Child Tax Credit Fully Refundable 2022 A17 You may claim the fully refundable Child Tax Credit even if you received no income and paid no U S Social Security taxes The credit has been

The Child Tax Credit is a fully refundable tax credit for families with qualifying children The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help to The American Rescue Plan increased the amount of the Child Tax Credit from 2 000 to 3 600 for qualifying children under age 6 and 3 000 for other qualifying children

Child Tax Credit Fully Refundable 2022

Child Tax Credit Fully Refundable 2022

https://static01.nyt.com/images/2022/01/08/business/07Adviser-illo/07Adviser-illo-videoSixteenByNineJumbo1600-v2.png

Child Tax Credit Expansion In New Bipartisan Deal Has Battle In House

https://s.hdnux.com/photos/01/35/74/61/24628288/5/rawImage.jpg

Written By Diane Kennedy CPA On March 12 2022

https://www.ustaxaid.com/wp-content/uploads/2022/03/1928846-1536x1024.jpg

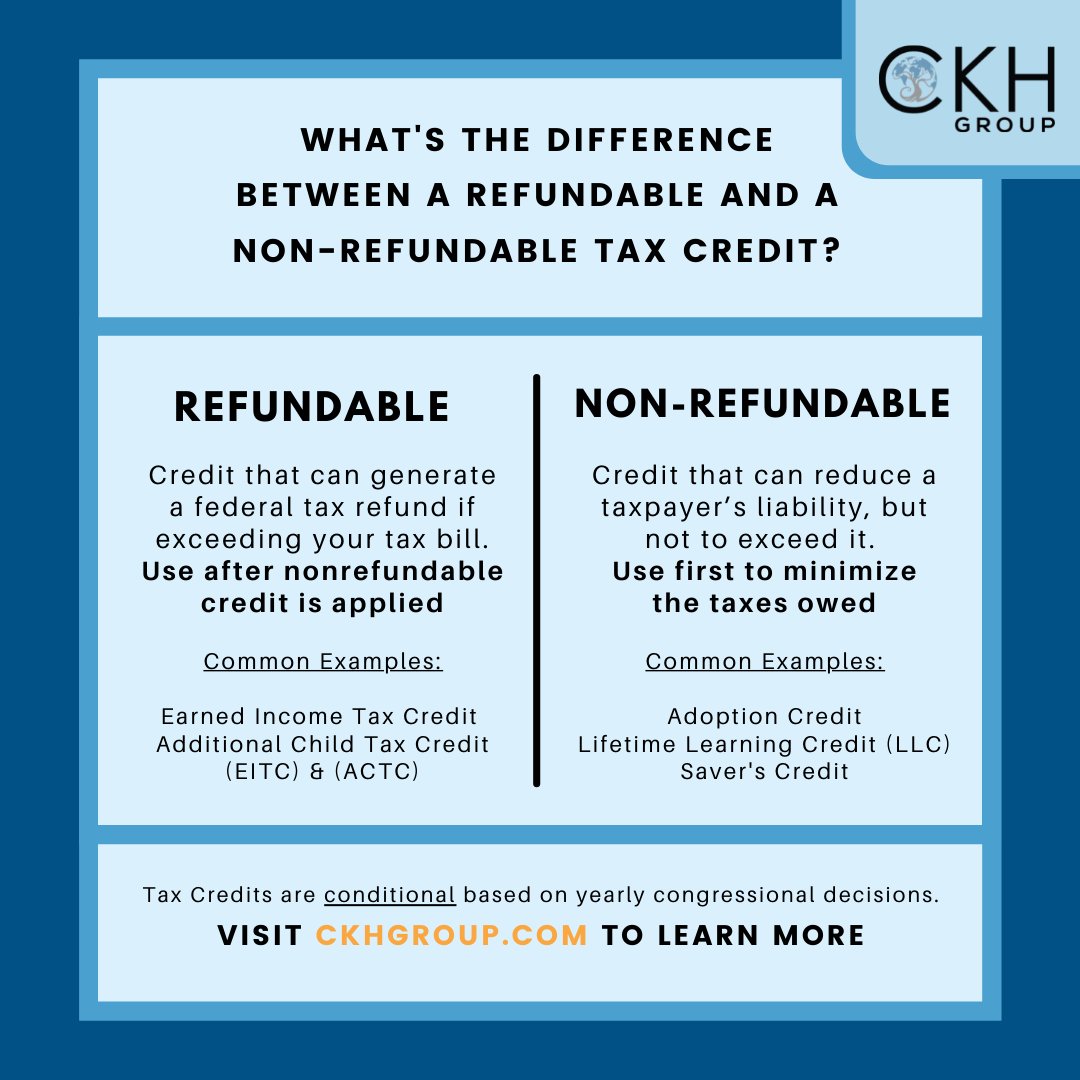

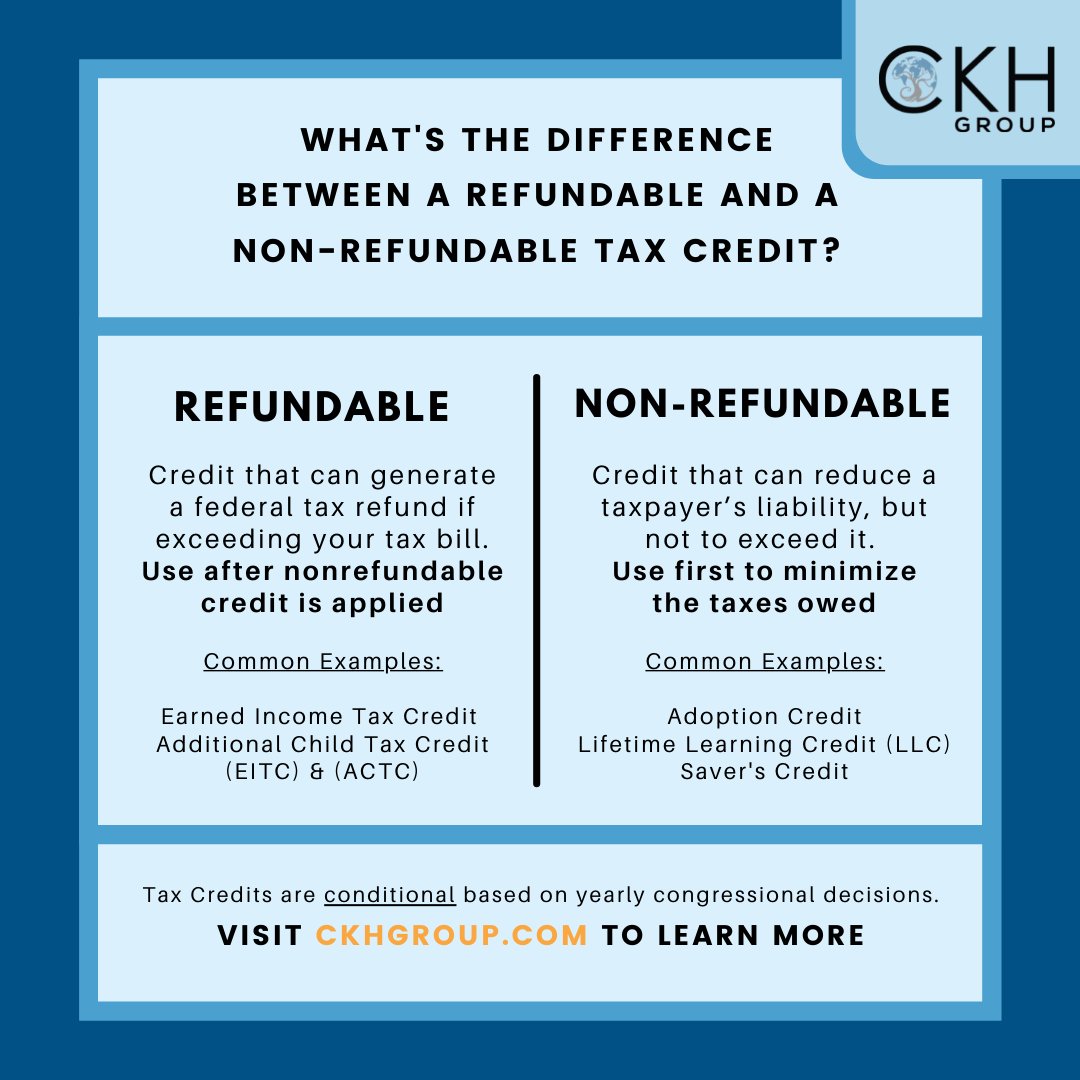

Prior to 2021 the child tax credit was only partially refundable up to 1 400 per qualifying child Plus you had to have at least 2 500 of earned income to even get that Families who owed little or no income tax could get cash of up to 1 400 per child a feature which made the tax credit only partially refundable Other dependents including children aged 17

