Child Care Rebate Eligibility Criteria Web You must have used CCB approved child care been eligible for CCB entitled at a rate of zero or more meet the work training study test for the purposes of the rebate Note

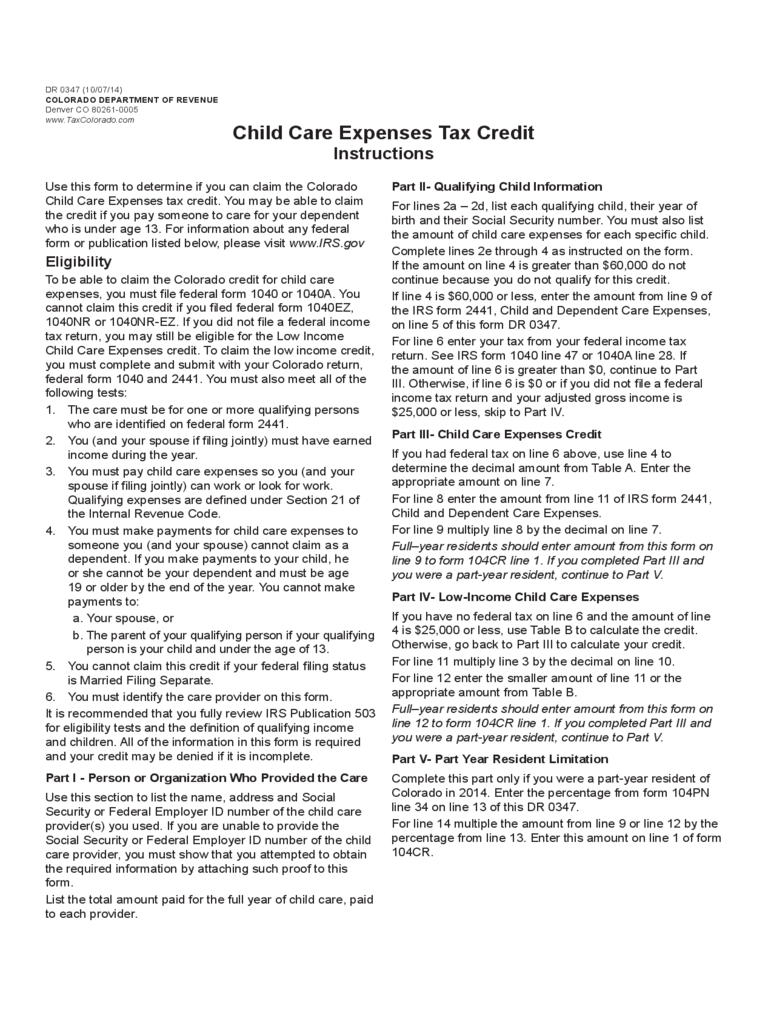

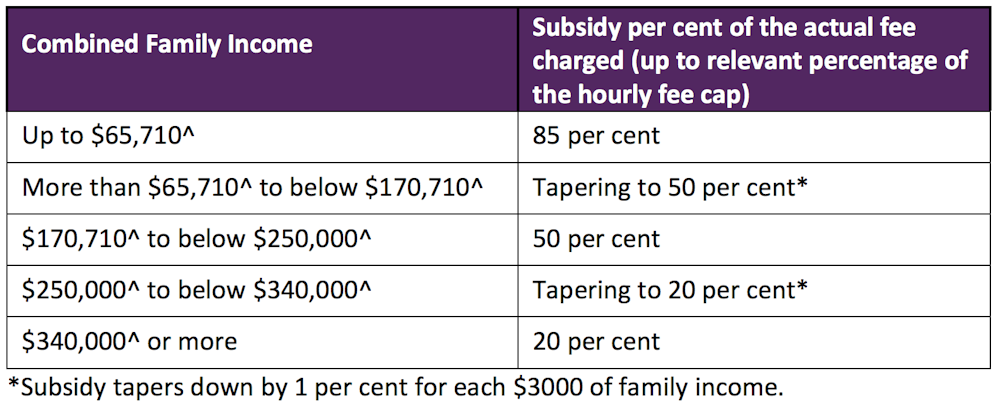

Web Families must meet eligibility criteria to get CCS The amount of CCS a family can get depends on their circumstances Services Australia looks at a family s income how Web Check what help you might be able to get with childcare schemes like tax credits Tax Free Childcare childcare vouchers and free childcare or education for 2 to 4 year olds

