Child Tax Credit 2023 Schedule Verkko 2 marrask 2023 nbsp 0183 32 English Use Schedule 8812 Form 1040 to figure your child tax credits to report advance child tax credit payments you received in 2021 and to figure any additional tax owed if you received excess advance child tax credit payments during 2021 Current Revision Schedule 8812 Form 1040 PDF

Verkko 27 kes 228 k 2023 nbsp 0183 32 Monthly installments of this tax credit were sent by mail or direct deposit to eligible taxpayers from July until December The monthly payments varied but tax payers received a maximum credit of 3 000 per eligible child ages 6 to 17 annually and up to 3 600 for children under age 6 annually Verkko 24 elok 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

Child Tax Credit 2023 Schedule

Child Tax Credit 2023 Schedule

https://miro.medium.com/v2/resize:fit:1200/1*KsfOocLtQfEdOBFic2MiOw.png

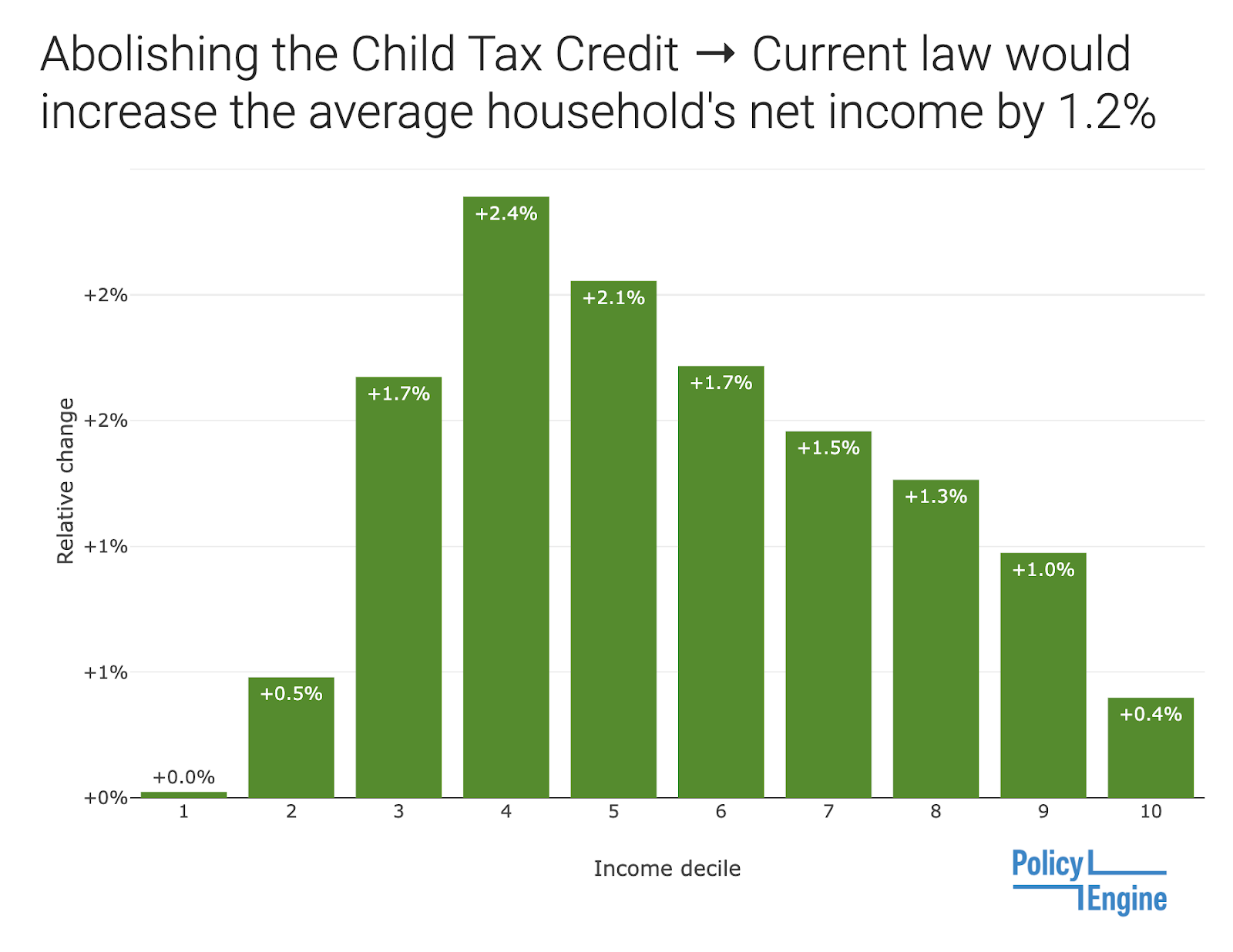

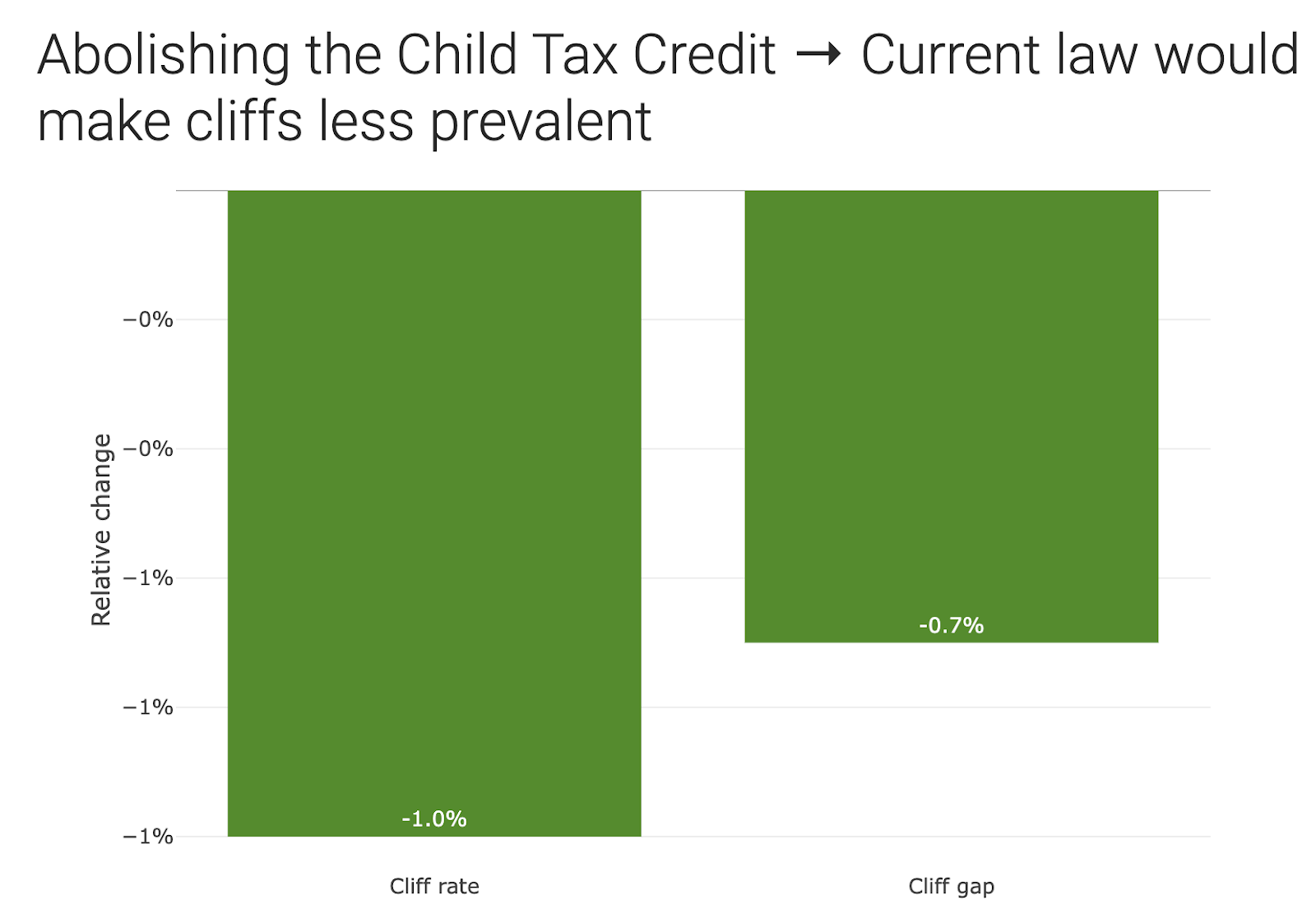

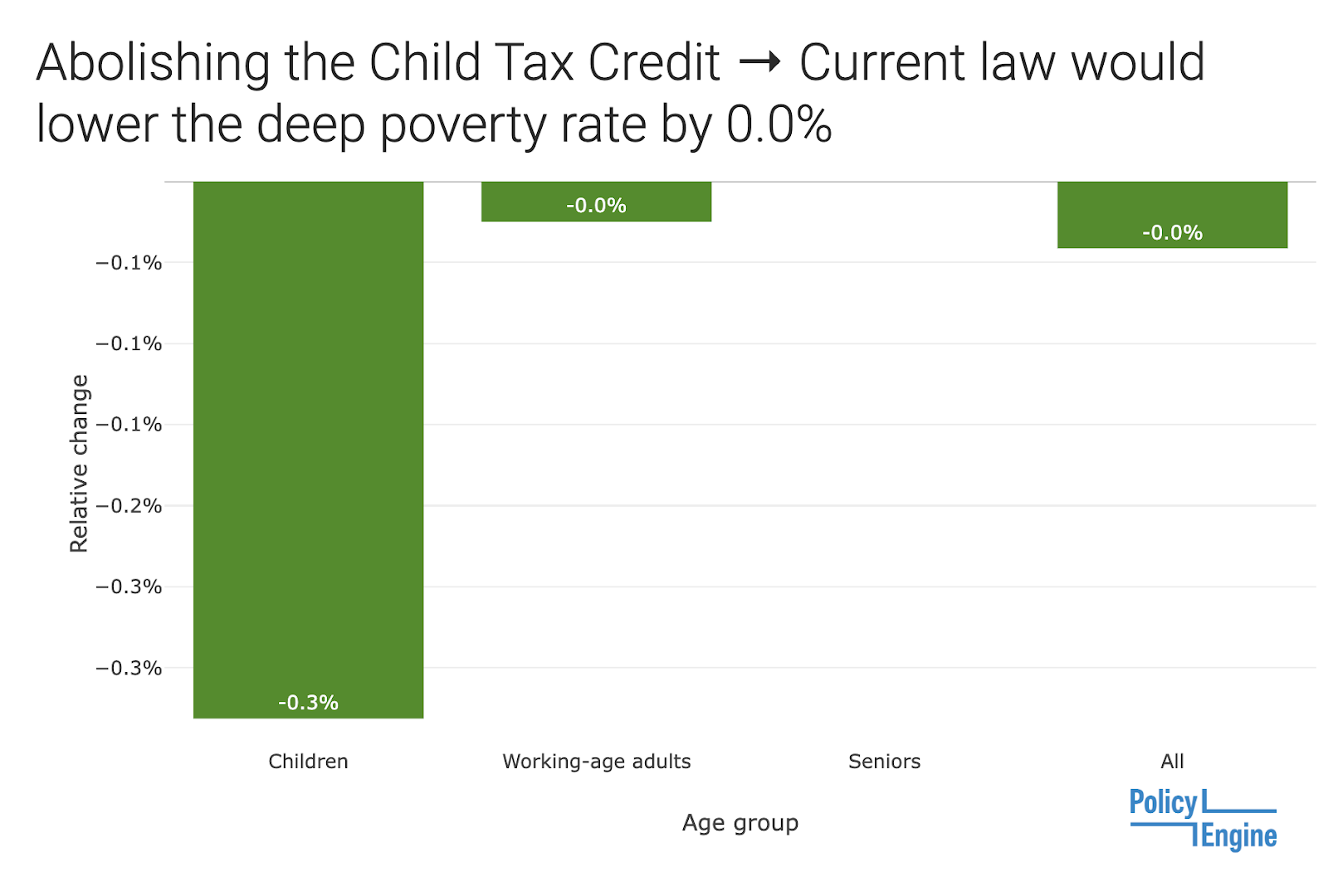

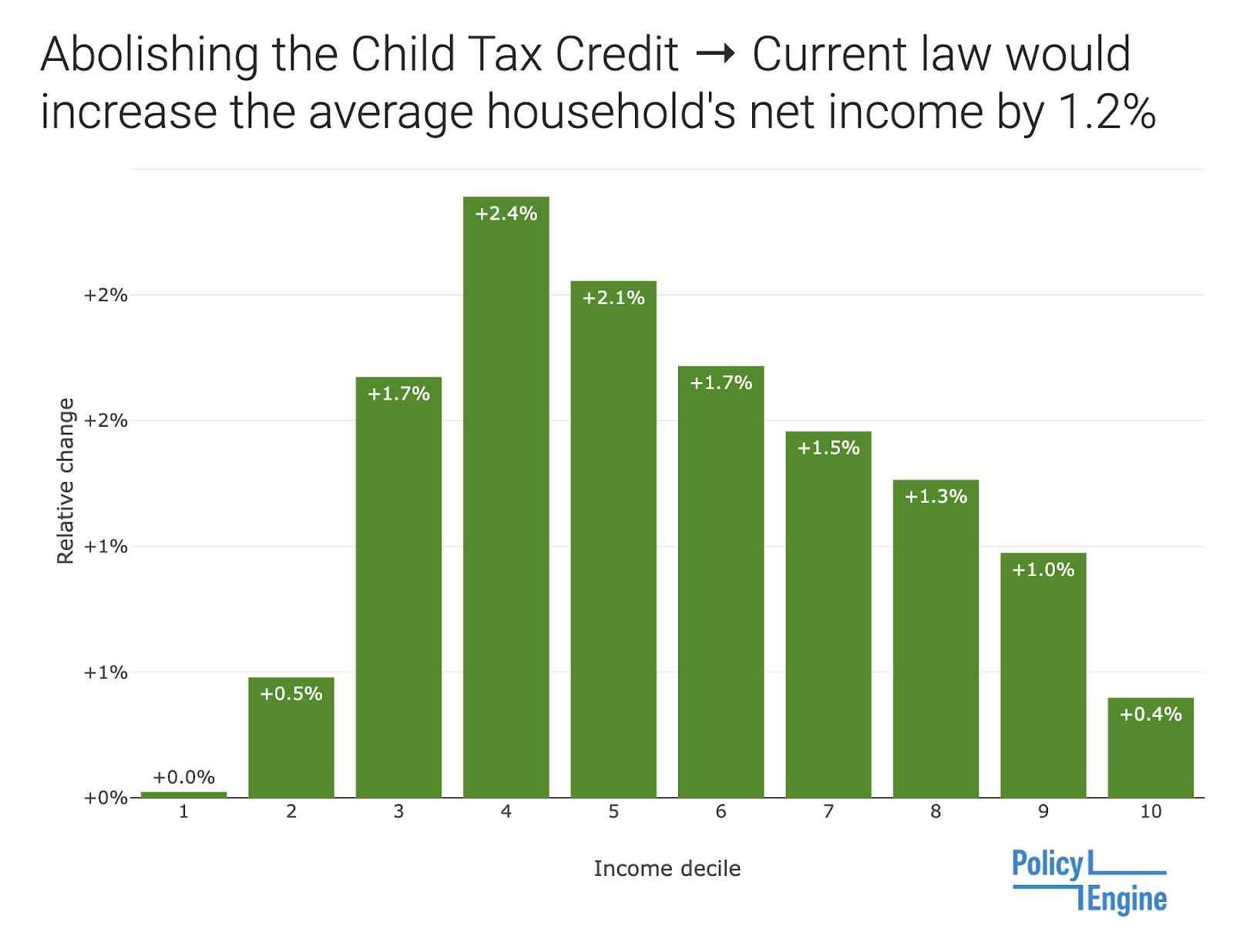

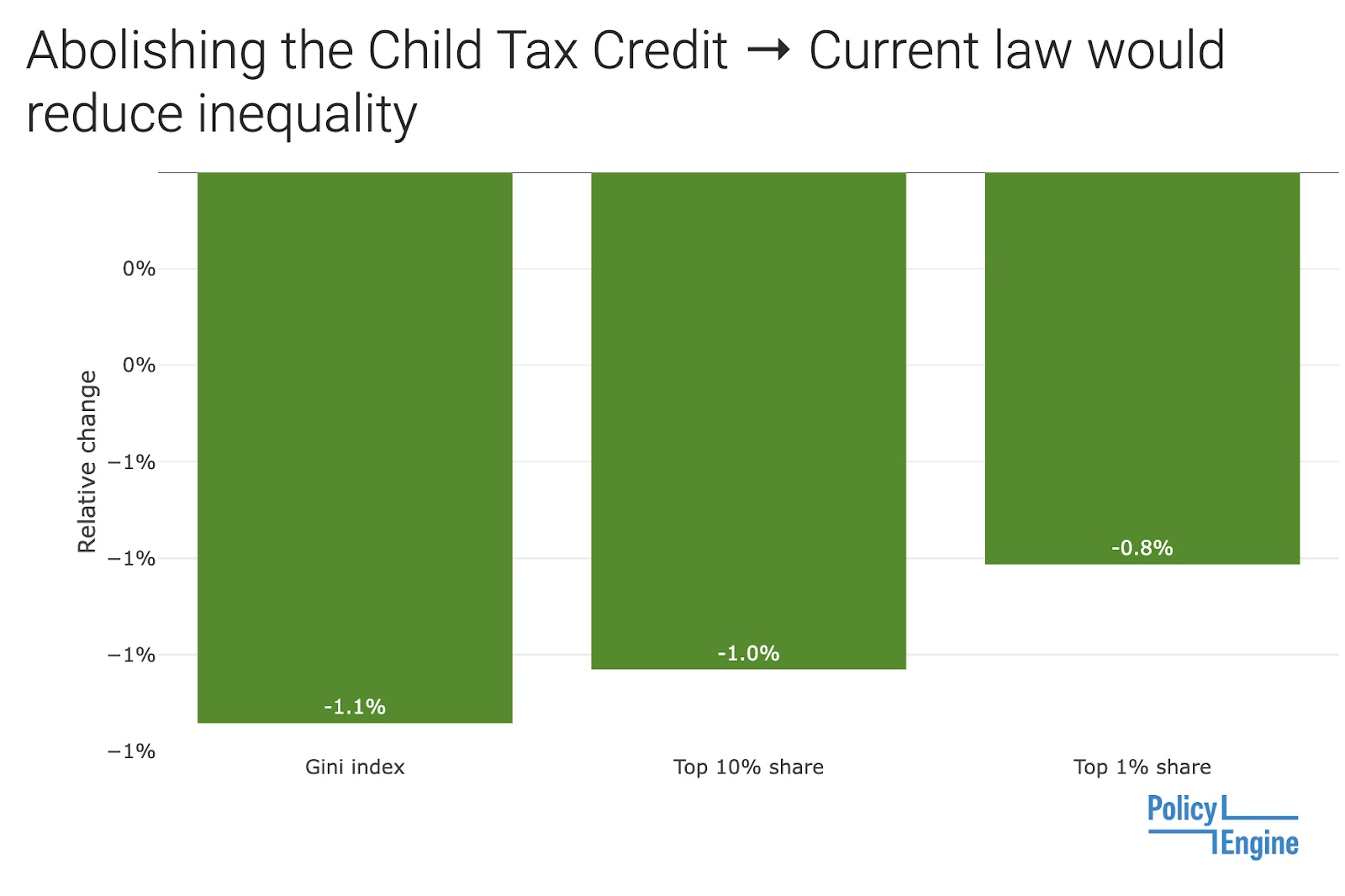

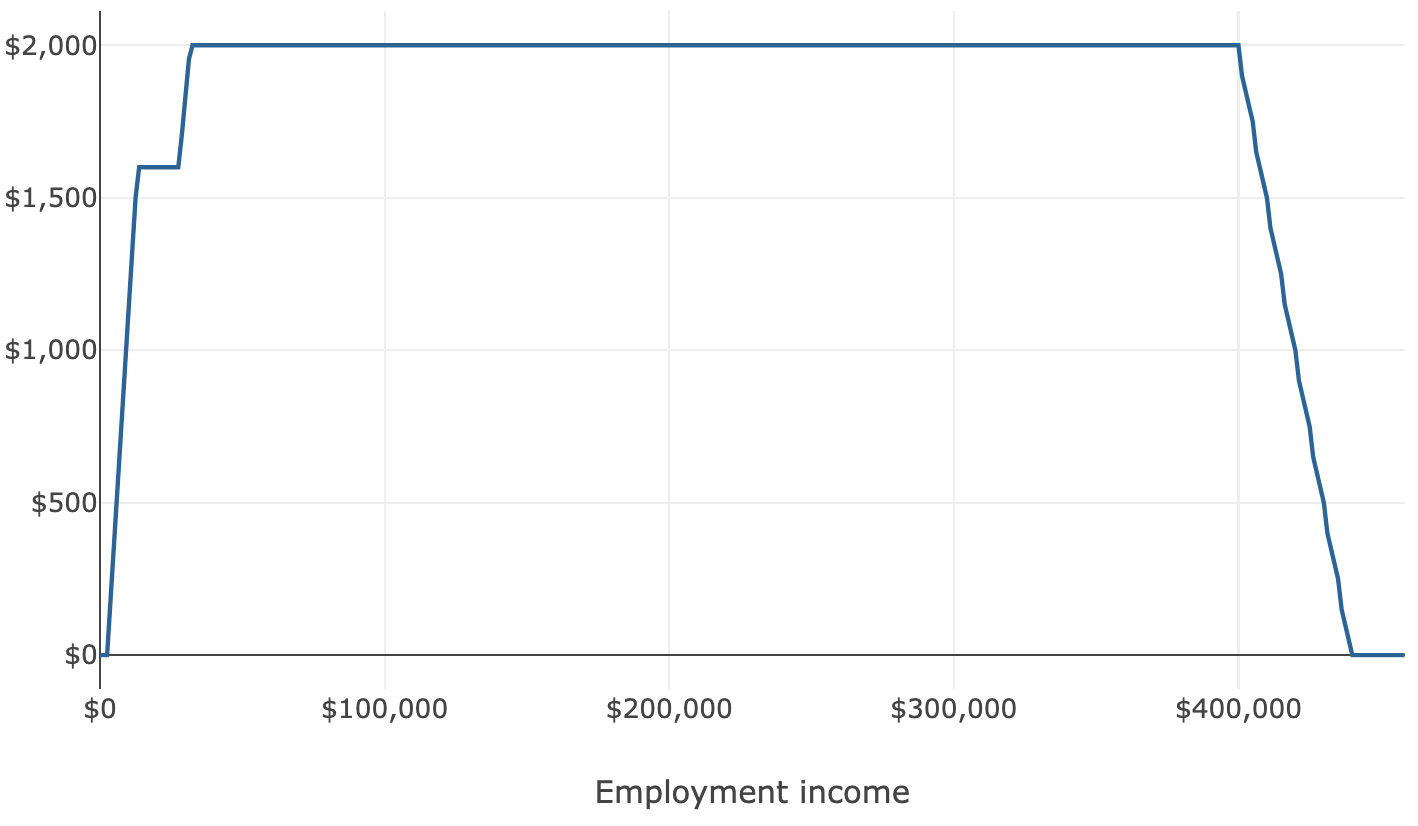

The Child Tax Credit In 2023 PolicyEngine US

https://cdn-images-1.medium.com/max/3200/0*0zeQPrJ9p_mki-gM

The Child Tax Credit In 2023 PolicyEngine US

https://cdn-images-1.medium.com/max/3200/0*dfD9j_Hng5cTIAQH

Verkko 14 huhtik 2023 nbsp 0183 32 How much is the child tax credit in 2023 The maximum tax credit available per child has reverted to its pre expansion level of 2 000 for each child under 17 on Dec 31 2022 Verkko 14 jouluk 2023 nbsp 0183 32 The 2023 child tax credit is worth up to 2 000 per qualifying child However the credit is not fully refundable which means that you cannot receive the entire 2 000 back as a tax

