Child Tax Credit 2024 Rebate Each payment will be up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 to 17 The IRS will issue advance CTC payments July 15 Aug 13 Sept 15 Oct 15 Nov 15 and Dec 15 Who needs to take action now If you haven t filed or registered with the IRS now is the time to take action

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents Parents can claim up to 2 000 in tax benefits through the CTC for each child under 17 years old The tax credit is based on income requiring that parents earn at least 2 500 to claim it

Child Tax Credit 2024 Rebate

Child Tax Credit 2024 Rebate

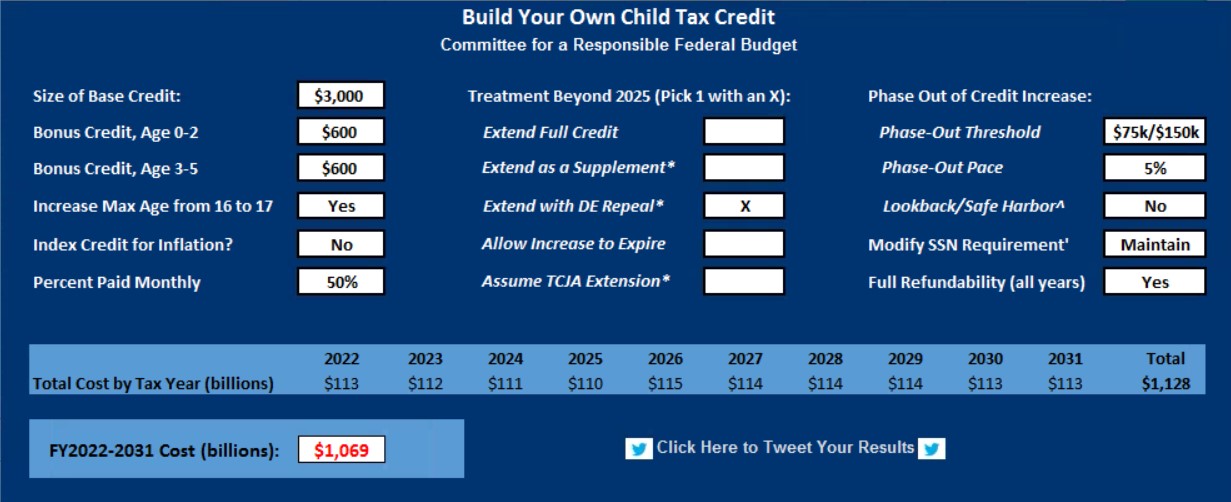

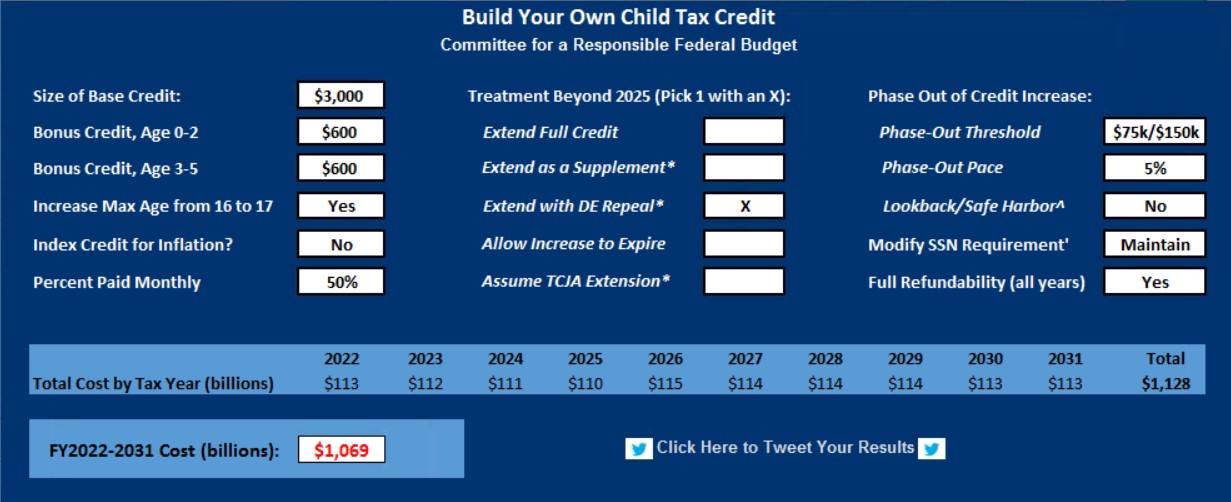

https://crfb.org/sites/default/files/ctcmodel.jpg

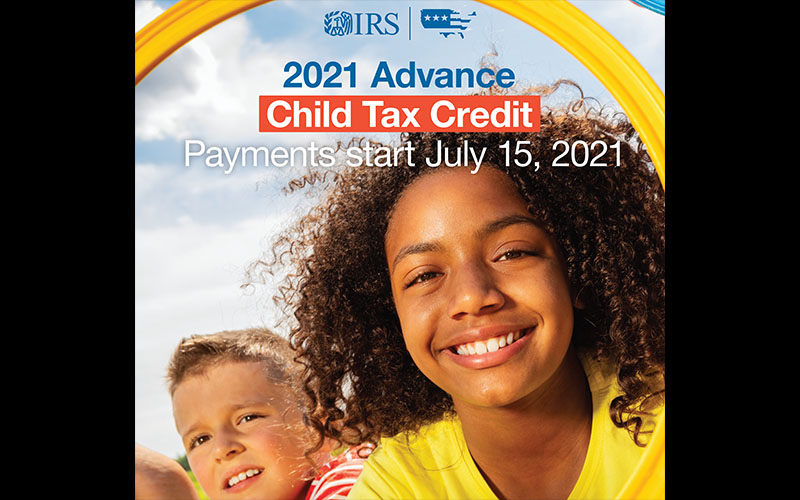

Advance Child Tax Credit Payments Start Tomorrow KM M CPAs

https://kmmcpas.com/wp-content/uploads/2021/07/7-14-21-child-tax-credit-poster.jpg

Did The Child Tax Credit Change For 2022 What You Need To Know

https://www.usatoday.com/gcdn/presto/2022/12/02/USAT/7dc53c6e-753d-4dbe-9927-b86d99089807-XXX_IMG_MONEY_CHILDTAXCREDIT_1_1_U6UQQIVP.JPG?crop=1897,1067,x224,y0&width=1897&height=1067&format=pjpg&auto=webp

The child tax credit is a tax break families can receive if they have qualifying children The amount a family can receive is up to 2 000 per child but it s only partially refundable Eligible families will receive a payment of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above The American Rescue Plan increased the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages 6 and 17

Lawmakers would also increase the refundability cap or the maximum child tax credit families can earn per child to adjust for inflation The new rules would increase the maximum refundable amount from 1 600 per child For the tax year 2023 it would increase to 1 800 for the tax year 2024 to 1 900 and for the tax

