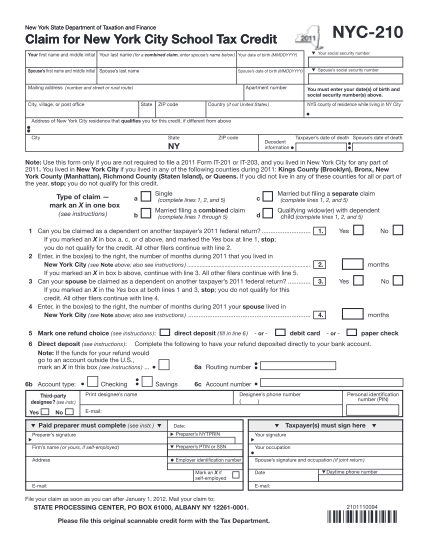

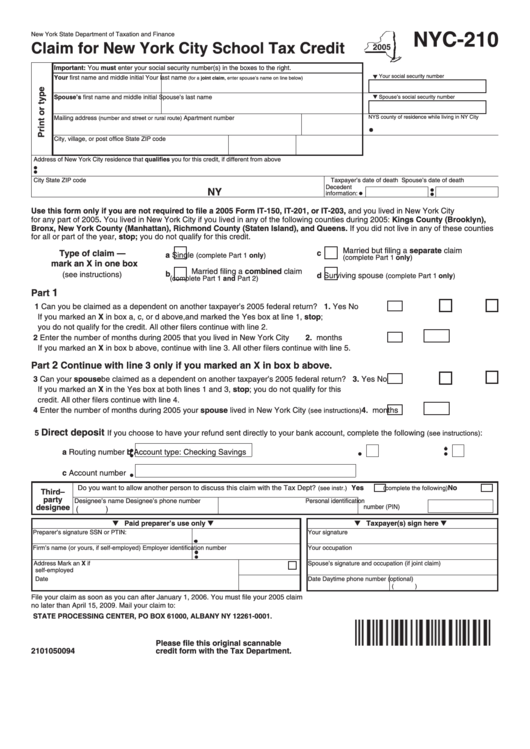

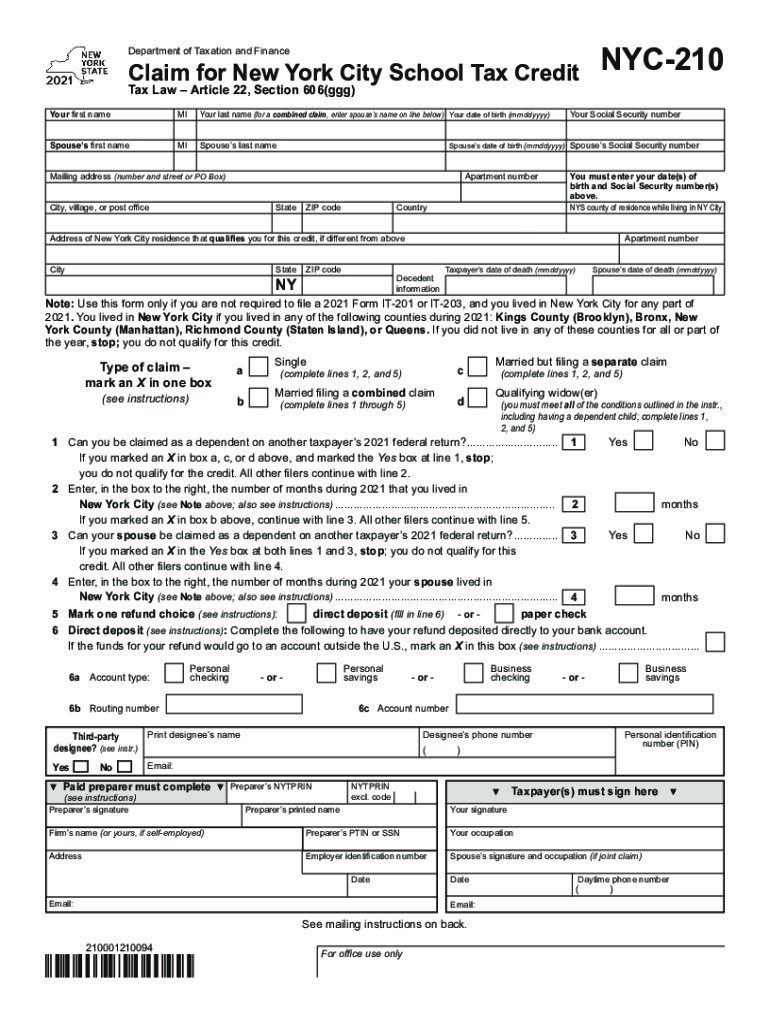

Claim For New York School Tax Credit Claim for New York City School Tax Credit NYC 210 Tax Law Section 606 ggg Note Use this form only if you are not required to file a 2023 Form IT 201 or IT 203 and you lived in New York City for any part of 2023

The New York City School Tax credit is available to New York City residents or part year residents who cannot be claimed as a dependent on another taxpayer s federal income tax return The credit amounts vary This credit must be claimed directly on the New York State personal income tax return In short the New York City school tax credit allows eligible taxpayers to claim a credit against their city personal income tax for a portion of tuition paid to K 12 private schools The credit can be worth up to 1 000 per child depending on income Read on to learn the full eligibility criteria how to calculate the credit and how to claim it

