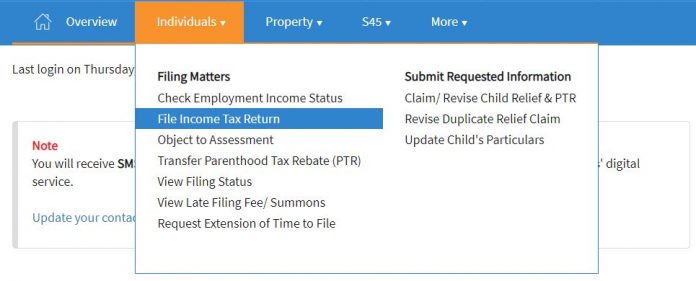

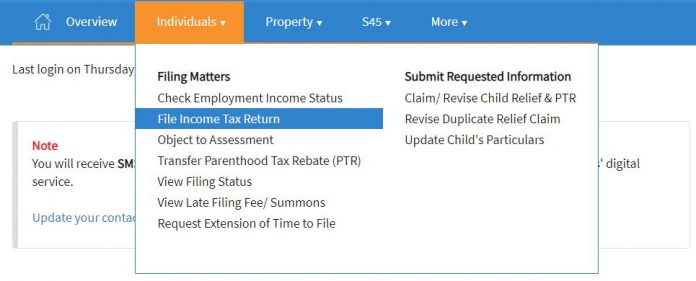

Child Parenthood Tax Rebate Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim

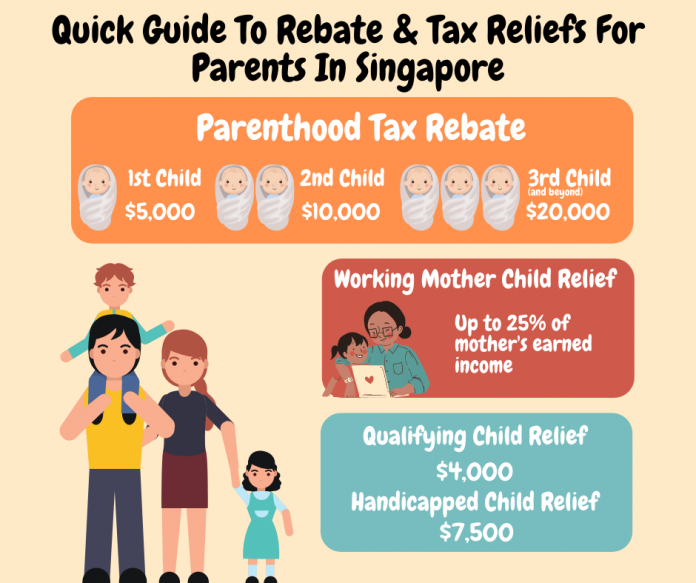

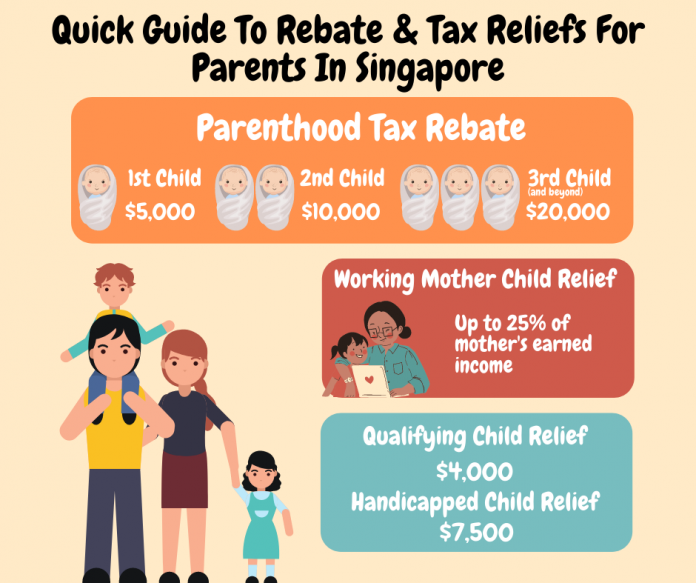

Web If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third and The Baby Bonus Scheme formerly known as Child Development Co Savings Scheme was first introduced in Singapore on 1 April 2001 The scheme is continuously enhanced since its inception till 2021 The objective is to improve the country s fertility rate by providing cash incentives with the hope of reducing the financial burden of raising children and thereby encouraging them to have more children The scheme consists of two components Cash Gift and Child Developme

