Child Tax Credit Income Limits 2023 Verkko 14 huhtik 2023 nbsp 0183 32 How much is the child tax credit in 2023 The maximum tax credit available per child has reverted to its pre expansion level of 2 000 for each child under 17 on Dec 31 2022

Verkko 14 jouluk 2023 nbsp 0183 32 What are the 2023 child tax credit income limits There are income limits for claiming the federal child tax credit but these limits are more generous than for some other Verkko 24 elok 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

Child Tax Credit Income Limits 2023

Child Tax Credit Income Limits 2023

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Child Tax Credit Income Limits 2024 Federal Tax Credits TaxUni

https://www.taxuni.com/wp-content/uploads/2021/12/Child-Tax-Credit-Income-Limits-768x432.jpg

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Verkko 3 helmik 2023 nbsp 0183 32 The maximum tax credit per qualifying child is 2 000 for kids 5 and younger or 3 000 for those 6 through 17 Additionally you can t receive a portion of the credit in advance as was Verkko 27 marrask 2023 nbsp 0183 32 For taxable years beginning in 2024 for a child to whom the 167 1 g kiddie tax applies the exemption amount under 167 167 55 d and 59 j for purposes of the alternative minimum tax under 167 55 may not exceed the sum of 1 the child s earned income for the taxable year plus 2 9 250

Verkko 19 lokak 2023 nbsp 0183 32 The Child Tax Credit changes for 2021 have lower income limits than the original Child Tax Credit Families that do not qualify for the credit using these lower income limits are still eligible for the 2 000 per child credit using the original Child Tax Credit income and phase out amounts Verkko 15 jouluk 2023 nbsp 0183 32 The child tax credit is limited to 2 000 for every you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint filers

