Child Tax Credit 2022 Refundable Or Nonrefundable The Child Tax Credit helps families with qualifying children get a tax break You may be able to claim the credit even if you don t normally file a tax return Who qualifies You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States

For 2022 the maximum nonrefundable Child Tax Credit equals 2 000 multiplied by the number of QCs This amount is combined with the taxpayer s credit for other dependents OD before determining if any What is the child tax credit The child tax credit is a nonrefundable credit that allows taxpayers to claim a tax credit of up to 2 000 per qualifying child which reduces their tax liability What do I need

Child Tax Credit 2022 Refundable Or Nonrefundable

Child Tax Credit 2022 Refundable Or Nonrefundable

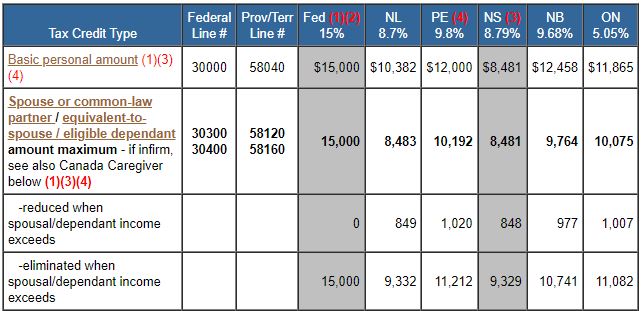

https://www.taxtips.ca/nrcredits/2023-personal-tax-credits.jpg

How Much Per Child Tax Credit 2022 A2022b

https://i2.wp.com/www.the-sun.com/wp-content/uploads/sites/6/2021/12/MP-CHILD-TAX-CREDIT-REG-COMP.jpg?strip=all&quality=100&w=1200&h=800&crop=1

Child Tax Credits Ending In 2022 Dailynationtoday

https://www.the-sun.com/wp-content/uploads/sites/6/2022/01/EP_CTC_END_2022_COMP-1.jpg