Child Parenthood Tax Rebate

Child Parenthood Tax Rebate

https://www.raisingangels.sg/wp-content/uploads/2021/11/Untitled-design-7-1-696x583.png

Parenthood Tax Rebate Guide For Singapore Parents

https://www.raisingangels.sg/wp-content/uploads/2021/11/PTR2-696x281.jpg

Baby Bonus Parenthood Tax Rebate More Perks For Making Babies

https://cdn-blog.seedly.sg/wp-content/uploads/2022/09/27154053/Baby-Bonus-Parenthood-Tax-Rebate-More_-Perks-For-Making-Babies-1024x538.png

Web Check your Eligibility for Parenthood Tax Rebate PTR only applies to children born to the family adopted by family on or after 1 Jan 2008 Is your child a Singapore citizen at the Web How much money you save Families can deduct 4 000 per child under Qualifying Child Relief or 7 500 per child under Handicapped Child Relief Parents may claim one

Web When you share the QCR HCR with your spouse ex spouse the total claim amounts must not exceed 4 000 QCR and 7 500 HCR for each child Expand all Example 3 Web 3 f 233 vr 2022 nbsp 0183 32 If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 for your third

Download Child Parenthood Tax Rebate

More picture related to Child Parenthood Tax Rebate

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

https://financialhorse.com/wp-content/uploads/2022/01/posb-768x779.jpg

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Are YOU Eligible For The CT Child Tax Rebate

https://www.cthousegop.com/ackert/wp-content/uploads/sites/3/2022/06/Child-Tax-Rebate-July-2022.png

Web 2 mars 2016 nbsp 0183 32 If you are a new parent you will be entitled to 5 000 parenthood tax rebate for your first kid This rebate can be shared between parents and utilised slowly over the Web 27 avr 2018 nbsp 0183 32 The Parenthood Tax Rebate PTR allows married divorced or widowed tax resident parents to claim rebates of up to SGD 20 000 per child To qualify for the PTR a number of conditions will

Web Total Child Tax Credit increased to 9 000 from 6 000 thanks to the American Rescue Plan 3 000 for each child over age 6 Receives 4 500 in 6 monthly installments of Web 23 f 233 vr 2022 nbsp 0183 32 Tips for parents who share custody or alternate tax benefits Some parents who have a legal agreement with their child s other parent about who claims the child

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Gov Lamont Child Tax Rebate Checks Will Start Going Out Next Week

https://gray-wfsb-prod.cdn.arcpublishing.com/resizer/gKQ2psaELuOBCeaQ8VxbmEjmLAI=/800x450/smart/filters:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

https://financialhorse.com/wp-content/uploads/2022/01/maternity-leave-1024x708.jpg

https://www.iras.gov.sg/.../tax-reliefs/parenthood-tax-rebate-(ptr)

Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim

https://www.madeforfamilies.gov.sg/.../tax-relief-and-rebates

Web If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third and

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Gov Lamont Child Tax Rebate Checks Will Start Going Out Next Week

Parenthood Tax Rebate Guide For Singapore Parents

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

All About The Parenthood Tax Rebate In Singapore

All About The Parenthood Tax Rebate In Singapore

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

IRAS Parenthood Tax Rebate PTR Can Be Shared Between Facebook

Child Parenthood Tax Rebate - Web 17 f 233 vr 2023 nbsp 0183 32 The Working Mother s Child Relief WMCR is an income tax relief that working mothers can qualify for if their child is a Singapore Citizen Unlike the