Child Rebate Credit 2023 Status Step 1 See if you qualify using the Child Tax Credit Eligibility Assistant Step 2 If you don t normally file a return register with the IRS using the Non filer Sign up Tool Alternatively file a return with the IRS Step 3 Check the status of your monthly payments and update your information using the Child Tax Credit Update Portal

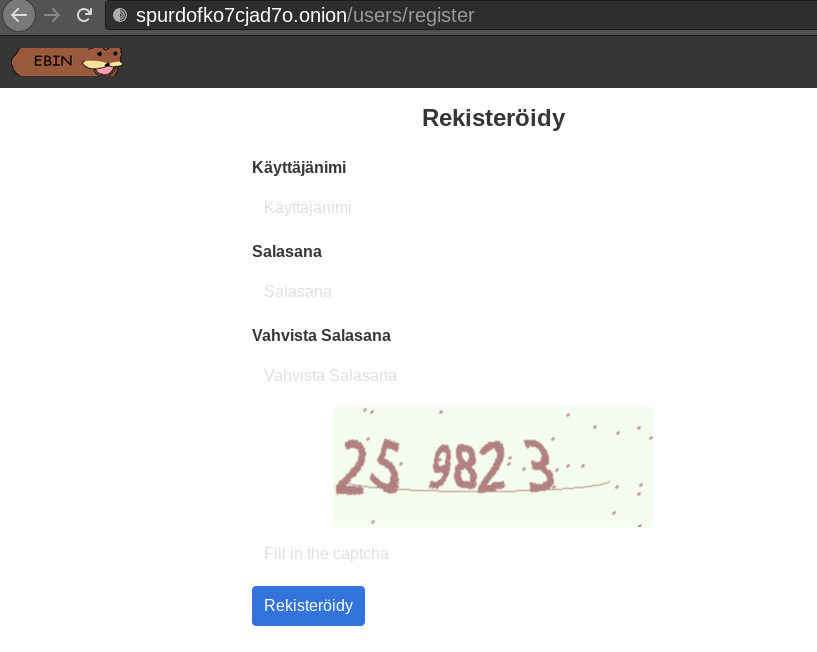

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit Right now unless Congress makes last minute changes the 2023 child tax credit is worth up to 2 000 per qualifying child However the credit is not fully refundable which means that

Child Rebate Credit 2023 Status

Child Rebate Credit 2023 Status

https://phantom-marca.unidadeditorial.es/82fa9a205c3d3ddbfe7321efc3932dfd/resize/1200/f/jpg/assets/multimedia/imagenes/2022/08/04/16596201266658.jpg

Spurdomarket Suomi Finnish Darknet Market

https://darknetpages.com/wp-content/uploads/2021/04/spurdomarket_login_page.png

Maryland Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Maryland-Renters-Rebate-2023-768x684.png

ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024 The amount of your Child Tax Credit will be reduced if your adjusted gross income exceeds 400 000 if married filing jointly or The Arizona Department of Revenue has launched a site that contains resources on how to check your eligibility and rebate status and file a claim or update your mailing address Please be sure to check familyrebate aztaxes gov for the latest news and updates as more information becomes available

The American Rescue Plan increased the amount of the Child Tax Credit from 2 000 to 3 600 for qualifying children under age 6 and 3 000 for other qualifying children under age 18 The credit was made fully refundable The IRS urges families to use a special online tool available only on IRS gov to help them determine whether they qualify for the child tax credit and the special monthly advance payments beginning July 15

Download Child Rebate Credit 2023 Status

More picture related to Child Rebate Credit 2023 Status

Governor Lamont Announces Families Can Apply For The 2022 Connecticut

https://danielalbertlaw.com/wp-content/uploads/2022/07/wp-header-logo-150-980x580.png

Menards 5879 Printable Rebate Forms RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/menards-5879-printable-rebate-forms.jpg?resize=1024%2C876&ssl=1

Recovery Rebate Credit Calculator EireneIgnacy

https://i0.wp.com/msofficegeek.com/wp-content/uploads/2022/03/Child-Tax-Credit-Calculator-2021.png?fit=752%2C432&ssl=1

Taxpayers can claim the 2024 child tax credit on the tax return they will file in 2025 If you still need to file your 2023 tax return that was due April 15 2024 or is due Oct 15 2024 with a Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit

2023 Arizona Families Tax Rebate You can use this page to check your rebate status update your rebate address or to make a claim for your rebate Instructions Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required Enacted in 1997 the credit currently provides up to 2 000 per child to about 40 million families every year The American Rescue Plan made historic expansions to the Child Tax Credit

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Menards Rebate Form For 2022 RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/menards-rebate-form-for-2022.png?w=1024&ssl=1

https://www.irs.gov/newsroom/child-tax-credit-most...

Step 1 See if you qualify using the Child Tax Credit Eligibility Assistant Step 2 If you don t normally file a return register with the IRS using the Non filer Sign up Tool Alternatively file a return with the IRS Step 3 Check the status of your monthly payments and update your information using the Child Tax Credit Update Portal

https://finance.yahoo.com/personal-finance/child...

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

Bravecto Online Rebate 2022 Rebate2022 Recovery Rebate

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

What Is A Recovery Rebate Credit 2023 Rebate2022

If The Income On The Return Is Over The Applicable Phase out

Chase sapphire reserve travel credit subway Lattes Runways

Chase sapphire reserve travel credit subway Lattes Runways

Innovative Saliva Based Glucose Sensor To Revolutionize Diabetes Monitoring

Murder Victim Mourned At Multi site Vigil The Carillon

Happy Makar Sankranti 2023 Status Video Download

Child Rebate Credit 2023 Status - Continues the child tax credit of 3 600 a year for children 6 or younger Expands the credit to 3 000 a year for children ages 6 to 17 Allows families to receive the credit every month