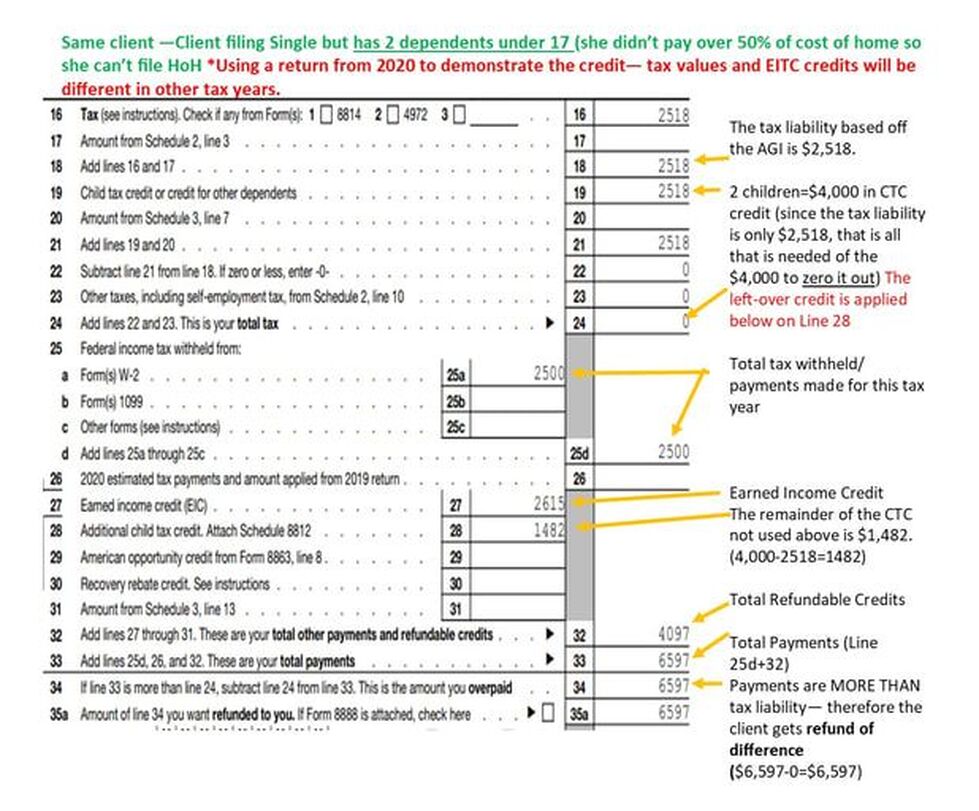

For tax year 2021 the Child Tax Credit is increased from 2 000 per qualifying child to 3 000 for each qualifying child age 6 through 17 at the end of 2021 Note The 500 nonrefundable Credit for Other Dependents amount has not changed Under the rules for 2022 The maximum credit per qualifying child is up to 2 000 Up to 1 400 of the credit is refundable per qualifying child as the Additional Child Tax Credit ACTC meaning that if the credit brings the tax liability to zero taxpayers can receive a refund of the remaining amount up to 1 400 per child

The Child Tax Credit is a nonrefundable credit This means if your tax liability is 0 you will not receive this credit because there is no tax to reduce However you may receive an additional child tax credit calculated on Schedule 8812 Additional Child Tax Credit and reported on Line 28 of IRS Form 1040 U S Individual Income Tax Return The credit is reduced by 5 percent of adjusted gross income over 200 000 for single parents 400 000 for married couples If the credit exceeds taxes owed taxpayers can receive up to 1 600 of the balance as a refund known as the additional

Download Child Tax Credit 2022 Refundable Or Nonrefundable

More picture related to Child Tax Credit 2022 Refundable Or Nonrefundable

Refundable V Non refundable Tax Credits What s The Difference YouTube

https://i.ytimg.com/vi/38DAHVg252Q/maxresdefault.jpg

The Proposed 2022 Child Tax Credit How Will The Changes Affect You

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-6863513-1920w.jpeg

Tax Season 2022 What To Know About Child Credit And Stimulus Payments

https://static01.nyt.com/images/2022/01/08/business/07Adviser-illo/07Adviser-illo-videoSixteenByNineJumbo1600-v2.png

