Child Tax Credit Application Form 2023 Verkko You can only make a claim for Child Tax Credit if you already get Working Tax Credit If you get Working Tax Credit To claim Child Tax Credit update your existing tax

Verkko 24 elok 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more Verkko 19 lokak 2023 nbsp 0183 32 The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements 1 age 2 relationship 3 support 4 dependent status 5

Child Tax Credit Application Form 2023

Child Tax Credit Application Form 2023

https://s.hdnux.com/photos/01/35/74/61/24628288/5/rawImage.jpg

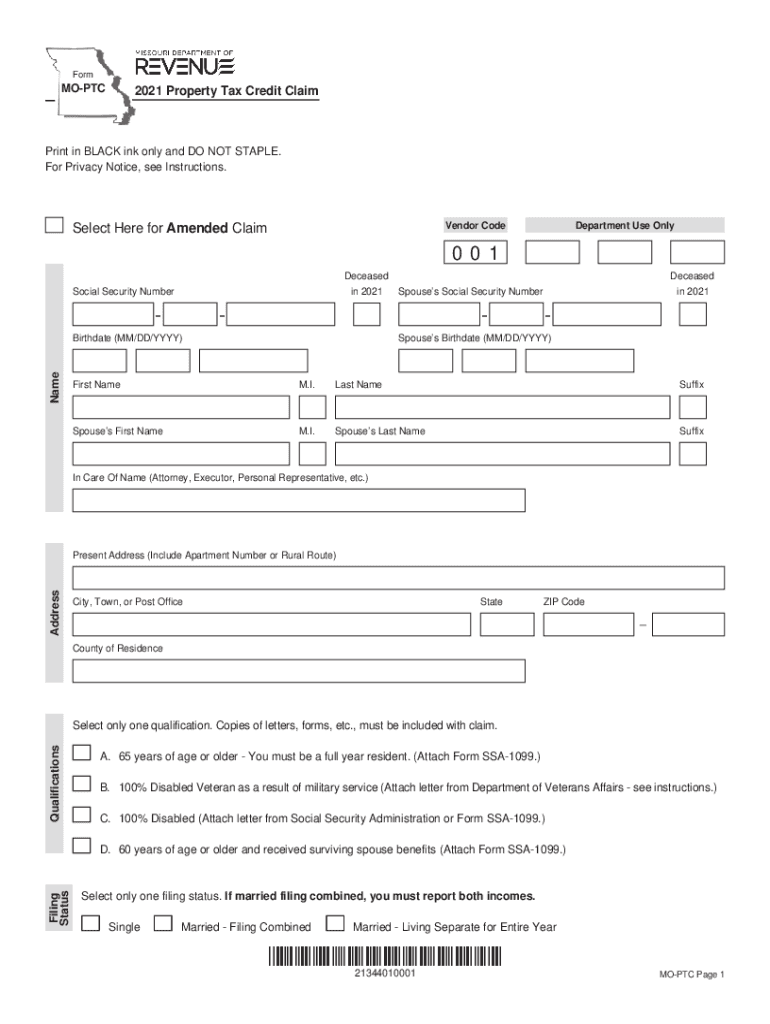

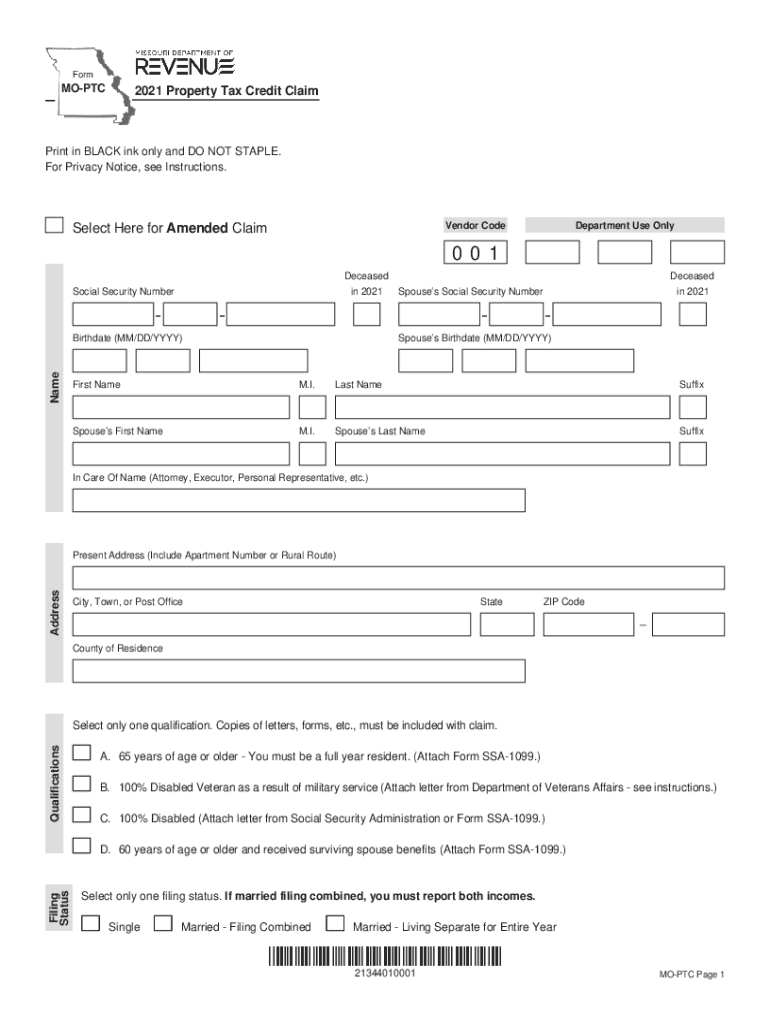

2021 Form MO MO PTC Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/579/959/579959492/large.png

Child Tax Credit 2024 Child Tax Credit 2024 By Clear Start Tax

https://miro.medium.com/v2/resize:fit:1200/1*KsfOocLtQfEdOBFic2MiOw.png

Verkko 14 jouluk 2023 nbsp 0183 32 The 2023 child tax credit is worth up to 2 000 per qualifying child However the credit is not fully refundable which means that you cannot receive the entire 2 000 back as a tax Verkko Manage an existing benefit payment or claim Financial help if you have children Tax credits Child Tax Credits if you re responsible for one child or more how much you

Verkko 18 marrask 2023 nbsp 0183 32 If their 2023 modified AGI is 415 000 their child tax credit will be reduced by 750 50 x 15 750 So instead of the maximum credit of 4 000 for Verkko 1 elok 2023 nbsp 0183 32 Continues the child tax credit of 3 600 a year for children 6 or younger Expands the credit to 3 000 a year for children ages 6 to 17 Allows families to

Download Child Tax Credit Application Form 2023

