Cis Tax Rebate Number Web 20 juil 2017 nbsp 0183 32 To make a claim online or by post you ll need to give your company name telephone number and UK address PAYE reference numbers company unique tax

Web Telephone 0300 200 3210 Outside UK 44 161 930 8706 Opening times Our phone line opening hours are Monday to Friday 8am to 6pm Closed weekends and bank holidays Web 6 avr 2023 nbsp 0183 32 How do I get the refund If you work under the CIS you will need to file a Self Assessment tax return and your refund will be reconciled as part of this For more

Cis Tax Rebate Number

Cis Tax Rebate Number

https://www.plasterersforum.com/attachments/sam_3116-jpg.49404/

What Are CIS Statements Frequently Asked Questions Rebatax UK

https://malcolm-en-gb.s3.eu-west-1.amazonaws.com/instances/CL7ogomfrv/resources/iPoyKsREgr/cis-receipt-statement.png

Cis Tax Rebate Calculator CALCULATORSD

https://i2.wp.com/easyaccountancy.co.uk/wp-content/uploads/2018/11/Screen-Shot-2018-11-13-at-21.14.32-1024x588.png

Web 9 mars 2023 nbsp 0183 32 The average tax rebate for CIS workers in the UK is 163 1453 so it s worth finding out what you re owed We will help you claim your CIS tax rebate as well as relief Web 4 janv 2022 nbsp 0183 32 Most CIS workers receive a tax refund rebate after they submit their Self Assessment tax return because they usually overpay towards their tax bill through CIS

Web How to claim a tax rebate If you are eligible for a rebate one of your options is to claim your tax rebate through the HMRC website However this process can be lengthy and Web Atthe end of the tax year once we have received the company s P35annual return any excess CIS deductions that cannot be set offmay be refunded or set against

Download Cis Tax Rebate Number

More picture related to Cis Tax Rebate Number

CIS Contractor How To File CIS Return Online Accountant s Notes

http://taxaccounts.ie/wp-content/uploads/2014/10/10.jpg

Setting Up A Subcontractor CIS Qtac Payroll QTAC Solutions Ltd

https://s3.amazonaws.com/cdn.freshdesk.com/data/helpdesk/attachments/production/17012733763/original/l5dgZ8kRJn8JxPOYtQ-hX74oJUkEpEjcOA.png?1500040079

CIS Contractor How To File CIS Return Online Accountant s Notes

http://taxaccounts.ie/wp-content/uploads/2014/10/25.jpg

Web We ll send the forms to HMRC handle any questions on your behalf and keep chasing the taxman until your rebate s paid 95 of our CIS customers get a tax refund with an Web Contact details webchat and helplines for enquiries with HMRC on tax Self Assessment Child Benefit or tax credits including Welsh language services

Web CLAIM BACK YOUR CIS TAX RETURNS NOW If you work in any type of construction or labouring job you will almost certainly be entitled to claim a Construction Industry Web START YOUR CIS TAX REBATE NOW ONLY 163 60 VAT 163 119 VAT GET STARTED Join over 7 900 happy customers and file your tax return with tax2u Are you

CIS Contractor How To File CIS Return Online Accountant s Notes

http://taxaccounts.ie/wp-content/uploads/2014/10/20.jpg

CIS Contractor How To File CIS Return Online Accountant s Notes

http://taxaccounts.ie/wp-content/uploads/2014/10/5.jpg

https://www.gov.uk/guidance/claim-a-refund-of-construction-industry...

Web 20 juil 2017 nbsp 0183 32 To make a claim online or by post you ll need to give your company name telephone number and UK address PAYE reference numbers company unique tax

https://www.gov.uk/government/organisations/hm-revenue-customs/conta…

Web Telephone 0300 200 3210 Outside UK 44 161 930 8706 Opening times Our phone line opening hours are Monday to Friday 8am to 6pm Closed weekends and bank holidays