Download Child Tax Credit Income Limits 2023

More picture related to Child Tax Credit Income Limits 2023

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/t22-0188.gif?itok=6FfQuMuW

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

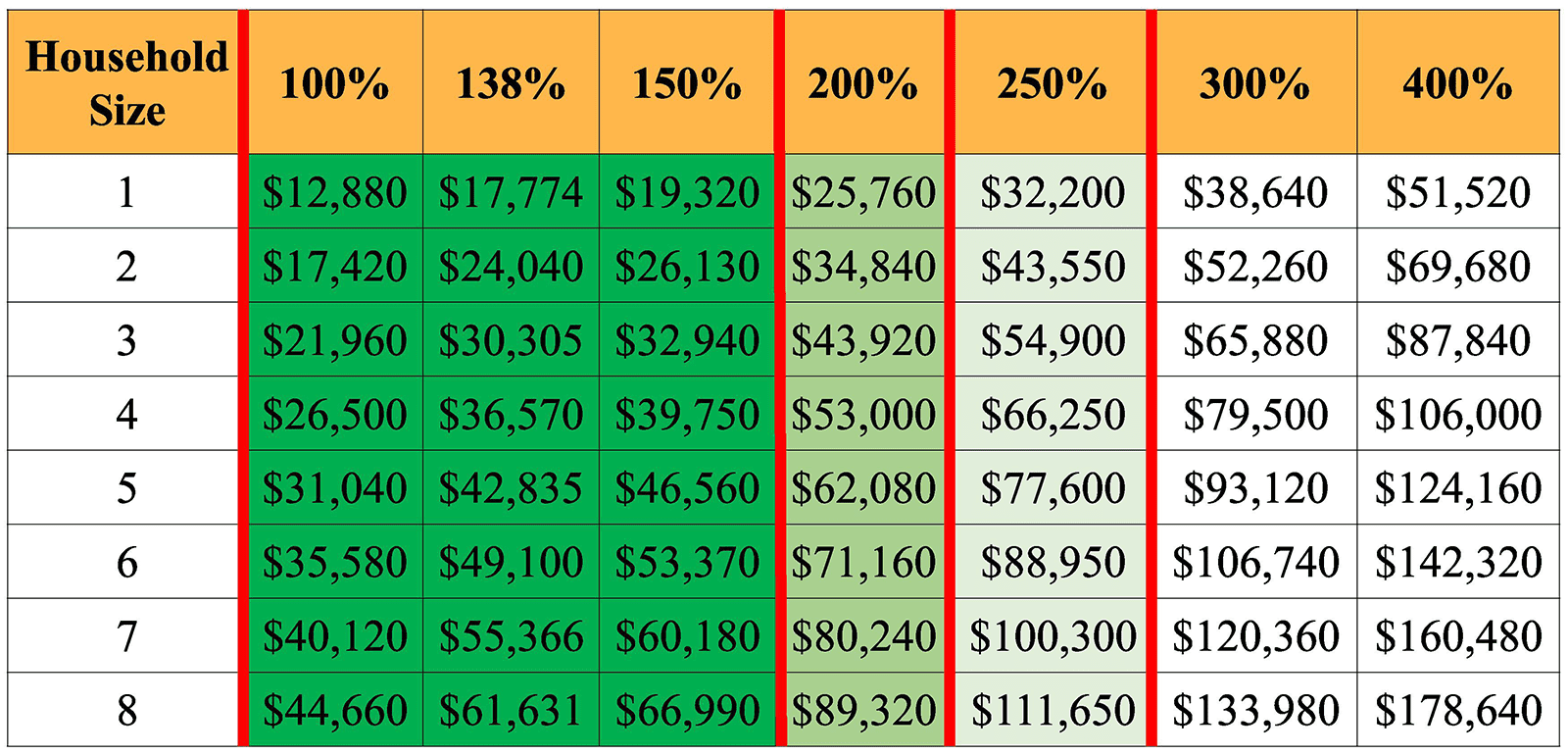

ACA Tax Credits To Help Pay Premiums White Insurance Agency

https://www.whiteinsuranceokc.com/wp-content/uploads/sites/4713/2021/11/2022-FPL-CHART_0001.png

Verkko 24 tammik 2023 nbsp 0183 32 Tax season 2023 officially started Here are key deadlines to keep in mind Head of household status If you re a single parent for tax purposes you re considered the head of the household Verkko 25 marrask 2023 nbsp 0183 32 Child Tax Credit The Child Tax Credit is given to taxpayers for each qualifying dependent child who is under the age of 17 at the end of the tax year Currently it s a 1 000 nonrefundable

Verkko 24 hein 228 k 2023 nbsp 0183 32 Enhanced Child Tax Credit Income Limit for 2023 2024 Support for Middle Income Families News Provided By Harbor Financial July 24 2023 18 56 GMT Share This Article Distribution Verkko The Child Tax Credit will help all families succeed The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from

House Passes Child Tax Credit Expansion NPR Tmg News

https://lh3.googleusercontent.com/J6_coFbogxhRI9iM864NL_liGXvsQp2AupsKei7z0cNNfDvGUmWUy20nuUhkREQyrpY4bEeIBuc=w0

New 2023 IRS Income Tax Brackets And Phaseouts

https://imageio.forbes.com/specials-images/imageserve/637d001647ac19edd4588245/0x0.jpg?format=jpg&width=1200

https://www.cnet.com/personal-finance/taxes/how-much-is-the-child-tax...

Verkko 14 huhtik 2023 nbsp 0183 32 How much is the child tax credit in 2023 The maximum tax credit available per child has reverted to its pre expansion level of 2 000 for each child under 17 on Dec 31 2022

https://www.kiplinger.com/taxes/child-tax-credit-faqs

Verkko 14 jouluk 2023 nbsp 0183 32 What are the 2023 child tax credit income limits There are income limits for claiming the federal child tax credit but these limits are more generous than for some other

