Child Tax Credit Rebate 2023 Status Web Il y a 7 heures nbsp 0183 32 The child poverty rate surged to 12 4 in 2022 up from 5 2 in the year prior according to the bureau s data The Census Bureau attributed the increase to the

Web 5 juil 2017 nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or Web 28 d 233 c 2022 nbsp 0183 32 For the 2022 tax year the Child Tax Credit CTC has returned to pre pandemic levels This means that the maximum credit will return to 2 000 per child

Child Tax Credit Rebate 2023 Status

Child Tax Credit Rebate 2023 Status

https://i.ytimg.com/vi/2fcIiqyn8Wk/maxresdefault.jpg

Child Tax Credit 2023 Will CTC Be There In Next Year

https://republicmonews.com/wp-content/uploads/2023/01/child-tax-credit-2023.jpg

How Much Is The Child Tax Credit For 2023 Leia Aqui What Will The

https://www.cbpp.org/sites/default/files/styles/report_580_high_dpi/public/atoms/files/7-21-20taxf3.png?itok=GwmrdmOg

Web Il y a 13 heures nbsp 0183 32 Overall the supplemental poverty rate was 12 4 for 2022 up from 7 8 a year earlier and higher than the pre pandemic rate of 11 7 It s the first increase in Web 12 sept 2023 nbsp 0183 32 In 2021 the child poverty rate fell to a historic low of 5 2 largely due to the American Rescue Plan s expansion of the federal Child Tax Credit Key to this

Web 24 janv 2023 nbsp 0183 32 Having a child could make you eligible for the Earned Income Tax Credit If you have one child and your adjusted gross income was 43 492 if you re filing a return alone or 49 622 if you re Web 16 nov 2022 nbsp 0183 32 The Child Tax Credit got a sizable boost in 2021 While that boost went away for 2022 lawmakers are still fighting to bring it back Check out our pick for Best

Download Child Tax Credit Rebate 2023 Status

More picture related to Child Tax Credit Rebate 2023 Status

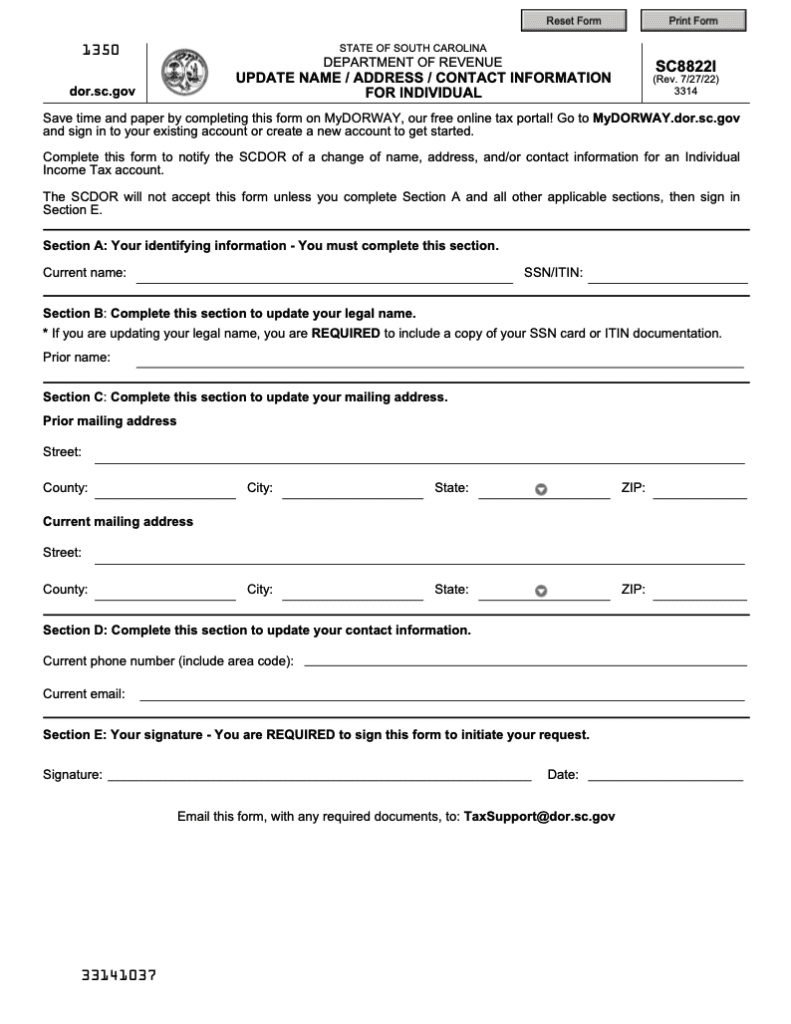

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/262/2629/262988/page_1_thumb_big.png

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

Nebraska Tax Rebate 2023 Eligibility Application Deadline Status

https://printablerebateform.net/wp-content/uploads/2023/04/Nebraska-Tax-Rebate-2023-768x678.png

Web Il y a 4 heures nbsp 0183 32 In 2021 as the economy reeled from the pandemic a one year expansion of the child tax credit led to a historic 46 percent decline in the child poverty rate But Web You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if

Web 14 avr 2023 nbsp 0183 32 How much is the child tax credit in 2023 The maximum tax credit available per child has reverted to its pre expansion level of 2 000 for each child under 17 on Web The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under

Carol Sordoni On Twitter The Welfare State No Compassion Cancel

https://pbs.twimg.com/media/FwpponeXoAIfEpI.jpg

Montana Tax Rebate 2023 Benefits Eligibility How To Apply

https://printablerebateform.net/wp-content/uploads/2023/04/Montana-Tax-Rebate-2023-768x684.png

https://www.cnbc.com/2023/09/12/child-poverty-surged-after-stimulus...

Web Il y a 7 heures nbsp 0183 32 The child poverty rate surged to 12 4 in 2022 up from 5 2 in the year prior according to the bureau s data The Census Bureau attributed the increase to the

https://www.nerdwallet.com/.../taxes/qualify-c…

Web 5 juil 2017 nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or

Homeowner Tax Rebate Credit 2023 DoyanTekno English

Carol Sordoni On Twitter The Welfare State No Compassion Cancel

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

Alconchoice Rebate 2023 Printable Rebate Form

Recovery Rebate Credit Child Born In 2023 Recovery Rebate

Recovery Rebate Credit Child Born In 2023 Recovery Rebate

Goodyear Rebate Form Guide October 2023 Steps To Apply And Track

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

Washington State Tax Rebate Printable Rebate Form

Child Tax Credit Rebate 2023 Status - Web 6 juil 2023 nbsp 0183 32 For the 2023 tax year taxes filed in 2024 the maximum child tax credit will remain 2 000 per qualifying dependent but the partially refundable payment will