Claim A Tax Credit A tax credit is an amount of money that you can subtract dollar for dollar from the income taxes you owe Find out if tax credits can save you money

A tax credit is a dollar amount that you can subtract from your income tax to reduce your overall tax liability So while a tax refund simply represents the difference between the taxes you paid versus the You can use credits and deductions to help lower your tax bill or increase your refund Credits can reduce the amount of tax due Deductions can reduce the amount of

Claim A Tax Credit

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

Claim A Tax Credit

https://www.investopedia.com/thmb/PvvAUlJB5Ssb6I7nPLUAsKSnDDk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg

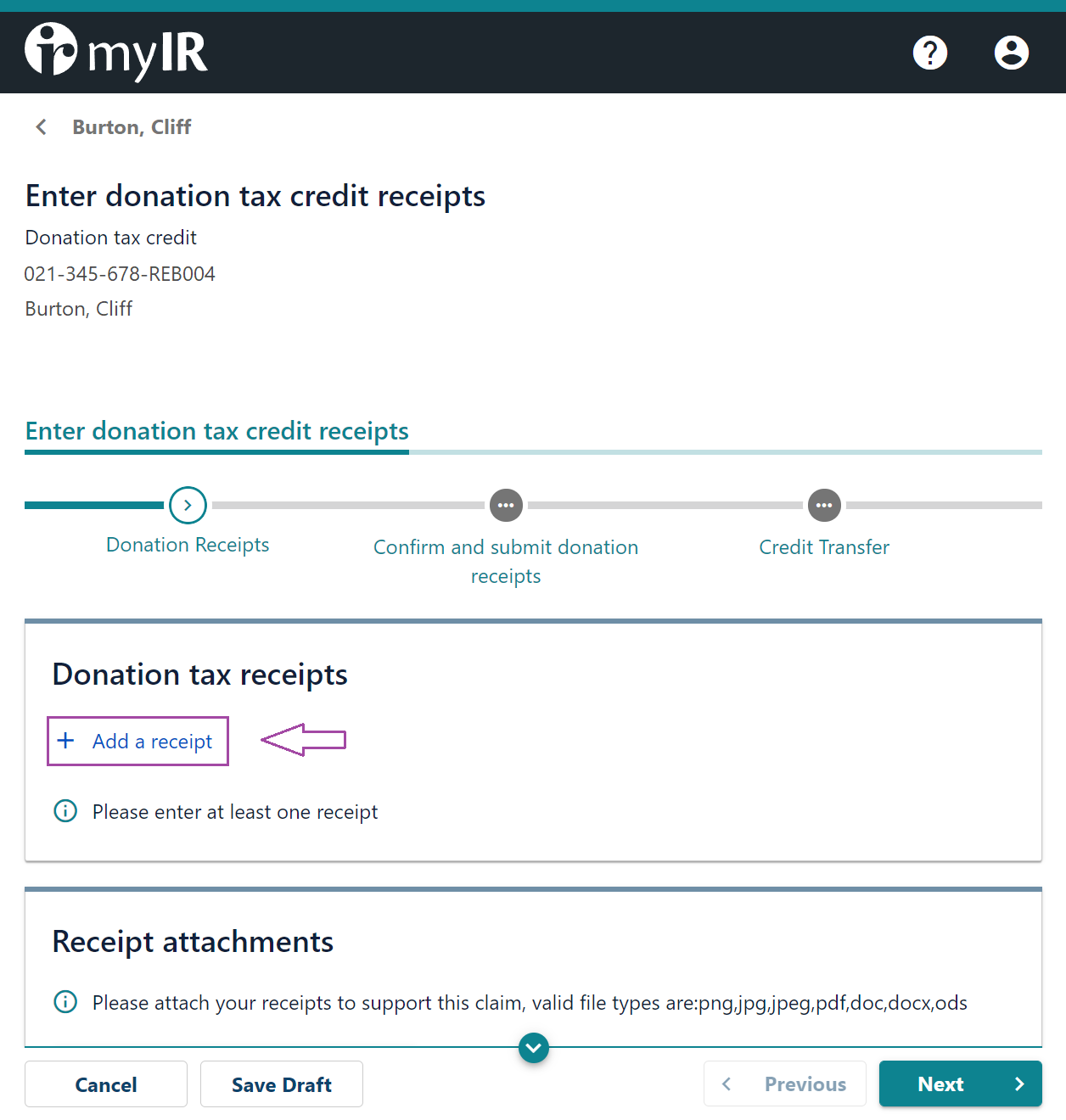

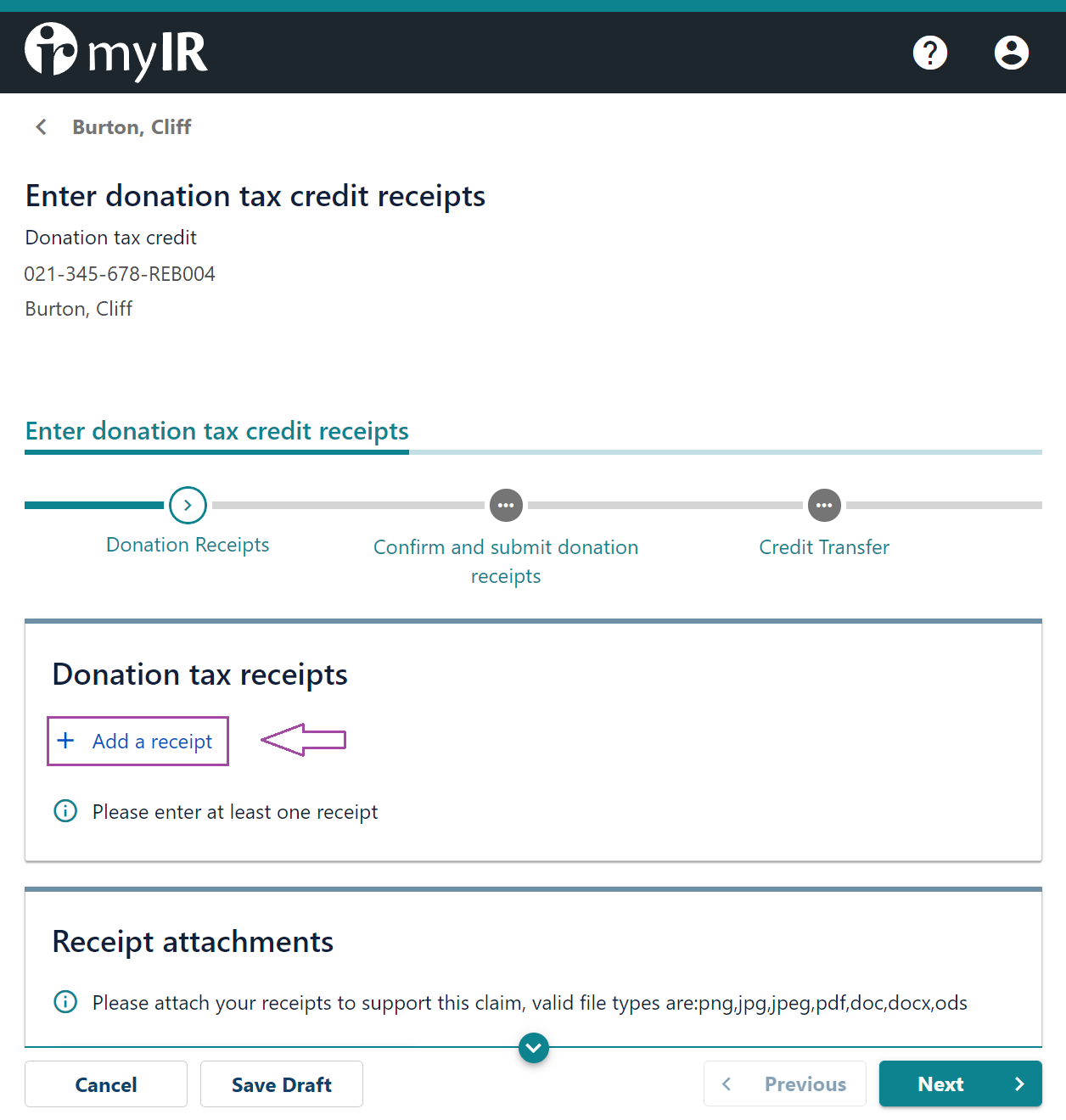

How To claim A Tax Credit

https://static.givealittle.co.nz/cms/539914f3-849c-404d-a7b3-28e56386fa3e/M_add_a_receipt.png

