Child Credit 2023 Uk 2023 to 2024 2022 to 2023 Income threshold 7 955 7 455 6 770 Withdrawal threshold rate 41 41 41 Threshold for those entitled to Child Tax Credit only 19 995 18 725

Child Tax Credit rates for the 2024 to 2025 tax year Moving to the UK from the EEA You must wait 3 months before claiming Child Tax Credit if you arrived in the UK from the EEA on or To get the maximum amount of child tax credit your annual income will need to be less than 19 995 in the 2024 25 tax year up from 18 725 in 2023 24 Child tax credit is gradually being replaced by Universal Credit so

Child Credit 2023 Uk

Child Credit 2023 Uk

https://conference.knowtex.pk/wp-content/uploads/2022/06/emblem.png

YMlabs 2023

https://501438041880-zoomcatalog-assets.s3.amazonaws.com/5995/1588f128ca8d4f469a4cec70792e6ed7/preview.jpg

Oppenheimer 2023

https://m.media-amazon.com/images/M/MV5BZWI2YWU2ODItYzBmNi00Yjc2LWJlMDQtMGJlMmUxM2M3NzMxXkEyXkFqcGdeQXVyMTUzMTg2ODkz._V1_.jpg

On 6 April 2024 it rose to 25 60 a week for the eldest or only child up from 24 16 95 a week for younger children up from 15 90 Child benefit is usually paid into a nominated bank For the 2024 25 tax year this is up to a maximum of 1 014 63 for one child or 1 739 37 for two or more This is compared with the 70 you could claim through the childcare costs element of Working Tax Credit To get the childcare costs element of Universal Credit you must be in paid work or

To get the payment you must have been entitled to a tax credit payment between 13 November and 12 December 2023 If you didn t get the last payment If you think you should have received a Cost of Living Payment you can report a missing payment on GOV UK If your child is disabled News UK Why has child tax credit been paid early and what does this mean for the next payment There are a string of payment dates that will change in 2023 Many people received their July

Download Child Credit 2023 Uk

More picture related to Child Credit 2023 Uk

Welcome 2023 Vector PNG Images Welcome 2023 Welcome 2023 Poster PNG

https://png.pngtree.com/png-clipart/20211205/original/pngtree-welcome-2023-png-image_6958923.png

Child Tax Credit 2023 What Is A Qualifying Child For The CTC YouTube

https://i.ytimg.com/vi/Ny_7qlykCcU/maxresdefault.jpg

Dossier 2023

https://www.bloom.be/uploads/images/Jaarhoroscoop.gif

If you re eligible you ll get 25 60 a week for your first child and 16 95 a week for any children after that You can claim Child Benefit if you re responsible for the child the child is under 16 years old or under 20 years old and still in education or training It doesn t matter if you work or have savings and investments Benefits Help on a low income Working and child tax credits Before you claim tax credits Check if you can get child tax credits This advice applies to England See advice for Northern Ireland Scotland Wales Universal Credit has replaced tax credits for

In the 2024 25 tax year you ll receive 25 60 a week for your eldest or only child and 16 95 for each additional child There is no upper limit to the number of children you can claim for Child Tax Credit is paid to help people with the costs of bringing up a child It is being replaced by Universal Credit so only some people can still claim Child Tax Credit Last reviewed 06 April 2024 Home page Get Support Information for your Situation How much Child Tax Credit will I get

2023 Emerging Leadership Conference

https://emergingconference.com/2023/wp-content/uploads/2021/09/logo.png

2023

https://www.nss.com.tw/wp-content/uploads/2023/01/shutterstock_296302727-scaled-1024x683.jpg

https://www.gov.uk/government/publications/rates...

