Child Care Rebate Calculator 2024 People with kids under the age of 17 may be eligible to claim a tax credit of up to 2 000 per qualifying dependent For taxes filed in 2024 1 600 of the credit is potentially refundable We ll

For the 2024 tax year returns you ll file in 2025 the refundable portion of the credit increases to 1 700 That means eligible taxpayers could receive an additional 100 per qualifying The maximum tax credit available per child is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to 1 600 per child For tax year 2021 the expanded child

Child Care Rebate Calculator 2024

Child Care Rebate Calculator 2024

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/if-only-singaporeans-stopped-to-think-higher-subsidies-for-child.jpg

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-tax-credit-payment-dates-2022-drift-hestia-bloger-1.jpg

Child Care Rebate Tax Brackets 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

The refundable portion of the child tax credit would increase to 1 800 for tax year 2023 1 900 for 2024 and 2 000 for 2025 and a new calculation would expand access The current The new deal would change the way child tax credit is calculated by allowing families to multiply the benefits per child For instance a family that makes 13 000 a year with two children would

Currently 1 600 of the 2 000 credit per child is refundable The credit s phaseout threshold is 400 000 for married earners filing jointly and 200 000 for head or single households At the One way to get relief is with the child tax credit which is currently 2 000 per kid However this could change just as taxes are being filed Some people are saying Should I wait to find

Download Child Care Rebate Calculator 2024

More picture related to Child Care Rebate Calculator 2024

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-tax-credit-payment-dates-2022-drift-hestia-bloger.jpg

Your Ultimate Guide To The Child Care Benefit And Child Care Rebate Petit Journey

https://www.petitjourney.com.au/wp-content/uploads/2017/01/how-to-apply-for-child-care-rebate-e1513120609516.jpg

HST Rebate Calculator GST HST Rebate Experts Sproule Associates

https://www.my-rebate.ca/wp-content/uploads/2020/08/Hero-Image-3-1024x683.jpg

The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the maximum Child and Dependent Care Credit Information If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the credit for child and dependent care expenses Your federal income tax may be reduced by claiming the Credit for Child and Dependent

While less generous than the enhanced child tax credit enacted during the Covid 19 pandemic the changes would boost the maximum refundable tax break to 1 800 per child for 2023 up from the The new calculation would multiply the parent s income by 15 as well as by the family s number of children A third tweak is linked to the partially refundable nature of the CTC which provides up

Illinois Child Care For All Coalition Launched As New Report Shows Depth Of Childcare Crisis

https://seiuhcilin.org/wp-content/uploads/2022/05/22.05.10-SEIU-HCII-Child-Care-for-All-White-Paper-Presser-01-1-1024x681.jpg

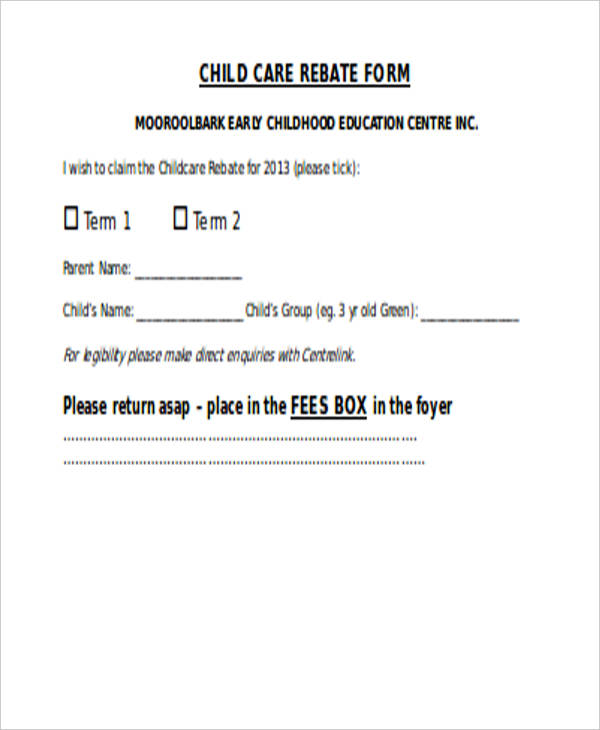

FREE 9 Sample Child Care Application Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Child-Care-Rebate-Application-Form.jpg

https://www.nerdwallet.com/article/taxes/qualify-child-child-care-tax-credit

People with kids under the age of 17 may be eligible to claim a tax credit of up to 2 000 per qualifying dependent For taxes filed in 2024 1 600 of the credit is potentially refundable We ll

https://www.kiplinger.com/taxes/how-much-is-the-child-tax-credit-for-2024

For the 2024 tax year returns you ll file in 2025 the refundable portion of the credit increases to 1 700 That means eligible taxpayers could receive an additional 100 per qualifying

How Parents Can Help To Discourage W siting Meet Our Experts To Learn More Visit Https

Illinois Child Care For All Coalition Launched As New Report Shows Depth Of Childcare Crisis

Child Care And Early Childhood Learning Future Options PC News And Other Articles

Your Ultimate Guide To The Child Care Benefit And Child Care Rebate Petit Journey

ittakesavillageMedford Pandemic Education Child Care Sanctuary United Church Of Christ

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

Ev Car Tax Rebate Calculator 2023 Carrebate

Help With The Cost Of Licensed Child Care City Of Toronto Ex Kindergarten Operator Charged

2023 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

Child Care Rebate Calculator 2024 - Currently 1 600 of the 2 000 credit per child is refundable The credit s phaseout threshold is 400 000 for married earners filing jointly and 200 000 for head or single households At the