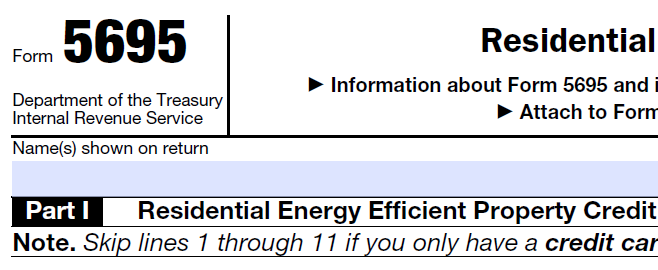

Heated Up February 2018

https://1.bp.blogspot.com/-GVEsqVInZ-I/XjSJchDtwsI/AAAAAAAADPw/ZXd2fV_oSMM5w8z_2HNm_ZZhPS_DsNOaQCLcBGAsYHQ/s1600/Home_Energy_Tax_Credit_IRS_Form_5695.png

Tax credits directly reduce the amount of tax you owe giving you a dollar for dollar reduction of your tax liability A tax credit valued at 1 000 for instance lowers your tax bill by the Usually what you re entitled to is based on your income for the last tax year 6 April 2023 to 5 April 2024 Income includes HM Revenue and Customs HMRC has detailed

What Is the Foreign Tax Credit The foreign tax credit is a U S tax credit used to offset income tax paid abroad U S citizens and resident aliens who pay income taxes imposed by a foreign THE RENT TAX Credit is back for Budget 2025 and it s worth more than ever The Government announced today that the credit will increase to 1 000 per person next year and that the new

Download Claim A Tax Credit

More picture related to Claim A Tax Credit

What Is A Tax Credit Tax Credits Explained

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

E 16 29 Tax Credit Uncertainty Regarding Sustainability LO16 9 L Delta

https://img.homeworklib.com/questions/0d53a9c0-6f5e-11ea-8257-9d5d7f09c537.png?x-oss-process=image/resize,w_560

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

https://udwa.org/wp-content/uploads/TaxCredit.png

Guidance and forms for claiming or renewing tax credits Including childcare costs payment dates leaving or coming to the UK overpayments and reporting changes If you can claim someone as a dependent deductions like the earned income tax credit EITC and child tax credit will lower your tax bill Learn which you can claim

By JACK BOWMAN BALTIMORE Democrat Angela Alsobrooks gave the most detail to date about her recent tax credit controversy on Tuesday while also taking aim at her Republican It s quicker and easier to manage your tax credits online than over the phone This guide is also available in Welsh Cymraeg You can also manage your tax credits through the

Earned Income Tax Credit EITC Get My Payment IL

https://getmypaymentil.org/wp-content/uploads/2022/10/gmpil-website-poll-banner.jpg

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg?w=186)

https://www.investopedia.com/terms/t/t…

A tax credit is an amount of money that you can subtract dollar for dollar from the income taxes you owe Find out if tax credits can save you money

https://turbotax.intuit.com/tax-tips/tax...

A tax credit is a dollar amount that you can subtract from your income tax to reduce your overall tax liability So while a tax refund simply represents the difference between the taxes you paid versus the

Tax Credit Universal Credit Impact Of Announced Changes House Of

Earned Income Tax Credit EITC Get My Payment IL

Business Tax Credits Types Of Credits Available How To Claim

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

Another Way To Save New Tax Credit For Plan Participants

Another Way To Save New Tax Credit For Plan Participants

New Tax Credit To Fully Offset The Cost For Small Businesses Who

How Does The Medical Expense Tax Credit Work In Canada

Corporation Prepaid Insurance Tax Deduction Financial Report

Claim A Tax Credit - You may want to file a prior year tax return to claim tax credits that you may have missed out on like the Earned Income Tax Credit EITC the Child Tax Credit