Child Care Rebate Eligibility Criteria

Child Care Rebate Eligibility Criteria

https://handypdf.com/resources/formfile/images/fb/source_images/child-care-rebate-application-form-d1.png

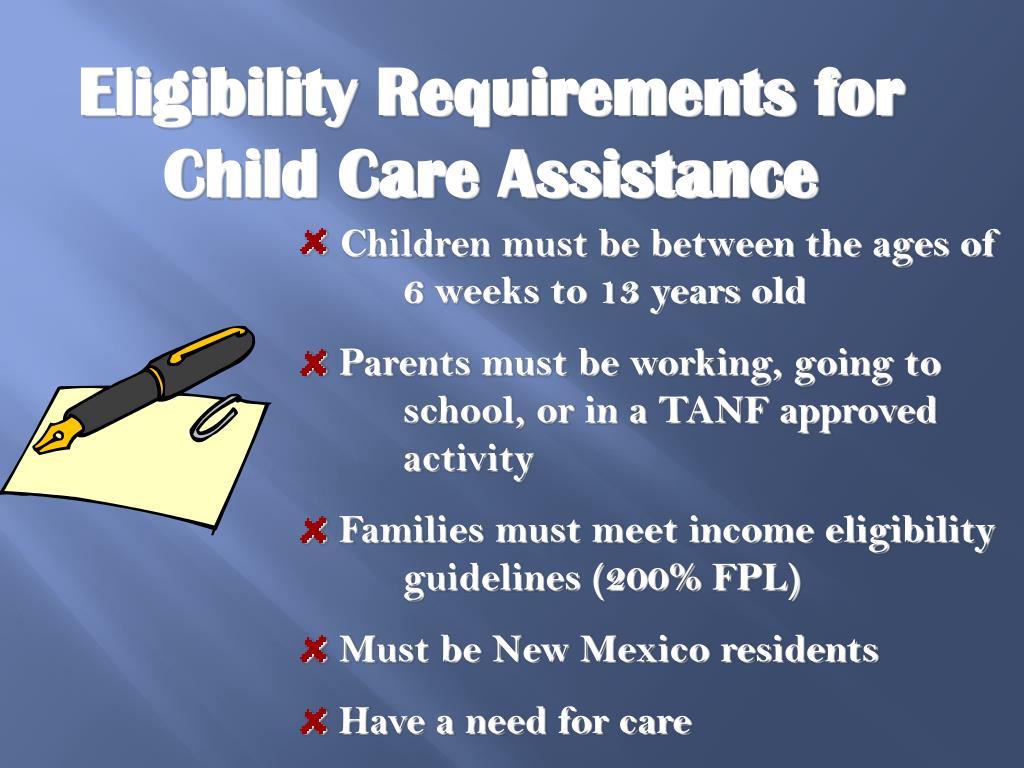

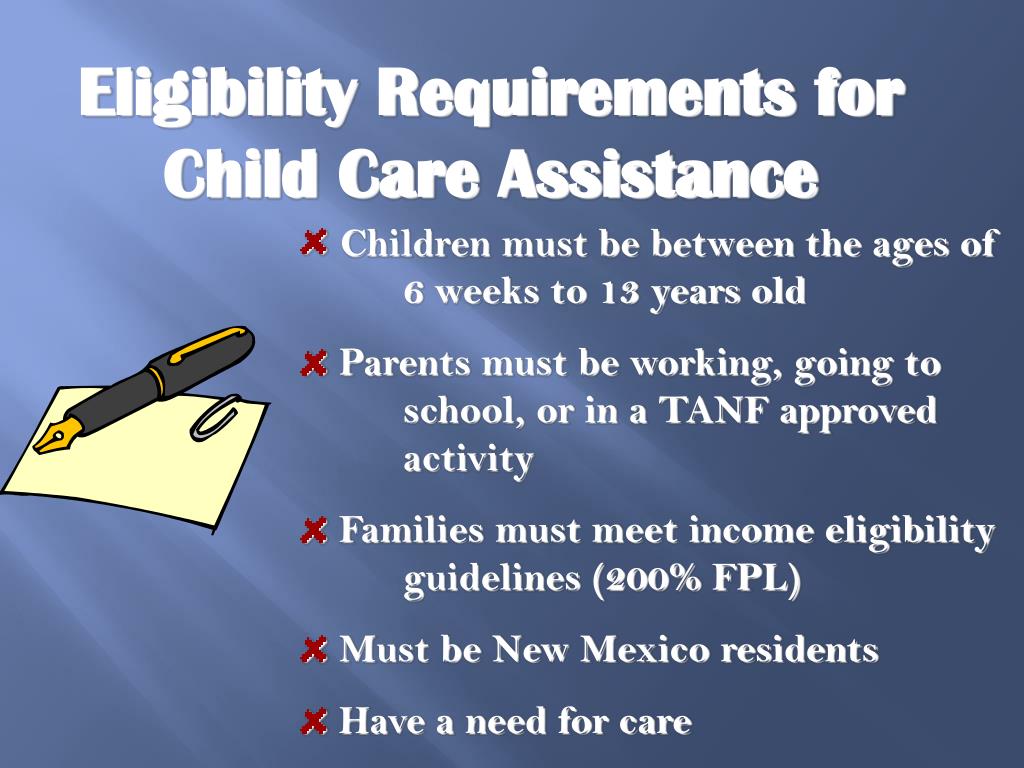

