Child Tax Rebate 2024 Application Who Qualifies You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States To be a qualifying child for the 2023 tax year your dependent generally must

For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional How will the Child Tax Credit change in 2024 On January 19 2024 the House Ways and Means Committee approved the Tax Relief for American Families and Workers Act of 2024 The proposed

Child Tax Rebate 2024 Application

Child Tax Rebate 2024 Application

https://baileyscarano.com/wp-content/uploads/2022/06/Depositphotos_329030836_XL.jpg

CT Child Tax Rebate Checks Are In The Mail Lamont Across Connecticut CT Patch

https://patch.com/img/cdn20/users/22994611/20220825/105526/styles/patch_image/public/money-bills___25105510368.jpg

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

Under the proposed bill the maximum refundable amount per child would rise to 1 800 in 2023 1 900 in 2024 and 2 000 in 2025 What else would change with the Child Tax Credit File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit ChildTaxCredit gov In addition the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the U S Territories

Child Tax Credit rates for the 2023 to 2024 tax year Moving to the UK from the EEA You must wait 3 months before claiming Child Tax Credit if you arrived in the UK from the EEA on or To claim Qualifying Child Relief QCR Handicapped Child Relief HCR for the Year of Assessment 2024 you must satisfy all these conditions in 2023 1 Your child is unmarried and was is a Born to you and your spouse ex spouse or b Is a step child or c Is legally adopted 2 Your child was a Below 16 years old or b

Download Child Tax Rebate 2024 Application

More picture related to Child Tax Rebate 2024 Application

Minnesota Rebate Checks And Child Tax Credit Coming Soon Kiplinger

https://cdn.mos.cms.futurecdn.net/6s7GLrUiaDFw4PtLwHLk5U-1024-80.jpg

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried Parents

https://womenbusinessnews.tv/the-1100-per-child-tax-rebate-bonus-for-divorced-and-unmarried-parents/1614527890_0x0.jpg

Child Tax Credit 2022 How Much Is It And When Will I Get It The US Sun

https://www.the-sun.com/wp-content/uploads/sites/6/2022/09/SC-Child-Tax-Credit-Comp-copy.jpg?w=1440

Credit The Child Tax Credit is one of the nation s strongest tools to provide tens of millions of families with some support and breathing room while raising children It has also being shown If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third and subsequent child The child must be a Singapore Citizen at the time of birth or within 12 months thereafter

As part of today s announcement Treasury Department s Office of Tax Analysis analyzed IRS data to identify where children who may be eligible to be claimed for the expanded and newly advanceable Child Tax Credit but who had not been claimed on a recent tax return are located If you have not registered your child for the CCB go to Canada child benefit How to apply If you and your ex spouse share custody of your child children if entitled you will receive payments equal to 50 of the amount you would have received if the child resided with you full time

