Claim Laundry Tax Rebate Web Updated 6 April 2023 If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 163 100s of tax for up to

Web 5 oct 2022 nbsp 0183 32 The uniform tax return is a tax relief you can claim if you re responsible for washing repairing and replacing your work uniform without any reimbursement from Web The standard amount you can claim back is 163 60 per tax year this can be more depending on your job Tax relief is applied to the 163 60 which will normally be at a rate of 20 or

Claim Laundry Tax Rebate

Claim Laundry Tax Rebate

https://taxrebates.co.uk/wp-content/uploads/uniform_laundry-1024x536.png

Can Tesco Workers Claim Back Tax For Their Uniforms Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/tesco-uniform-refund-768x384.jpg

How To Claim and Increase Your P800 Refund Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/P800_Calculation.jpeg

Web 3 mars 2016 nbsp 0183 32 3 March 2016 Last updated 9 January 2023 See all updates Get emails about this page Contents Check if you can claim Claim online Claim by post Claim by Web If you claim a deduction for laundering washing and drying you must keep details of how you work out your claim If your laundry expenses washing drying and ironing but

Web To claim a deduction for a work related expense you must have spent the money yourself and weren t reimbursed it must be directly related to earning your income you must have Web You are entitled to claim a uniform washing allowance for the cost of washing your uniform provided that your employer does not provide on site washing facilities Tools amp

Download Claim Laundry Tax Rebate

More picture related to Claim Laundry Tax Rebate

Tax Back For Cabin Crew Tax Rebates

https://taxrebates.co.uk/wp-content/uploads/Cabin-Crew-Tax-Rebate.png

2023 ERTC Eligibility Claim Assistance For Maximum Tax Rebates Trust

https://online.pubhtml5.com/nerc/ddsg/files/large/4.jpg

Download Form P87 For Claiming Uniform Tax Rebate DNS Accountants

http://www.dnsassociates.co.uk/assets/img/blog/how-to-fill-the-form-p87.png

Web 20 mars 2023 nbsp 0183 32 Not necessarily according to the Internal Revenue Service IRS Work clothes that can double as street or evening clothes are no more deductible than Web If you wear a uniform or protective clothing to work you may be able to reclaim 163 100 s in tax from HMRC by applying for a uniform tax refund HMRC do not provide this allowance automatically You must apply for it

Web 28 mars 2023 nbsp 0183 32 Last updated 28 Mar 2023 How much can I claim for laundry expenses self employed one of our most commonly asked questions The answer is that it Web 11 f 233 vr 2022 nbsp 0183 32 Common tax deductions to claim Before you start adding up all the line items make sure you know what s covered and what isn t Here are some of the most

Login Tax Rebate

https://claims.taxrebate.anywebcms.com/images/anyweb-bg.jpg

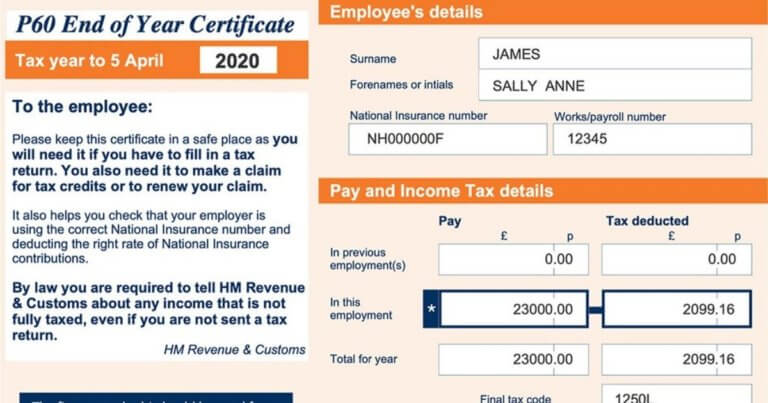

How To Get A Replacement P60 Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/p60-certificate-768x403.jpeg

https://www.moneysavingexpert.com/reclaim/…

Web Updated 6 April 2023 If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 163 100s of tax for up to

https://blog.pleo.io/en/hmrc-uniform-tax

Web 5 oct 2022 nbsp 0183 32 The uniform tax return is a tax relief you can claim if you re responsible for washing repairing and replacing your work uniform without any reimbursement from

P55 Tax Rebate Form By State Printable Rebate Form

Login Tax Rebate

Claim A Tax Rebate For Your Uniform Rmt

How To Apply For The Council Tax Rebate What To Do If You Can Claim

Claiming Tax Back When Working From Home Tax Rebates

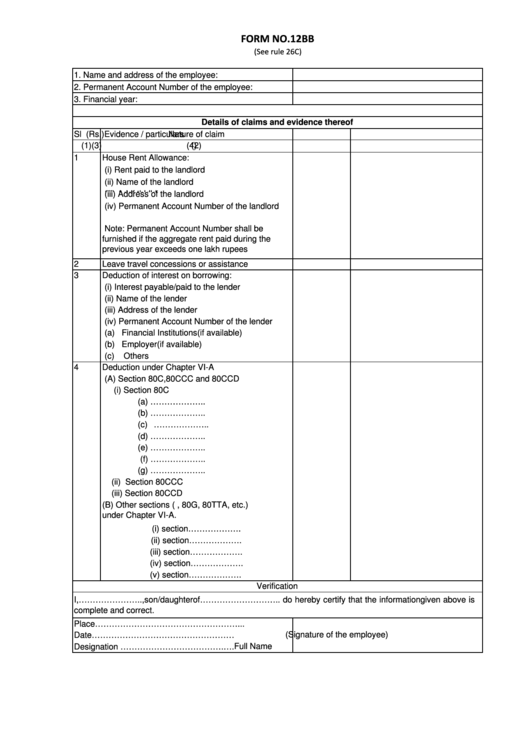

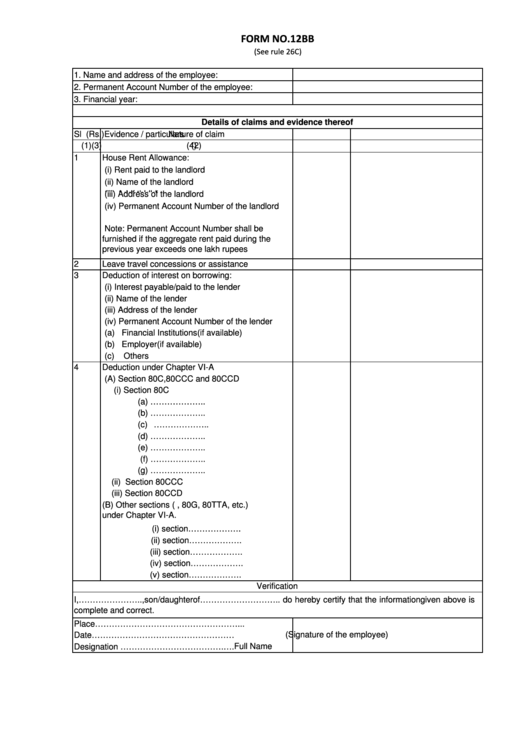

Form 12 Bb Form To Claim Income Tax Benefits Rebate Printable Pdf

Form 12 Bb Form To Claim Income Tax Benefits Rebate Printable Pdf

Printable P50 Form Printable Forms Free Online

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Irish Tax Rebates Claim Your Tax Back

Claim Laundry Tax Rebate - Web To claim a deduction for a work related expense you must have spent the money yourself and weren t reimbursed it must be directly related to earning your income you must have