Claim For New York School Tax Credit

Claim For New York School Tax Credit

https://www.pdffiller.com/preview/666/836/666836252/large.png

Cash For Houses New York Hammarland

https://www.cash-for-houses.org/wp-content/uploads/2023/06/google-review.webp

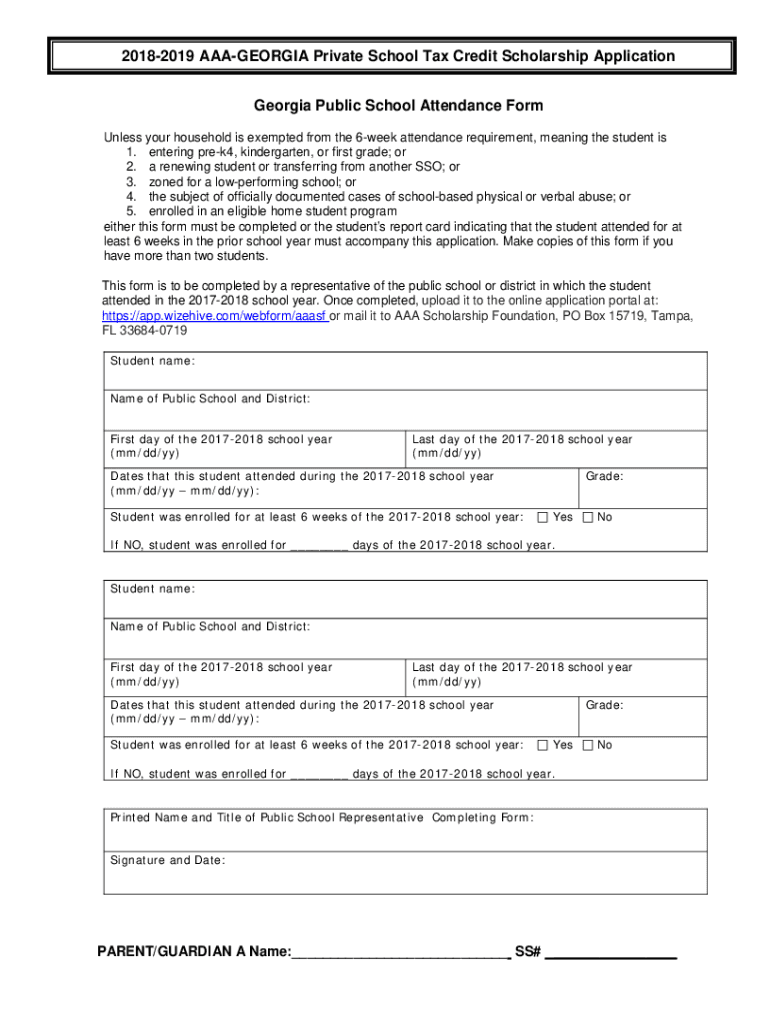

Fillable Online 2018 2019 AAA GEORGIA Private School Tax Credit Fax

https://www.pdffiller.com/preview/572/122/572122314/large.png

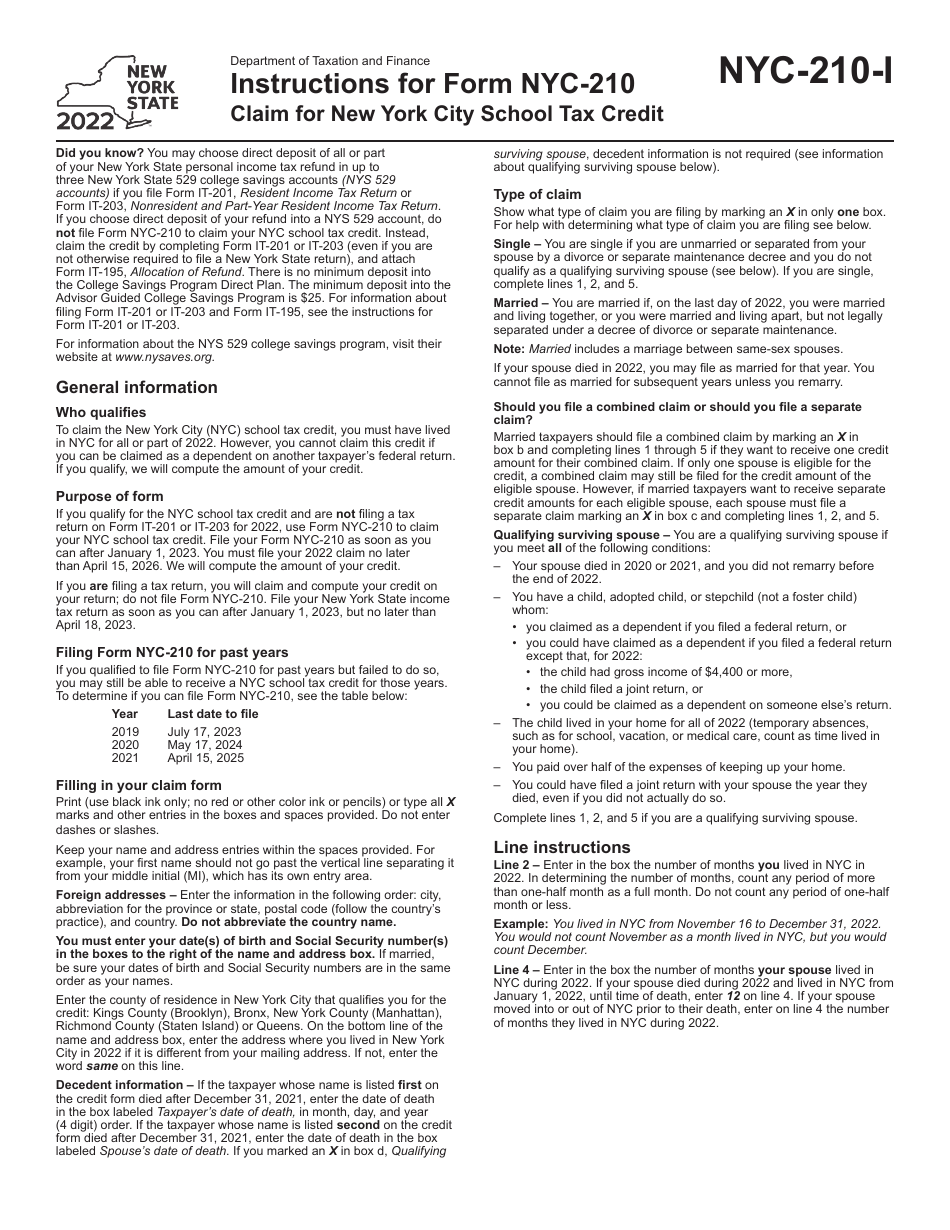

Purpose of form If you qualify for the NYC school tax credit and are not filing a tax return on Form IT 201 or IT 203 for 2015 use Form NYC 210 to claim your NYC school tax credit File your Form NYC 210 as soon as you can after January 1 2016 You must file your 2015 claim no later than April 15 2019 Use Form NYC 210 to claim your city of New York school tax credit if you qualify and are not filing a return on Form IT 100 IT 200 IT 201 or IT 203 for 2001 If you are filing a tax return you will claim the city of New York school tax credit on your return we will compute the credit for Form IT 100 filers do not file Form NYC 210

