Child Education Allowance Exemption In Income Tax Section As per Section 10 14 of the Income Tax Act 1961 special allowances are given to salaried individuals to cover their children s education and hostel expenses Children s

Most children education allowance exemptions are categorised under Section 80C of the IT Act The 7th Pay Commission provides several major boosts to such allowances and tax breaks Taxable Children education allowance Advisory Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct

Child Education Allowance Exemption In Income Tax Section

Child Education Allowance Exemption In Income Tax Section

https://life.futuregenerali.in/media/fa4hvorf/children-education-allowance.jpg

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

https://i.pinimg.com/originals/cd/bf/52/cdbf5266dd5ee6d50226e5e607a73e23.png

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

As per section 10 14 of Income tax children education allowance and Hostel Expenditure Allowance are eligible for deduction available to individuals employed in India Children Education Allowance Up to Rs 100 per month per child up Under Section 10 14 of the Indian Income Tax Act 1961 a certain amount is tax exempted for the purpose their children s education This permits Rs 100 exemption per child

Exemption Limit to claim Children s Education allowance The allowance is tax exempt up to 100 per child per month 1 200 annually per child For hostel expenditure an additional Is children education allowance taxable Yes the children education allowance is considered a taxable salary component Under the old tax regime CEA is tax exempt up to 100 per child per month for a maximum of

Download Child Education Allowance Exemption In Income Tax Section

More picture related to Child Education Allowance Exemption In Income Tax Section

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

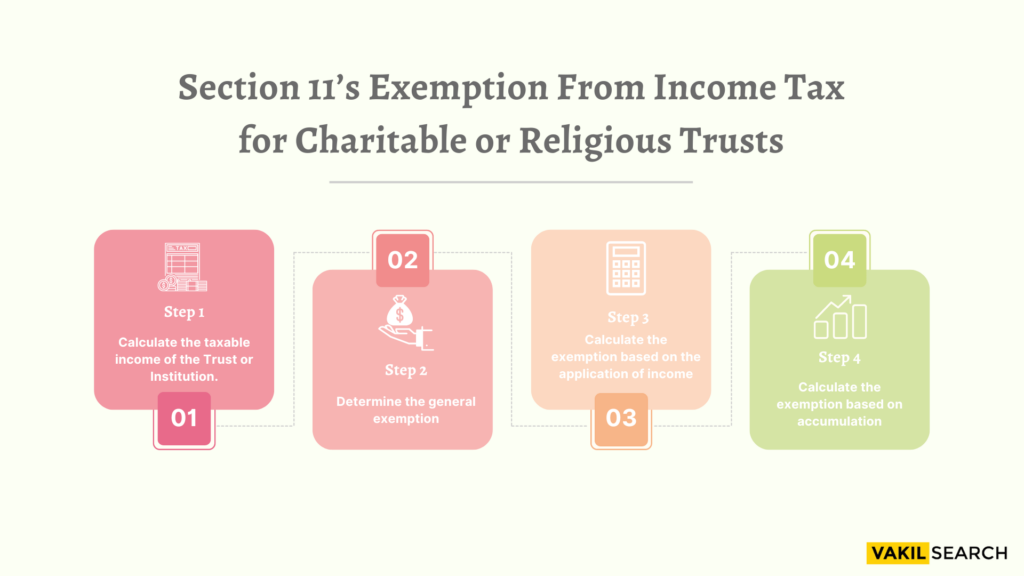

Section 11 Of Income Tax Act 1961 Exemption For Trusts

https://vakilsearch.com/blog/wp-content/uploads/2022/08/Section-11-Income-Tax-Act.png

If your employer provides you children education allowance as a part of your salary structure for the payment of education or tuition fee expenses of your children you can This tax benefit encompasses children s education allowance hostel expenditure allowance and deductions for tuition fees This article helps you understand the tax advantages available for children s education outlining