2023 to 2024 2022 to 2023 Income threshold 7 955 7 455 6 770 Withdrawal threshold rate 41 41 41 Threshold for those entitled to Child Tax Credit only 19 995 18 725

https://www.gov.uk/child-tax-credit/new-claim

Child Tax Credit rates for the 2024 to 2025 tax year Moving to the UK from the EEA You must wait 3 months before claiming Child Tax Credit if you arrived in the UK from the EEA on or

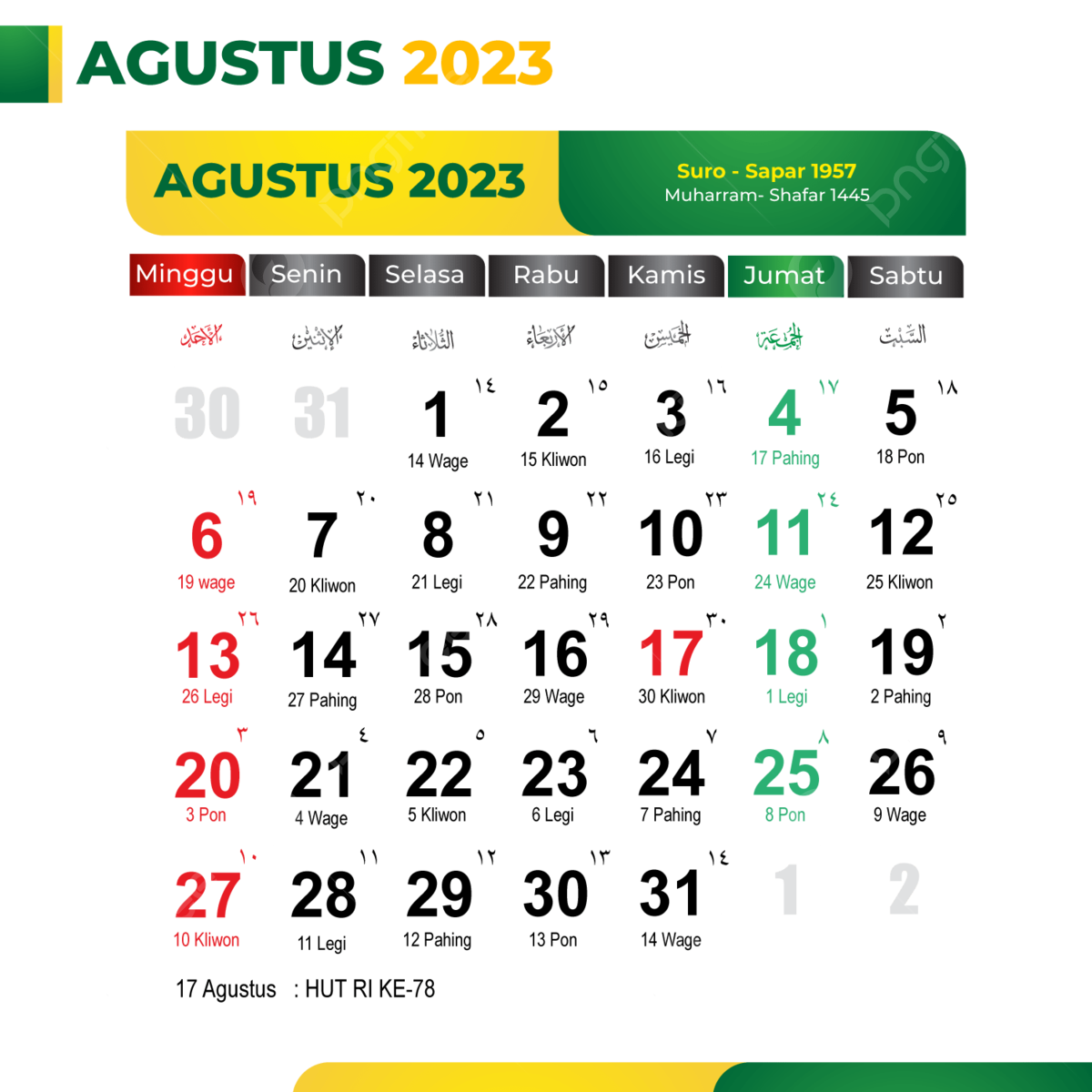

Kalender 2023 Agustus 2023 2023 2023

2023 Emerging Leadership Conference

Not Having A Credit Card Means You Have No Credit History