PPT CYFD Child Care Services Bureau Programs PowerPoint Presentation

http://image.slideserve.com/234904/slide5-l.jpg

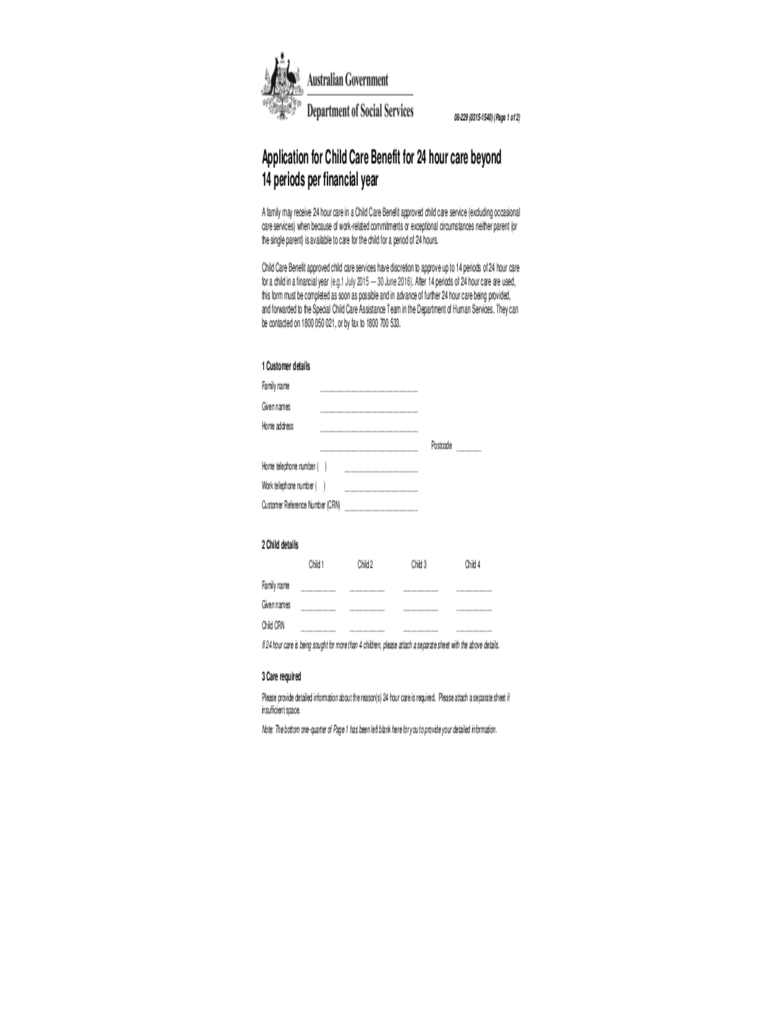

FREE 11 Child Care Application Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Child-Care-Rebate-Application-Form.jpg?width=390