Who qualifies To claim the New York City school tax credit you must have lived in New York City for all or part of 2005 However you cannot claim this credit if you can be claimed as a dependent on another taxpayer s federal return If you qualify for the credit we will compute the amount of credit for you and send it to you Purpose of form How to apply for the STAR credit How to apply for the STAR exemption if eligible How you will receive the benefit Other forms

Download Claim For New York School Tax Credit

More picture related to Claim For New York School Tax Credit

New York New Haven Hartford RR Freight Bill Stop Shop Frozen

http://www.jumpingfrog.com/images/epm12jun20/hmp7606.jpg

14 Home Office Deduction 2016 Free To Edit Download Print CocoDoc

https://cdn.cocodoc.com/cocodoc-form/png/21755640-fillable-claim-nyc-school-tax-credit-210-form-tax-ny-x-01.png

Tax Credit Laws Turn Your Arizona Tax Liability Into A Scholarship

https://apsto.org/Media/339/Banners/Tax-Laws-APSTO.jpg

This credit allows families to claim qualifying expenses for each child enrolled in public or private school grades K 8 Eligible expenses include Tuition Fees School supplies Textbooks Uniforms Academic enrichment programs The maximum credit amount is 125 per qualifying child Download Form Nyc 210 Instructions Claim For New York City School Tax Credit New York In Pdf The Latest Version Of The Instructions Is Applicable For 2022 See How To Fill Out The Claim For New York City School Tax Credit New York Online And Print It

New York State Department of Taxation and Finance Claim for New York City School Tax Credit NYC 210 Note Use this form only if you are not required to file a 2012 Form IT 201 or IT 203 and you lived in New York City for any part of 2012 May 18 2021 ISSUE STAR School Tax Relief Program STAR Program Enhanced Star Basic STAR The School Tax Relief STAR Program FAQ Updated 2021 The School Tax Relief STAR program offers property tax

Tax Credit Form 7 Free Templates In PDF Word Excel Download

https://www.formsbirds.com/formimg/tax-credit-form/1107/foreign-tax-credit-d1.png

Download Instructions For Form NYC 210 Claim For New York City School

https://data.templateroller.com/pdf_docs_html/2553/25538/2553864/instructions-for-form-nyc-210-claim-for-new-york-city-school-tax-credit-new-york_print_big.png

https://www.tax.ny.gov/pdf/current_forms/it/nyc210_fill_in.pdf

Claim for New York City School Tax Credit NYC 210 Tax Law Section 606 ggg Note Use this form only if you are not required to file a 2023 Form IT 201 or IT 203 and you lived in New York City for any part of 2023

https://portal.311.nyc.gov/article/?kanumber=KA-01488

The New York City School Tax credit is available to New York City residents or part year residents who cannot be claimed as a dependent on another taxpayer s federal income tax return The credit amounts vary This credit must be claimed directly on the New York State personal income tax return