Download Child Tax Credit 2024 Rebate

More picture related to Child Tax Credit 2024 Rebate

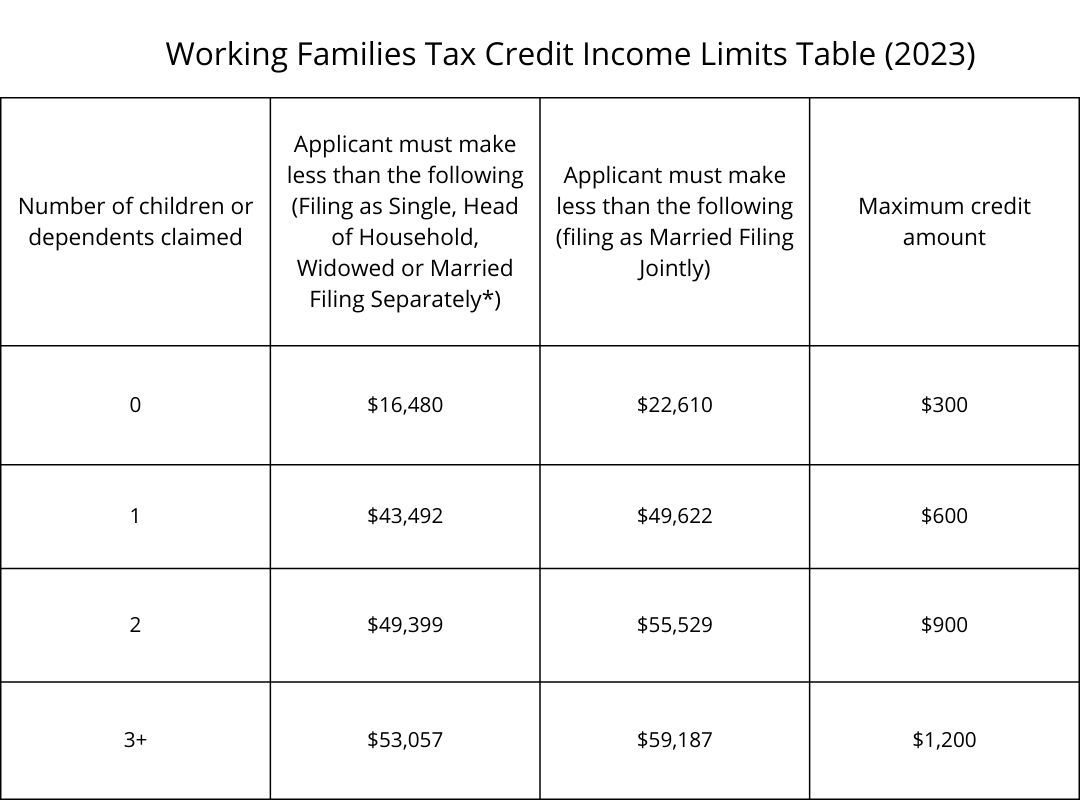

How Much Would A Child Tax Credit Be For A 2023 Leia Aqui What Is The Additional Child Tax

https://www.wataxcredit.org/wp-content/uploads/2023/01/WFTC-Income-Table-.jpg

What Is The Child Tax Credit Going To Be For 2023 Leia Aqui What Is The Monthly Child Tax

https://cclponline.org/wp-content/uploads/2023/01/AdobeStock_165208034-scaled.jpeg

Monthly Child Tax Credit Payments Start Thursday Here s What To Know

https://www.courier-journal.com/gcdn/-mm-/a75b61cdf29c924e642301138dcb5b5b73c5e5d5/c=0-30-1998-1159/local/-/media/2018/01/31/Louisville/Louisville/636530052069237063-IMG-3796.jpg?width=1998&height=1129&fit=crop&format=pjpg&auto=webp

How much is the 2024 child tax credit The maximum tax credit available per kid is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to The Child Tax Credit is one of the nation s strongest tools to provide tens of millions of families with some support and breathing room while raising children It has also being shown to

ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024 The amount of your Child Tax Credit will be reduced if your adjusted gross income exceeds 400 000 if married filing jointly or 200 000 for all other tax filing statuses Eligible families received a payment of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 to 17 This tax relief is having a real impact on the lives of America s children

Why The Child Tax Credit Is Lower In 2023 Khou

https://media.khou.com/assets/VERIFY/images/15a040f1-9821-4933-a978-2b8b0a8fc521/15a040f1-9821-4933-a978-2b8b0a8fc521_1140x641.jpg

How To Track Down Your Child Tax Credit Payment If You Still Haven t Received It The US Sun

https://www.the-sun.com/wp-content/uploads/sites/6/2021/07/kc-child-tax-credit-comp-2.jpg?w=1560

https://www.irs.gov/newsroom/child-tax-credit-most...

Each payment will be up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 to 17 The IRS will issue advance CTC payments July 15 Aug 13 Sept 15 Oct 15 Nov 15 and Dec 15 Who needs to take action now If you haven t filed or registered with the IRS now is the time to take action

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

Why The Child Tax Credit Is Lower In 2023 Khou

Child Tax Credits 1st Payments Sent July 15 Welcomed By Chicago Area Families ABC7 Chicago

Child Tax Credit CTC Update 2024

Child Tax Credit Checks Arriving July 15 For Iowa Families How It Works

It s Tax Season Don t Panic The Standard Deduction podcast Listen Notes

It s Tax Season Don t Panic The Standard Deduction podcast Listen Notes

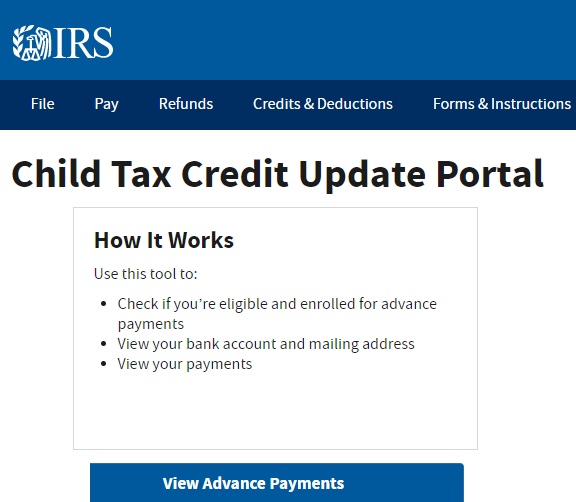

IRS Child Tax Credit Portal 2024 Login Advance Update Bank Information Payments Dates Phone

Earned Income Tax Credit For Households With One Child 2023 Center On Budget And Policy

Watch CBS Mornings Child Tax Credit Set To Expire Full Show On CBS

Child Tax Credit 2024 Rebate - For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional child tax