Child Care Rebate Tax Return Ato Web Your rebate income is the total amount of your taxable income excluding any assessable First home super saver released amount plus the following amounts if they apply to you

Web The ATO may extend the date you and your partner need to lodge your tax return by However this won t change the time limits for CCS You still need to confirm your family Web Find out which expenses you can claim as income tax deductions and work out the amount to claim How to claim deductions How to claim income tax deductions for work related

Child Care Rebate Tax Return Ato

Child Care Rebate Tax Return Ato

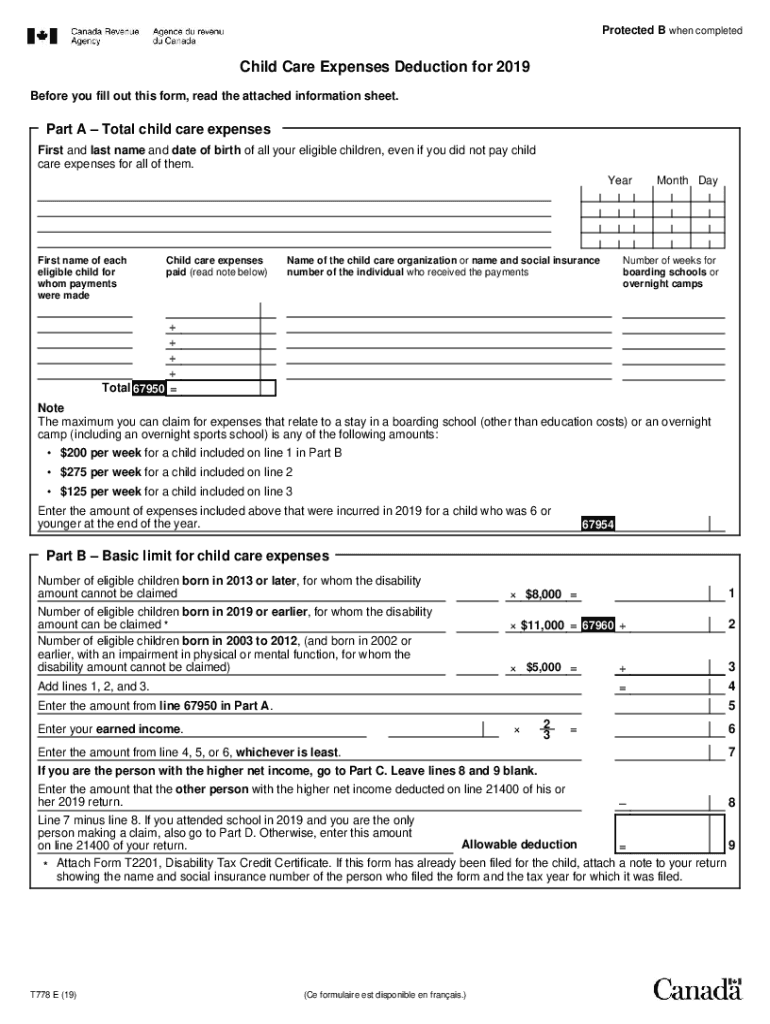

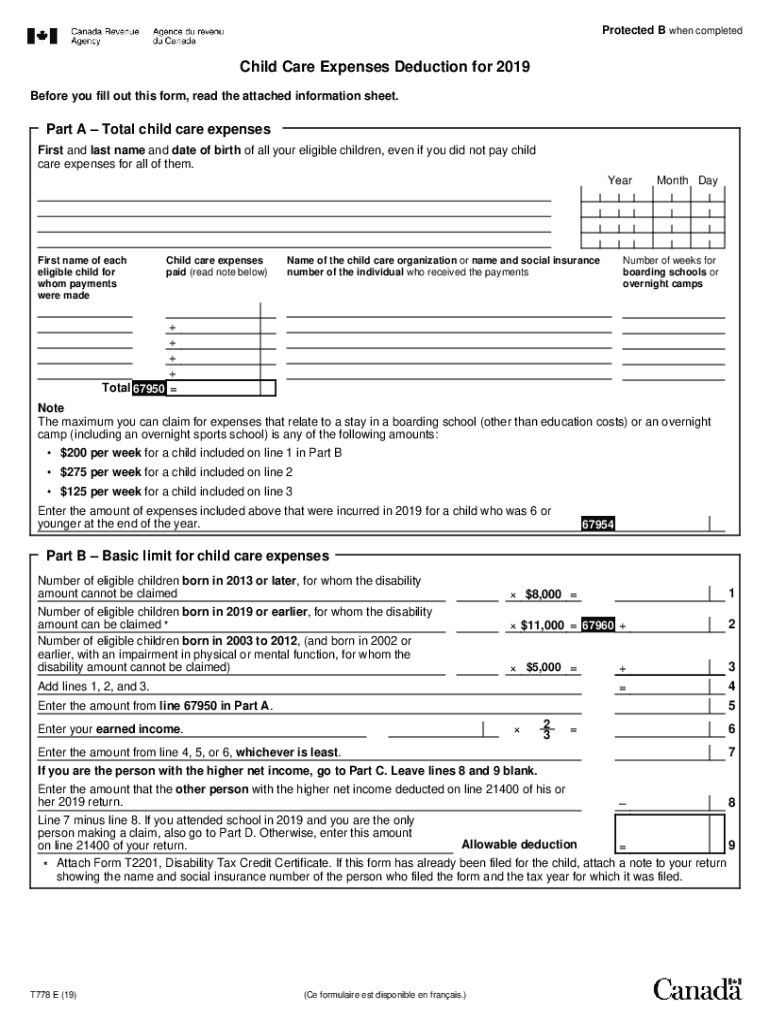

https://www.carrebate.net/wp-content/uploads/2022/08/t778-fill-19e-pdf-clear-data-child-care-expenses-fill-out-and-sign.png

30 Child Care Tax Rebate 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/child-care-tax-rebate-payment-dates-2022-2022-carrebate.jpg?resize=840%2C473&ssl=1

Child Care Rebate Tax Brackets 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

Web superannuation released early We won t count superannuation withdrawals made under the First Home Super Saver Scheme as taxable income If you make a loss for the year Web 10 juil 2023 nbsp 0183 32 Standard CCS rates from 10 July 2023 If you have more than one child aged 5 or younger you may get a higher rate for one or more of your children You can still