Monthly Child Tax Credit Payments Understand The Options Articles

House Passes Child Tax Credit Expansion NPR Tmg News

Married Taxpayers Filing Separately

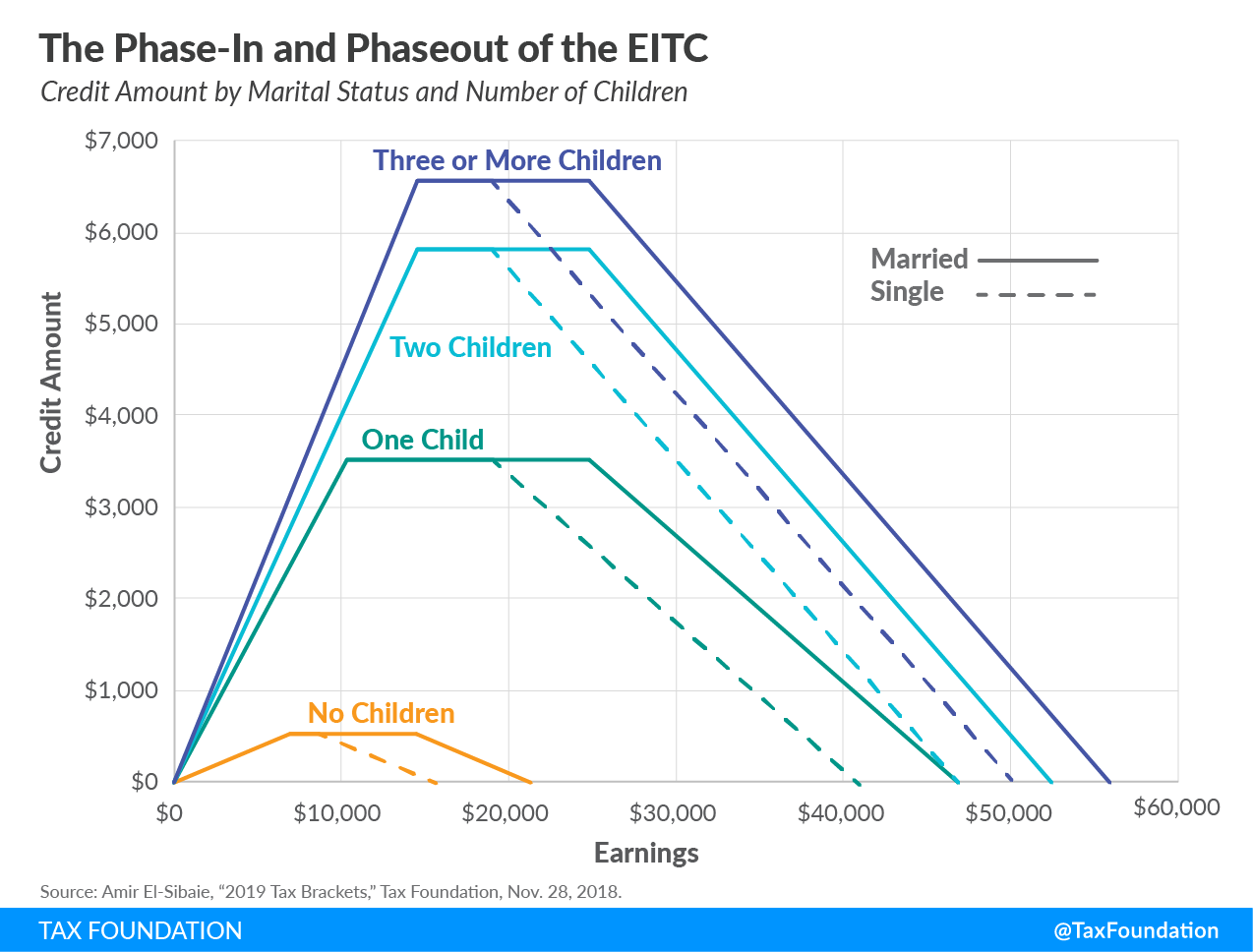

Earned Income Tax Credit EITC A Primer Tax Foundation

Child Tax Credit 2024 And Other Family Tax Credit Amounts Kiplinger

2023 Tax Brackets The Best Income To Live A Great Life

2023 Tax Brackets The Best Income To Live A Great Life

Details From IRS About Enhanced Child Tax Credits

2022 Education Tax Credits Are You Eligible

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Child Tax Credit Income Limits 2023 - Verkko 6 maalisk 2023 nbsp 0183 32 This portion of the child tax credit allows you to receive up to 1 500 per child as a refund even after your tax bill is reduced to zero For example Tim and Martha are a couple with a kid