Child Daycare Tax Return Information about Form 2441 Child and Dependent Care Expenses including recent updates related forms and instructions on how to file Form 2441 is used to by persons

Form 2441 Child and Dependent Care Expenses is an Internal Revenue Service IRS form used to report child and dependent care expenses on your tax return To enter your childcare expenses please refer below To Add a Childcare Provider in TurboTax Online 1 Go to Federal Taxes at the top of the screen 2

Child Daycare Tax Return

Child Daycare Tax Return

https://i.etsystatic.com/27501955/r/il/df84d7/3597285216/il_1080xN.3597285216_4adk.jpg

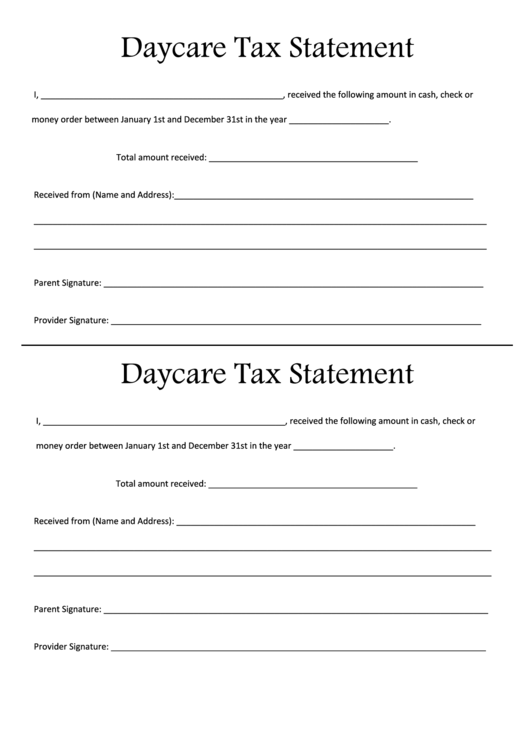

Home Office Deduction Worksheet 2021

https://i.pinimg.com/originals/ca/43/e0/ca43e0d9e04562c9fe549f7e609ef8b9.jpg

3 Daycare Tax Form For Parents FabTemplatez

http://www.fabtemplatez.com/wp-content/uploads/2017/12/daycare-tax-form-for-parents-93831-filing-your-tax-return-don-t-for-these-credits-deductions-daycare-tax-form-for-parents943728.jpg

The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503 You can get private day care allowance if you are the parent of a child the parent s spouse or partner or a legal guardian of the child your child is under school age and either

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to Early childhood education is for children aged 0 6 We offer early childhood education in daycare centres family daycare clubs and playgrounds

Download Child Daycare Tax Return

More picture related to Child Daycare Tax Return

Free Daycare Child Care Contract Template Word PDF EForms

https://i0.wp.com/eforms.com/images/2019/08/Daycare-Childcare-Agreement.png?fit=1600%2C2070&ssl=1

2023 Child Tax Credits Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-tax-credits-form-irs-d1.png

The Child Care Credit And Your US Expat Tax Return When Abroad

https://www.greenbacktaxservices.com/wp-content/uploads/2020/07/childcare-us-expat-tax-return.png

The IRS allows you to deduct certain childcare expenses on your 2023 and 2024 tax return If you paid for a babysitter a summer camp or any care provider for a While claiming daycare expenses toward a tax credit won t defray all the costs associated with child care it can help reduce them significantly This article will

If you re a parent or caretaker of young children disabled dependents or a disabled spouse listen up you may qualify for a special tax credit used for claiming child care To claim the credit taxpayers must complete Form 2441 a two page document that reports child and dependent care expenses as part of a federal income

