Child Tax Rebate Status Wisconsin Web 3 avr 2022 nbsp 0183 32 2022 Tax Refund How Child Tax Credit Affect Wisconsin Parents Ethan Duran April 3 2022 183 5 min read 0 MILWAUKEE WI Parents across America

Web 3 avr 2022 nbsp 0183 32 The tax credits part of President Joe Biden s 1 9 trillion coronavirus relief program increased payments to up to 3 600 annually for each child age 5 or younger Web Child Care Tax Credits Information for Parents Wisconsin Department of Children and Families SKU B 17 Program Child Care Information Center CCIC Category For

Child Tax Rebate Status Wisconsin

Child Tax Rebate Status Wisconsin

https://fox47.com/resources/media2/16x9/full/1024/center/80/cb7c2645-4974-4715-af8a-bc8432e275ac-large16x9_Taxestaxforms.jpg

/cloudfront-us-east-1.images.arcpublishing.com/gray/I5C5EXIP6RIRDAL5J3CQLM5U2Q.jpg)

Wisconsin Taxpayers Can Apply For Child Tax Rebate May 15

https://gray-wbay-prod.cdn.arcpublishing.com/resizer/I2wQF3gAKqHh-1j2_sKN_4n8WLo=/1200x600/smart/filters:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/gray/I5C5EXIP6RIRDAL5J3CQLM5U2Q.jpg

Wisconsin Child Tax Rebate Proving To Be Popular WXPR

https://npr.brightspotcdn.com/dims4/default/eb020f0/2147483647/strip/true/crop/275x144+0+19/resize/1200x630!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Flegacy%2Fsites%2Fwxpr%2Ffiles%2F201805%2Fmoney_moo.jpg

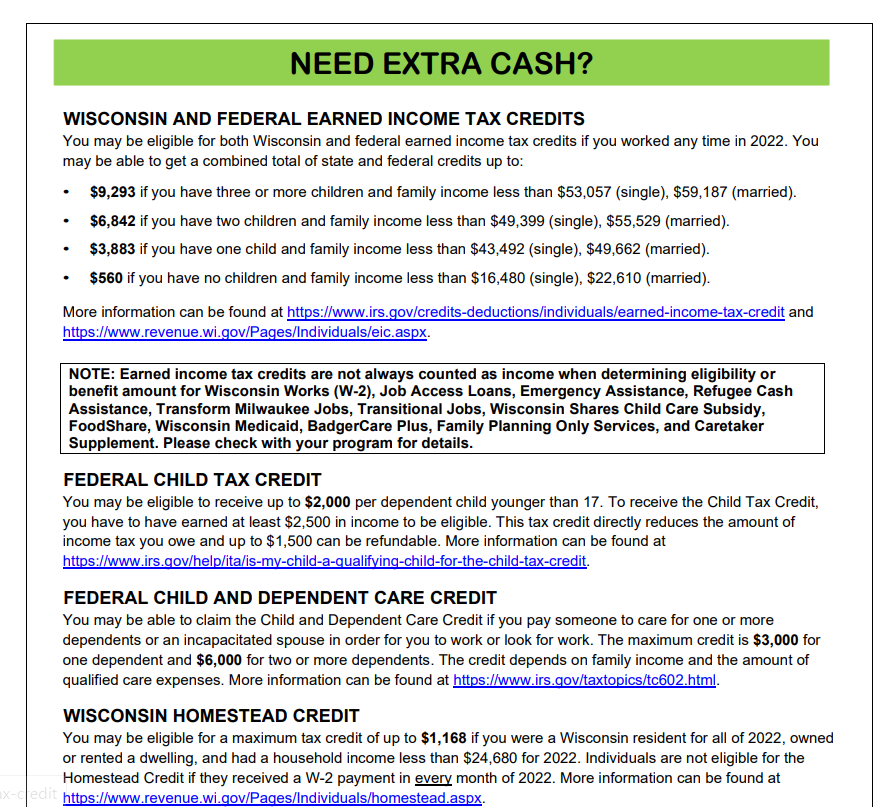

Web Wisconsin taxpayers can apply online starting Tuesday for a 100 per child tax rebate The rebate can be claimed through a newly launched state website Web 2 d 233 c 2021 nbsp 0183 32 What You Should Know In order to claim the homestead credit you or your spouse must meet certain qualifications including one of the following You or your

Web 28 janv 2022 nbsp 0183 32 With a mix of direct rebates to taxpayers tax credits and education funding increases Gov Tony Evers rolled out a plan Thursday for more than one third of the state s projected 3 8 billion revenue Web 16 mai 2018 nbsp 0183 32 MADISON Wisconsin taxpayers with children younger than 18 are eligible for a 100 per child tax rebate Here s how to claim the money Here s how to claim the

Download Child Tax Rebate Status Wisconsin

More picture related to Child Tax Rebate Status Wisconsin

Gov s Office Announces Final Tally Of Applications For Child Tax Rebate

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAZZRwK.img?w=1280&h=720&m=4&q=79

Wisconsin Parents Want Your 100 Child Tax Rebate Today Is The LAST

https://i.ytimg.com/vi/f1FHUxMqmdM/maxresdefault.jpg

Wisconsin Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/05/Wisconsin-Tax-Rebate-2023.png

Web 15 mai 2018 nbsp 0183 32 and last updated 7 43 AM May 15 2018 MADISON Wis AP The application window is now open for Wisconsin taxpayers with children under age 18 to Web 15 mai 2018 nbsp 0183 32 MADISON Wisconsin taxpayers with children under age 18 are eligible for a 100 per child tax rebate More than 71 000 submitted claims for the rebate in the

Web New in 2022 Additional Child and Dependent Care Tax Credit A new credit is available to taxpayers claiming the federal child and dependent care tax credit As a result the child Web 4 a claimant may claim as an approximation of the nonbusiness Wisconsin sales or use tax paid in 2017 for raising children a rebate equal to 100 for each qualified child of

2022 Child Tax Rebate Stratford Crier

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

State Officials To Provide Update On State Child Tax Rebate

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/state-officials-to-provide-update-on-state-child-tax-rebate.jpg?resize=1024%2C576&ssl=1

https://news.yahoo.com/2022-tax-refund-child-tax-160529061.html

Web 3 avr 2022 nbsp 0183 32 2022 Tax Refund How Child Tax Credit Affect Wisconsin Parents Ethan Duran April 3 2022 183 5 min read 0 MILWAUKEE WI Parents across America

/cloudfront-us-east-1.images.arcpublishing.com/gray/I5C5EXIP6RIRDAL5J3CQLM5U2Q.jpg?w=186)

https://patch.com/wisconsin/milwaukee/2022-tax-refund-how-child-tax...

Web 3 avr 2022 nbsp 0183 32 The tax credits part of President Joe Biden s 1 9 trillion coronavirus relief program increased payments to up to 3 600 annually for each child age 5 or younger

Wisc Child Tax Rebate Deadline KDWA 1460 AM

2022 Child Tax Rebate Stratford Crier

Shawn Black Official SBlack Twitter

Tax Child Rebate Dates And How To Get A Rebate Of Up To 750 Marca

CT Families Should Begin Receiving Child Tax Rebates This Week

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate

Are YOU Eligible For The CT Child Tax Rebate

Martwick Encourages Residents To Check Their Tax Rebate Status

How To Check The Status Of Your Child s Tax Refund Gardner Quad Squad

Child Tax Rebate Status Wisconsin - Web 2 d 233 c 2021 nbsp 0183 32 What You Should Know In order to claim the homestead credit you or your spouse must meet certain qualifications including one of the following You or your