Verkko 6 jouluk 2022 nbsp 0183 32 Those who got 3 600 per dependent in 2021 for the CTC will if eligible get 2 000 for the 2022 tax year For the EITC eligible taxpayers with no children who received roughly 1 500 in 2021 will now get 500 in 2022 The Child and Dependent Care Credit returns to a maximum of 2 100 in 2022 instead of 8 000 in 2021 Verkko 19 lokak 2023 nbsp 0183 32 Updated for Tax Year 2023 October 19 2023 8 46 PM OVERVIEW The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements 1 age 2 relationship 3 support 4 dependent status 5 citizenship 6 length of residency and 7 family income You and or your child must pass all seven to

Download Child Tax Credit 2023 Schedule

More picture related to Child Tax Credit 2023 Schedule

Earned Income Credit 2022 Calculator INCOMEBAU

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

2022 Form IRS 1040 Schedule 8812 Instructions Fill Online Printable

https://www.pdffiller.com/preview/624/405/624405770/large.png

The Child Tax Credit In 2023 PolicyEngine US

https://cdn-images-1.medium.com/max/3200/0*IW-FLe4tzpb46cbn

Verkko 6 maalisk 2023 nbsp 0183 32 How the child tax credit will look in 2023 The child tax credit isn t going away but it has returned to its previous levels There are a handful of requirements that you and your Verkko 1 elok 2023 nbsp 0183 32 Child tax credit 2023 What new proposals from Dems GOP mean for you Ken Tran Rachel Looker Miles J Herszenhorn USA TODAY 0 00 2 34 WASHINGTON Lawmakers on Capitol Hill from both sides

Verkko 25 marrask 2023 nbsp 0183 32 Child Tax Credit The Child Tax Credit is given to taxpayers for each qualifying dependent child who is under the age of 17 at the end of the tax year Currently it s a 1 000 nonrefundable Verkko 6 maalisk 2023 nbsp 0183 32 In 2021 parents were eligible to receive up to 3 600 for each child under six and 3 000 for other children including 17 year olds Those enhancements have since expired and the program has

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

https://cdn.cheapism.com/images/2023-eitc.width-1000.png

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

https://www.irs.gov/forms-pubs/about-schedule-8812-form-1040

Verkko 2 marrask 2023 nbsp 0183 32 English Use Schedule 8812 Form 1040 to figure your child tax credits to report advance child tax credit payments you received in 2021 and to figure any additional tax owed if you received excess advance child tax credit payments during 2021 Current Revision Schedule 8812 Form 1040 PDF

https://www.irs.com/en/the-2023-child-tax-credit-payment-schedule-only...

Verkko 27 kes 228 k 2023 nbsp 0183 32 Monthly installments of this tax credit were sent by mail or direct deposit to eligible taxpayers from July until December The monthly payments varied but tax payers received a maximum credit of 3 000 per eligible child ages 6 to 17 annually and up to 3 600 for children under age 6 annually