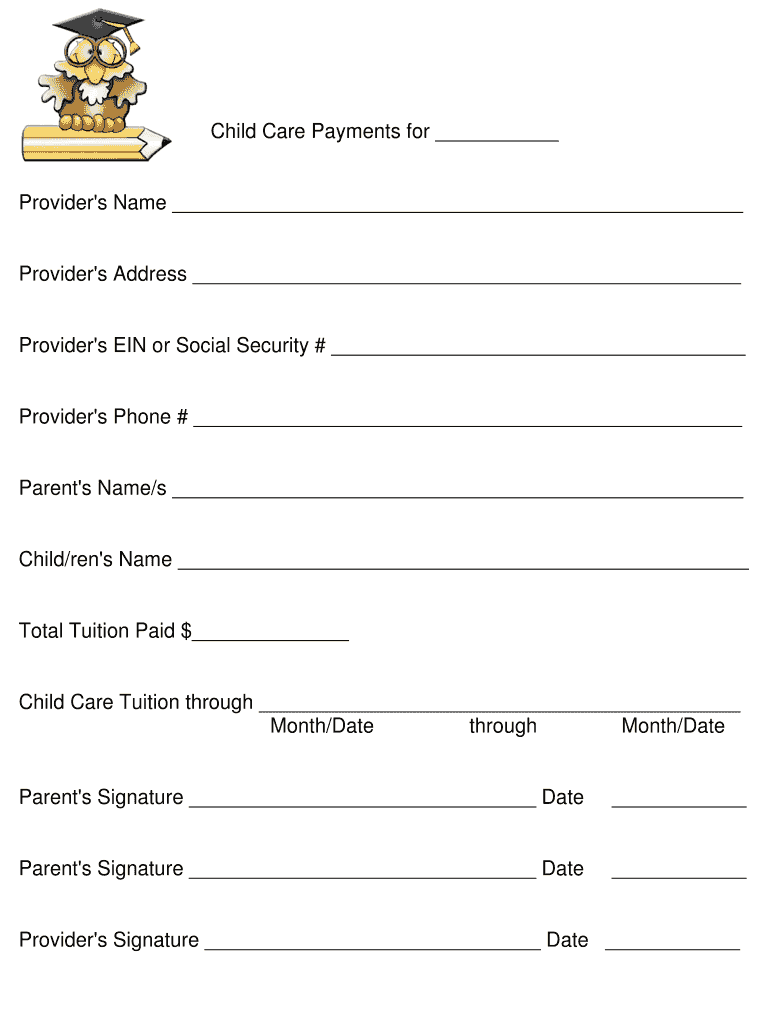

Child Care Year End Tax Statement PDF Form FormsPal

https://formspal.com/pdf-forms/other/child-care-year-end-tax-statement/child-care-year-end-tax-statement-preview.webp