The limit under section 10 for child education allowance is Rs 100 per child per month So if you have 2 children you can claim deduction of Rs 2400 per year Further if you Section 10 14 w r t Rule 2BB 2 provide following exemption to individual employed in India Children Education Allowance 100 per month per child up to a maximum of

Section 11 Income Tax Act Exemptions For Charitable Trusts

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/08/SECTION-11S-INCOME-TAX-EXEMPTION-1024x576.png

Income Tax Response To Defective Notice 139 9 TAXCONCEPT

https://i0.wp.com/taxconcept.net/wp-content/uploads/2023/07/income-tax-rubber-stamp-income-tax-typographic-stamp_664675-794.jpg?fit=1080%2C900&ssl=1

https://tax2win.in › guide

As per Section 10 14 of the Income Tax Act 1961 special allowances are given to salaried individuals to cover their children s education and hostel expenses Children s

https://groww.in › tax › children-education-allowance

Most children education allowance exemptions are categorised under Section 80C of the IT Act The 7th Pay Commission provides several major boosts to such allowances and tax breaks

Income Tax Benefits And Deductions For Expenditure On Children

Section 11 Income Tax Act Exemptions For Charitable Trusts

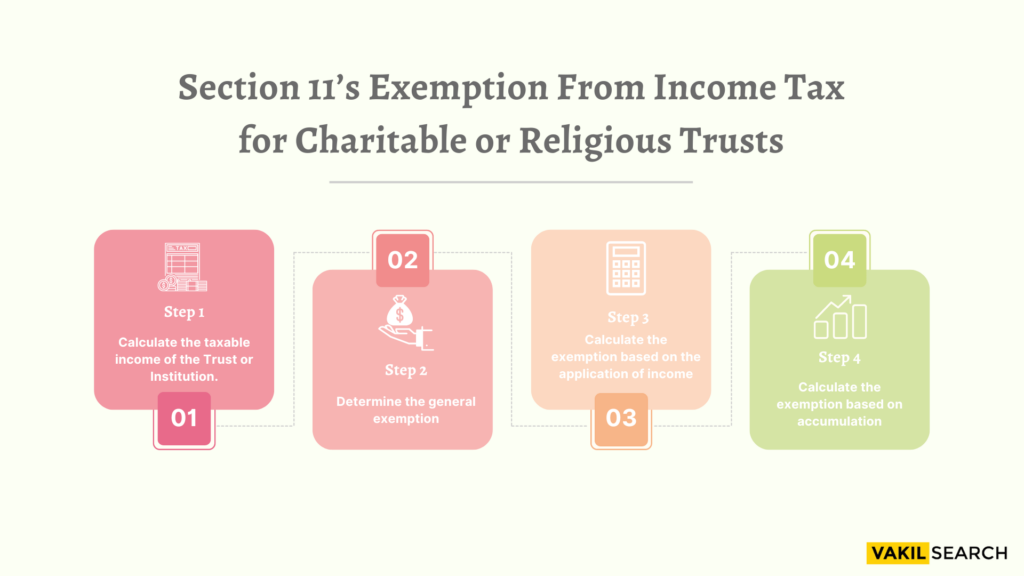

14 Individual Income Tax 14 INCOME TAX INDIVIDUAL Page 1 Of 18

HRA Exemption Calculator For Income Tax Benefits Calculation And

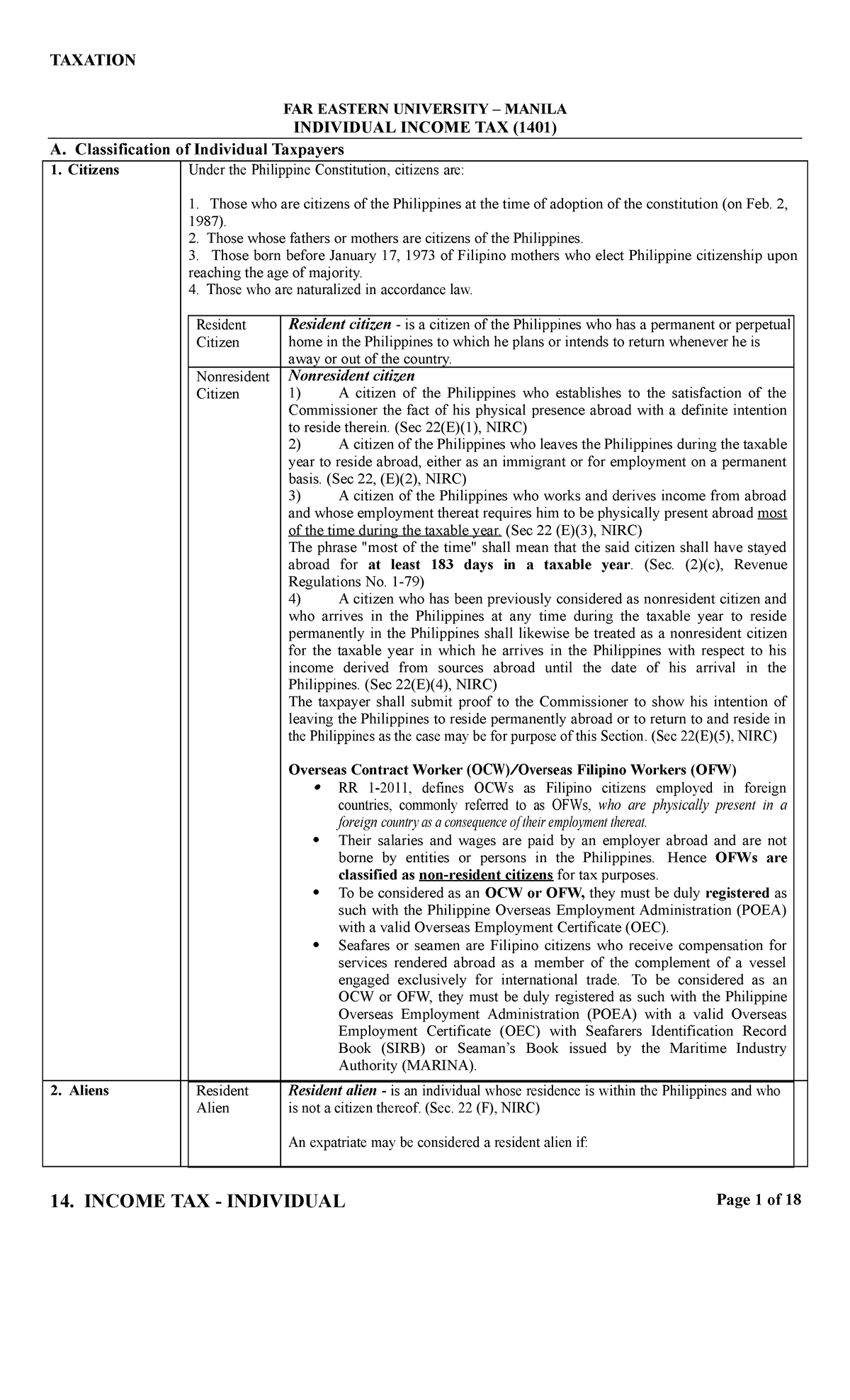

Income Tax Computation Format PDF A Comprehensive Guide

Taxability Of Income Under Salaries Section 15 Deep Gyan

Taxability Of Income Under Salaries Section 15 Deep Gyan

House Rent Receipt Format PDF Download

Section 10 5 Leave Travel Allowance Income Tax Exemption FinCalC Blog

Sample Letter Exemption Doc Template PdfFiller

Child Education Allowance Exemption In Income Tax Section - As per section 10 14 of Income tax children education allowance and Hostel Expenditure Allowance are eligible for deduction available to individuals employed in India Children Education Allowance Up to Rs 100 per month per child up