Web 10 juil 2023 nbsp 0183 32 To get Child Care Subsidy CCS you must care for a child 13 or younger who s not attending secondary school unless an exemption applies use an approved Web Additional Child Care Subsidy If you re eligible for Child Care Subsidy you may get extra help with the cost of approved child care To get this you must be eligible for Child Care

Web Your immigration status To be eligible for 30 hours free childcare you must have a National Insurance number and at least one of the following British or Irish citizenship settled or Web be 13 or under except in certain circumstances If a child doesn t attend a session of care at least once in 26 consecutive weeks they will stop being eligible for CCS If a child

Download Child Care Rebate Eligibility Criteria

More picture related to Child Care Rebate Eligibility Criteria

Child Care Rebate Tax Brackets 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

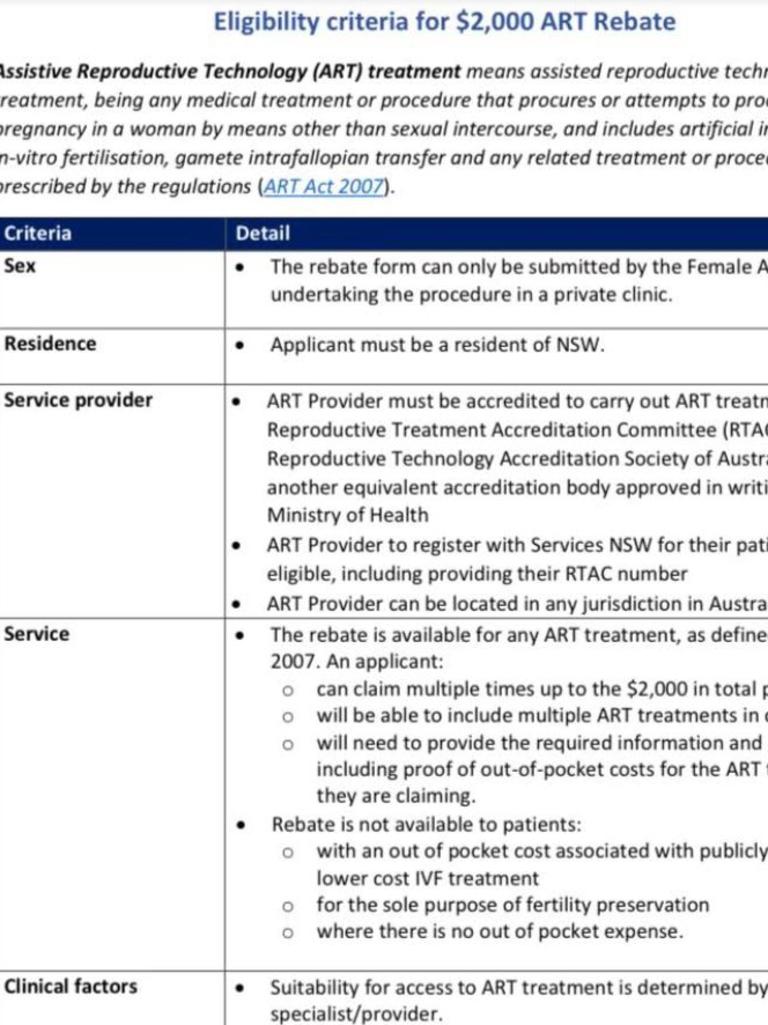

IVF Cash Rebate Eligibility Criteria Revealed As Scheme Opens Oct 1

