Child Care Tax Rebate Limit Web 11 juin 2021 nbsp 0183 32 The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503

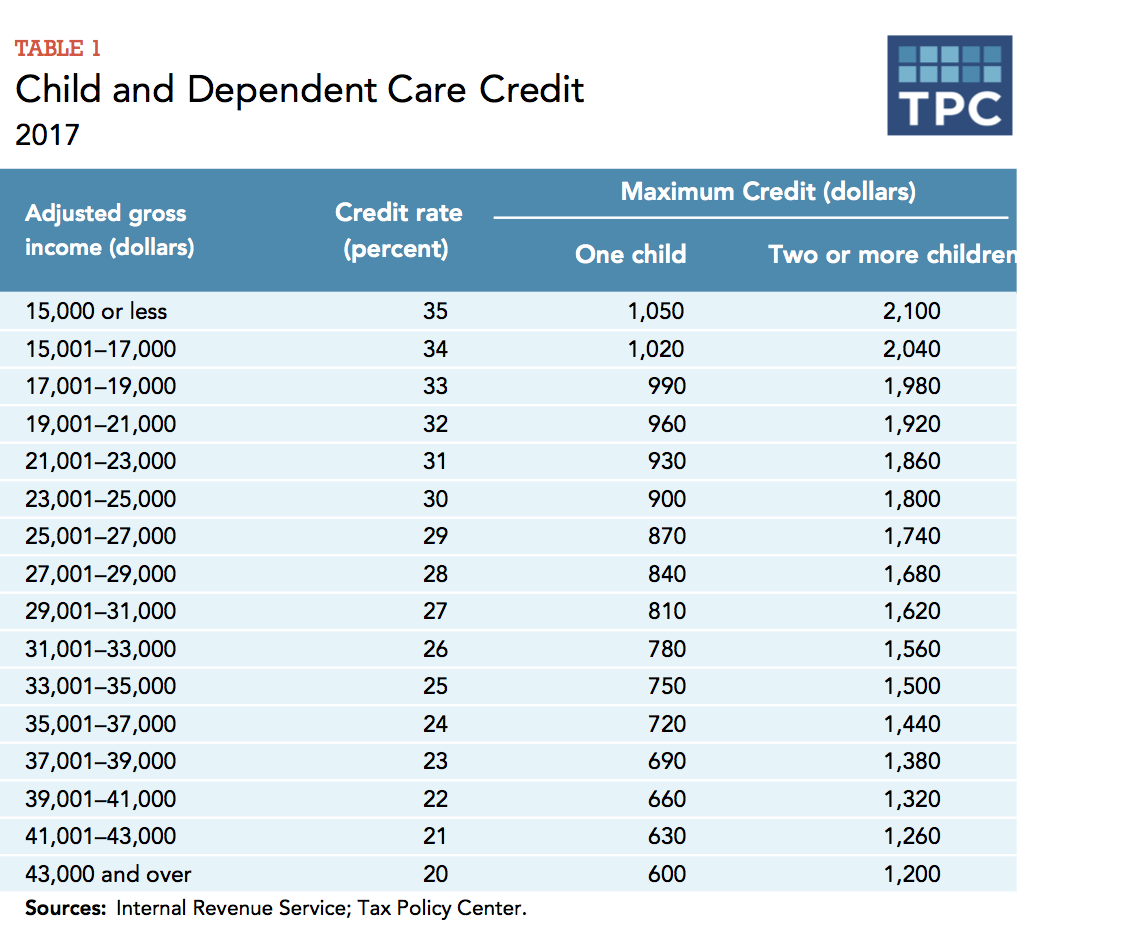

Web 24 f 233 vr 2022 nbsp 0183 32 This means you potentially could get a maximum credit of 4 000 for one child and 8 000 for two or more up from 1 050 and 2 100 respectively And Web 2 mars 2022 nbsp 0183 32 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit

Child Care Tax Rebate Limit

Child Care Tax Rebate Limit

https://i2.wp.com/www.promisethechildren.org/wp-content/uploads/child-care-tax-credit-1024x607.png

30 Child Care Tax Rebate 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/child-care-tax-rebate-payment-dates-2022-2022-carrebate.jpg?resize=840%2C473&ssl=1

Child Care Tax Credit Income Limit

https://i2.wp.com/templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-13.jpg

Web You can use the scheme to pay for up to 163 10 000 of childcare per child each year meaning you d pay up to 163 8 000 and would get up to an extra 163 2 000 per child each Web 17 ao 251 t 2023 nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married filing jointly or 200 000 or below all

Web 20 d 233 c 2022 nbsp 0183 32 Special alert for parents of children born in 2021 and for families who added a new dependent in 2021 Parents of a child born in 2021 who claim the child as a Web 12 f 233 vr 2022 nbsp 0183 32 In brief for the 2021 tax year you could get up to 4 000 back for one child and 8 000 back for care of two or more In prior years the maximum return for the

