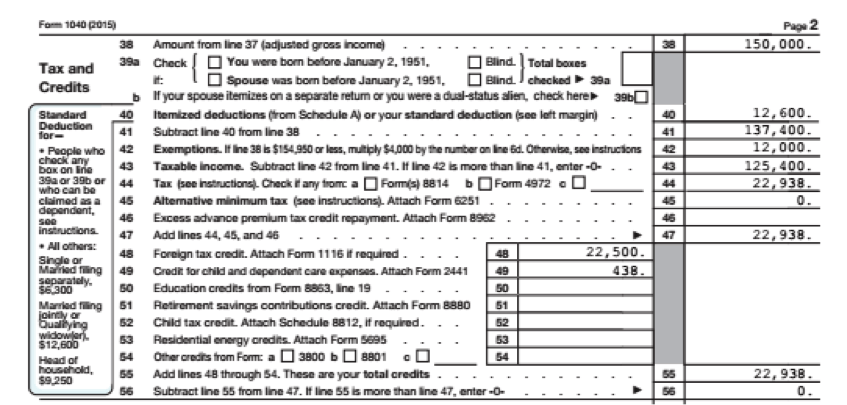

Child Care Rebate And Tax Return - Web 13 juin 2023 nbsp 0183 32 How do I claim the child care tax credit on my 2023 taxes and what can I expect to save You will need to file IRS Form 2441 with your personal federal income