Claim Cis Tax Rebate Web 4 avr 2014 nbsp 0183 32 Use the Construction Industry Scheme CIS form CIS40 if you re an individual to claim repayment of subcontractor deductions during the current tax year From HM

Web Am I entitled to a tax rebate under the Construction Industry Scheme Under the CIS you will likely be entitled to a tax rebate as you will have had 20 tax deducted from your Web Quickly calculate how big your CIS tax rebate is and what expenses you can claim Sometimes you can claim expenses even without receipts

Claim Cis Tax Rebate

Claim Cis Tax Rebate

https://www.cis-taxlink.co.uk/wp-content/uploads/2015/03/home-banner3.jpg

Cis Tax Rebate Calculator CALCULATORSD

https://i2.wp.com/www.quickrebates.co.uk/fileadmin/_processed_/3/9/csm_Tax_Rebate_Calculator_FB_a1adb6a1ba.png

Cis Tax Rebate Calculator CALCULATORSD

https://i2.wp.com/easyaccountancy.co.uk/wp-content/uploads/2018/11/Screen-Shot-2018-11-13-at-21.14.32-1024x588.png

Web Claiming CIS Construction Industry Scheme tax rebates can be a complicated process with errors leading to delays fines or even the loss of qualified returns To assist you in Web 9 f 233 vr 2023 nbsp 0183 32 CIS deductions what expenses can you claim TaxScouts gt Guides 4 min read Last updated 9 Feb 2023 If you re a self employed individual under the CIS

Web CLAIM BACK YOUR CIS TAX RETURNS NOW If you work in any type of construction or labouring job you will almost certainly be entitled to claim a Construction Industry Web 9 mars 2023 nbsp 0183 32 The average tax rebate for CIS workers in the UK is 163 1453 so it s worth finding out what you re owed We will help you claim your CIS tax rebate as well as

Download Claim Cis Tax Rebate

More picture related to Claim Cis Tax Rebate

Online Income Tax Cis Tax Rebate Hmrc Tax Refund And Return Calculator

https://www.mysimplytax.com/assets/front/img/hclient2.png

What Is The CIS Tax Rebate Calculator For Tax Rebate Services

https://www.taxrebateservices.co.uk/wp-content/uploads/2019/11/bigstock-Roofer-Worker-In-Protective-Un-322995583-624x416.jpg

CIS Tax Rebate CIS Refunds CIS Tax Link Accountants London

https://www.cis-taxlink.co.uk/wp-content/uploads/2015/03/home-banner4.jpg

Web If you are earning more than the 163 12 570 tax threshold then you can use your expenses to offset the amount of tax you ve paid through the CIS and maximise the rebate that you Web What is the CIS rebate The 20 deduction usually works out as more than you owe in tax so subcontractors can claim back a CIS tax rebate from HMRC in the April of the following tax year For most CIS construction

Web Our free to use CIS tax rebate calculator is here to help you estimate what you can claim back What you need to get a CIS tax refund To complete your CIS tax return you ll need Web 6 avr 2023 nbsp 0183 32 How do I get the refund If you work under the CIS you will need to file a Self Assessment tax return and your refund will be reconciled as part of this For more

CIS Tax Rebate CIS Refunds CIS Tax Link Accountants London

https://www.cis-taxlink.co.uk/wp-content/uploads/2015/03/home-banner2.jpg

Are You Due A Tax Rebate As A Construction Worker CIS Tax Rebates

https://i.ytimg.com/vi/15YyMso62Pg/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgTChBMA8=&rs=AOn4CLASCPM38RGfKJdxMK3jSJV9qnVM9g

https://www.gov.uk/government/publications/construction-industry...

Web 4 avr 2014 nbsp 0183 32 Use the Construction Industry Scheme CIS form CIS40 if you re an individual to claim repayment of subcontractor deductions during the current tax year From HM

https://brianalfred.co.uk/guides/entitled-tax-rebate-cis-worker

Web Am I entitled to a tax rebate under the Construction Industry Scheme Under the CIS you will likely be entitled to a tax rebate as you will have had 20 tax deducted from your

CIS Tax Rebates Get The Most From Your Tax Rebate Brian Alfred

CIS Tax Rebate CIS Refunds CIS Tax Link Accountants London

How Do I Claim The Recovery Rebate Credit On My Ta

CIS Tax Refunds rebates For Sub contractors Claim Your Tax Refund Here

CIS Tax Rebates Verulams

How Does A Limited Company Claim Back CIS Tax Deducted

How Does A Limited Company Claim Back CIS Tax Deducted

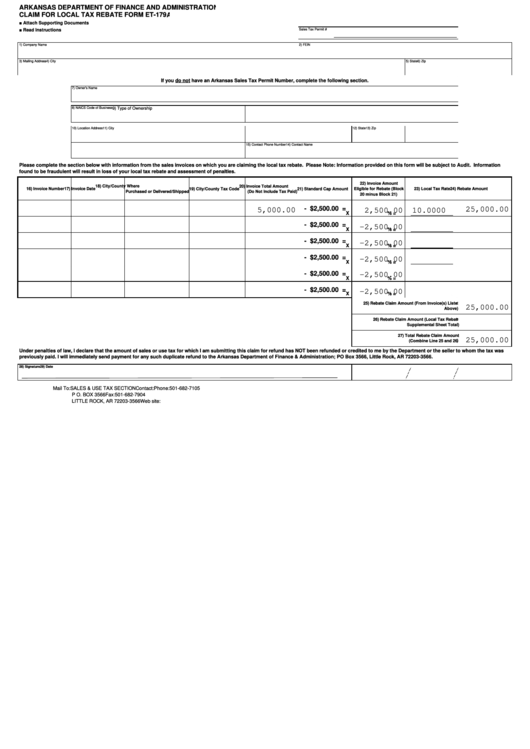

Fillable Form Et 179a Claim For Local Tax Rebate Printable Pdf Download

Do Your Cis Tax Return For You By Paulamestoy Fiverr

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Claim Cis Tax Rebate - Web 9 f 233 vr 2023 nbsp 0183 32 CIS deductions what expenses can you claim TaxScouts gt Guides 4 min read Last updated 9 Feb 2023 If you re a self employed individual under the CIS