Child Care Tax Credit 2023 Phase Out If you still need to file your 2023 tax return that was due April 15 2024 or is due Oct 15 2024 with a tax extension you can claim the child tax credit and the additional child

The child and dependent care credit can be claimed on tax returns filed in mid April You ll need to attach two forms to the standard Form 1040 Form 2441 and Schedule 3 To be able to claim the credit for child and dependent care expenses you must file Form 1040 1040 SR or 1040 NR and meet all the tests in Tests you must meet to claim a credit for child and dependent care expenses next

Child Care Tax Credit 2023 Phase Out

Child Care Tax Credit 2023 Phase Out

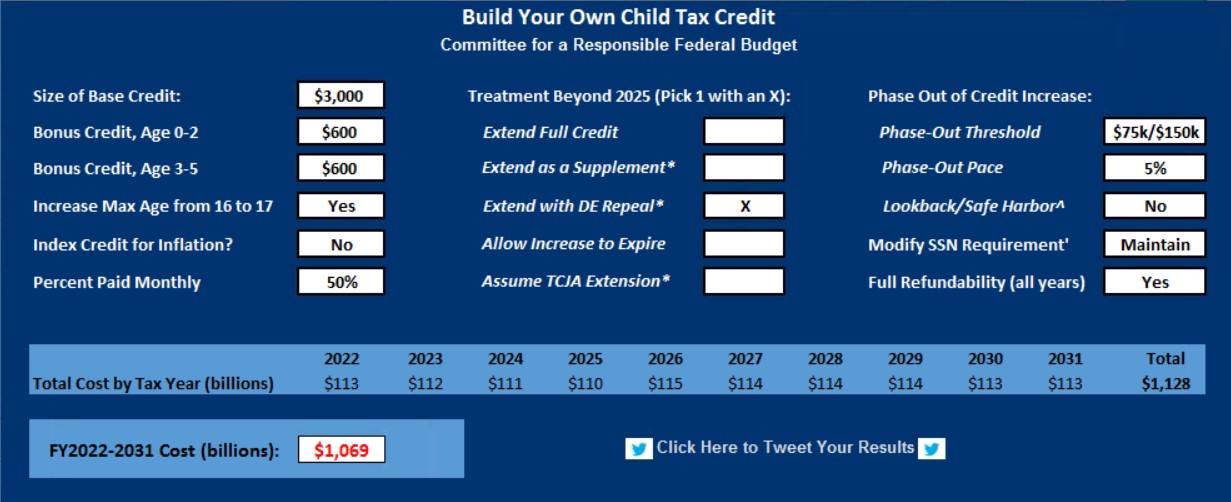

https://crfb.org/sites/default/files/ctcmodel.jpg

Child Tax Credit Schedule 8812 H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/child-tax-credit-1080x675.jpg

Child Care Tax Credit Dates Librus

https://s-media-cache-ak0.pinimg.com/736x/06/05/27/060527e8a870eabbacbabf70af4b0408.jpg

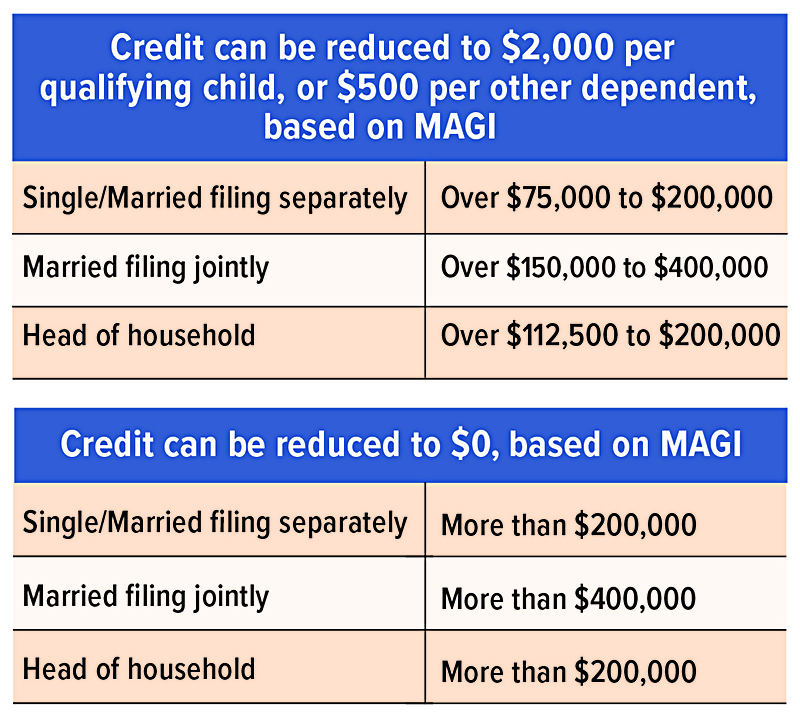

In short the CTC begins phasing out for families with income above 200 000 single filers or 400 000 joint filers How to Claim and Track Your Child Tax Credit Here s what you need to know about claiming your credit Eligible filers can claim the CTC onForm 1040 line 12a or on Form 1040NR line 49 See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

Unless Congress changes the child tax credit for the 2024 tax year returns you ll file in 2025 the refundable portion of the child tax credit is scheduled to increase to 1 700 You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

Download Child Care Tax Credit 2023 Phase Out

More picture related to Child Care Tax Credit 2023 Phase Out

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Earned Income Credit 2022 Calculator INCOMEBAU

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you The child tax credit is phased out completely at 240 000 for individuals and 480 000 for married couples filing jointly Note If you search online for information on the child tax credit