The Child Tax Credit In 2023 PolicyEngine US

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

Child Tax Credit How Much Is It For 2024

Are They Sending Out Child Tax Credit Checks In 2023 Leia Aqui Will

The Child Tax Credit In 2023 PolicyEngine US

Taking A Stand For Children Through The Child Tax Credit Tax Credits

Taking A Stand For Children Through The Child Tax Credit Tax Credits

Planilla Child Tax Credit Desarrolladora Empresarial

Monthly Child Tax Credit Payments Understand The Options Articles

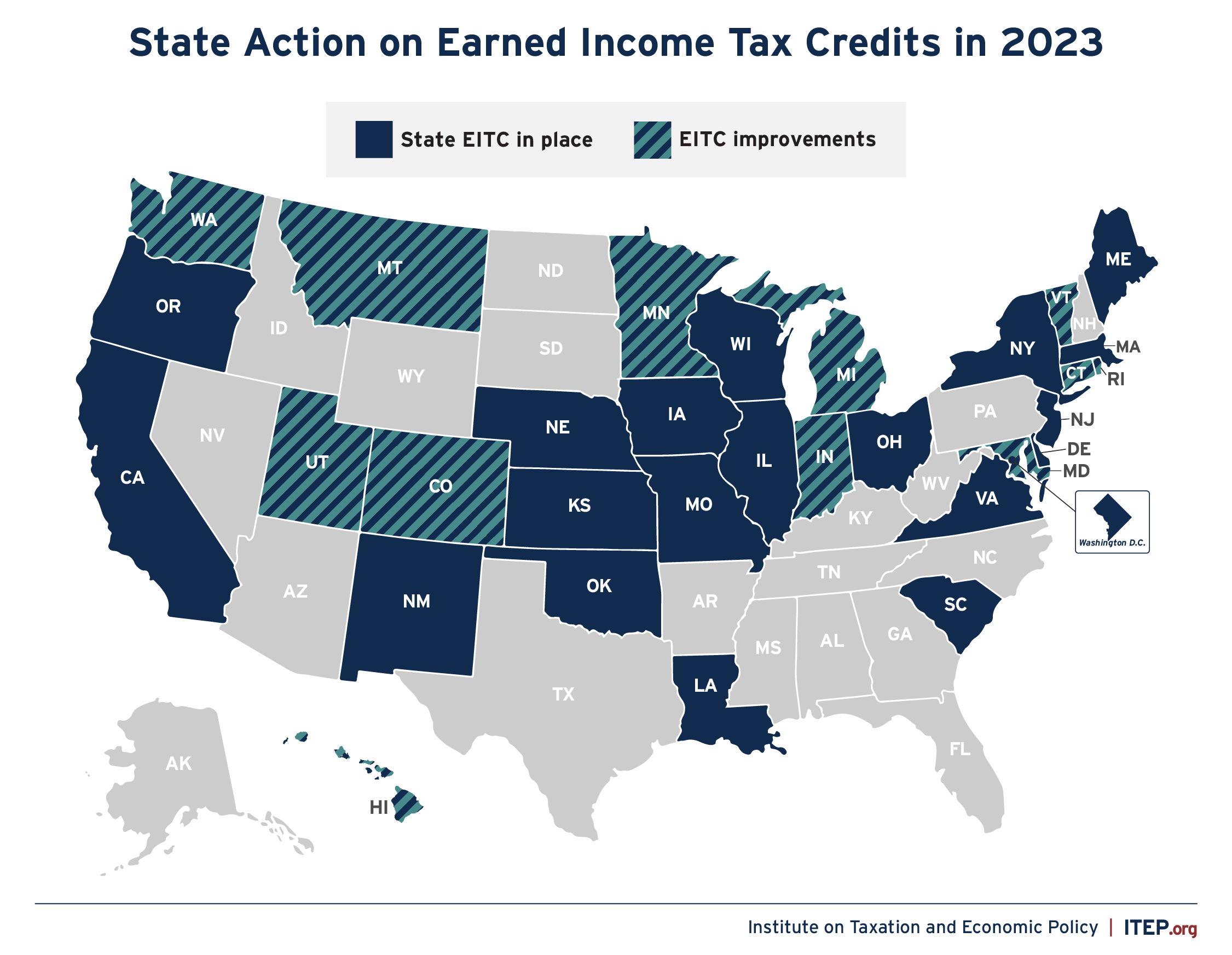

Refundable Credits A Winning Policy Choice Again In 2023 ITEP

Child Tax Credit 2023 Schedule - Verkko 14 jouluk 2023 nbsp 0183 32 The 2023 child tax credit is worth up to 2 000 per qualifying child However the credit is not fully refundable which means that you cannot receive the entire 2 000 back as a tax