Web The rebate is 30 of your out of pocket expenses for approved child care you had to pay in the previous year of income This means that for the 2005 06 income year you can Web If your income is more you may have to pay tax and the Medicare levy at tax time You ll find out how much tax you need to pay after you lodge your tax return Any tax you

Download Child Care Rebate Tax Return Ato

More picture related to Child Care Rebate Tax Return Ato

Childcare Tax Rebate Google Docs

https://lh3.googleusercontent.com/docs/AOD9vFr_UKhK8qduqUufb1KgrPjWuQgA9bQz6e_fB4Id6GSAU9bertsDMt_QDKuWXxNyOwyWifG2KNWPFPPizPhVuqSffuQxD5RfFL3awCjHxPMH=w1200-h630-p

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-tax-credit-payment-dates-2022-drift-hestia-bloger.jpg

Web 7 nov 2022 nbsp 0183 32 child care subsidy rebate So somehow in the blur of having twin babies and a just turned two year old at daycare I overlooked submitting my 2015 2016 return Web 10 juil 2023 nbsp 0183 32 How to claim Complete the following steps to apply for Child Care Subsidy CCS Before you start check if you can get it How to manage your payment If you get

Web If you got Family Tax Benefit FTB or Child Care Subsidy CCS between 1 July 2022 to 30 June 2023 you need to confirm your income If you had a partner during this time they ll Web 30 juin 2023 nbsp 0183 32 If you are eligible for the rebate you can claim the rebate either through your private health insurance provider your private health insurance provider will apply