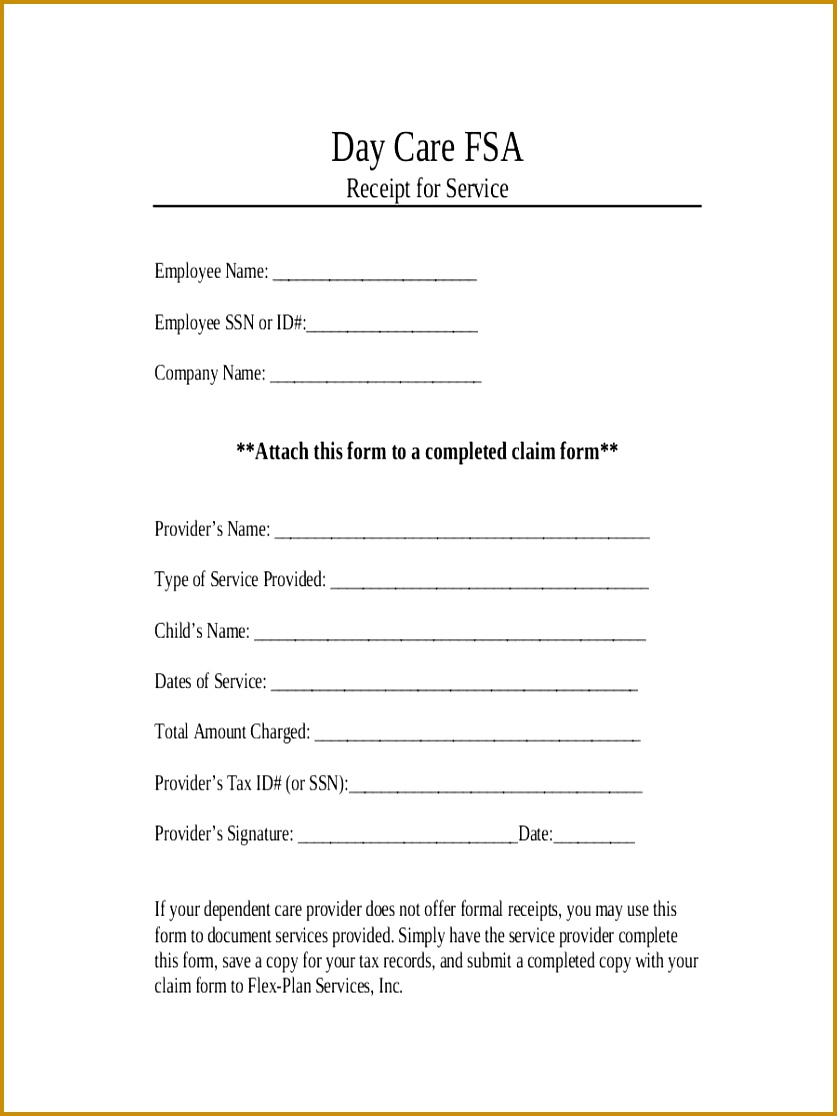

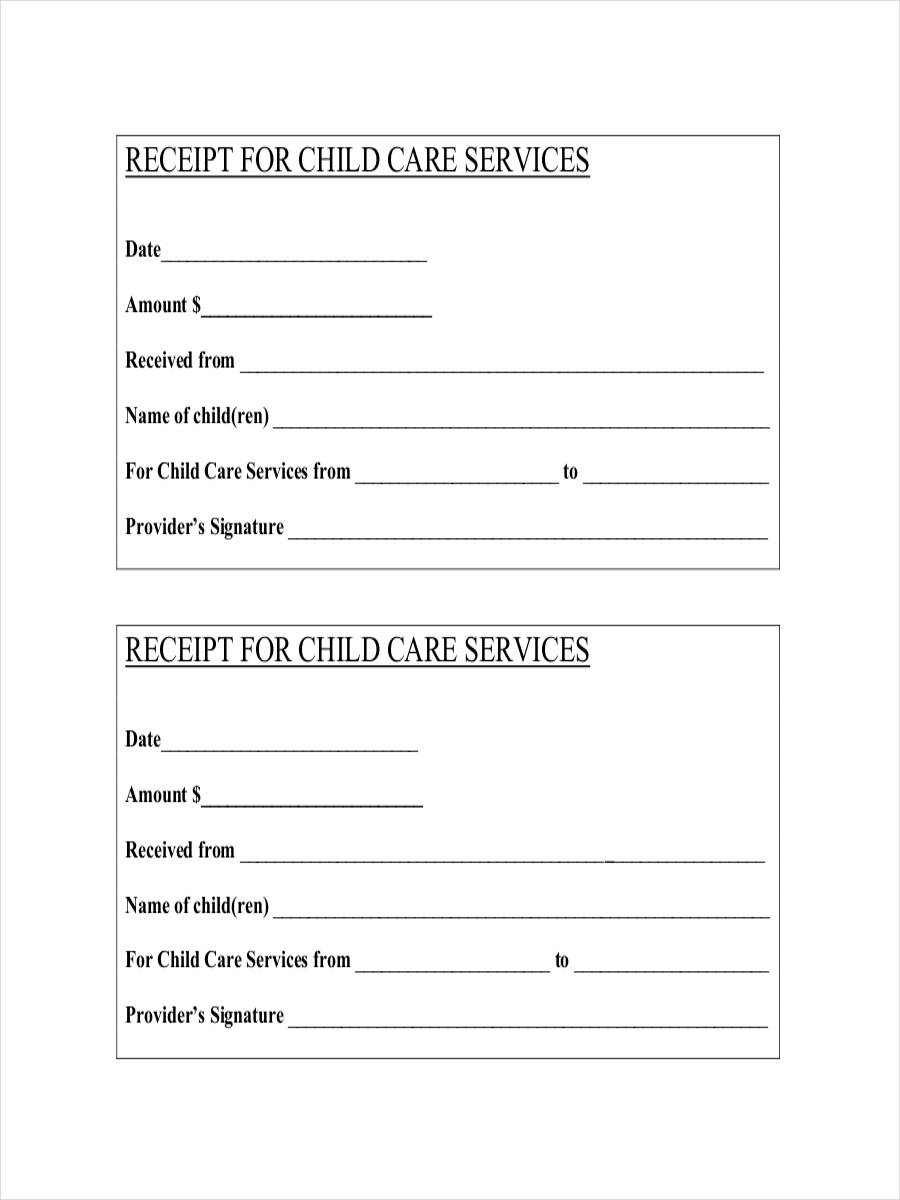

Daycare Tax Statement PDF Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/100/315/100315789/large.png

https://www.irs.gov/forms-pubs/about-form-2441

Information about Form 2441 Child and Dependent Care Expenses including recent updates related forms and instructions on how to file Form 2441 is used to by persons

https://www.investopedia.com/form-2441-child-and...

Form 2441 Child and Dependent Care Expenses is an Internal Revenue Service IRS form used to report child and dependent care expenses on your tax return

