Child Care Rebate Income Tax Return Web 7 ao 251 t 2023 nbsp 0183 32 You must meet the requirements detailed below to claim the Child and Dependent Care Credit on this year s income tax return You must have earned

Web 11 juin 2021 nbsp 0183 32 To claim the credit you will need to complete Form 2441 Child and Dependent Care Expenses and include the form when you file your Federal income tax Web Forms and publications Income Tax Package Guide Return and Schedules Form T778 Child Care Expenses Deduction for 2022 Income Tax Folio S1 F3 C1 Child Care

Child Care Rebate Income Tax Return

Child Care Rebate Income Tax Return

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/daycare-business-income-and-expense-sheet-to-file-your-daycare-business-1.jpg

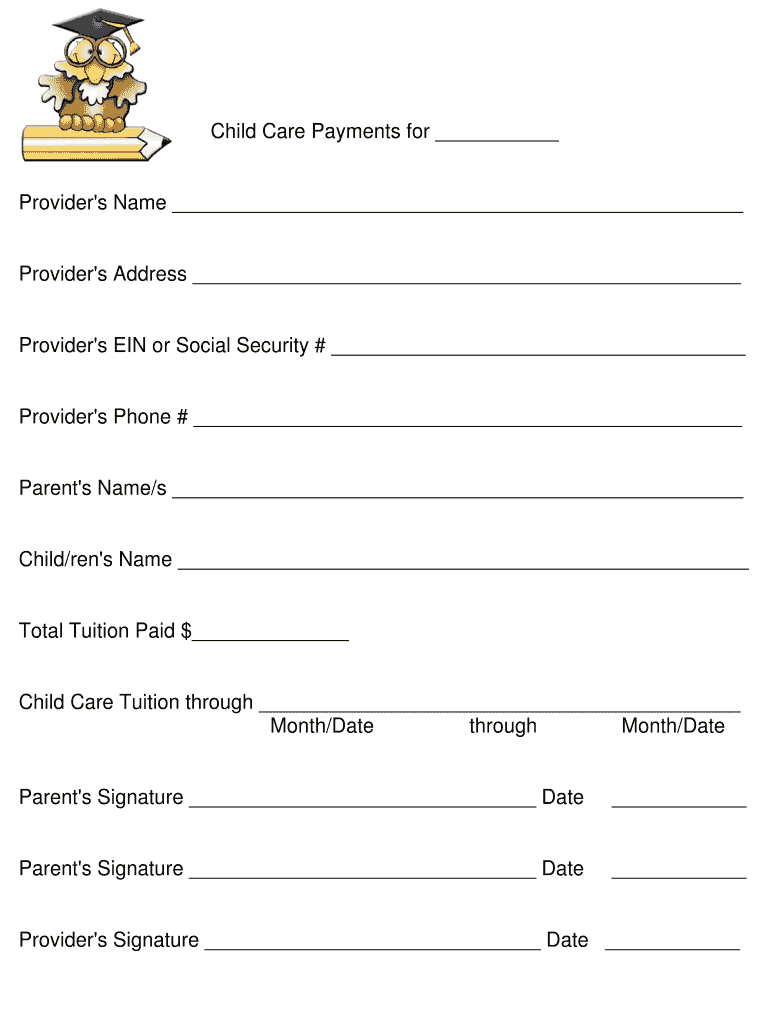

Pin On Childcare Providers

https://i.pinimg.com/originals/5b/3b/21/5b3b21e30091d2391c9664101cf13515.jpg

Child Care Rebate Income Tax Return 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/your-us-expat-tax-return-and-the-child-care-credit-when-abroad.png?w=836&h=400&ssl=1

Web 13 janv 2022 nbsp 0183 32 For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from Web 24 f 233 vr 2022 nbsp 0183 32 For your 2021 tax return the cap on the expenses eligible for the credit is 8 000 for one child up from 3 000 or 16 000 up from 6 000 for two or more

Web If you got Family Tax Benefit or Child Care Subsidy and you or your partner are not required to lodge a tax return you need to tell us When we balance your Child Care Subsidy Web You claim the 30 child care tax rebate from the Tax Office on your income tax return CCB must be claimed from the Family Assistance Office FAO The amount you receive