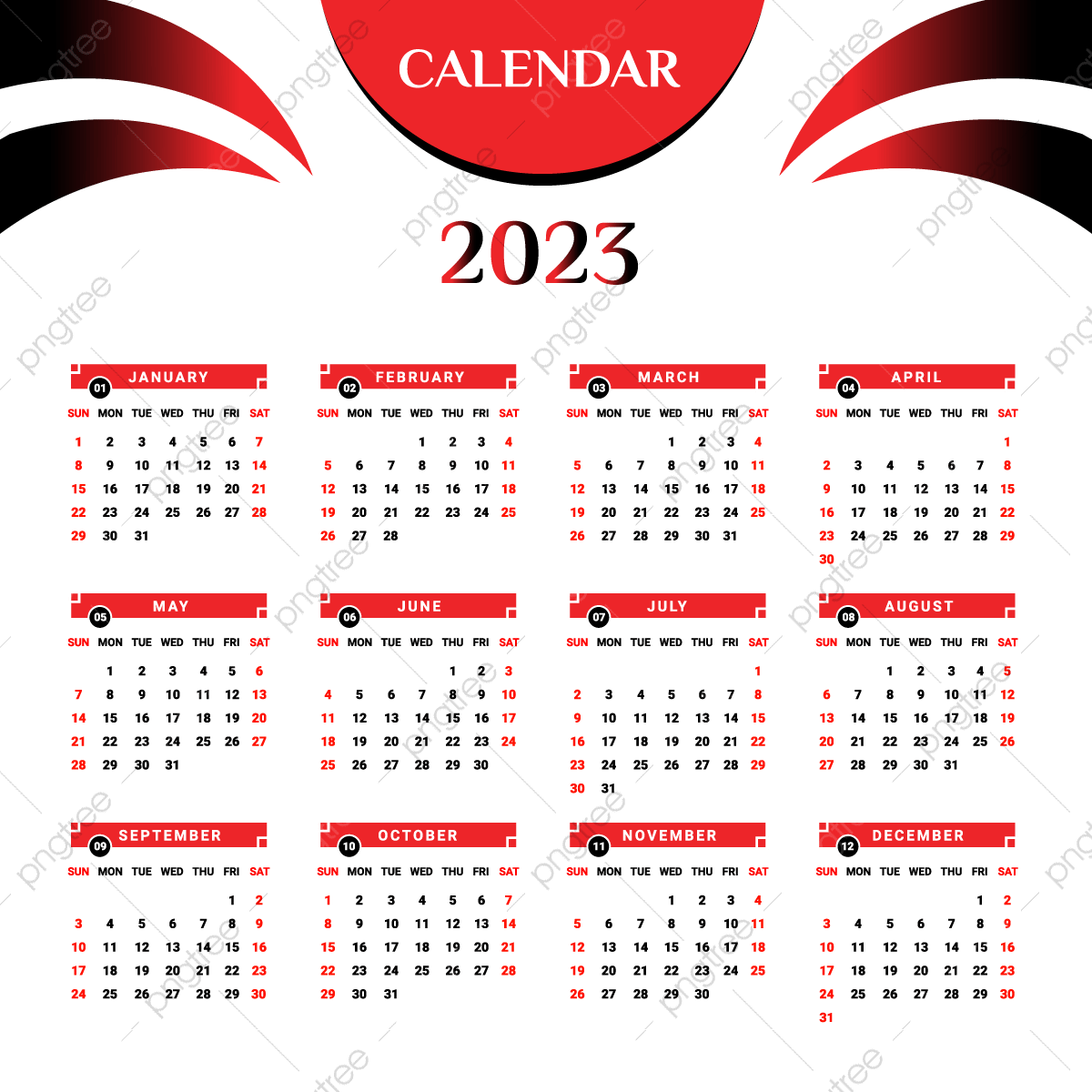

2023 Calendar Planner Vector Hd PNG Images 2023 Calendar With Black

Cadet Worlds In Nieuwpoort 2023

Vol 7 No 3 2023 Volume 7 Number 3 2023 International Journal

Vol 7 No 3 2023 Volume 7 Number 3 2023 International Journal

IPRC 2023

2023 8 2023 8 2023 8 PNG Pngtree

Buy X F mily 2023 X F mily 2022 2023 Monthly Planner With Exclusive

Child Credit 2023 Uk - On 6 April 2024 it rose to 25 60 a week for the eldest or only child up from 24 16 95 a week for younger children up from 15 90 Child benefit is usually paid into a nominated bank