Child Tax Rebate Iowa Web 14 juil 2021 nbsp 0183 32 48 000 Iowa kids under 18 will be lifted above or closer to the poverty line by the expansion How it works All working families making up to 150 000 per couple or

Web 8 juil 2021 nbsp 0183 32 Iowans with children qualify for the child tax credit if their household income is less than 112 500 for a single tax filer or less than 150 000 for a married couple filing Web 15 d 233 c 2021 nbsp 0183 32 Families with children received an advance payment from the federal government 300 a month for kids 5 and younger and 250 for children aged 6 to 17

Child Tax Rebate Iowa

Child Tax Rebate Iowa

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAZZRwK.img?w=1280&h=720&m=4&q=79

200 000 CT Households Have Applied For The Child Tax Credit Rebate

https://greenwichfreepress.com/wp-content/uploads/2022/07/Screen-Shot-2022-07-28-at-9.30.59-PM.jpg

Child Tax Rebate When Will You Get These 600 Payments Marca

https://phantom-marca.unidadeditorial.es/eaacd793de6f1e52c6781f60436f50f4/crop/33x0/582x366/f/jpg/assets/multimedia/imagenes/2022/07/21/16583911124272.png

Web 26 juil 2021 nbsp 0183 32 Under the new program families can receive 3 000 per child aged six to 17 or about 250 per month per child Families will receive 3 600 per child under the age Web Thanks to the ARP the vast majority of families in Iowa will receive 3 000 per child ages 6 17 years old and 3 600 per child under 6 as a result of the increased 2021 Child Tax

Web 7 janv 2022 nbsp 0183 32 The Child Tax Credit is a credit available to certain taxpayers who claim a minor child in the household on their tax return This article will not address the Web Applications for 2021 installations are due May 2 2022 Submit applications through taxcredit iowa gov Line 60 For tax years 2021 and later the income eligibility threshold

Download Child Tax Rebate Iowa

More picture related to Child Tax Rebate Iowa

Wisc Child Tax Rebate Deadline KDWA 1460 AM

https://kdwa.com/wp-content/uploads/2018/06/8a1b87173780fceeda2ee53307209157.jpg

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/2022-child-tax-rebate-ends-july-31-access-community-action-agency-1.png?fit=1080%2C1920&ssl=1

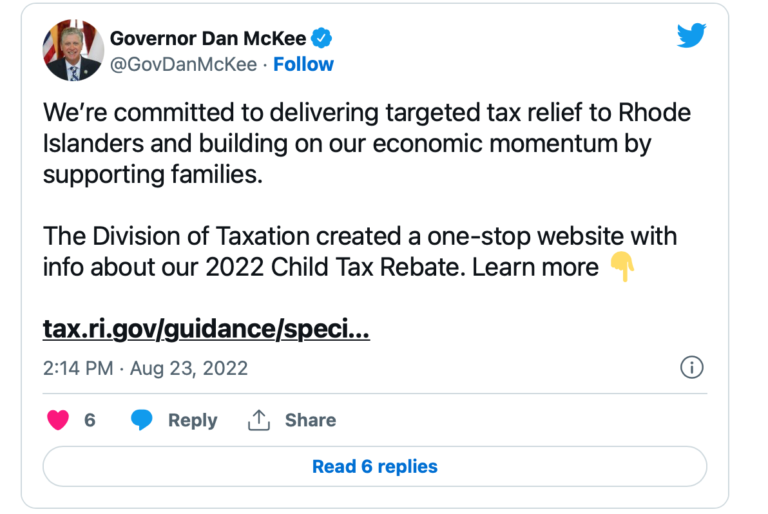

Online Portal To Help Rhode Islanders With Child Tax Rebate

https://oceanstatecurrent.com/wp-content/uploads/2022/08/Screen-Shot-2022-08-30-at-9.46.51-AM-768x514.png

Web CHILD AND DEPENDENT CARE TAX CREDIT CDCTC Rate Fully Refundable Ranges from 75 30 of federal CDCTC based on income See Iowa s Child and Dependent Web 3 f 233 vr 2022 nbsp 0183 32 She said Democrats want to increase the amount of the Child and Dependent Care Tax Credit which is currently available to taxpayers making up to 90 000 a year

Web 20 d 233 c 2022 nbsp 0183 32 The temporary expanded child tax credit part of a COVID 19 relief deal in 2021 allowed more low income families including those with no income at all to claim Web The federal CDC Tax Credit allows taxpayers to reduce tax liability depending on the income of the taxpayer by an amount up to 50 0 of 8 000 in eligible child care

Nearly 800 000 Parents California Tax Rebate Fair Game For Garnishing

https://bloximages.newyork1.vip.townnews.com/thecentersquare.com/content/tncms/assets/v3/editorial/c/59/c59d0fae-3eac-11ed-8eee-a3590b0ff792/63336d8936bf1.image.jpg?resize=990%2C660

Jimmy Tickey On Twitter Starting Today 250 Per Child Tax Rebates

https://pbs.twimg.com/media/FUNcpk7XEAIy3dE?format=jpg&name=large

https://www.senate.iowa.gov/democrats/2021/07/expanded-child-tax...

Web 14 juil 2021 nbsp 0183 32 48 000 Iowa kids under 18 will be lifted above or closer to the poverty line by the expansion How it works All working families making up to 150 000 per couple or

https://www.desmoinesregister.com/story/news/politics/2021/07/08/iowa...

Web 8 juil 2021 nbsp 0183 32 Iowans with children qualify for the child tax credit if their household income is less than 112 500 for a single tax filer or less than 150 000 for a married couple filing

WFSB Channel 3 Eyewitness News CT Child Tax Rebate Deadline

Nearly 800 000 Parents California Tax Rebate Fair Game For Garnishing

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate

CT Families Should Begin Receiving Child Tax Rebates This Week

State Child Tax Rebate Checks To Begin Arriving This Week NBC Connecticut

/cloudfront-us-east-1.images.arcpublishing.com/gray/POPXNPLVGVH6RB6S2K5SW2CPRE.jpg)

Gov Lamont Child Tax Rebate Checks Will Start Going Out Next Week

/cloudfront-us-east-1.images.arcpublishing.com/gray/POPXNPLVGVH6RB6S2K5SW2CPRE.jpg)

Gov Lamont Child Tax Rebate Checks Will Start Going Out Next Week

250 RI

Did You Qualify For The Child Tax Rebate It ll Be Sent Out To

Deadline Approaching To Apply For State Child Tax Rebate NBC Connecticut

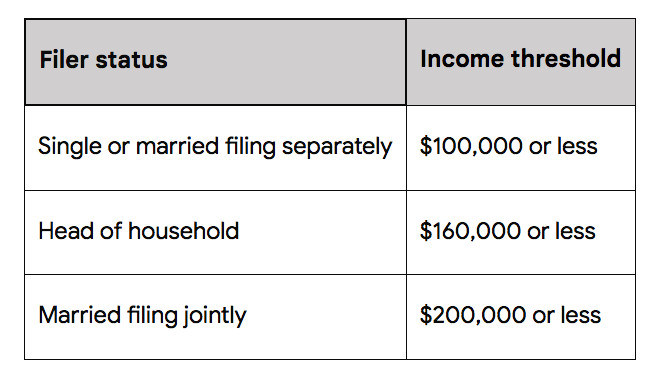

Child Tax Rebate Iowa - Web 20 d 233 c 2021 nbsp 0183 32 That means the child tax credit returns to a 2 000 lump sum for individuals making up to 200 000 and couples filing jointly who make up to 400 000 with 1 400