https://content.api.news/v3/images/bin/c6e15c34e13a6e937eefd17d3f1ed9e3

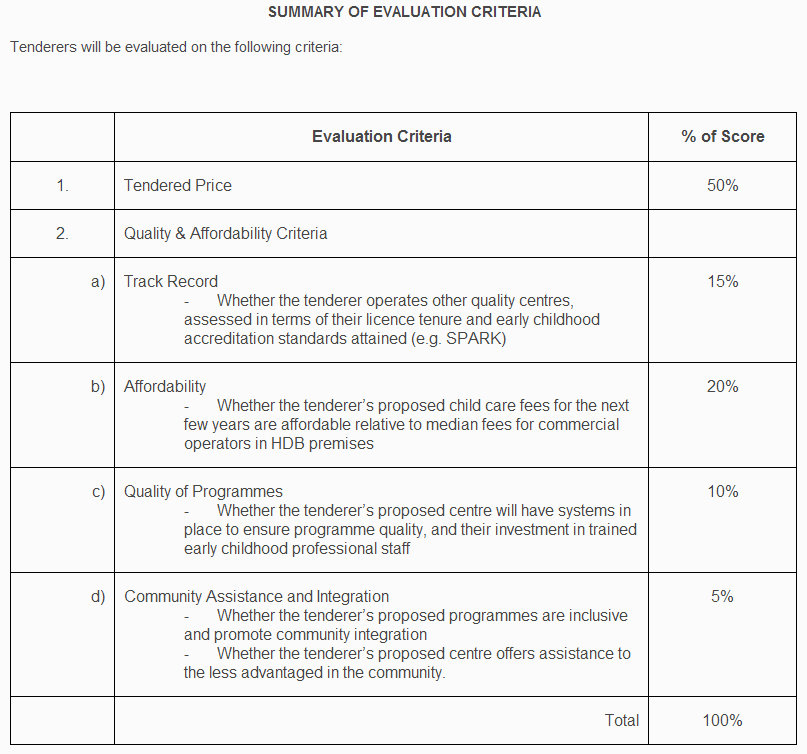

If Only Singaporeans Stopped To Think Tender Criteria For HDB

https://1.bp.blogspot.com/-dvUn8B9C6EU/Ubwd9m4AhDI/AAAAAAAATfE/ffGxADTPesg/s1600/New+Commercial+child+care+centre+evaluation+criteria.jpg

Web the individual s eligibility for CCS for a child and the individual s eligibility for either ACCS child wellbeing ACCS grandparent ACCS temporary financial hardship or Web More information About In Home Care IHC is a flexible form of early childhood education and care that takes place in the family home It is for families who can t access other

Web To be eligible for Child Care Subsidy you must meet the residence rules On the day you claim you or your partner must be living in Australia and also have one of the following Web To qualify for the child care subsidy program a family needs for meet both the real real financial criteria Situational Criteria You may will right to receive child caring