The House of Representatives passed the Build Back Better Act on Friday The 1 75 trillion social and climate bill would make the child tax credit fully The refundable part of the credit ACTC is worth up to 1 600 for each qualifying child A qualifying child must have a Social Security Number issued by the

Download Child Tax Credit Fully Refundable 2022

More picture related to Child Tax Credit Fully Refundable 2022

Child Tax Credit 2021 American Parents Could Owe Money After Monthly

https://cdn.abcotvs.com/dip/images/11421664_010322-ktrk-ewn-4pm-NNA-child-tax-credit-MON-matt-vid.jpg?w=1600

The Proposed 2022 Child Tax Credit How Will The Changes Affect You

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-6863513-1920w.jpeg

Planilla Child Tax Credit Desarrolladora Empresarial

https://www.incubadorasurcos.com/wp-content/uploads/2021/02/Untitled-design-38.png

The United States federal child tax credit CTC is a partially refundable a tax credit for parents with dependent children It provided 2 000 in tax relief per qualifying child with For 2023 taxes filed in 2024 the Child Tax Credit is 2 000 for children under age 17 Up to 1 600 of that amount is refundable Learn what it means for your taxes

ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024 The amount of your Child Tax The Tax Policy Center TPC estimates full refundability of the ARPA expanded child credit increases the average credit amount by 1 040 from 3 270 to