Families that do not qualify for the credit using these lower income limits are still eligible for the 2 000 per child credit using the original Child Tax Credit income and phase out amounts In addition the entire credit is fully refundable for 2021 For 2023 taxes for returns filed in 2024 the Child Tax Credit is worth 2 000 for each qualifying child You can claim this full amount if your income is at or below the modified adjusted gross income threshold see the

How Much Do You Get Back In Taxes For A Child 2023 Leia Aqui Will We

https://static01.nyt.com/images/2022/12/14/upshot/14up-child-tax-credit-promo-promo/14up-child-tax-credit-promo-promo-videoSixteenByNineJumbo1600.png

At What Income Do You No Longer Get Child Tax Credit Leia Aqui Do

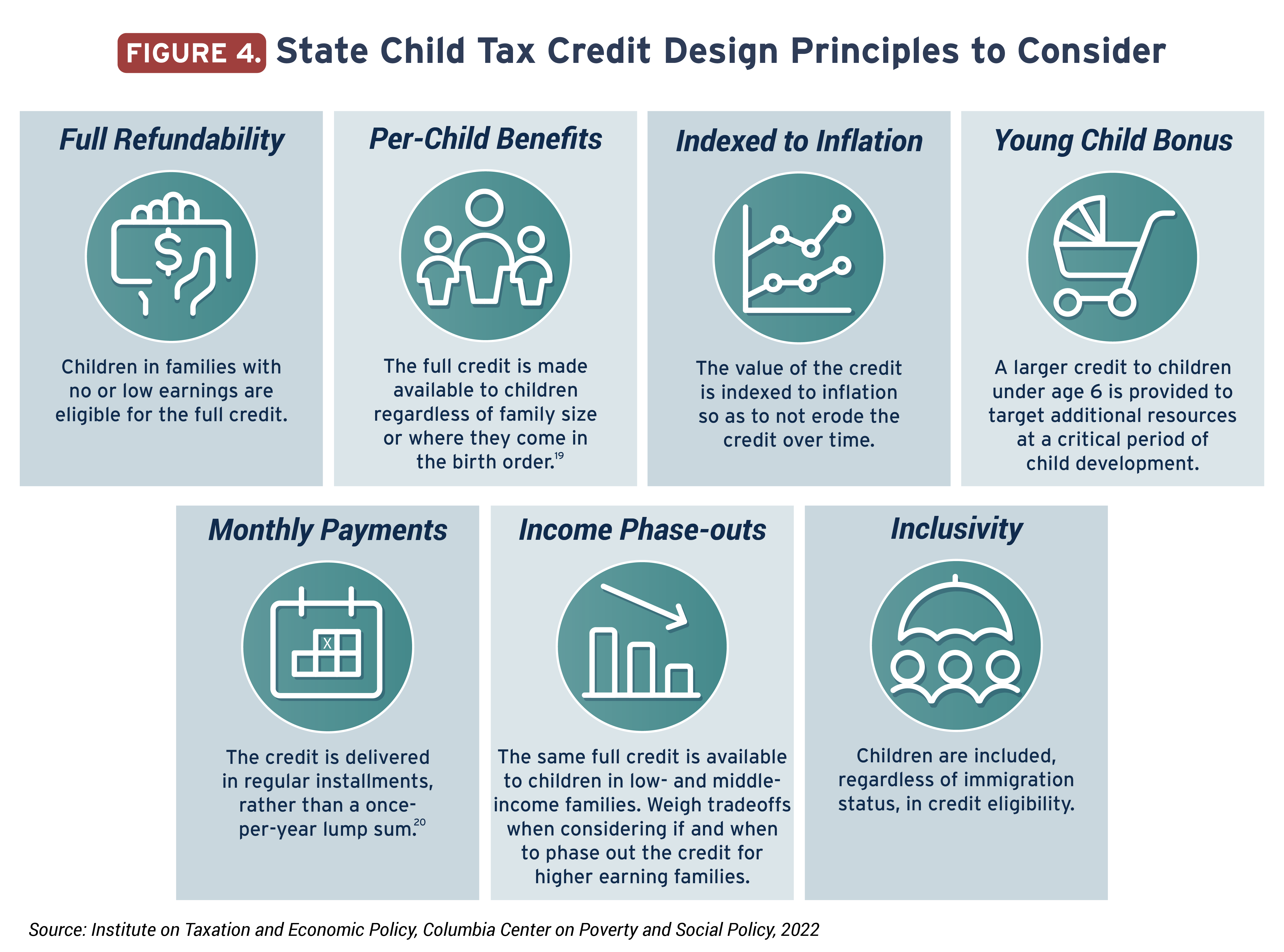

https://itep.sfo2.digitaloceanspaces.com/Figure-4-State-Child-Tax-Credit-Design-Principles-to-Consider.png

https://www.nerdwallet.com/article/taxes/qualify...

If you still need to file your 2023 tax return that was due April 15 2024 or is due Oct 15 2024 with a tax extension you can claim the child tax credit and the additional child

https://www.nerdwallet.com/article/taxes/child-and...

The child and dependent care credit can be claimed on tax returns filed in mid April You ll need to attach two forms to the standard Form 1040 Form 2441 and Schedule 3

Child And Dependent Care Expenses Credit 2023 2024

How Much Do You Get Back In Taxes For A Child 2023 Leia Aqui Will We

What Is The Amount Of The Child Tax Credit For 2023 Leia Aqui How

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

How Much Would A Child Tax Credit Be For A 2023 Leia Aqui What Is The

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

What Families Need To Know About The CTC In 2022 CLASP

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

Child Tax Credit For 2021 Will You Get More Velocity Retirement

Child Care Tax Credit 2023 Phase Out - You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit