Child Tax Credit 2023 Here is what you should know about the child tax credit for this year s tax season and whether you qualify Tax credit per child for 2023 The maximum tax credit per qualifying child

The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

Child Tax Credit 2023

Child Tax Credit 2023

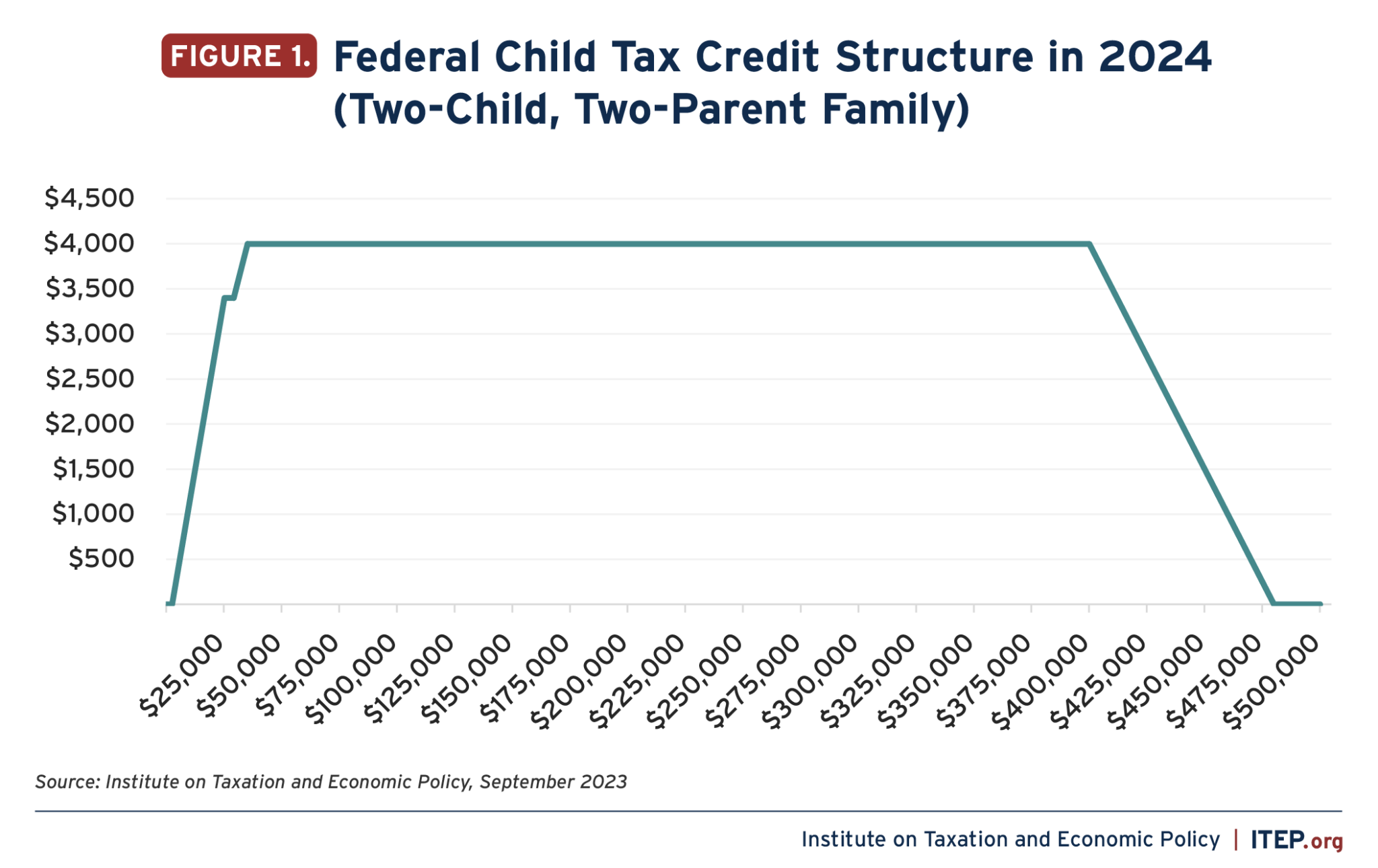

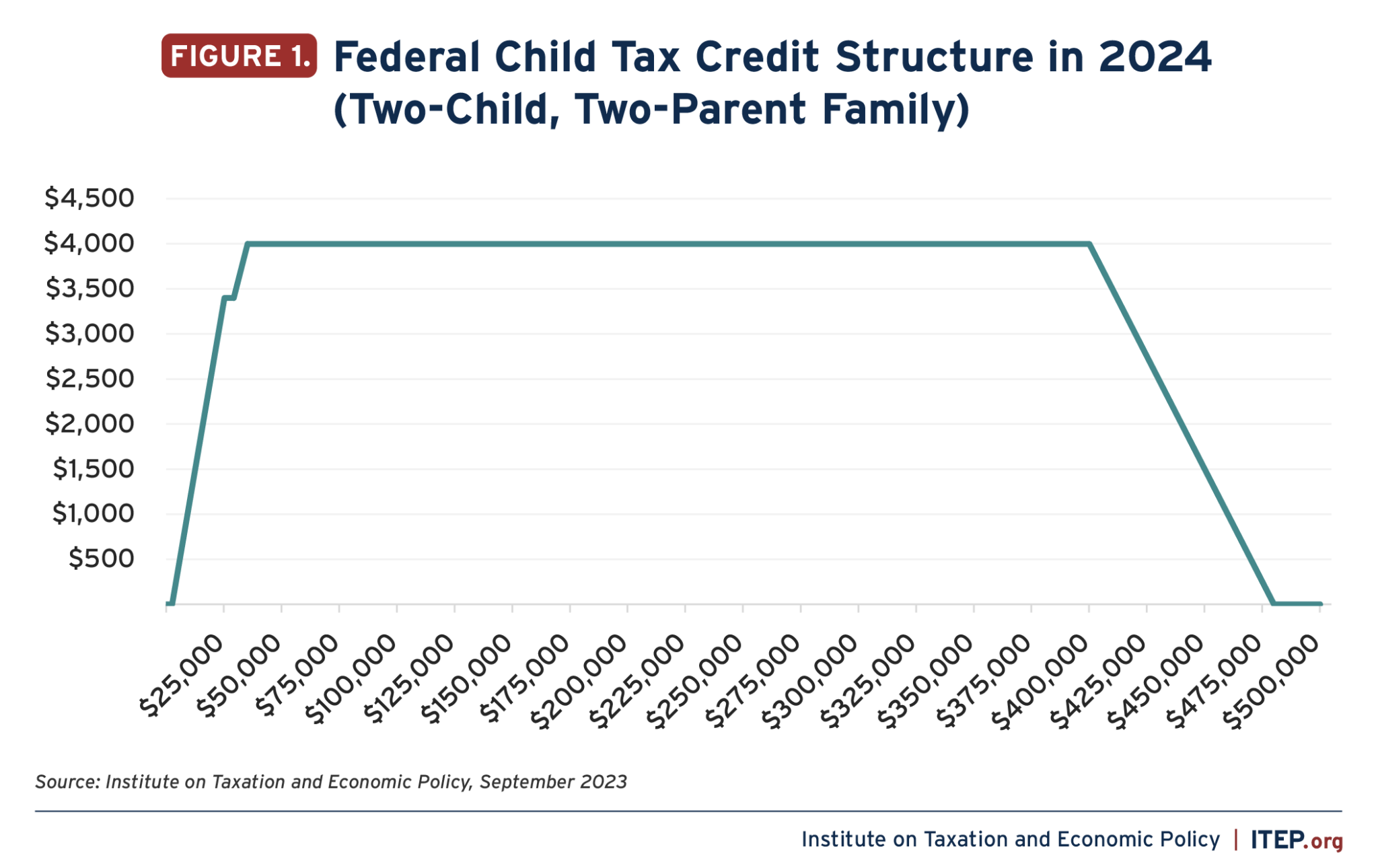

https://media.itep.org/cdn-cgi/image/format=webp/https://media.itep.org/Federal-Child-Tax-Credit-Structure-in-2024-Two-Child-Two-Parent-Family-figure-1-2048x1290.png

New 2023 IRS Income Tax Brackets And Phaseouts

https://imageio.forbes.com/specials-images/imageserve/637d001647ac19edd4588245/0x0.jpg?format=jpg&width=1200

What The New Child Tax Credit Could Mean For You Now And For Your 2021

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

Right now unless Congress makes last minute changes the 2023 child tax credit is worth up to 2 000 per qualifying child However the credit is not fully refundable which means that you Up to 1 600 per qualifying child in 2024 and 2023 is refundable with the Additional Child Tax Credit You can find out if you re eligible for this refundable credit by completing the worksheet in IRS Form 8812

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages 6 and 17 Before 2021 the credit was worth up to 2 000 per eligible child The United States federal child tax credit CTC is a partially refundable are eligible for the additional child tax credit ACTC a phased in 1 400 1 600 starting 2023 refundable tax credit with similar qualifications For example if a taxpayer has one qualifying child and a tax liability of 100 then they can use 100 of the CTC to

Download Child Tax Credit 2023

More picture related to Child Tax Credit 2023

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

CHILD TAX CREDIT 2023 AMOUNT Tax Refund 2022 2023 IRS TAX REFUND UPDATE

https://i.ytimg.com/vi/uy_73yxbNpo/maxresdefault.jpg

Child Tax Credit 2022 Income Limit TAX

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2020/02/child-tax-credit-worksheet-help.jpg

How the child tax credit will look in 2023 The child tax credit isn t going away but it has returned to its previous levels There are a handful of requirements that you and your kids A portion of the Child Tax Credit is refundable for 2023 This portion is called the Additional Child Tax Credit ACTC For 2023 up to 1 600 per child may be refundable Find out more about the Child Tax Credit American Opportunity Tax Credit partially refundable

[desc-10] [desc-11]

What Is The Child Tax Credit And How Much Of It Is Refundable Brookings

https://i0.wp.com/www.brookings.edu/wp-content/uploads/2021/01/Who-gets-the-Child-Tax-Credit-in-2020_by-income.png?fit=600%2C9999px&ssl=1

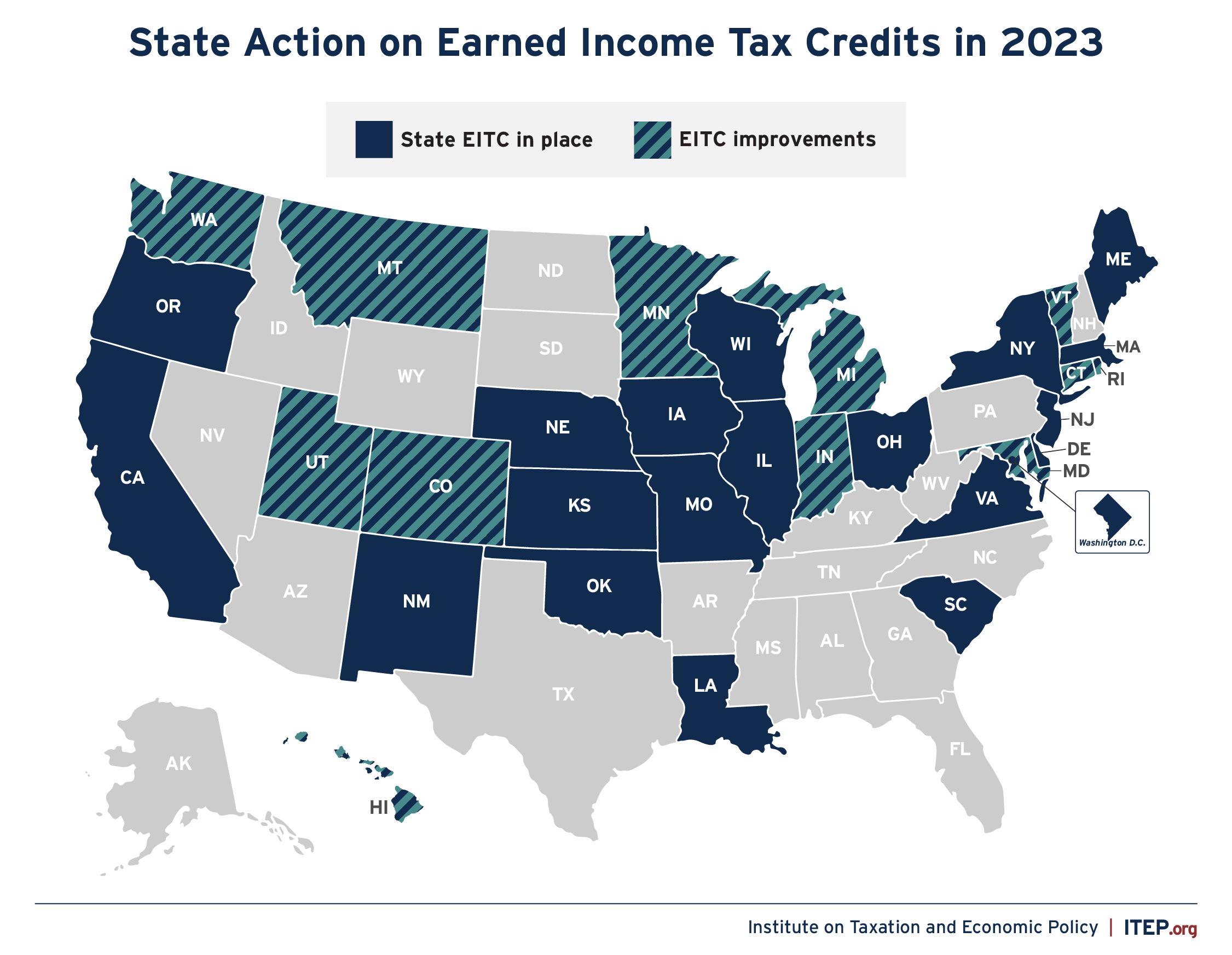

Refundable Credits A Winning Policy Choice Again In 2023 ITEP

https://sfo2.digitaloceanspaces.com/itep/EITC-2023.png

https://www.usatoday.com/story/money/taxes/2024/01/...

Here is what you should know about the child tax credit for this year s tax season and whether you qualify Tax credit per child for 2023 The maximum tax credit per qualifying child

https://smartasset.com/taxes/all-about-child-tax-credits

The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint

Irs Earned Income Definition Definition Jwk Free Nude Porn Photos

What Is The Child Tax Credit And How Much Of It Is Refundable Brookings

What Is The Difference Between Child Tax Credit And Child Care Tax

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

TaxTips ca 2023 Non Refundable Personal Tax Credits Tax Amounts

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

Child Tax Credit 2023 Why Is CTC Not Included In The Omnibus Spending

2022 Child Tax Credit Refundable Amount Latest News Update

What Is Child Tax Benefit

Child Tax Credit 2023 - The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages 6 and 17 Before 2021 the credit was worth up to 2 000 per eligible child