More picture related to Child Tax Credit Application Form 2023

Thousands Of Americans Eligible For 5 000 Stimulus Check And Child Tax

https://www.the-sun.com/wp-content/uploads/sites/6/2022/01/MF-Thousands-eligible-stimulus-payments-OFFPLAT.jpg?w=1920

What Is The Child Tax Credit Going To Be For 2023 Leia Aqui What Is

https://cclponline.org/wp-content/uploads/2023/01/AdobeStock_165208034-scaled.jpeg

2022 Form MO DoR MO PTS Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/623/237/623237583/large.png

Verkko 2 marrask 2023 nbsp 0183 32 Information about Schedule 8812 Form 1040 Additional Child Tax Credit including recent updates related forms and instructions on how to file Use Verkko 13 hein 228 k 2023 nbsp 0183 32 Child tax credit is a means tested benefit that tops up your income if you re a parent or responsible for a child however it is being replaced by Universal Credit Find out how much you could get

Verkko Starting November 20 2023 all individuals will be required to provide proof of birth when applying for the Canada child benefit CCB On this page When to apply Verkko Print Universal Credit has replaced tax credits for most people making a new claim Make sure you check if you can still get Working Tax Credits or Child Tax Credits

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

House Passes Child Tax Credit Expansion NPR Tmg News

https://lh3.googleusercontent.com/J6_coFbogxhRI9iM864NL_liGXvsQp2AupsKei7z0cNNfDvGUmWUy20nuUhkREQyrpY4bEeIBuc=w0

https://www.gov.uk/child-tax-credit/how-to-claim

Verkko You can only make a claim for Child Tax Credit if you already get Working Tax Credit If you get Working Tax Credit To claim Child Tax Credit update your existing tax