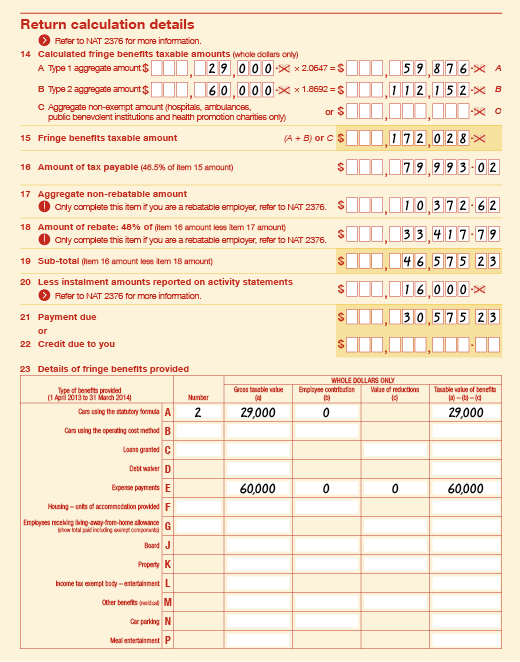

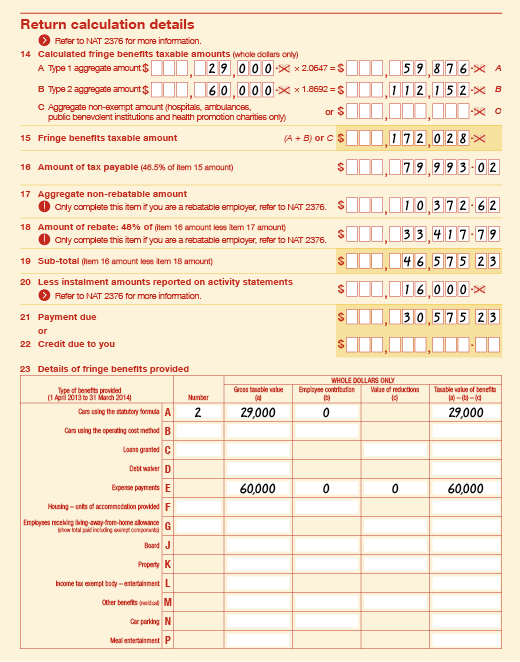

Rebatable Employers Australian Taxation Office

https://www.ato.gov.au/uploadedImages/Content/SME/Images/39720_05.jpg?n=5095

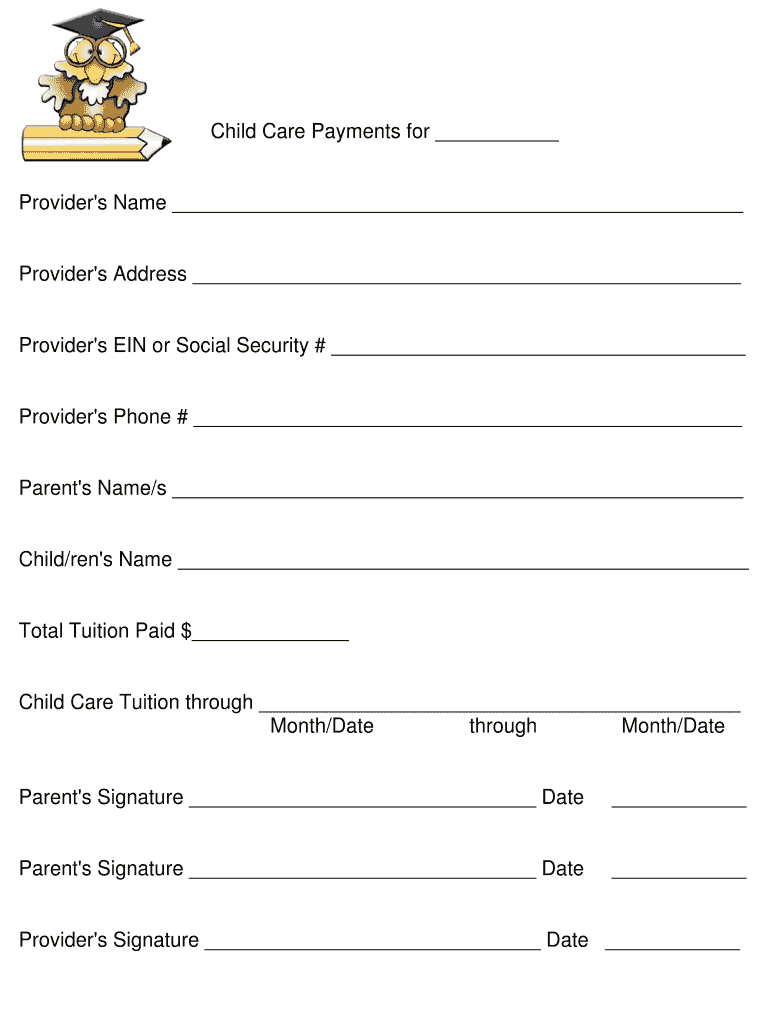

Child Care Expenses Tax Credit Colorado Free Download

https://www.formsbirds.com/formimg/child-care-rebate-form/3306/child-care-expenses-tax-credit-colorado-l2.png

https://www.ato.gov.au/Individuals/Tax-Return/2023/Supporting...

Web Your rebate income is the total amount of your taxable income excluding any assessable First home super saver released amount plus the following amounts if they apply to you

https://www.servicesaustralia.gov.au/time-limits-for-confirming-income...

Web The ATO may extend the date you and your partner need to lodge your tax return by However this won t change the time limits for CCS You still need to confirm your family

Child Care Rebate

Rebatable Employers Australian Taxation Office

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

Form For Daycare Tax Fill Online Printable Fillable Blank PdfFiller

Promise The Children 2016 Child Care For All Promise The Children

Daycare Business Income And Expense Sheet To File Your Daycare Business

Daycare Business Income And Expense Sheet To File Your Daycare Business

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Child Care Receipt For Tax Purposes

Child Care Expenses Tax Credit Colorado Free Download

Child Care Rebate Tax Return Ato - Web To complete your return as a child care worker child care assistant nanny kindergarten assistant or pre school aide employed by a company you ll first need an income