Planned Parenthood Empire State Votes PAC Sarah Clark For New York

Tax Credit Form 7 Free Templates In PDF Word Excel Download

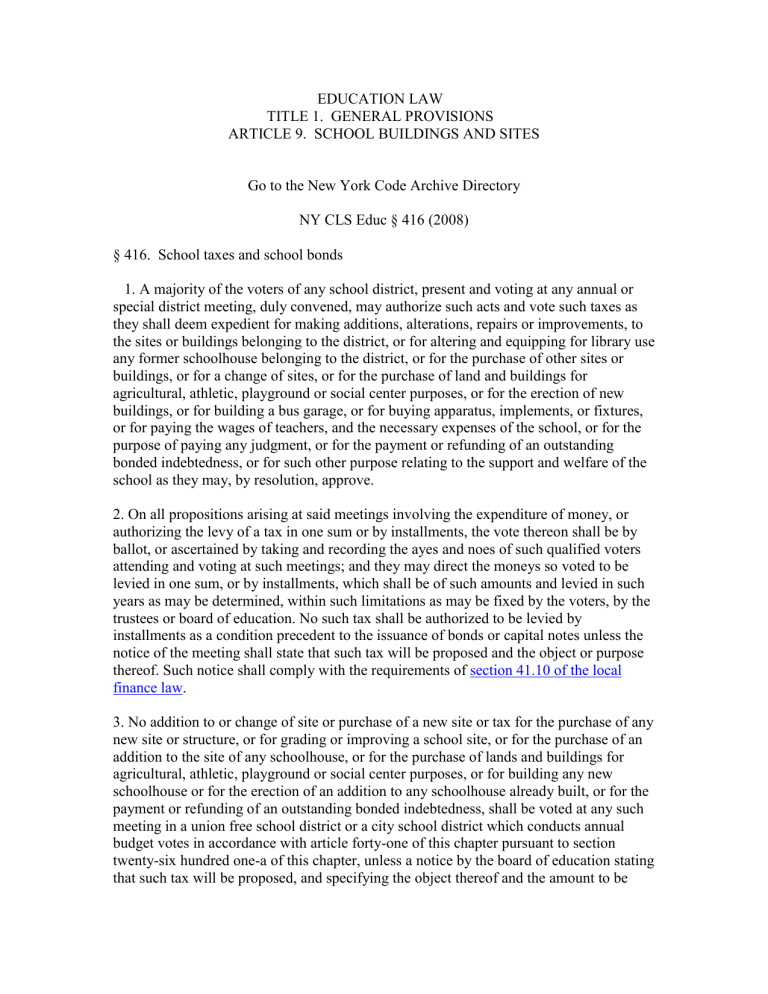

New York School Taxes And Bonds

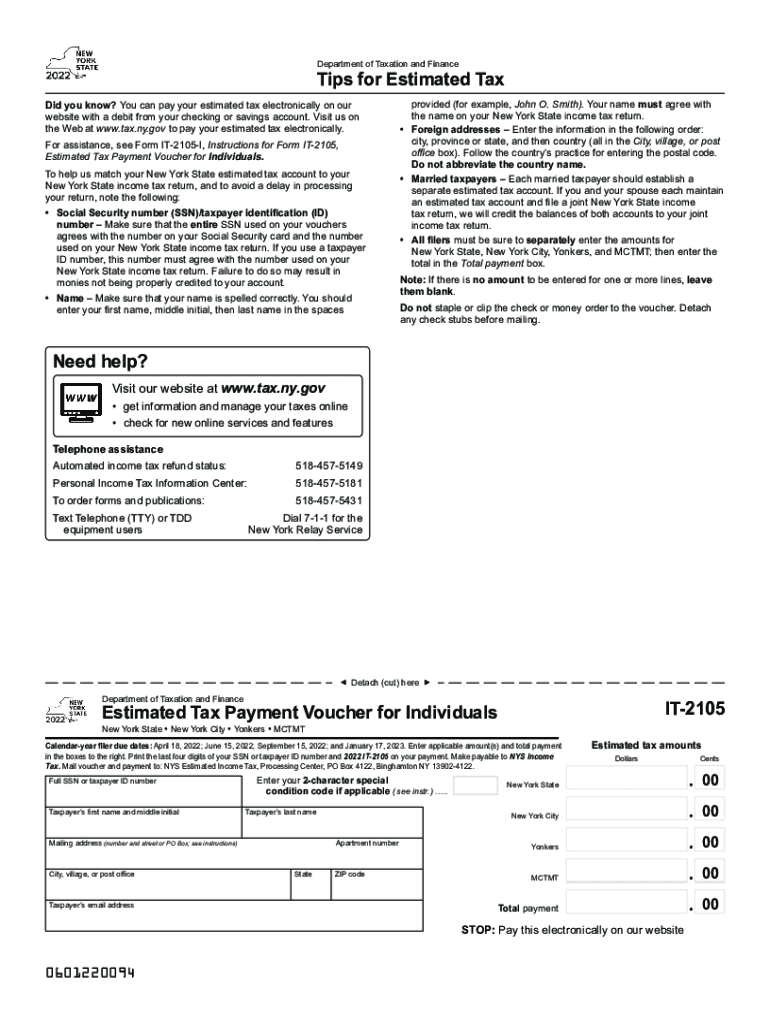

Ny It 2105 Complete With Ease AirSlate SignNow

Fillable Form Nyc 210 Claim For New York City School Tax Credit Form

West New York School District

West New York School District

Nyc 210 School Tax Credit 2021 2024 Form Fill Out And Sign Printable

BiddingOwl New York School Nutrition Association Auction