3 Daycare Tax Form For Parents FabTemplatez

Child Care Year End Tax Statement PDF Form FormsPal

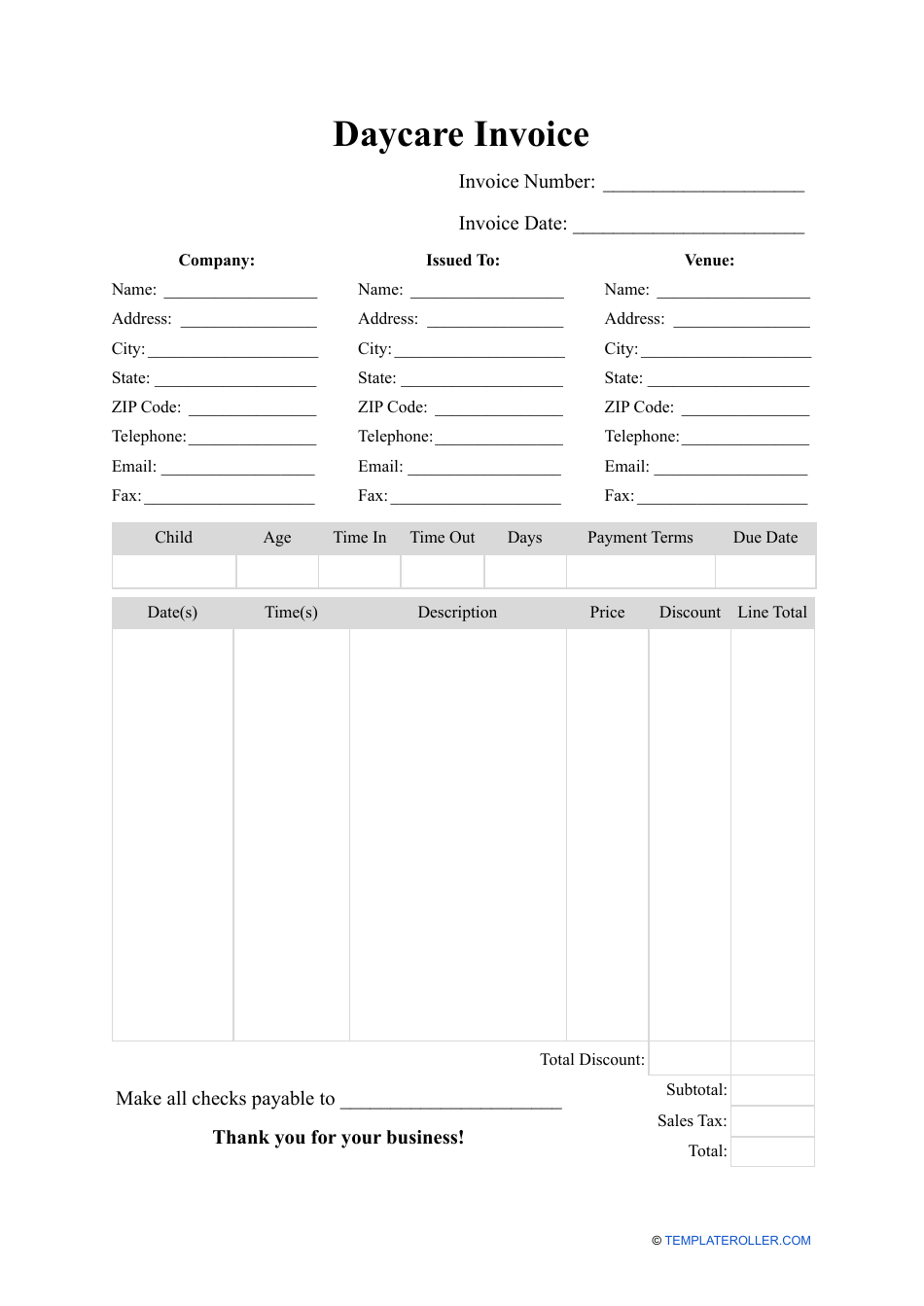

Free Printable Daycare Invoice Template

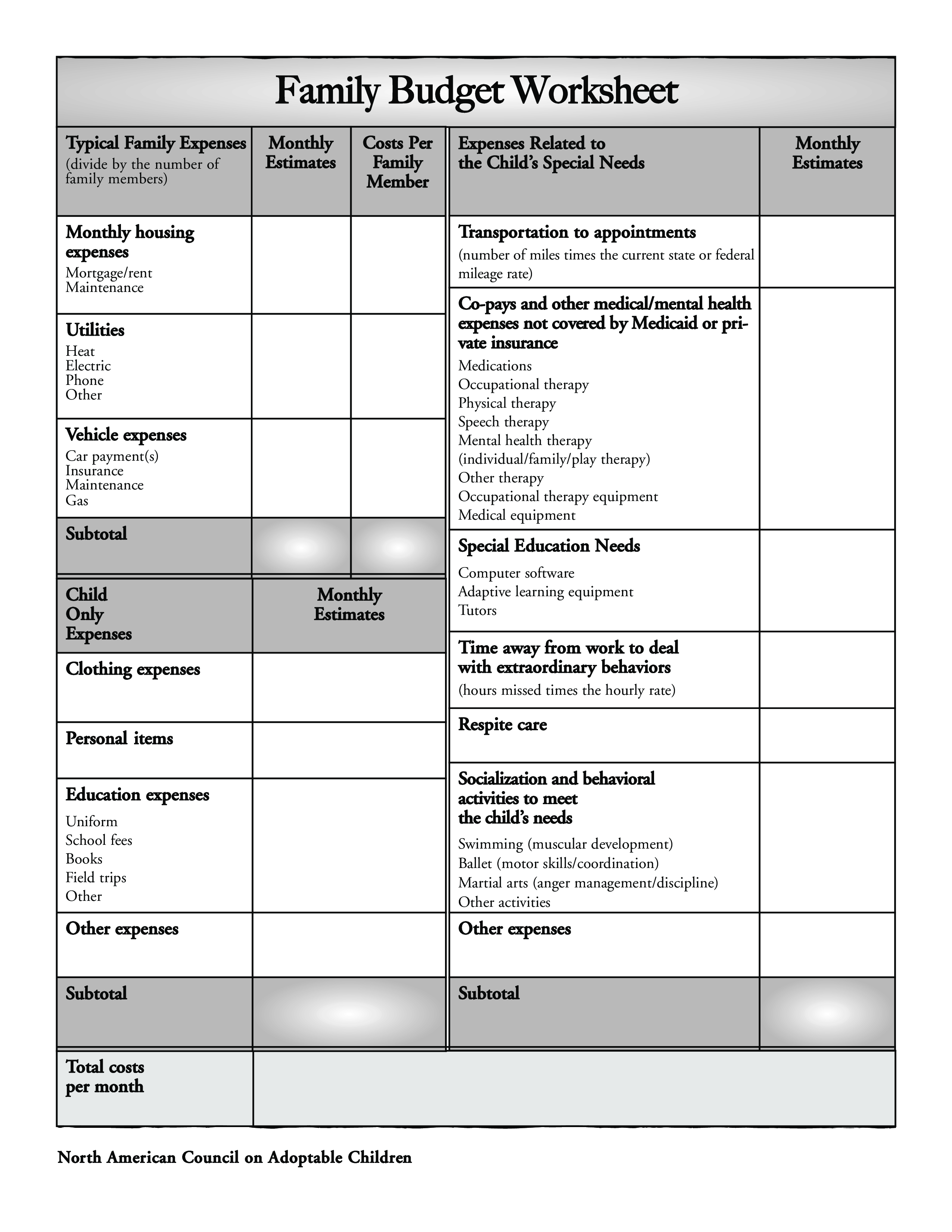

Daycare Budget Template

The BIG List Of Common Tax Deductions For Home Daycare Home Daycare

