Child Care Tax Credit 2023 Irs You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

Do you pay child and dependent care expenses so you can work You may be eligible for a federal income tax credit Find out if you qualify You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to work or actively look for work

Child Care Tax Credit 2023 Irs

Child Care Tax Credit 2023 Irs

https://crfb.org/sites/default/files/ctcmodel.jpg

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

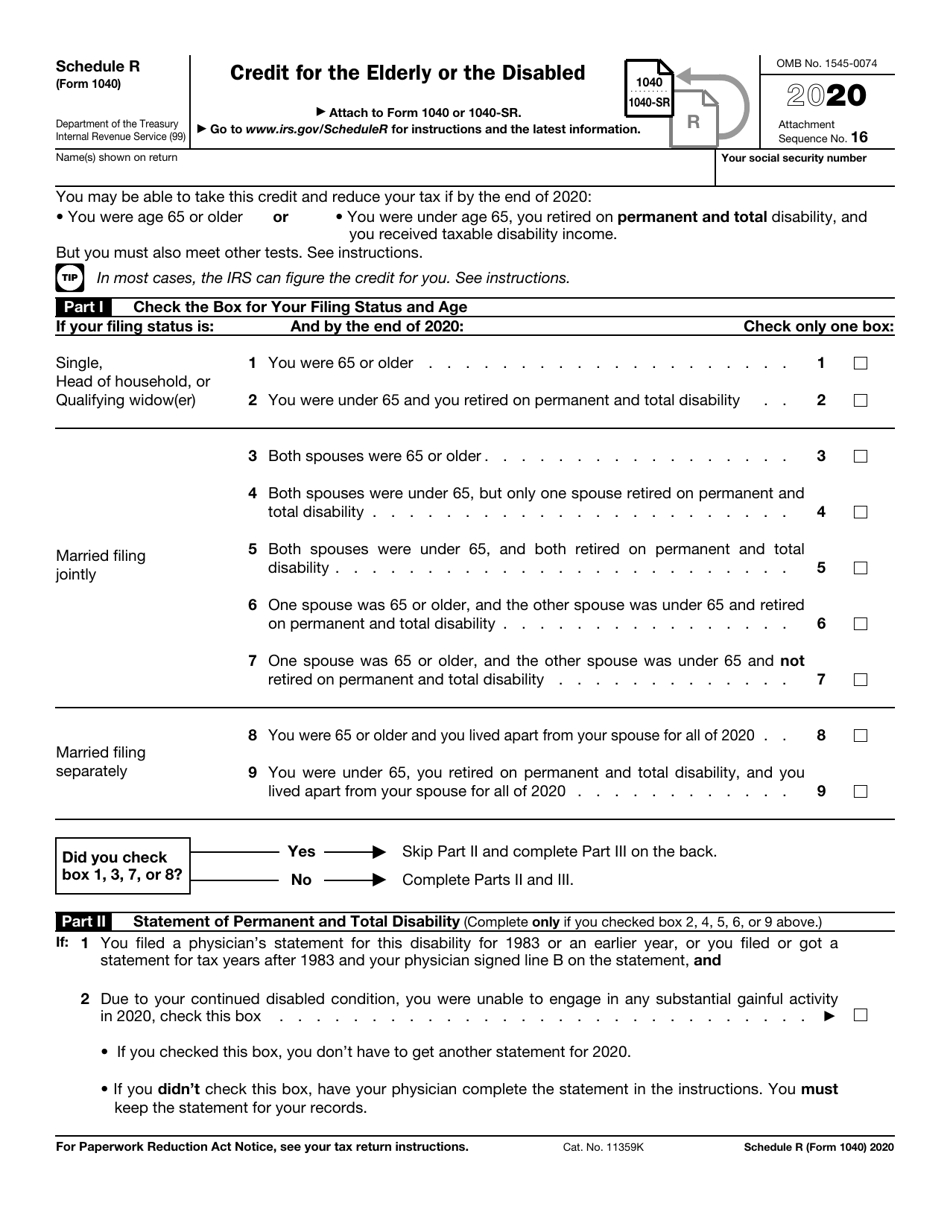

To be able to claim the credit for child and dependent care expenses you must file Form 1040 1040 SR or 1040 NR and meet all the tests in Tests you must meet to claim a credit for child and dependent care expenses next The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to