Download Child Care Tax Rebate Limit

More picture related to Child Care Tax Rebate Limit

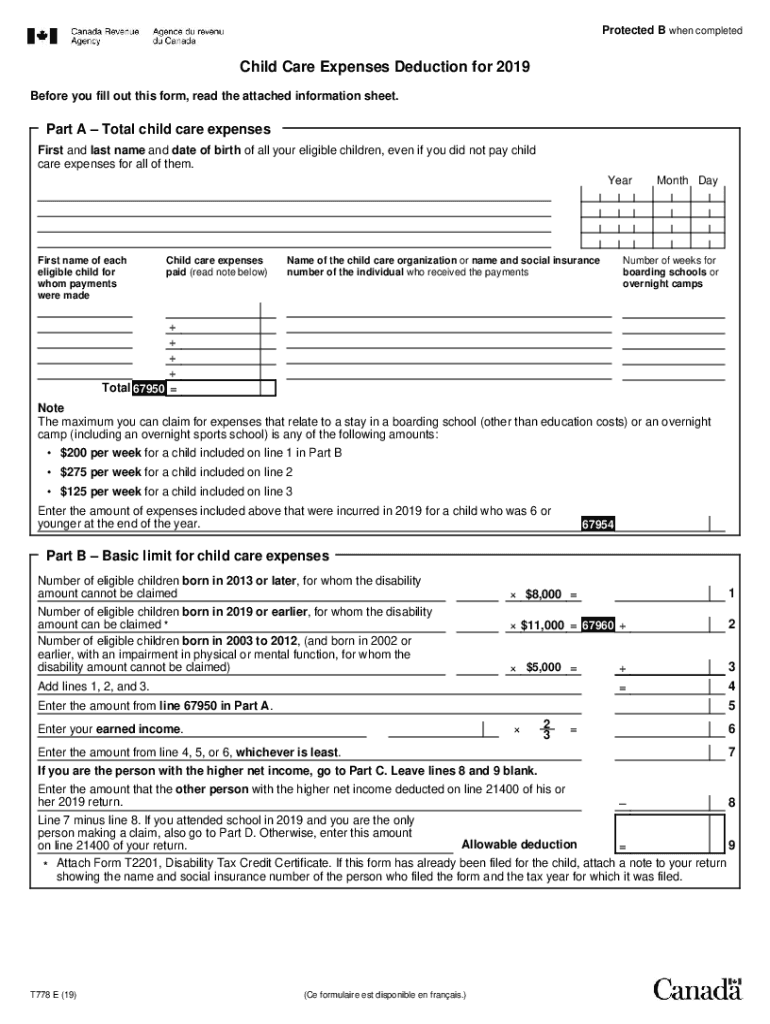

Child Care Rebate Tax Return 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/t778-fill-19e-pdf-clear-data-child-care-expenses-fill-out-and-sign.png