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

Verkko 24 elok 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more

Taking A Stand For Children Through The Child Tax Credit Tax Credits

Taking A Stand For Children Through The Child Tax Credit Tax Credits

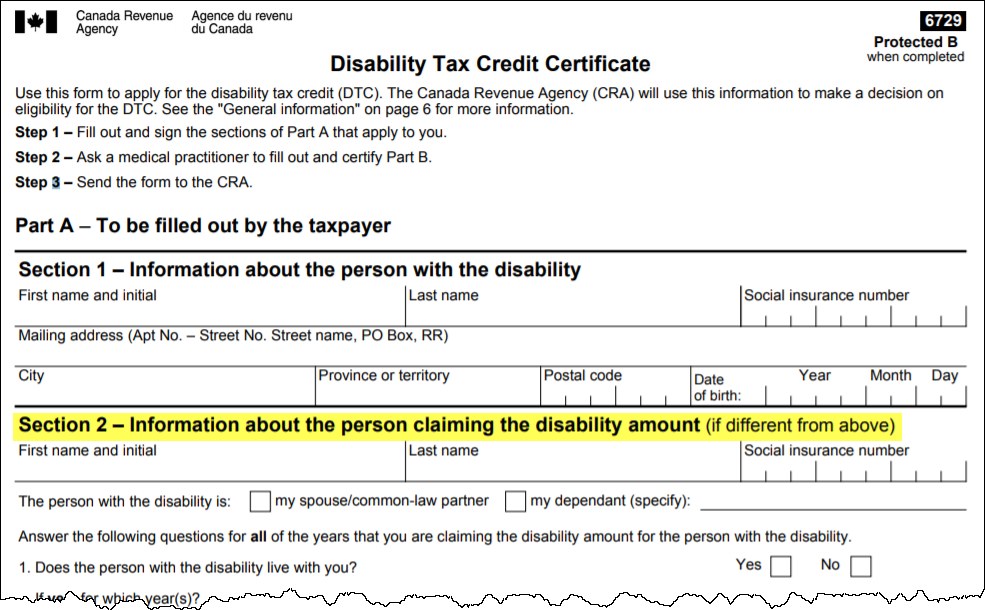

2008 Form Canada T2201 E Fill Online Printable Fillable Blank

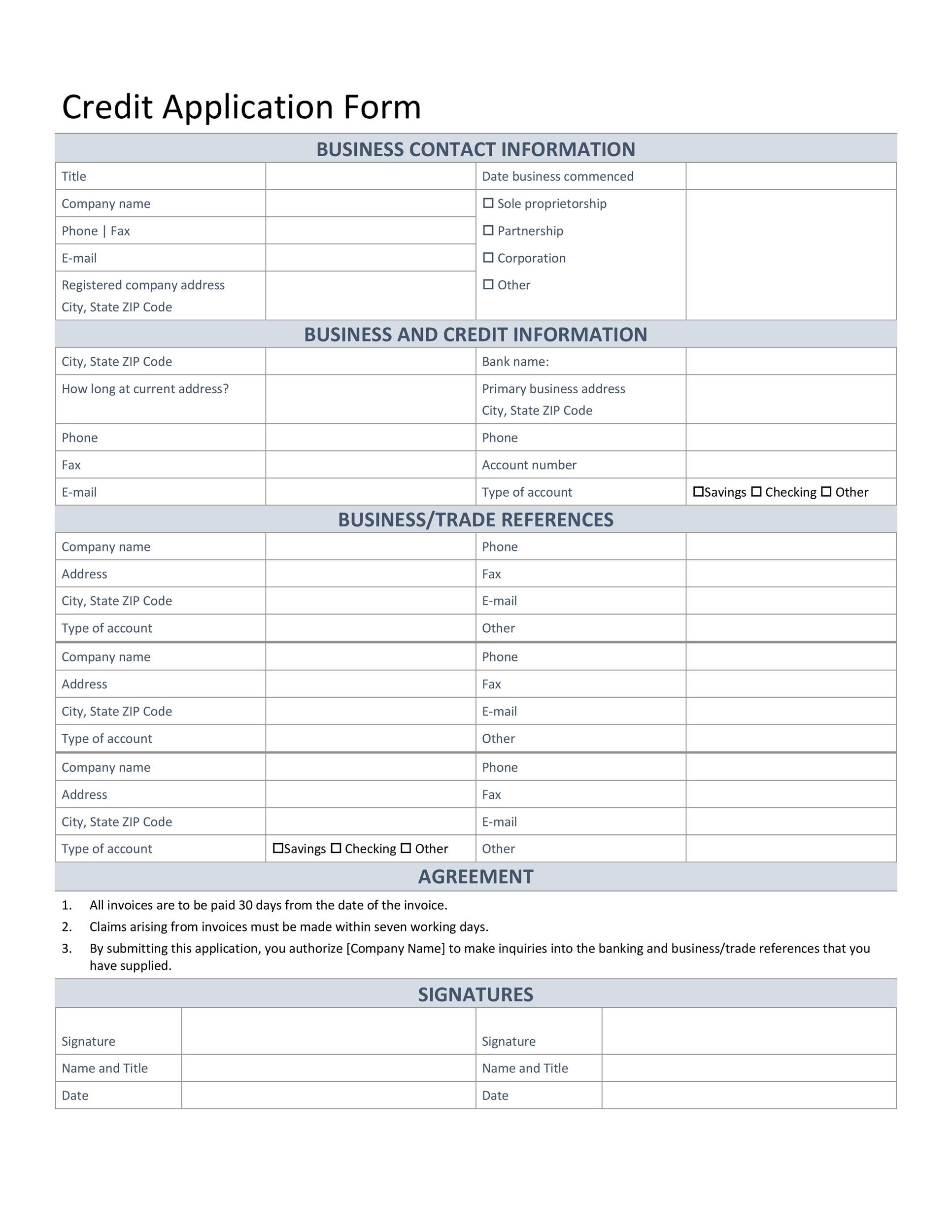

Printable Credit Application Form

Monthly Child Tax Credit Payments Understand The Options Articles

Child Tax Credit How Much Is It For 2024

Child Tax Credit How Much Is It For 2024

T2201 Fillable Form Printable Forms Free Online

How People Are Using The Monthly Child Tax Credit Payments SaverLife

Understanding The Child Tax Credit Government Assistance Online

Child Tax Credit Application Form 2023 - Verkko 6 maalisk 2023 nbsp 0183 32 In 2021 parents were eligible to receive up to 3 600 for each child under six and 3 000 for other children including 17 year olds Those enhancements