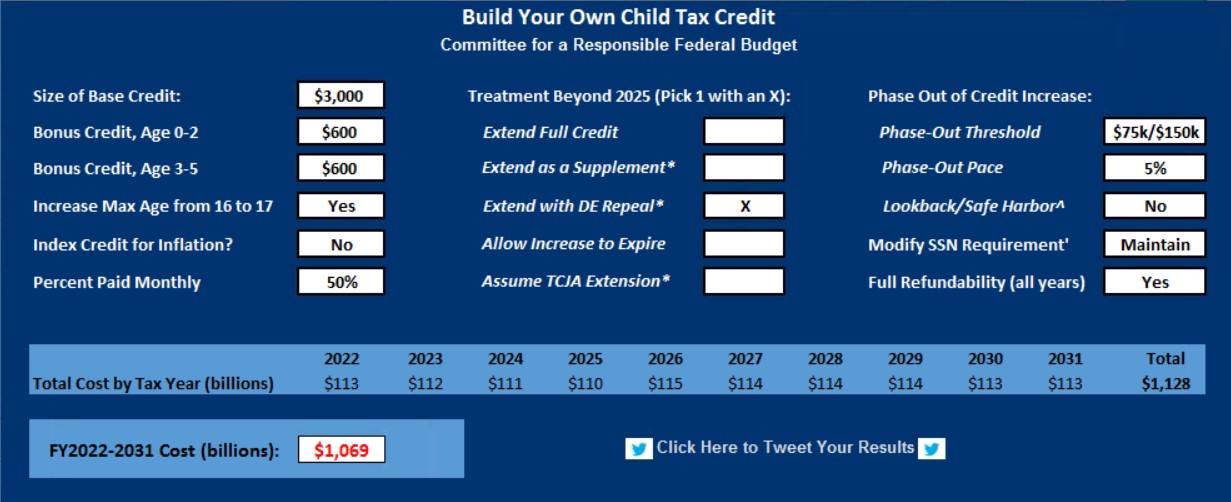

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages 6 and 17 Before 2021 the credit was worth up to 2 000 per eligible child IRS Tax Tip 2023 58 June 11 2023 The Employer Provided Childcare Tax Credit is an incentive for businesses to provide childcare services to their employees About the tax credit This tax credit helps employers cover some costs for childcare resource and referral and for a qualified childcare facility

Download Child Care Tax Credit 2023 Irs

More picture related to Child Care Tax Credit 2023 Irs

Child Tax Credit 2022 Age Limit Latest News Update

https://i2.wp.com/www.cpabr.com/assets/htmlimages/Articles/child tax credit payments chart.JPG

Earned Income Credit 2022 Calculator INCOMEBAU

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

https://static01.nyt.com/images/2022/12/14/upshot/14up-child-tax-credit-promo-promo/14up-child-tax-credit-promo-promo-mediumSquareAt3X.png

That s because the 2023 child tax credit for taxes filed in 2024 is based on income filing status the number of children and whether the IRS considers your dependent a qualifying child If you paid someone to care for a child who was under age 13 when the care was provided and whom you claim as a dependent on your tax return you may qualify for the Child and Dependent Care Credit

For tax year 2023 you can claim the child tax credit and the additional child tax credit on the federal tax return Form 1040 or 1040 SR that was due by April 15 2024 or by The IRS designed the dependent care tax credit to for care expenses for young children under 13 of working parents and caregivers with incapacitated spouses or loved ones

FSA Or Tax Credit Which Is Best To Save On Child Care

https://blog.havenlife.com/wp-content/uploads/2018/06/FSA-or-tax-credit_-Which-is-best-to-save-on-child-care_.jpg

2021 Child Tax Credits Paar Melis Associates P C

https://paarmelis.com/wp-content/uploads/2021/07/childtaxcredit.jpeg

https://www. irs.gov /credits-deductions/individuals/child-tax-credit

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

https://www. irs.gov /credits-deductions/individuals/...

Do you pay child and dependent care expenses so you can work You may be eligible for a federal income tax credit Find out if you qualify

What Is The Amount Of The Child Tax Credit For 2023 Leia Aqui How

FSA Or Tax Credit Which Is Best To Save On Child Care

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

What Is The Phase Out For Dependent Care Credit Latest News Update

What Is The Phase Out For Dependent Care Credit Latest News Update

Dependent And Child Care Credits Tax Policy Center

Aca Percentage Of Income 2022 INCOMUNTA

IRS Form 1040 Schedule R Download Fillable PDF Or Fill Online Credit

Child Care Tax Credit 2023 Irs - IRS Tax Tip 2023 58 June 11 2023 The Employer Provided Childcare Tax Credit is an incentive for businesses to provide childcare services to their employees About the tax credit This tax credit helps employers cover some costs for childcare resource and referral and for a qualified childcare facility