Child Tax Rebate 2024 Status You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents

The child tax credit is a tax break families can receive if they have qualifying children The amount a family can receive is up to 2 000 per child but it s only partially refundable Under the proposed bill the maximum refundable amount per child would rise to 1 800 in 2023 1 900 in 2024 and 2 000 in 2025 What else would change with the Child Tax Credit Millions of

Child Tax Rebate 2024 Status

Child Tax Rebate 2024 Status

https://patch.com/img/cdn20/users/22994611/20220825/105526/styles/patch_image/public/money-bills___25105510368.jpg

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

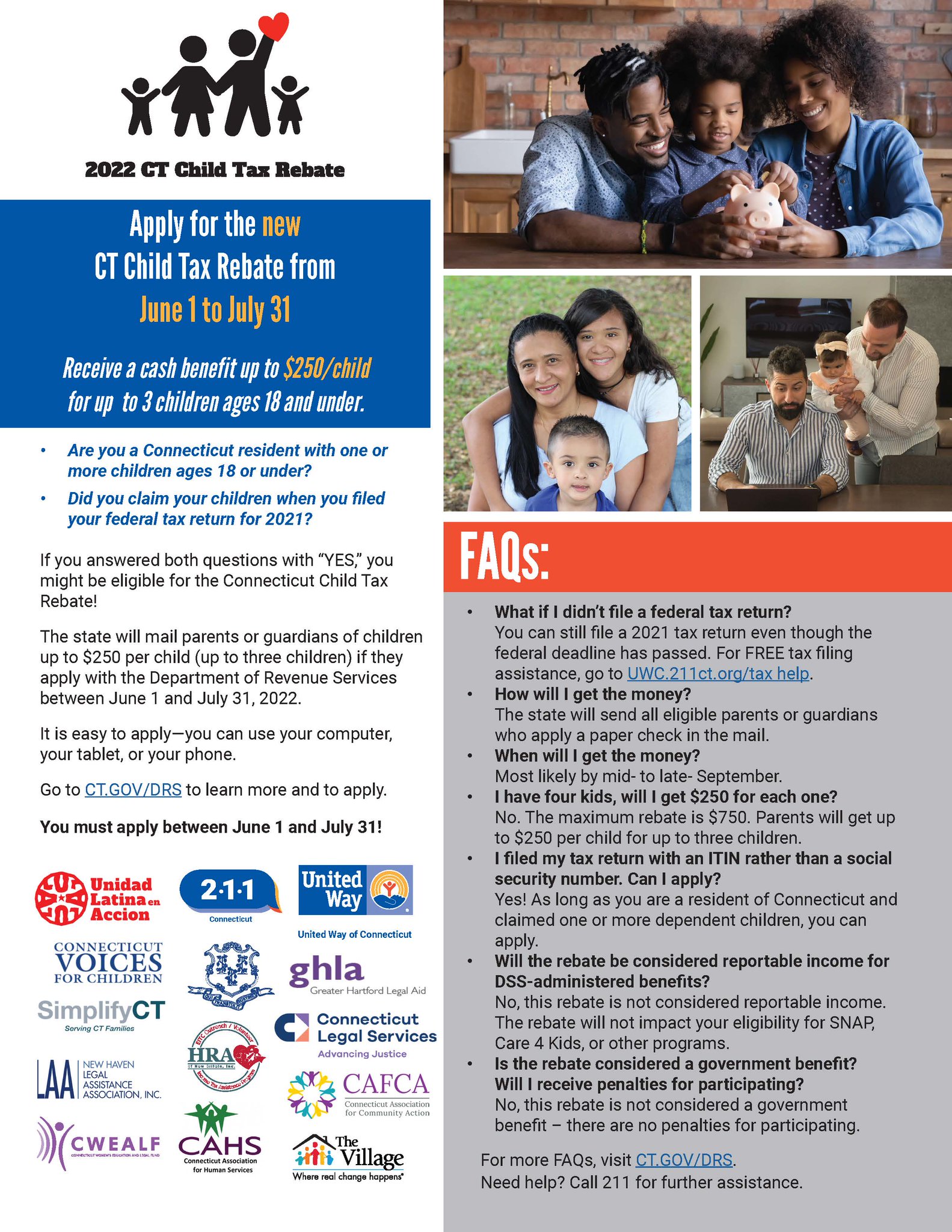

2022 Child Tax Rebate

https://portal.ct.gov/-/media/DCF/SPOTLIGHT/2022/June/Child-Tax-Rebate.png?sc_lang=en&h=1080&w=1080&la=en&hash=71DF1F1C6E19B1AE7C1DCCD9E598E4C5

At the beginning of 2024 the U S House of Representatives passed 78 billion tax legislation that includes a newly expanded federal child tax credit CTC and various tax breaks for The Tax Relief for American Families and Workers Act of 2024 is currently making its way to the Senate would raise the refundable portion cap of child tax credit from 1 800 to 1 900 to

For 2024 returns you ll typically file in early 2025 the refundable portion of the child tax credit is 1 700 For the prior 2023 tax year only 1 600 was refundable Note Remember if you How much is the 2024 child tax credit The maximum tax credit available per kid is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to 1 600 per

Download Child Tax Rebate 2024 Status

More picture related to Child Tax Rebate 2024 Status

Minnesota Rebate Checks And Child Tax Credit Coming Soon Kiplinger

https://cdn.mos.cms.futurecdn.net/6s7GLrUiaDFw4PtLwHLk5U-1024-80.jpg

2022 Connecticut Child Tax Rebate Bailey Scarano

https://baileyscarano.com/wp-content/uploads/2022/06/Depositphotos_329030836_XL.jpg

New Haven CSA On Twitter Applications For The Child Tax Rebate Are Open June 1st To July 31st

https://pbs.twimg.com/media/FUQOuiOWQAI-e9m.jpg:large