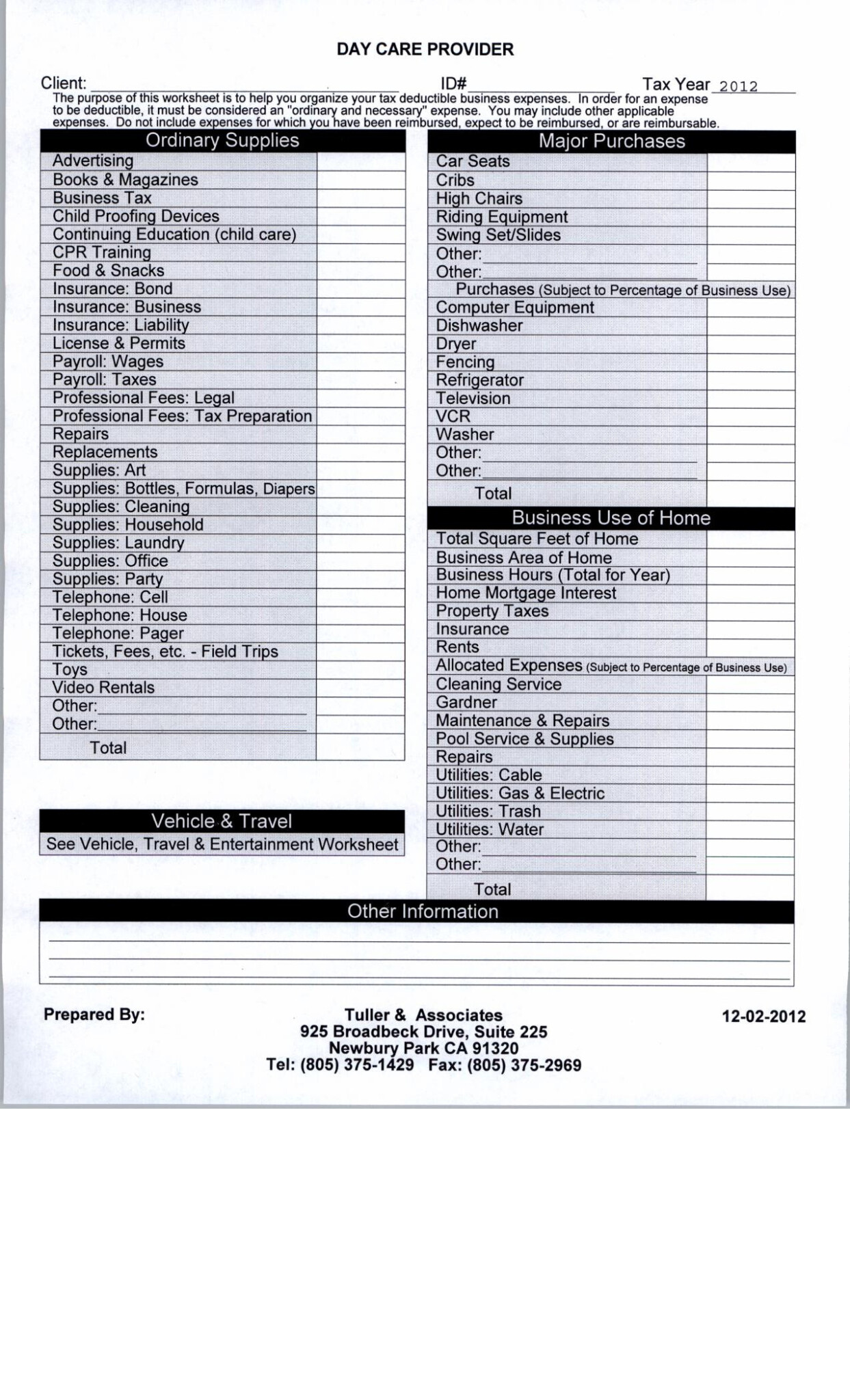

5 Best Photos Of Child Care Provider Tax Form Daycare Provider Tax Db

https://www.latestrebate.com/wp-content/uploads/2023/02/5-best-photos-of-child-care-provider-tax-form-daycare-provider-tax-db-1243x2048.jpg

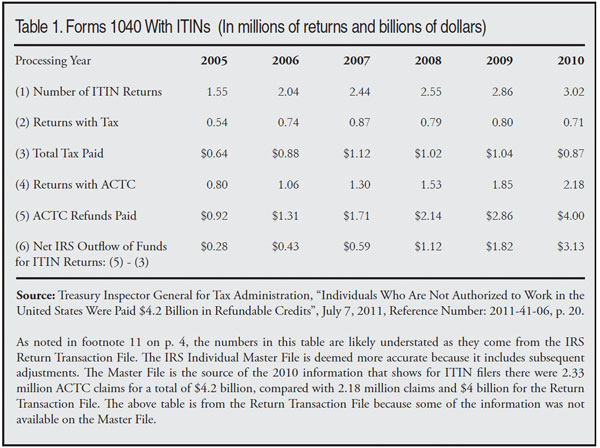

Child Care Tax Credit Fraud Number Review On Lifeproof Iphone 4 Case

http://2.bp.blogspot.com/-hi2Ye1fF-g0/T6x8AJjyD5I/AAAAAAAABek/8VaESZInlXM/s1600/child-tax-credits-2011-t1.jpg

Web Updated 18 July 2023 The Government s Tax Free Childcare scheme offers up to 163 2 000 a year per child towards childcare costs including nursery childminder and even some holiday camps But while 1 3 million Web Universal Credit and childcare You may be able to claim back up to 85 of your childcare costs if you re eligible for Universal Credit This guide is also available in Welsh Cymraeg

Web 13 janv 2022 nbsp 0183 32 For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from Web 5 d 233 c 2022 nbsp 0183 32 According to IRS Form 2441 the form used for the child care tax credit the credit itself is dependent on your income level but the vast majority of families should

Child Care Tax Credit 2022 Income Limit Bed Frames Ideas

https://i2.wp.com/www.cbpp.org/sites/default/files/styles/facebook_og_image/public/thumbnails/image/eitc-ctc-landing_landing.png?itok=NnuUkX9T

Child Tax Credits Calculator CALCULATORUK HJW

https://i2.wp.com/db-excel.com/wp-content/uploads/2019/09/23-latest-child-tax-credit-worksheets-calculators-froms-4.jpg

https://www.irs.gov/newsroom/child-and-dependent-care-credit-faqs

Web 11 juin 2021 nbsp 0183 32 The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503

https://www.cnbc.com/2022/02/24/your-2021-child-care-costs-could-mean...

Web 24 f 233 vr 2022 nbsp 0183 32 This means you potentially could get a maximum credit of 4 000 for one child and 8 000 for two or more up from 1 050 and 2 100 respectively And

Child Care Tax Credit Income Limit

Child Care Tax Credit 2022 Income Limit Bed Frames Ideas

Child Care Tax Credit Income Limit Paradox

Child Tax Credit 2020 Changes Canada Claiming The Child Tax Credit

Daycare Tax Statement Tuition Receipt Child Care Forms Daycare

Child Care Tax Credit 2020 Care World Zones

Child Care Tax Credit 2020 Care World Zones

Childcare Tax Rebate Google Docs

When Can I Claim Child Care Expenses

Does The Child And Dependent Care Credit Phase Out Completely Latest

Child Care Tax Rebate Limit - Web 17 ao 251 t 2023 nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married filing jointly or 200 000 or below all