Child Care Rebate Wiki The Household and Dependent Care Credit is a nonrefundable tax credit available to United States taxpayers Taxpayers that care for a qualifying individual are eligible The purpose of the credit is to allow the taxpayer or their spouse if married to be gainfully employed This credit is created by 26 U S Code U S C 167 21 section 21 of the Internal Revenue Code IRC

Web No Jab No Pay is an Australian policy initiative which withholds three state payments Child Care Benefit the Child Care Rebate and a portion of the fortnightly Family Tax Benefit Web If you are using approved child care for the purposes of Child Care Benefit CCB for work training or study related reasons the Government will provide you with 50 per cent of

Child Care Rebate Wiki

Child Care Rebate Wiki

https://i.pinimg.com/originals/a3/58/24/a35824fc6d11236aaa9eca09b9fe7fb1.jpg

Five Things You Need To Know About The New Child Care Subsidy

http://babyology.com.au/wp-content/uploads/2017/11/childcarerebate2-600x313.jpg

Child Care Rebate Application Form Free Download

https://www.formsbirds.com/formimg/child-care-rebate-form/1012/child-care-rebate-application-form-l2.png

Web 4 juil 2011 nbsp 0183 32 History of Child Care rebate Forum rules IMPORTANT Student s support in our forum will now be a part of our Premium Subscription service This means students Web The child tax credit is available to taxpayers who have children under the age of 17 or in 2021 under the age of 18 Since 2018 the CTC is 2 000 per qualifying child It is

Web Child care otherwise known as day care is the care and supervision of a child or multiple children at a time whose ages range from two weeks of age to 18 years Although most Web 24 mai 2017 nbsp 0183 32 Child Care Rebate CCR on the other hand is a financial assistance applied in 2004 to supplement CCB qualified families out of pocket expenses provided that they

Download Child Care Rebate Wiki

More picture related to Child Care Rebate Wiki

Child Care Rebate

https://s2.studylib.es/store/data/005176746_1-5f58414245153e95907f2f11a65b3252-768x994.png

Ask Your Centrelink Family Assistance Questions Wearing Your Pyjamas

https://www.mamamia.com.au/wp/wp/wp-content/uploads/gallery/dohs-gallery/ChildCareRebate.jpg

Child Care Rebate To Be E

https://img.yumpu.com/32598086/652/500x640/childcare-draft.jpg

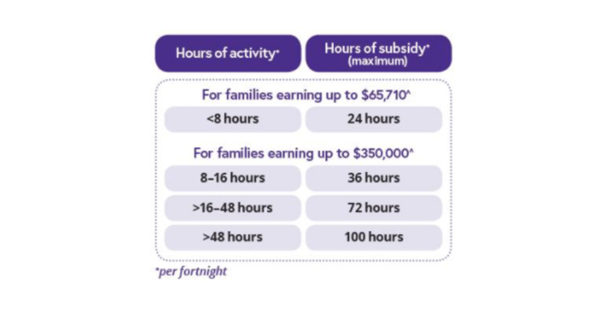

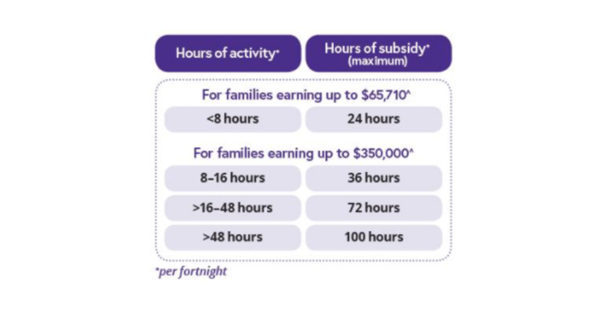

Web The amount each family receives through the child care rebate varies based on a number of factors Rebates are capped at 7 500 per child per financial year The childcare rebate Web Child Care Subsidy Income Test 2023 Updates From July 2023 The maximum CCS rate will be lifted to 90 for families earning 80 000 or less CCS rates will be increased for

Web What is Child Care Benefit Child Care Benefit CCB is a payment from the Australian Government that helps you with the cost of your child care Who can get CCB You can Web 2 juil 2022 nbsp 0183 32 In 2018 the government replaced two payments the Child Care Benefit and Child Care Rebate with one single payment now called the Child Care Subsidy The

What The Changes To Child Care Rebates Mean For YOUR Family Keep Calm

https://keepcalmgetorganised.com.au/wp-content/uploads/2015/05/changes-to-childcare-rebate-your-family-682x1024.jpg

How To Keep Receiving Childcare Rebates Under The Government s New System

https://cdn.babyology.com.au/wp-content/uploads/2019/03/childcare-rebate-update.jpg

https://en.wikipedia.org/wiki/Child_and_dependent_care_credit

The Household and Dependent Care Credit is a nonrefundable tax credit available to United States taxpayers Taxpayers that care for a qualifying individual are eligible The purpose of the credit is to allow the taxpayer or their spouse if married to be gainfully employed This credit is created by 26 U S Code U S C 167 21 section 21 of the Internal Revenue Code IRC

https://en.wikipedia.org/wiki/No_Jab,_No_Pay

Web No Jab No Pay is an Australian policy initiative which withholds three state payments Child Care Benefit the Child Care Rebate and a portion of the fortnightly Family Tax Benefit

Child Care Rebate Tax Brackets 2023 Carrebate

What The Changes To Child Care Rebates Mean For YOUR Family Keep Calm

FREE 11 Child Care Application Forms In PDF MS Word

Changes To Child Care Fee Assistance July 2018

Benefits How To Calculate Your Child Care Rebate Harmony Learning

Qualifying Child Care Rebates Expected This Fall Huntsville Doppler

Qualifying Child Care Rebates Expected This Fall Huntsville Doppler

The Changes After The Child Care Rebate Ended In Australia By

Child Care Rebate On Vimeo

Childcare Subsidy Abstract Concept Vector Illustration Stock Vector

Child Care Rebate Wiki - Web 24 mai 2017 nbsp 0183 32 Child Care Rebate CCR on the other hand is a financial assistance applied in 2004 to supplement CCB qualified families out of pocket expenses provided that they