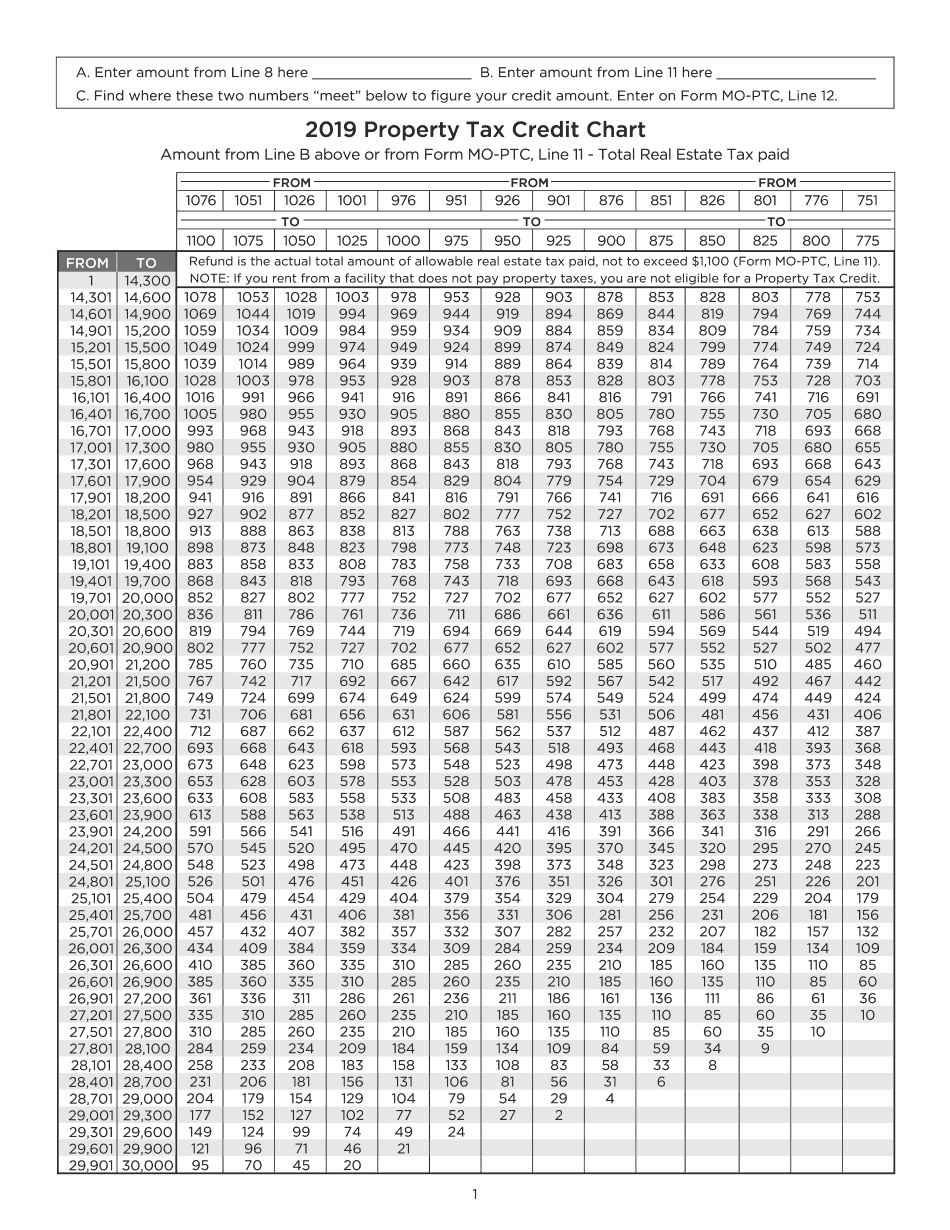

Manage Documents Using Our Editable Form For Property Tax Credit Chart Form

Claim For New York School Tax Credit - Who qualifies To claim the New York City school tax credit you must have lived in New York City for all or part of 2005 However you cannot claim this credit if you can be claimed as a dependent on another taxpayer s federal return If you qualify for the credit we will compute the amount of credit for you and send it to you Purpose of form