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

https://lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

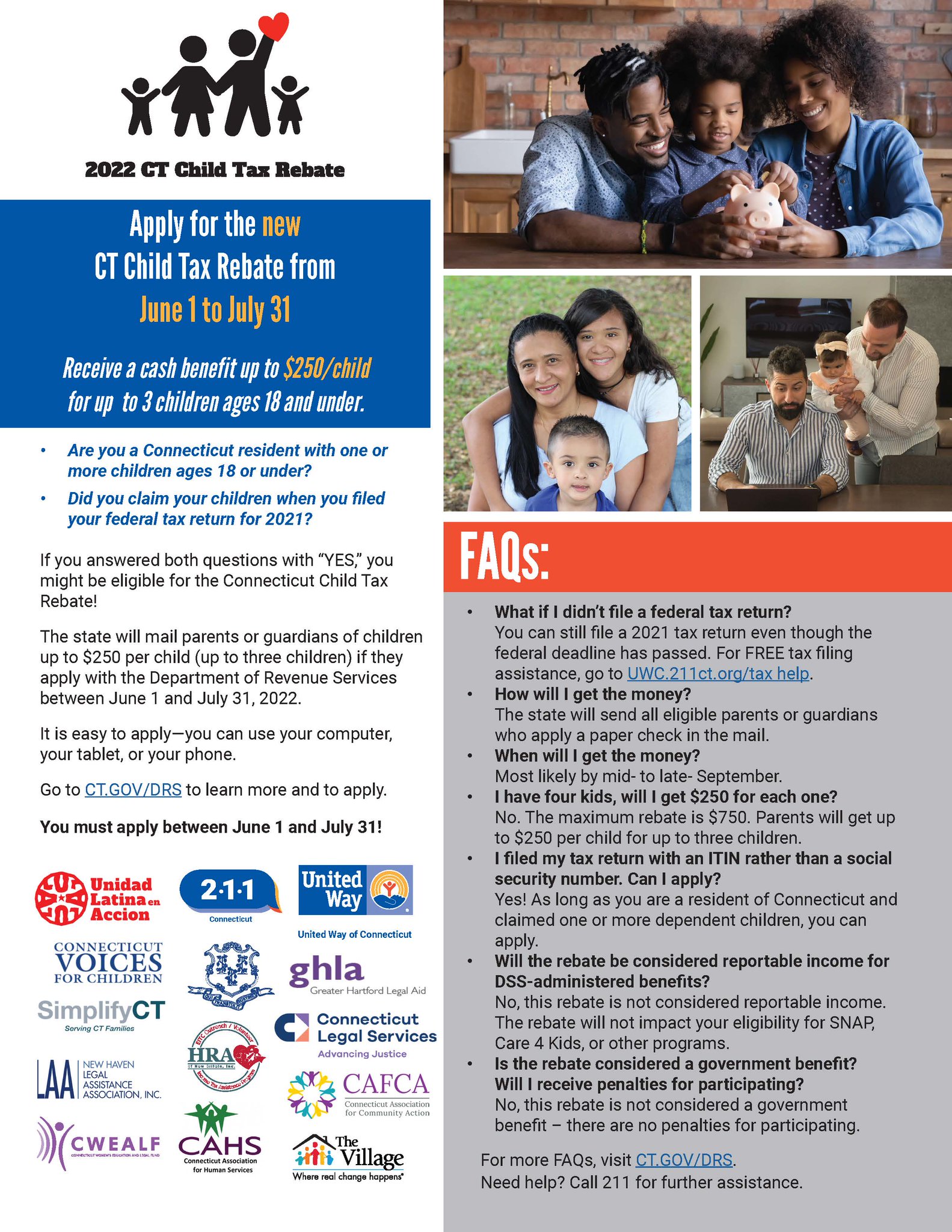

Application For 2022 Connecticut Child Tax Rebate Now Open

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAXXDjp.img?w=900&h=506&m=4&q=89

https://www. irs.gov /credits-deductions/individuals/child-tax-credit

Who Qualifies You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States To be a qualifying child for the 2023 tax year your dependent generally must

https://www. nerdwallet.com /article/taxes/qualify...

For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional

2022 Child Tax Rebate

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

Child Tax Rebate Program MUST APPLY BY 7 31 22 Borgida CPAs

What Is The Child Tax Credit Going To Be For 2023 Leia Aqui What Is The Monthly Child Tax

New Haven CSA On Twitter Applications For The Child Tax Rebate Are Open June 1st To July 31st

Did The Child Tax Credit Change For 2022 What You Need To Know

Did The Child Tax Credit Change For 2022 What You Need To Know

Child Tax Credits 1st Payments Sent July 15 Welcomed By Chicago Area Families ABC7 Chicago

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate Before July 31 Deadline

Child Tax Credit 2023 Can You Claim CTC With No Income YouTube

Child Tax Rebate 2024 Application - For the 2024 tax year returns you ll file in 2025 the refundable portion of the credit increases to 1 700 That means eligible taxpayers could receive an additional 100 per qualifying