CIS Contractor How To File CIS Return Online Accountant s Notes

CIS Contractor How To File CIS Return Online Accountant s Notes

CIS Contractor How To File CIS Return Online Accountant s Notes

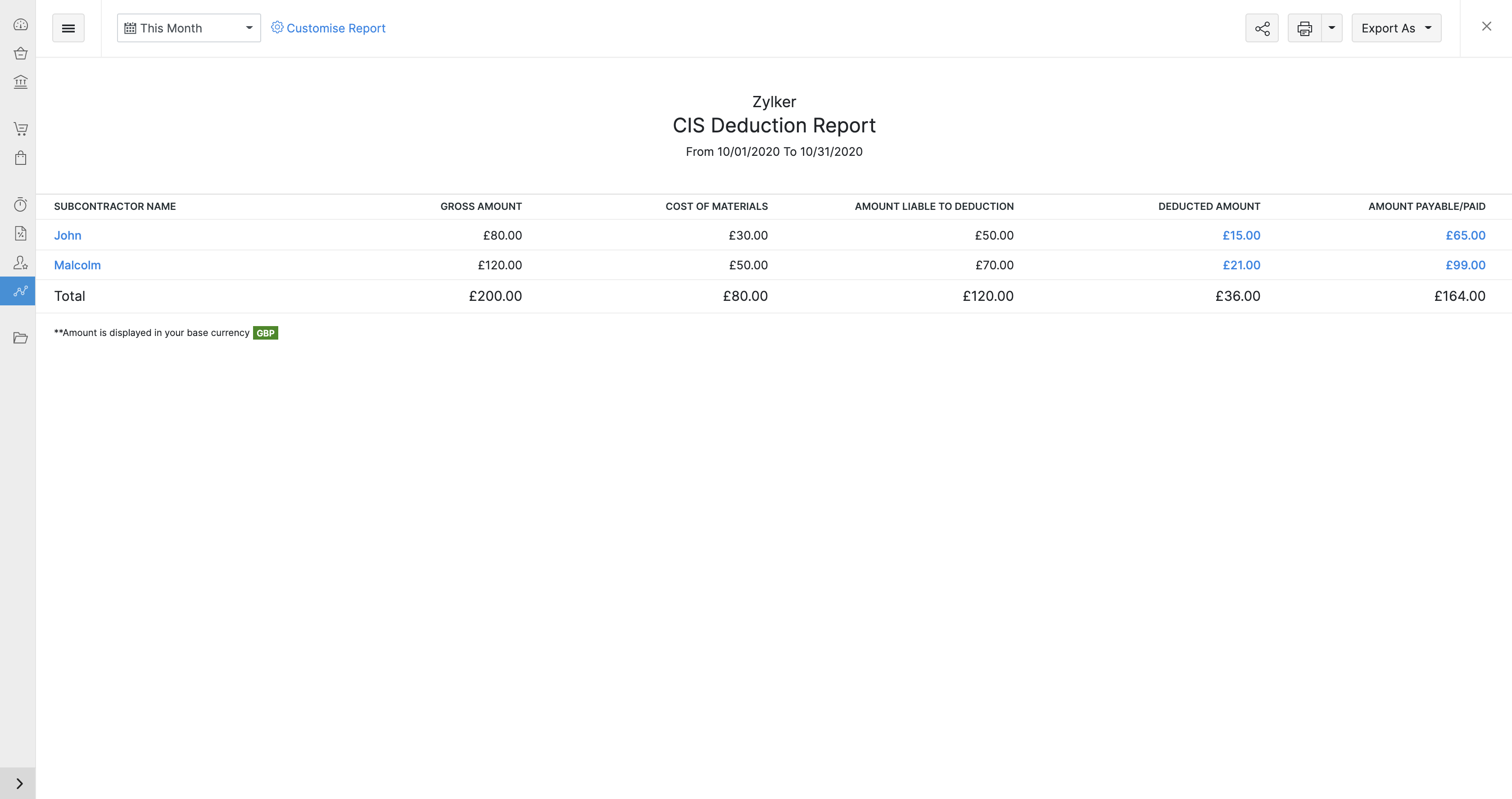

CIS Reports Help Zoho Books

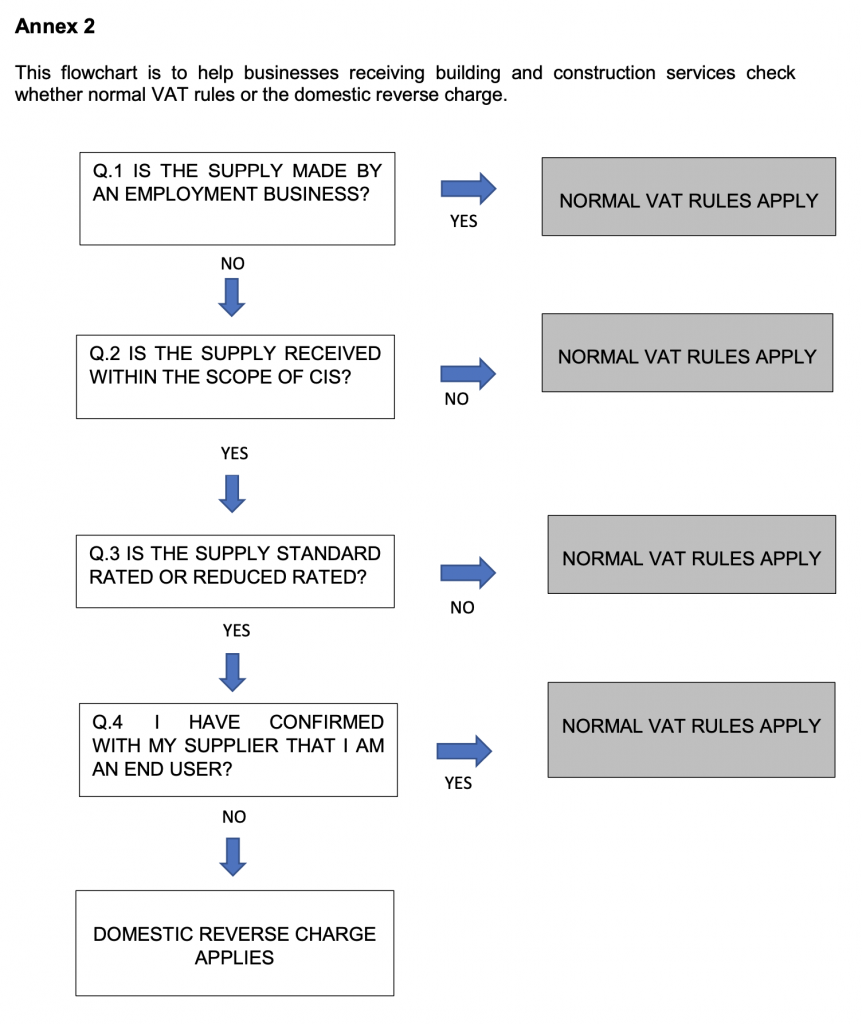

Reverse Charges Of VAT For CIS TN6 Ltd Accounting Business Tax

Cis Tax Rebates

Cis Tax Rebates

CIS Tax Refunds For Painters Expert CIS Rebate Help Fish4money

CIS Tax Rebates BOOK NOW To Claim Your Refunds

CIS Tax Rebate CIS Refund Claim CIS Tax Back Online

Cis Tax Rebate Number - Web 4 janv 2022 nbsp 0183 32 Most CIS workers receive a tax refund rebate after they submit their Self Assessment tax return because they usually overpay towards their tax bill through CIS