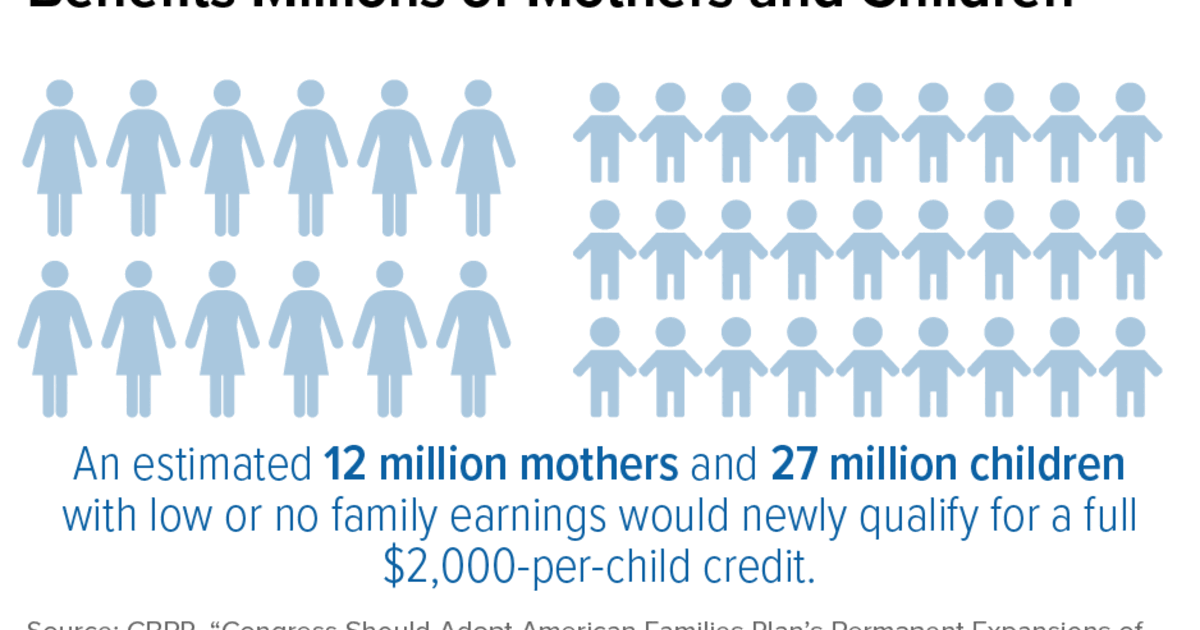

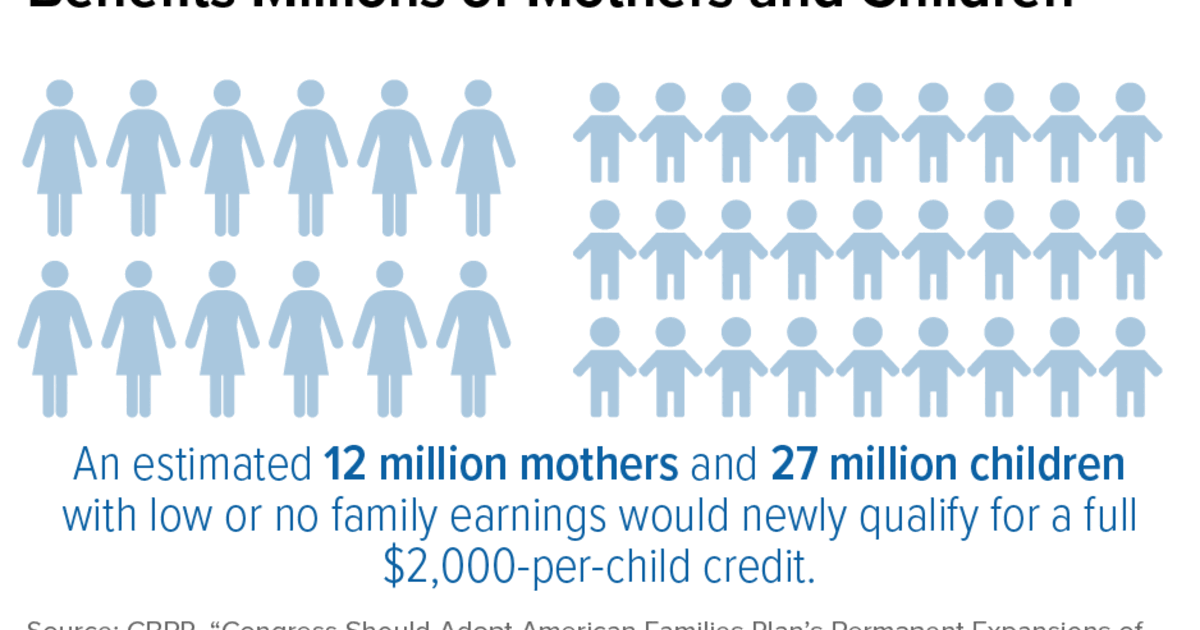

Making The Child Tax Credit Fully Refundable Benefits Millions Of

https://www.cbpp.org/sites/default/files/styles/facebook_og_image/public/2022-05/5-5-22tax_f0.png?itok=lIJbMDGK

Child Tax Credit 2022 Wie Die Erweiterung Die Armut F r Millionen

https://www.cnet.com/a/img/resize/467a7ff924dc1eb7faee5d1cbde3084323df7b33/2021/10/27/099cb325-85ba-4417-bd71-97d141b7c50f/child-tax-credit-stimulus-payment-cash-300-a-month-per-kid-2021-cnet-how-to-claim-009.jpg?auto=webp&fit=crop&height=630&width=1200

https://www.irs.gov/credits-deductions/tax-year...

A17 You may claim the fully refundable Child Tax Credit even if you received no income and paid no U S Social Security taxes The credit has been

https://www.irs.gov/pub/taxpros/fs-2022-28.pdf

The Child Tax Credit is a fully refundable tax credit for families with qualifying children The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help to

Child Tax Credits Ending In 2022 Dailynationtoday

Making The Child Tax Credit Fully Refundable Benefits Millions Of

Will We Get The Extra Child Tax Credit In January 2023 Leia Aqui What

Taking A Stand For Children Through The Child Tax Credit Tax Credits

Did Child Tax Credit Get Extended 2022 Latest News Update

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

House Passes Child Tax Credit Expansion NPR Tmg News

T22 0147 Make Child Tax Credit CTC Fully Refundable By ECI Level

How Much Is Child Tax Credit In 2022 Commons credit portal

Child Tax Credit Fully Refundable 2022 - Altogether Build Back Better s Child Tax Credit expansions full refundability and expanding the maximum credit to 3 600 for children under age 6 and