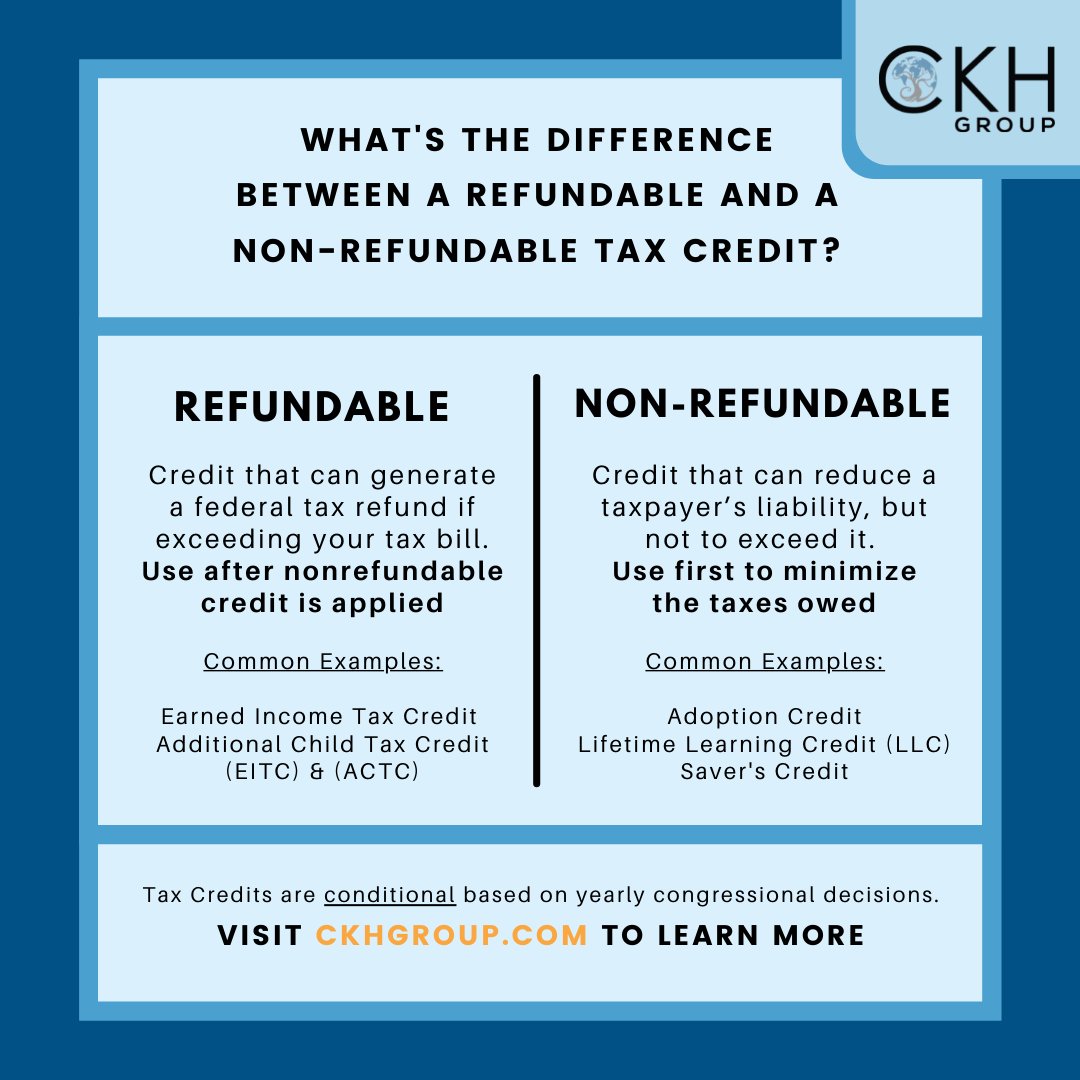

The child tax credit provides up to 2 000 per child with a partial refund of up to 1 500 in 2022 To qualify the child must have lived with the taxpayer for at least half the year and received at least half their support from the taxpayer Refundable tax credit vs Nonrefundable tax credit Refundable Tax Credit A refundable tax credit allows taxpayers to lower their tax liability to below zero When this occurs the government owes the taxpayer a refund The additional child tax credit is a refundable tax credit

The United States federal child tax credit CTC is a partially refundable a tax credit for parents with dependent children It provides 2 000 in tax relief per qualifying child with up to 1 600 of that refundable subject to a refundability threshold phase in and phase out b Let s say you are eligible for the Child Tax Credit for 1 000 but only owe 200 in taxes The additional amount 800 is treated as a refund A nonrefundable tax credit means you get a refund only up to the amount you owe

List Of 4 Refundable Tax Credits For Tax Year 2022 2023 Internal

https://www.irstaxapp.com/wp-content/uploads/2023/01/refundable-tax-credits.png

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

https://pbs.twimg.com/media/FMICWgDXsAYhCqs.jpg

https://www.irs.gov › credits-deductions › individuals › child-tax-credit

The Child Tax Credit helps families with qualifying children get a tax break You may be able to claim the credit even if you don t normally file a tax return Who qualifies You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States

https://www.irs.gov › pub › irs-soi

For 2022 the maximum nonrefundable Child Tax Credit equals 2 000 multiplied by the number of QCs This amount is combined with the taxpayer s credit for other dependents OD before determining if any

Refundable Vs Nonrefundable Tax Credits Experian

List Of 4 Refundable Tax Credits For Tax Year 2022 2023 Internal

2022 Child Tax Credit Refundable Amount Latest News Update

Refundable Credits

Will We Get The Extra Child Tax Credit In January 2023 Leia Aqui What

The 2021 Child Tax Credit An Overview Letitia Berbaum

The 2021 Child Tax Credit An Overview Letitia Berbaum

11 MMajor Tax Changes For 2022 Pearson Co CPAs

New Child Tax Credit Changes For 2018 H R Block

Enhanced Child Tax Credit 2022

Child Tax Credit 2022 Refundable Or Nonrefundable - The credit is reduced by 5 percent of adjusted gross income over 200 000 for single parents 400 000 for married couples If the credit exceeds taxes owed taxpayers can receive up to 1 600 of the balance as a refund known as the additional