Child Tax Rebate Singapore Web Based on the income tax rates for Singapore tax resident for Year of Assessment 2023 Next 7 000 7 490 Gross Tax Payable 1 040 Less Parenthood Tax Rebate

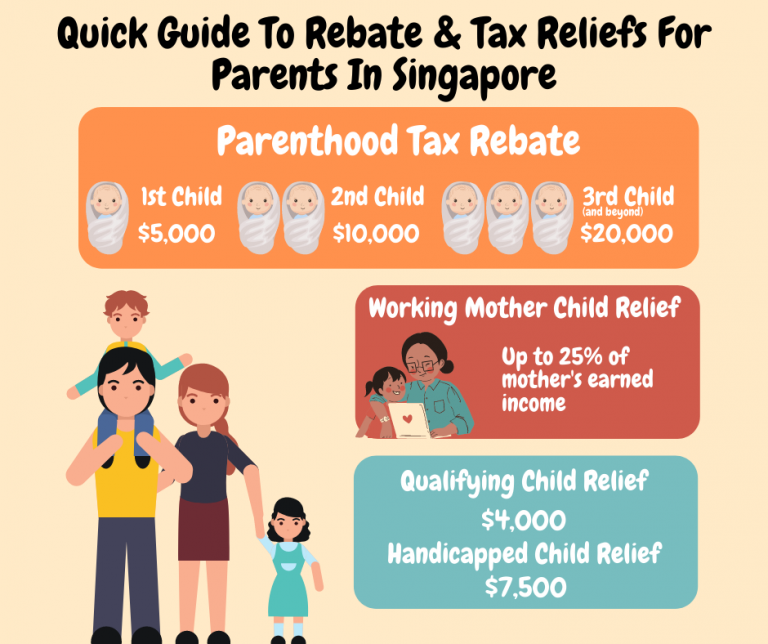

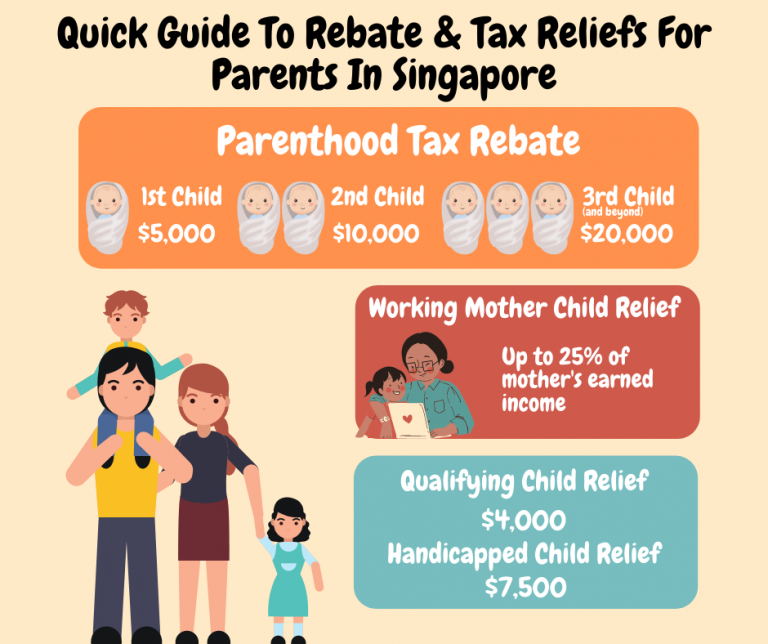

Web Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 Web You are eligible for personal reliefs and rebates if you are a Singapore Tax Resident and if you fulfilled the qualifying conditions of the reliefs and rebates Answer a few simple

Child Tax Rebate Singapore

Child Tax Rebate Singapore

https://www.raisingangels.sg/wp-content/uploads/2021/11/Untitled-design-7-1-768x644.png

SG Budget Babe How To Reduce Your Income Tax In Singapore make Use Of

https://2.bp.blogspot.com/-_pLNiXKLQqI/WsuZ3S3YQJI/AAAAAAAAYsE/E9ORc-9MkocQGM1lJApJ0ugHZXzRROWAgCLcBGAs/s1600/Child-Related%2BReliefs.JPG

2022 Child Tax Rebate Stratford Crier

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

Web 27 sept 2022 nbsp 0183 32 The lump sum rebate is given to most Singapore tax residents who may be married divorced or widowed and if you are qualified you can claim up to 20 000 per Web 21 avr 2021 nbsp 0183 32 The Parenthood Tax Rebate PTR is given to tax residents to encourage them to have more children To qualify you must be a Singapore tax resident who is married divorced or widowed in the

Web 27 avr 2018 nbsp 0183 32 The Parenthood Tax Rebate PTR allows married divorced or widowed tax resident parents to claim rebates of up to SGD 20 000 per child To qualify for the PTR a number of conditions will need to be met Web claim Parenthood Tax Rebate PTR if you are a married divorced or widowed tax resident of Singapore who has a a child born to you and your spouse ex spouse in 2016 and

Download Child Tax Rebate Singapore

More picture related to Child Tax Rebate Singapore

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

https://accessagency.org/wp-content/uploads/2022/06/Story-Get-your-2022-Child-Tax-Rebate-600x1067.png

Are YOU Eligible For The CT Child Tax Rebate

https://www.cthousegop.com/ackert/wp-content/uploads/sites/3/2022/06/Child-Tax-Rebate-July-2022.png

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Web Here s How Singapore s Parenthood Tax Rebate 2023 Can Save You up to 50 000 Tax season in Singapore is here Did you know that you re entitled to a range of parenting Web 14 f 233 vr 2023 nbsp 0183 32 It comprises the Baby Bonus Cash Gift BBCG and a Child Development Account CDA a special co savings scheme for your child The CDA has two

Web 11 nov 2021 nbsp 0183 32 1st child 5 000 2nd child 10 000 3rd subsequent child 20 000 If your child was born before 1 Jan 2008 you will not qualify for the 1st child rebate nor the Web 24 janv 2020 nbsp 0183 32 An SGD5 000 tax rebate is granted for the first child and SGD10 000 is granted for the second child SGD20 000 is granted for the fourth and the fifth child

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

https://theindependent.sg/wp-content/uploads/2020/02/Screen-Shot-2020-02-29-at-12.34.17-PM.png

200 000 CT Households Have Applied For The Child Tax Credit Rebate

https://greenwichfreepress.com/wp-content/uploads/2022/07/Screen-Shot-2022-07-28-at-9.30.59-PM.jpg

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of...

Web Based on the income tax rates for Singapore tax resident for Year of Assessment 2023 Next 7 000 7 490 Gross Tax Payable 1 040 Less Parenthood Tax Rebate

https://www.madeforfamilies.gov.sg/.../tax-relief-and-rebates

Web Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000

Child Tax Rebates

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

Child Tax Rebate Program MUST APPLY BY 7 31 22 Borgida CPAs

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate

Child Tax Credit 2022 Three 250 Direct Payments Dropping Next Month

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

Wisc Child Tax Rebate Deadline KDWA 1460 AM

/cloudfront-us-east-1.images.arcpublishing.com/gray/4XYKWGZPTNJWFDTUFAYALIPNZ4.jpg)

Nearly 95 Million Claimed By Families Through Child Tax Rebate

Child Tax Rebate Singapore - Web 13 mars 2023 nbsp 0183 32 You will have to pay taxes if you re a Singapore citizen earning an annual income of S 20 000 or more and the filing deadline for individuals is 18 April annually