Child Tax Credit And Income Limits Everything you need to know about the 2024 child tax credit CTC including eligibility income limits and how to claim up to 2 000 per child on your federal tax return

The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax For 2024 taxes for returns filed in 2025 the IRS Child Tax Credit is worth up to 2 000 for each qualifying dependent child You can claim this

Child Tax Credit And Income Limits

Child Tax Credit And Income Limits

https://www.courier-journal.com/gcdn/-mm-/a75b61cdf29c924e642301138dcb5b5b73c5e5d5/c=0-30-1998-1159/local/-/media/2018/01/31/Louisville/Louisville/636530052069237063-IMG-3796.jpg?width=1998&height=1129&fit=crop&format=pjpg&auto=webp

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Expanding The Child Tax Credit Budgetary Distributional And

https://images.squarespace-cdn.com/content/v1/55693d60e4b06d83cf793431/1635174298909-BVRM1BK6BUJQKSEXWQK9/AdobeStock_299187554.jpeg

Parents or guardians must meet income requirements a modified adjusted gross income of up to 200 000 for individuals or 400 000 for married joint filers to qualify for the full credit in The 2025 Child Tax Credit can reduce your tax liability on your annual taxes Here s a breakdown of the CTC s income limits and rules

The Child Tax Credit CTC and Additional Child Tax Credit ACTC are credits for individuals who claim a child as a dependent if the child meets certain eligibility requirements The CTC is a In 2025 the Child Tax Credit CTC provides 2 000 per qualifying child under 17 with income phase out thresholds starting at 400 000 for married couples filing jointly and 200 000 for single filers heads of household and

Download Child Tax Credit And Income Limits

More picture related to Child Tax Credit And Income Limits

Child Tax Credit CTC Update 2024

https://www.zrivo.com/wp-content/uploads/2022/10/Child-Tax-Credit-CTC-Update-Zrivo-Cover-1-1536x864.jpg

FAQ WA Tax Credit

https://www.wataxcredit.org/wp-content/uploads/2023/01/WFTC-Income-Table-.jpg

2021 Child Tax Credit And Payments What Your Family Needs To Know

https://static.twentyoverten.com/5d5413591d304774fba39eb3/6kFYVeqmtJC/Adjusted-Gross-Income.jpg

The base Child Tax Credit in 2025 is 2 000 per qualifying child though the actual amount depends on income and the number of dependents Up to 1 400 of the credit is non For example if you owe 5 500 of income tax to the government getting awarded 2 000 of the child tax credit will reduce your tax bill to 3 500 Moreover the child tax credit is

Thanks to the tax law changes in the Tax Cuts and Jobs Act of 2017 the Child Tax Credit CTC is now worth up to 2 000 per qualifying child A tax credit is a powerful tool Eligibility depends on filing status income and the child s relationship to the caregiver The maximum credit amount is 2 000 but it phases out based on modified

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

What Is The Phase Out For Dependent Care Credit Latest News Update

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

https://www.kiplinger.com › taxes › child-t…

Everything you need to know about the 2024 child tax credit CTC including eligibility income limits and how to claim up to 2 000 per child on your federal tax return

https://www.usatoday.com › story › mone…

The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax

The Child Tax Credit Proved Unrestricted Cash Keeps Families Out Of

2022 Education Tax Credits Are You Eligible

Child Tax Credit

Month 2 Of Child Tax Credit Hits Bank Accounts AP News

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Last Chance To Sign Up For 3 600 Advanced Child Tax Credit Payment Is

Last Chance To Sign Up For 3 600 Advanced Child Tax Credit Payment Is

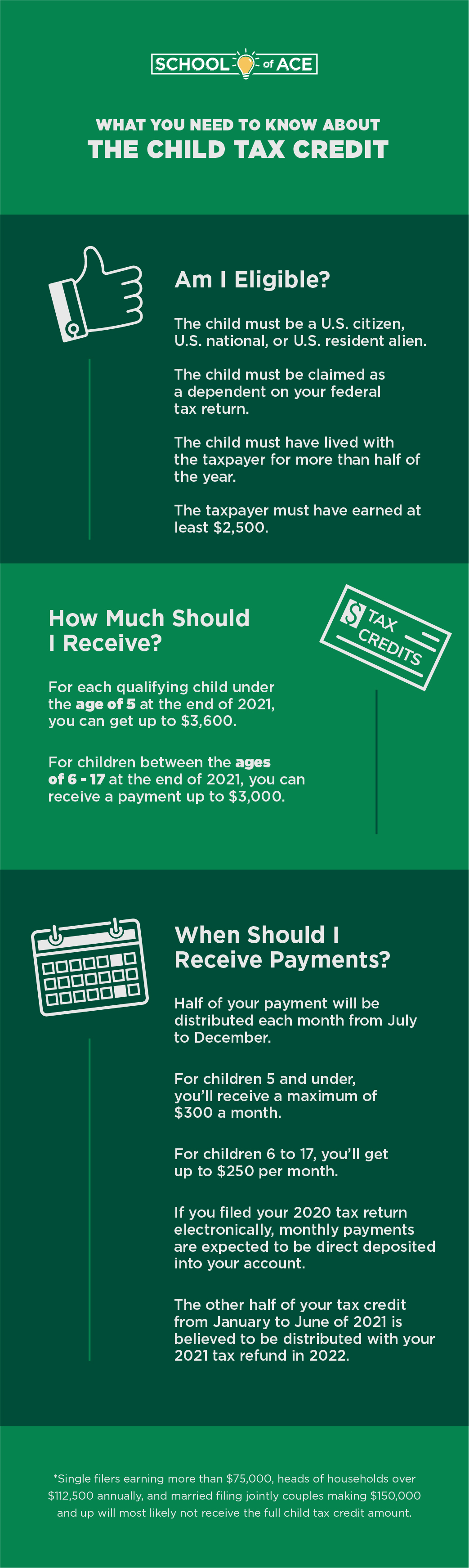

What You Need To Know About The Child Tax Credit

Maximize Your Paycheck Understanding FICA Tax In 2024

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

Child Tax Credit And Income Limits - The Child Tax Credit CTC and Additional Child Tax Credit ACTC are credits for individuals who claim a child as a dependent if the child meets certain eligibility requirements The CTC is a