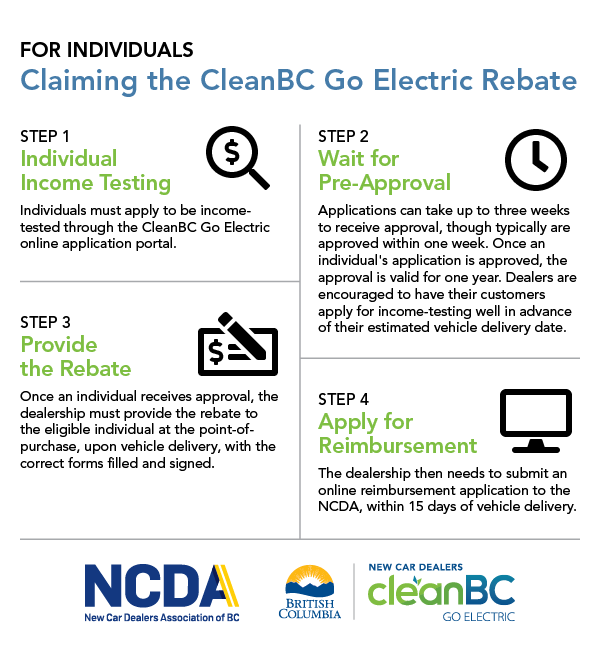

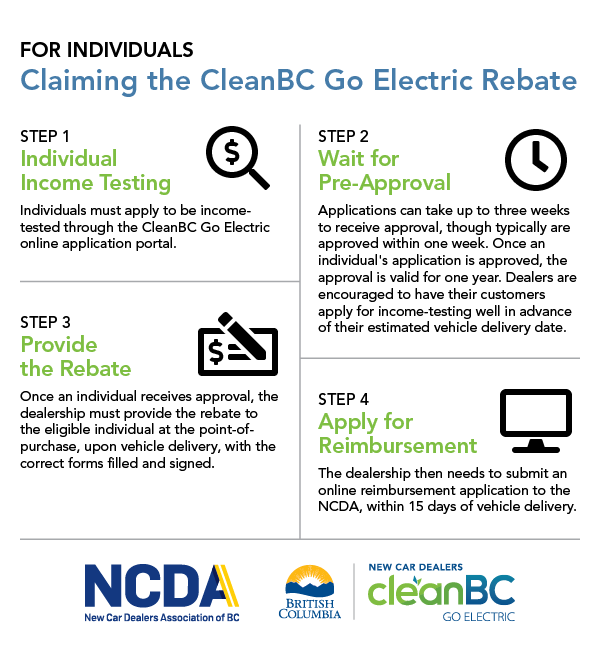

Rebate Eligibility Criteria CleanBC Go Electric Passenger Vehicle

https://newcardealersgoelectric.ca/wp-content/uploads/Individuals-CleanBC-Rebate-Program-Infographic.png

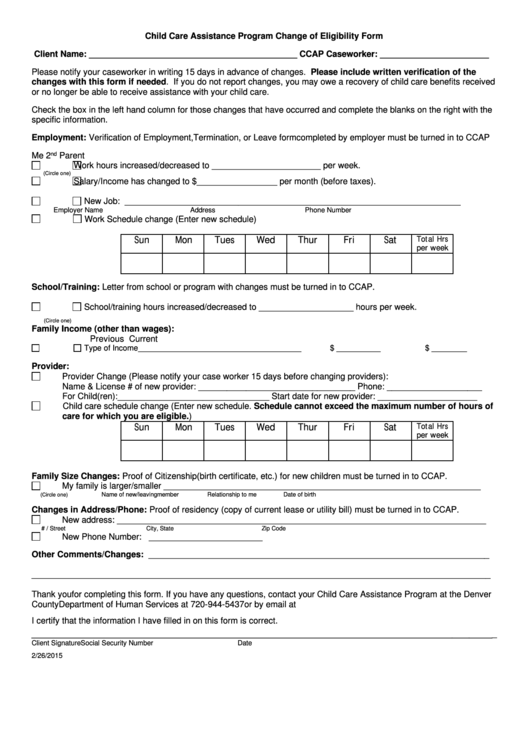

Child Care Assistance Program Change Of Eligibility Form Printable Pdf

https://data.formsbank.com/pdf_docs_html/179/1796/179676/page_1_thumb_big.png

https://www.dss.gov.au/sites/default/files/documents/05_201…

Web You must have used CCB approved child care been eligible for CCB entitled at a rate of zero or more meet the work training study test for the purposes of the rebate Note

https://www.education.gov.au/early-childhood/child-care-subsidy

Web Families must meet eligibility criteria to get CCS The amount of CCS a family can get depends on their circumstances Services Australia looks at a family s income how

