Cis Scheme Tax Rebate Web 20 juil 2017 nbsp 0183 32 You can claim a repayment of your Construction Industry Scheme deductions if you re a limited company subcontractor or an agent of a limited company and you ve

Web Under the Construction Industry Scheme CIS contractors deduct money from a subcontractor s payments and pass it to HM Revenue and Customs HMRC The Web Quickly calculate how big your CIS tax rebate is and what expenses you can claim Sometimes you can claim expenses even without receipts

Cis Scheme Tax Rebate

Cis Scheme Tax Rebate

https://image.slidesharecdn.com/cistaxrebates-190325141611/95/cis-tax-rebates-1-638.jpg?cb=1553523394

Are You Due A Tax Rebate As A Construction Worker CIS Tax Rebates

https://i.ytimg.com/vi/15YyMso62Pg/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgTChBMA8=&rs=AOn4CLASCPM38RGfKJdxMK3jSJV9qnVM9g

CIS Tax Rebates Verulams

https://verulams.co.uk/wp-content/uploads/2022/01/construction-engineers-discussion-with-architects-at-construction-site-1024x540.jpg

Web 4 janv 2022 nbsp 0183 32 Most CIS workers receive a tax refund rebate after they submit their Self Assessment tax return because they usually overpay towards their tax bill through CIS Web Under the CIS you will likely be entitled to a tax rebate as you will have had 20 tax deducted from your salary to contribute towards your tax and National Insurance

Web CIS tax rebates generally take about 4 10 weeks for HMRC to process RIFT s CIS refund service includes handling your Self Assessment CIS tax return and full aftercare Web Taxfile will help you claim a tax refund rebate for overpayment of tax you have already paid through the Construction Industry Scheme CIS You can claim from 6 April for