Federal lawmakers have proposed a 78 billion bipartisan bill that enhances the child tax credit by providing more generous benefits to parents a move that could lift nearly half a million 2024 10 10 List of payment dates for Canada Child Tax Benefit CCTB GST HST credit Universal Child Care Benefit UCCB and Working Income Tax Benefit WITB

The American Rescue Plan increased the amount of the Child Tax Credit from 2 000 to 3 600 for qualifying children under age 6 and 3 000 for other qualifying children under age 18 The credit was made fully refundable The child tax credit is a 2 000 benefit available to those with dependent children under 17 For 2024 and 2025 1 700 of the credit will be potentially refundable

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried Parents

https://womenbusinessnews.tv/the-1100-per-child-tax-rebate-bonus-for-divorced-and-unmarried-parents/1614527890_0x0.jpg

Child Tax Credit 2022 How Much Is It And When Will I Get It The US Sun

https://www.the-sun.com/wp-content/uploads/sites/6/2022/09/SC-Child-Tax-Credit-Comp-copy.jpg?w=1440

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents

https://www.cnet.com/personal-finance/taxes/child...

The child tax credit is a tax break families can receive if they have qualifying children The amount a family can receive is up to 2 000 per child but it s only partially refundable

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate Before July 31 Deadline

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried Parents

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

Child Tax Rebate Program MUST APPLY BY 7 31 22 Borgida CPAs

Application For 2022 Connecticut Child Tax Rebate Now Open

What Is The Child Tax Credit Going To Be For 2023 Leia Aqui What Is The Monthly Child Tax

What Is The Child Tax Credit Going To Be For 2023 Leia Aqui What Is The Monthly Child Tax

Did The Child Tax Credit Change For 2022 What You Need To Know

Child Tax Credits 1st Payments Sent July 15 Welcomed By Chicago Area Families ABC7 Chicago

Topic Child Tax Credit Change

Child Tax Rebate 2024 Status - At the beginning of 2024 the U S House of Representatives passed 78 billion tax legislation that includes a newly expanded federal child tax credit CTC and various tax breaks for