Income Eligibility For Child Care Assistance Increase On August 1st

Rebate Eligibility Criteria CleanBC Go Electric Passenger Vehicle

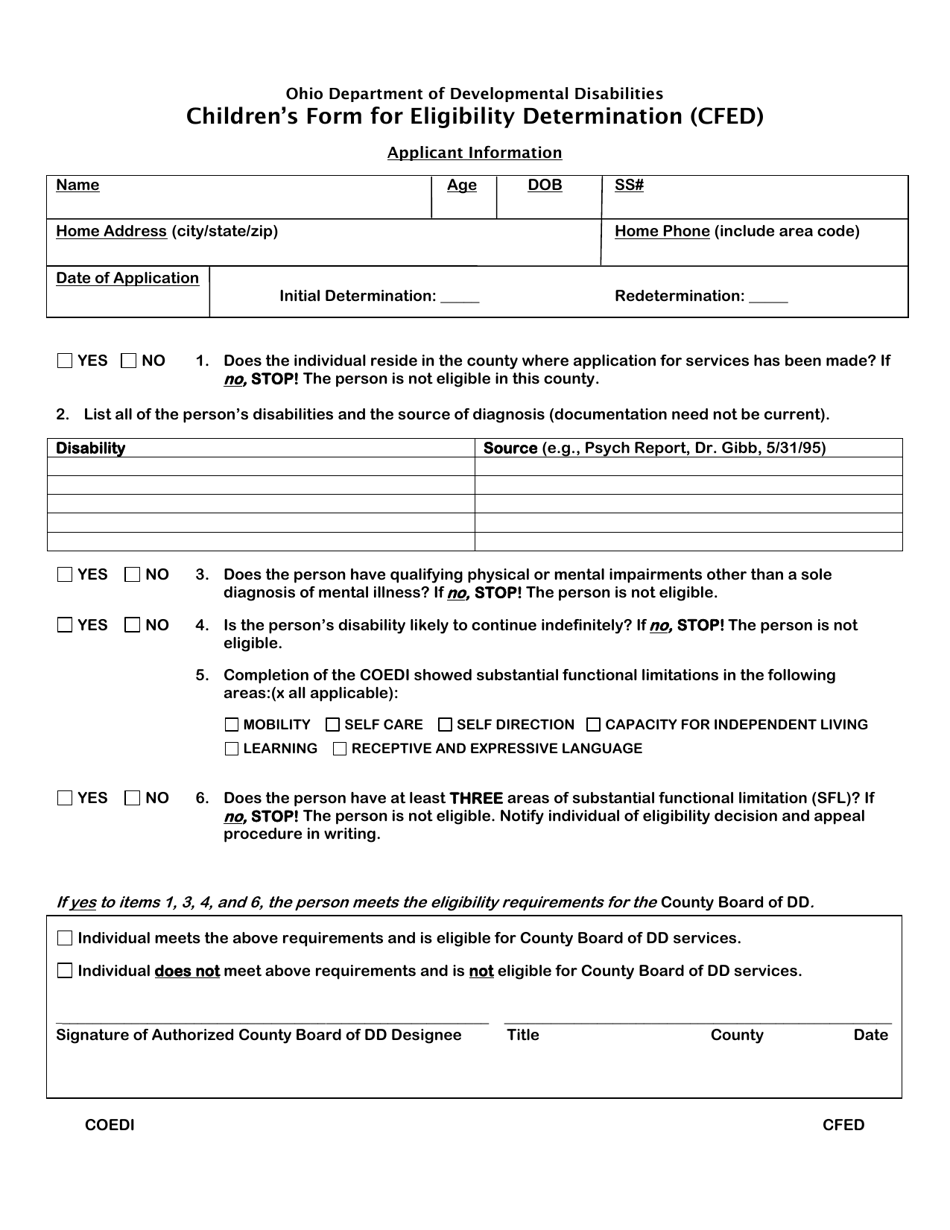

Ohio Children s Form For Eligibility Determination Cfed Download

Child Care Benefit Claim Form Notes Australia Free Download

Family Tax Child Care Rebate 2023 Carrebate

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

PolicyCheck The Government s New Child Care Plan

Child Care Rebate Application Form Free Download

How To Keep Receiving Childcare Rebates Under The Government s New System

Child Care Rebate Eligibility Criteria - Web Additional Child Care Subsidy If you re eligible for Child Care Subsidy you may get extra help with the cost of approved child care To get this you must be eligible for Child Care