Download Child Care Rebate Income Tax Return

More picture related to Child Care Rebate Income Tax Return

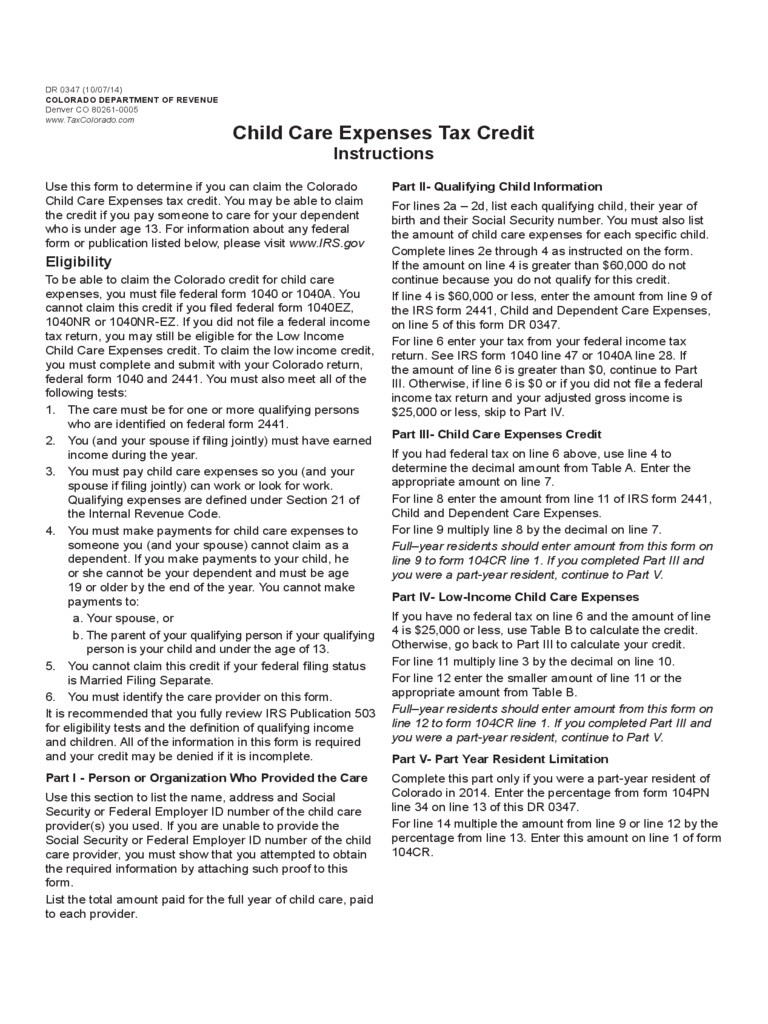

Child Care Expenses Tax Credit Colorado Free Download

http://www.formsbirds.com/formimg/child-care-rebate-form/3306/child-care-expenses-tax-credit-colorado-l2.png

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-care-expenses-tax-credit-colorado-d1.png

Form For Daycare Tax Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/100/315/100315789/large.png

Web 2 f 233 vr 2023 nbsp 0183 32 Child and Dependent Care Credit Information If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work Web 17 ao 251 t 2023 nbsp 0183 32 For tax year 2023 you can claim the child tax credit and the additional child tax credit on the federal tax return Form 1040 or 1040 SR that you file by April 15 2024 or by October 2024 with

Web If you got CCS or Additional Child Care Subsidy ACCS for 2021 22 and didn t confirm your family s income by 30 June 2023 your payments will have stopped From 10 July 2023 Web 12 f 233 vr 2022 nbsp 0183 32 What does that mean In brief for the 2021 tax year you could get up to 4 000 back for one child and 8 000 back for care of two or more In prior years the

Child Care Expenses Tax Credit Colorado Free Download

http://www.formsbirds.com/formimg/child-care-rebate-form/3306/child-care-expenses-tax-credit-colorado-l3.png