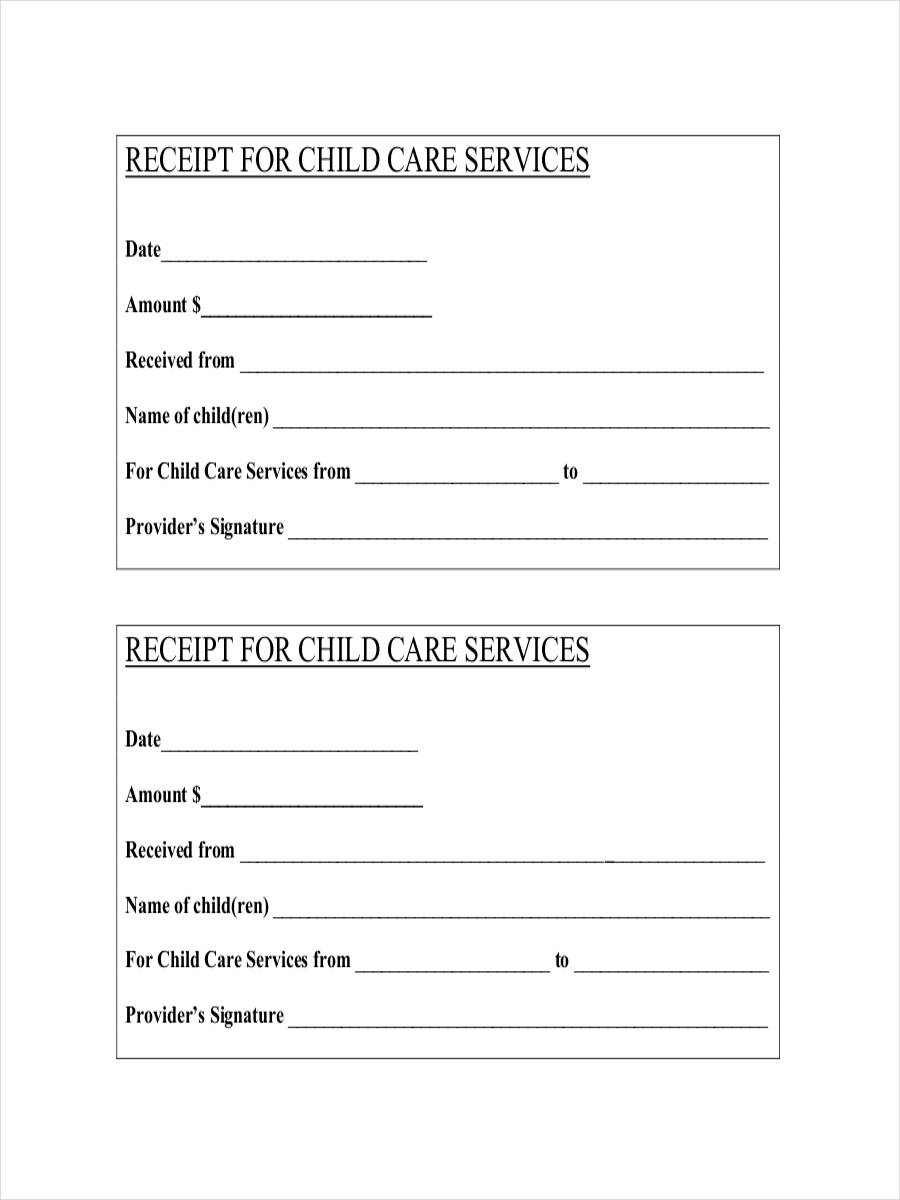

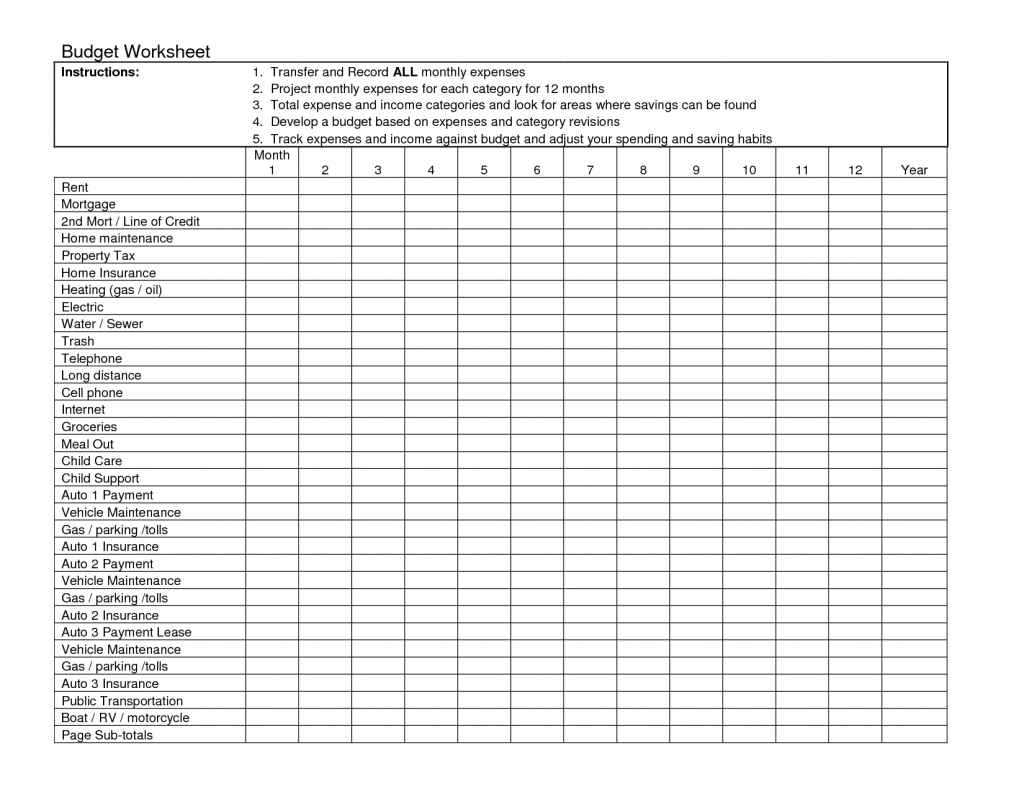

Daycare Receipt 9 Examples Format Pdf Examples

Daycare Receipt 9 Examples Format Pdf Examples

Top 7 Daycare Tax Form Templates Free To Download In PDF Format

Free Daycare Tax Form To Give To Parents

Family Day Care Tax Spreadsheet Pertaining To Child Care Receipt

Child Daycare Tax Return - Key Takeaways If you paid someone to care for a child who was under age 13 when the care was provided and whom you claim as a dependent on your tax return