Download Cis Scheme Tax Rebate

More picture related to Cis Scheme Tax Rebate

CIS Tax Rebate CIS Refunds CIS Tax Link Accountants London

https://www.cis-taxlink.co.uk/wp-content/uploads/2015/03/home-banner3.jpg

What Is CIS Construction Industry Scheme TaxScouts

https://cloud.squidex.io/api/assets/1c23ea2b-08a5-45fa-b1fc-e93d3cf8d611

CIS Tax Rebate CIS Refunds CIS Tax Link Accountants London

https://www.cis-taxlink.co.uk/wp-content/uploads/2015/03/home-banner4.jpg

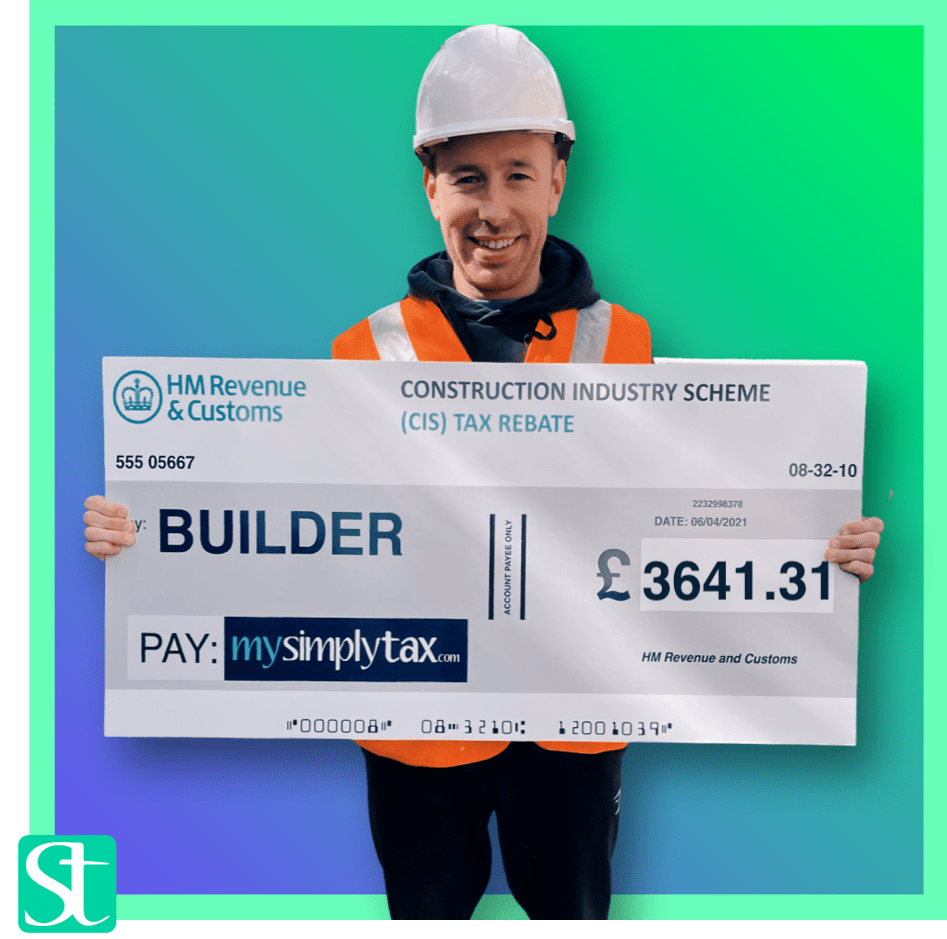

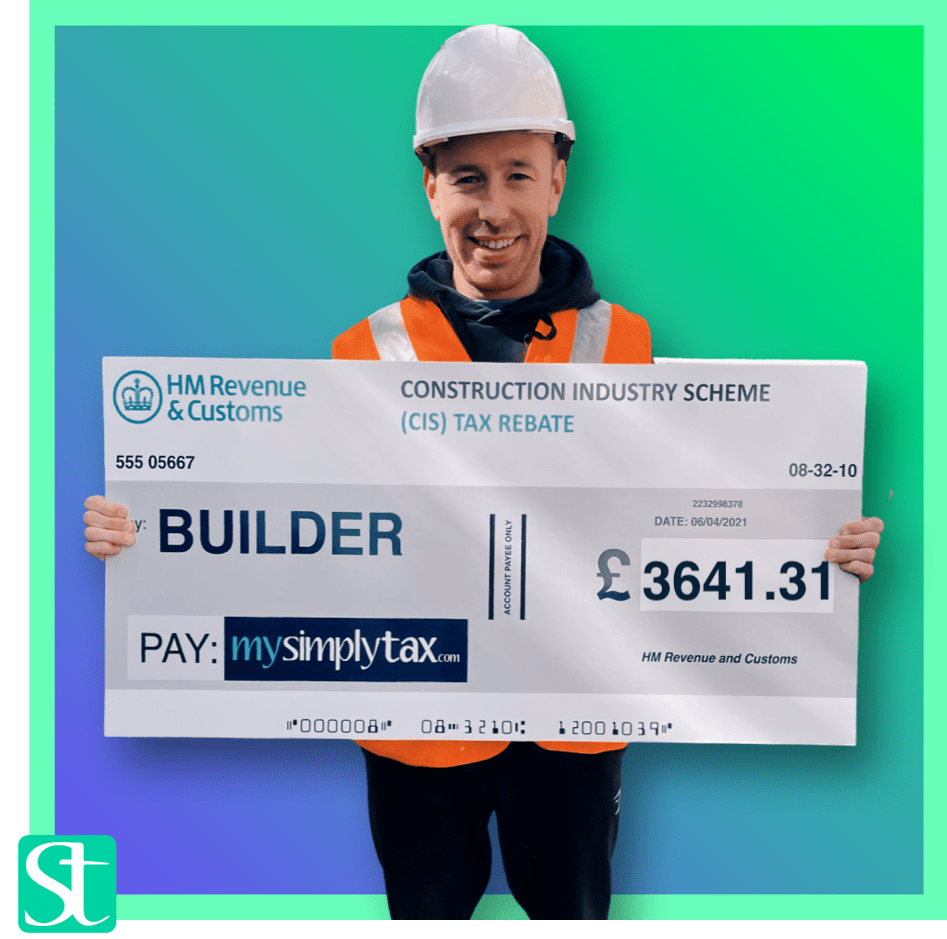

Web 29 sept 2020 nbsp 0183 32 Construction Industry Scheme CIS Tax Rebate By CANALITIX ACCOUNTANTS September 29 2020 CIS contractors CIS subcontractors Construction Web James reclaimed 163 2 274 through IN SYNC James was a self employed plumber and knew that he could claim a CIS tax refund but wasn t sure how to do it With the help of our team we helped him get a refund of 163 2 274

Web Under the Construction Industry Scheme CIS your tax is deducted from your pay in advance at 20 or 30 Emergency Tax if your UTR has not been CIS activated If Web CLAIM BACK YOUR CIS TAX RETURNS NOW If you work in any type of construction or labouring job you will almost certainly be entitled to claim a Construction Industry

CIS Construction Industry Scheme Rebate My Tax Ltd

https://www.rebatemytax.com/wp-content/uploads/2020/07/Service_3-1160x770.jpg

Tax In 10 ish Seconds What Is The CIS Rebate YouTube

https://i.ytimg.com/vi/v2kYgc9PlOE/maxresdefault.jpg

https://www.gov.uk/guidance/claim-a-refund-of-construction-industry...

Web 20 juil 2017 nbsp 0183 32 You can claim a repayment of your Construction Industry Scheme deductions if you re a limited company subcontractor or an agent of a limited company and you ve

https://www.gov.uk/what-is-the-construction-industry-scheme

Web Under the Construction Industry Scheme CIS contractors deduct money from a subcontractor s payments and pass it to HM Revenue and Customs HMRC The

CIS Tax Rebate Service YouTube

CIS Construction Industry Scheme Rebate My Tax Ltd

Personal Tax Return CIS REBATE Company Accounts VAT Returns

Cis Domestic Reverse Charge Invoice Template Words That End In Vat

CIS Tax Rebate CIS Refunds CIS Tax Link Accountants London

Online Income Tax Cis Tax Rebate Hmrc Tax Refund And Return Calculator

Online Income Tax Cis Tax Rebate Hmrc Tax Refund And Return Calculator

Cis Tax Rebate Calculator CALCULATORSD

What Is The CIS Tax Rebate Calculator For Tax Rebate Services

CIS Tax Refund In London The CIS Tax Rebate Is A Refund Of Tax To

Cis Scheme Tax Rebate - Web What is the CIS rebate The 20 deduction usually works out as more than you owe in tax so subcontractors can claim back a CIS tax rebate from HMRC in the April of the