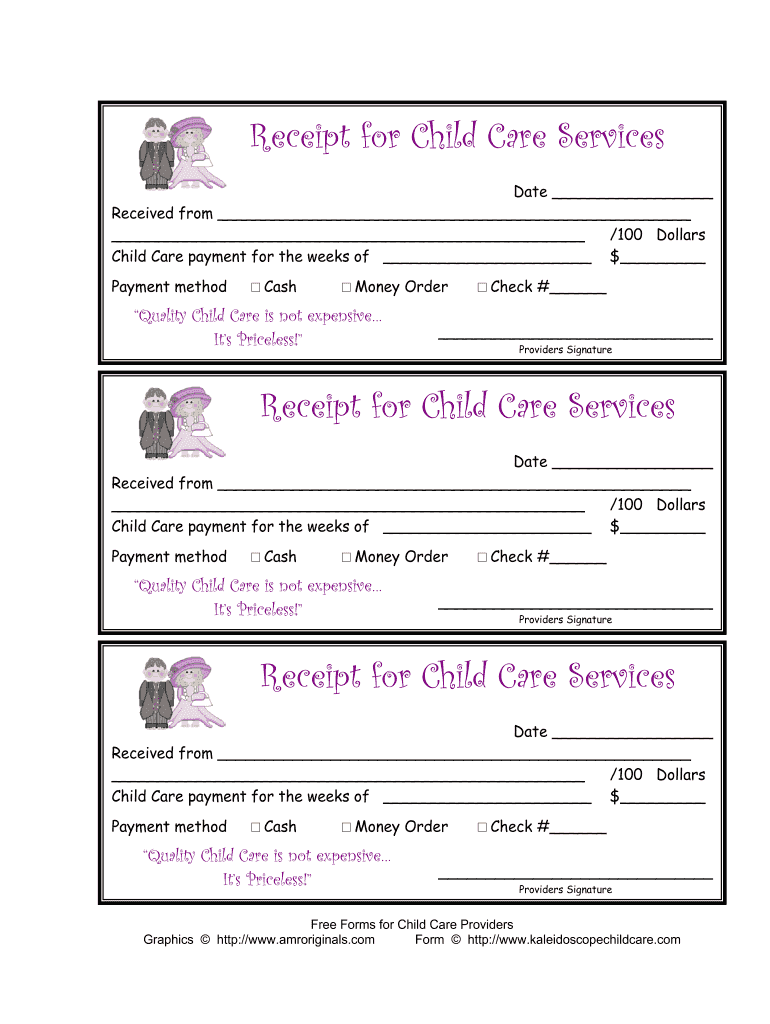

FREE 11 Daycare Receipt Samples And Templates In PDF MS Word

https://images.sampletemplates.com/wp-content/uploads/2018/05/Daycare-Tax-Receipt.jpg

https://nationaltaxreports.com/can-you-deduct-child-care-expenses

Web 7 ao 251 t 2023 nbsp 0183 32 You must meet the requirements detailed below to claim the Child and Dependent Care Credit on this year s income tax return You must have earned

https://www.irs.gov/newsroom/child-and-dependent-care-credit-faqs

Web 11 juin 2021 nbsp 0183 32 To claim the credit you will need to complete Form 2441 Child and Dependent Care Expenses and include the form when you file your Federal income tax

Printable Daycare Income And Expense Worksheet

Child Care Expenses Tax Credit Colorado Free Download

Promise The Children 2016 Child Care For All Promise The Children

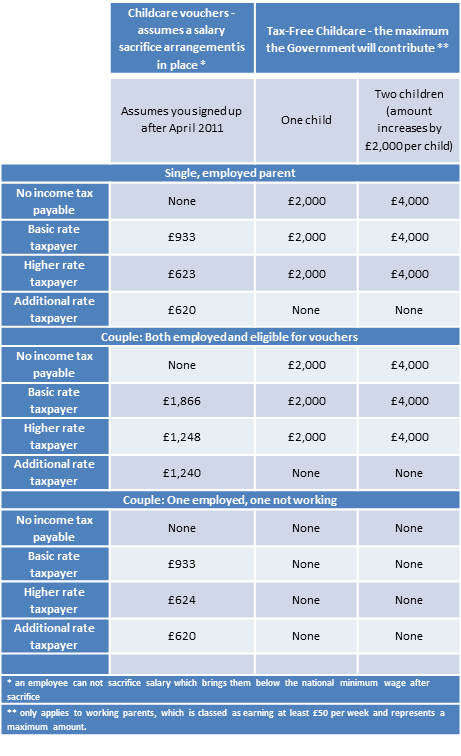

New Tax free Childcare Is It The End Of Salary Sacrifice For

Child Care Receipt Fillable Fill Out Sign Online DocHub

2021 Child Tax Form Fillable Printable PDF Forms Handypdf

2021 Child Tax Form Fillable Printable PDF Forms Handypdf

2019 2023 Form Canada T1159 EFill Online Printable Fillable Blank

Fillable Pa 40 Fill Out Sign Online DocHub

Child Care Tax Credit Income Limit

Child Care Rebate Income Tax Return - Web If you got Family Tax Benefit or Child Care Subsidy and you or your partner are not required to lodge a tax return you need to tell us When we balance your Child Care Subsidy